Global Automotive Engineering Services Market

Market Size in USD Billion

CAGR :

%

USD

94.63 Billion

USD

222.85 Billion

2024

2032

USD

94.63 Billion

USD

222.85 Billion

2024

2032

| 2025 –2032 | |

| USD 94.63 Billion | |

| USD 222.85 Billion | |

|

|

|

|

Automotive Engineering Services Market Size

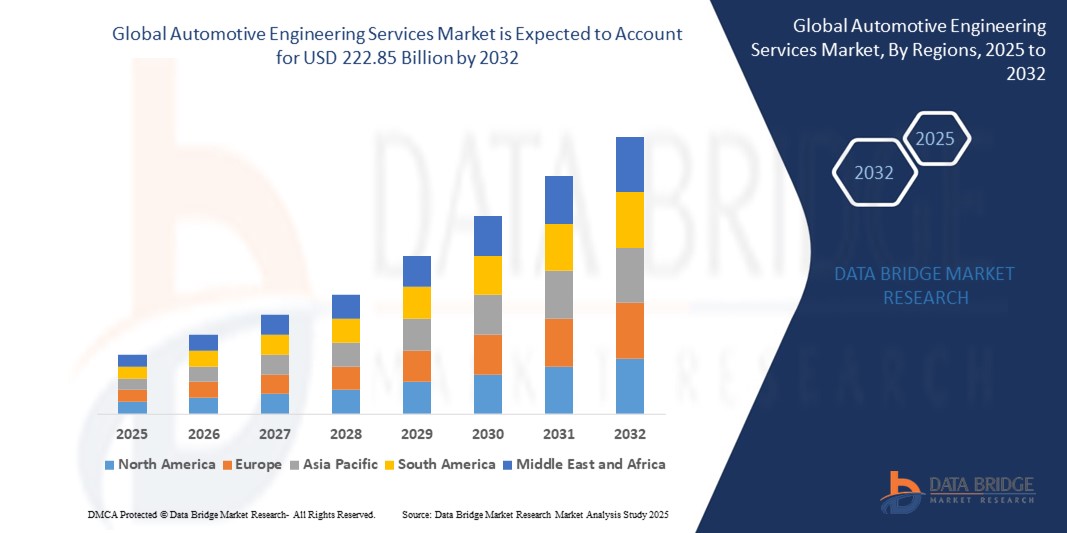

- The global automotive engineering services market size was valued at USD 94.63 billion in 2024 and is expected to reach USD 222.85 billion by 2032, at a CAGR of 11.30% during the forecast period

- The market growth is largely fuelled by the increasing demand for advanced automotive technologies and the rising focus on electric and autonomous vehicles

- Growing investments in research and development to enhance vehicle safety, efficiency, and performance are further driving market expansion

Automotive Engineering Services Market Analysis

- The automotive engineering services market is growing as manufacturers focus on improving vehicle design and performance through outsourced expertise in development and testing

- Increasing adoption of advanced technologies in vehicles is driving demand for specialized engineering services to support innovation and regulatory compliance

- Asia-Pacific dominates the automotive engineering services market with the largest revenue share of 41.3% in 2024, driven by the strong presence of leading automotive OEMs and the rapid development of electric vehicles (EVs) and connected car technologies across countries such as China, Japan, and India

- Europe region is expected to witness the highest growth rate in the global automotive engineering services market, driven by increasing demand for electric vehicles (EVs), stringent emission regulations, and accelerated investments in autonomous driving and connected car technologies across the region

- The designing segment dominated the largest market revenue share in 2024, driven by increasing complexity in vehicle aesthetics and functionality. Automakers rely on design services to optimize vehicle performance while meeting customer expectations for innovation and comfort. The demand for computer-aided design (CAD) and virtual design validation has significantly increased, further boosting this segment

Report Scope and Automotive Engineering Services Market Segmentation

|

Attributes |

Automotive Engineering Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Engineering Services Market Trends

“Shift Toward Electric and Autonomous Vehicles Driving Market Trends”

- The shift toward electric and autonomous vehicles is driving major changes in automotive engineering services

- Engineering services are evolving to support electric powertrain, battery management, and autonomous driving system development

- Expertise in software development, system integration, and testing is essential for safety and regulatory compliance

- For instance, Tesla are investing heavily in autonomous technology, increasing demand for advanced engineering solutions

- Collaborations between automakers and engineering firms are accelerating product development and reducing time to market

Automotive Engineering Services Market Dynamics

Driver

“Rapid Advancement and Adoption of Electric and Autonomous Vehicle Technologies”

- The rapid growth of electric and autonomous vehicle technologies is a key driver for the automotive engineering services market

- Specialized engineering services are needed for designing, developing, and integrating complex systems in these advanced vehicles

- Electric vehicles require expertise in battery management, powertrain design, and charging infrastructure development

- Autonomous vehicles demand sophisticated software, sensor integration, and rigorous safety testing

- For instance, companies such as Tesla collaborate extensively with engineering service providers to accelerate innovation and comply with regulations, helping to reduce development time and costs

Restraint/Challenge

“Increasing Complexity of Vehicle Technologies and Stringent Regulatory Requirements”

- The growing complexity of electric and autonomous vehicle technologies presents significant challenges for engineering service providers

- Integrating hardware and software while ensuring safety, reliability, and regulatory compliance requires highly skilled engineers and advanced testing facilities

- High development costs and long project timelines can limit smaller providers’ competitiveness in the market

- Continuous need for updating technical skills and investing in new tools and infrastructure adds to operational difficulties

- For instance, smaller engineering firms may struggle to meet the demands of rapid innovation compared to larger companies with more resources, impacting their market position and growth potential

Automotive Engineering Services Market Scope

The market is segmented on the basis of service type, application, location, and vehicle type.

- By Service Type

On the basis of service type, the automotive engineering services market is segmented into concept/research, designing, prototyping, system integration, and testing. The designing segment dominated the largest market revenue share in 2024, driven by increasing complexity in vehicle aesthetics and functionality. Automakers rely on design services to optimize vehicle performance while meeting customer expectations for innovation and comfort. The demand for computer-aided design (CAD) and virtual design validation has significantly increased, further boosting this segment.

The prototyping segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the need for rapid development and real-world testing of vehicle systems. Growing focus on faster time-to-market, especially in electric vehicles (EVs), has led OEMs to increasingly outsource prototyping services to reduce costs and development cycles.

- By Application

On the basis of application, the automotive engineering services market is segmented into ADAS and safety, electrical, electronics and body controls, chassis, connectivity services, interior, exterior and body engineering, powertrain and exhaust, simulation, and others. The powertrain and exhaust segment accounted for the largest market revenue share in 2024, due to growing demand for fuel-efficient engines and regulatory pressure on emission norms. Engineering services in this segment help in designing hybrid and electric powertrains, optimizing engine performance, and ensuring compliance with global emission standards.

The ADAS and safety segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising consumer demand for advanced safety features and regulatory mandates for active safety systems. Engineering services are essential in the development and validation of technologies such as automatic emergency braking, adaptive cruise control, and lane-keeping assistance.

- By Location

On the basis of location, the automotive engineering services market is segmented into in-house and outsource. The outsource segment held the largest market revenue share in 2024, driven by the need for cost optimization, access to specialized expertise, and flexibility in resource allocation. OEMs and Tier 1 suppliers increasingly collaborate with engineering service providers to manage the complexity of vehicle development while focusing on core competencies.

The in-house segment is expected to witness the fastest growth rate from 2025 to 2032, as companies seek to strengthen internal capabilities and maintain better control over proprietary technologies. Investments in building internal R&D centers and in-house testing facilities are rising, particularly among established automakers.

- By Vehicle Type

On the basis of vehicle type, the automotive engineering services market is segmented into passenger car (PC) and commercial vehicle (CV). The passenger car segment dominated the market with the largest revenue share in 2024, driven by high global production volumes and increasing integration of advanced features. Consumer demand for electric, connected, and autonomous passenger vehicles continues to expand engineering service requirements.

The commercial vehicle segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rise in logistics and e-commerce, leading to increased demand for efficient, connected, and low-emission CVs. Engineering services are vital for optimizing performance, durability, and fuel efficiency of trucks, buses, and light commercial vehicles.

Automotive Engineering Services Market Regional Analysis

- Asia-Pacific dominates the automotive engineering services market with the largest revenue share of 41.3% in 2024, driven by the strong presence of leading automotive OEMs and the rapid development of electric vehicles (EVs) and connected car technologies across countries such as China, Japan, and India

- The region benefits from favorable government policies, rising vehicle production, and increased R&D investment in autonomous driving and emission control technologies

- In addition, the availability of a skilled workforce, growing export-oriented production, and the emergence of smart mobility solutions support the region’s leadership in the market

China Automotive Engineering Services Market Insight

The China automotive engineering services market captured the largest revenue share in Asia-Pacific in 2024, supported by a robust manufacturing base and national initiatives promoting EV adoption and intelligent transportation systems. Chinese service providers are increasingly focusing on software integration, powertrain development, and ADAS testing to meet both domestic and global demand.

Japan Automotive Engineering Services Market Insight

The Japan automotive engineering services market is expected to witness fastest growth rate from 2025 to 2032, driven by the country’s technological leadership in hybrid and electric vehicle development. Japan’s well-established automotive industry, supported by major OEMs and component suppliers, is actively investing in advanced engineering solutions such as powertrain optimization, autonomous driving, and vehicle light weighting. The integration of AI, robotics, and connected vehicle technologies is fuelling demand for high-end engineering services.

Europe Automotive Engineering Services Market Insight

The Europe automotive engineering services market is expected to witness fastest growth rate from 2025 to 2032, primarily fuelled by strict environmental regulations, the electrification of mobility, and high demand for vehicle safety innovations. The region's established automotive sector, comprising premium car manufacturers, is increasingly outsourcing engineering services to optimize cost and improve time-to-market for EVs and autonomous vehicles. Europe is also seeing rising demand for software-defined vehicle engineering, with a focus on over-the-air updates, HMI design, and connected infrastructure integration.

Germany Automotive Engineering Services Market Insight

The Germany leads the European market due to its position as a global hub for automotive innovation and manufacturing. Engineering services in the country are highly focused on advanced drivetrain development, lightweight materials, and next-gen vehicle architecture. Collaborations between automakers, research institutions, and Tier-1 suppliers further support innovation and market expansion.

U.K. Automotive Engineering Services Market Insight

The U.K. market is expected to witness fastest growth rate from 2025 to 2032, driven by increasing R&D in autonomous and electric vehicles, government support for clean energy mobility, and a strong base of engineering talent. The nation’s efforts to transition to zero-emission transport and its testing infrastructure for self-driving cars are contributing to its rising market share in Europe.

North America Automotive Engineering Services Market Insight

The North America held a significant revenue share in 2024, backed by continuous investment in automotive innovation, particularly in EV and autonomous vehicle technology. The region benefits from major OEMs and technology companies focusing on AI-driven vehicle solutions, with the U.S. leading in ADAS, cybersecurity, and vehicle connectivity services.

U.S. Automotive Engineering Services Market Insight

The U.S. market remains pivotal, supported by high R&D spending and the presence of leading autonomous vehicle start-ups and automotive giants. The growing shift toward software-centric vehicles, alongside the push for sustainable mobility solutions, is creating robust demand for outsourced and in-house engineering services across the country.

Automotive Engineering Services Market Share

The Automotive Engineering Services industry is primarily led by well-established companies, including:

- Akkodis (Belgium)

- Altair Engineering Inc. (U.S.)

- Alten Group (France)

- Cap Gemini Engineering (France)

- ARRK Product Development Group USA. Inc. (U.S.)

- ASAP HOLDING GMBH (Germany)

- AVL List GmbH (Austria)

- Bertrandt AG (Germany)

- EDAG Group (Germany)

- ESG Elektroniksystem- und Logistik-GmbH (Germany)

- FEV Group GmbH (Germany), Horiba, LTD. (Japan)

- IAV (Germany), ITK Engineering GmbH (Germany)

- Kistler Group (Germany)

- P3 group GmbH (Germany)

- RLE INTERNATIONAL Group (Germany)

Latest Developments in Global Automotive Engineering Services Market

- In September 2022, Harman International launched Ready Care, a driver behavior detection service designed to improve road safety. It provides features such as Cognitive Distraction alerts, Stress-Free Routing, and Personalized Comfort. This service integrates with Harman’s connected vehicle solutions to enhance driver safety and experience. The launch reflects Harman’s commitment to safer, smarter mobility through advanced technology. It also expands their footprint in driver assistance and connected car services

- In September 2022, Tech Mahindra introduced YANTRA.AI, a cognitive artificial intelligence solution aimed at strengthening their automotive portfolio. The platform offers enhanced insights for enterprise partners, improving the planning and execution of field services. YANTRA.AI helps automotive companies optimize their operations and resource management. This development boosts Tech Mahindra’s capabilities in AI-driven automotive solutions. It supports faster decision-making and better service quality across automotive service networks

- In August 2022, AVL launched a new inverter test system for electric motors and batteries to validate performance and safety. The system simulates safety-related reactions following standard specifications, ensuring comprehensive testing. This innovation improves the reliability of electric vehicle components by providing detailed inverter validation. It helps manufacturers meet safety regulations and enhance product quality. The service strengthens AVL’s position in electric mobility testing solutions

- In April 2022, FEV introduced FEV.io Intelligent Mobility Software, combining expertise in intelligent mobility, software, and powertrain technologies. The software suite includes advanced driver assistance systems and connectivity services tailored for the automotive industry. This offering enables automakers to accelerate innovation in electric and autonomous vehicle development. FEV.io supports the integration of complex systems for smarter and safer vehicles. It reflects FEV’s commitment to leading intelligent mobility solutions

- In February 2022, Harman International announced the Ready Together and Software Enabled Branded Audio solutions. These combine connected vehicle technologies with premium in-car entertainment to enhance driver engagement. The integrated solution aims to create a fully connected and immersive in-car experience. This launch highlights Harman’s strategy to unify entertainment and connectivity in vehicles. It strengthens their presence in automotive infotainment and digital services

- In January 2022, FEV expanded its portfolio with new solutions for hybrid electric vehicle development. The hybrid-BEV platform eliminates the need for multiple development platforms, simplifying automaker workflows. This approach accelerates the design and production of hybrid vehicles by streamlining processes. FEV’s offering addresses the growing demand for efficient hybrid technologies in the automotive market. It enhances the company’s leadership in electrification engineering services

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.