Global Automotive Smart Antenna Market

Market Size in USD Billion

CAGR :

%

USD

4.69 Billion

USD

14.66 Billion

2024

2032

USD

4.69 Billion

USD

14.66 Billion

2024

2032

| 2025 –2032 | |

| USD 4.69 Billion | |

| USD 14.66 Billion | |

|

|

|

|

Automotive Smart Antenna Market Size

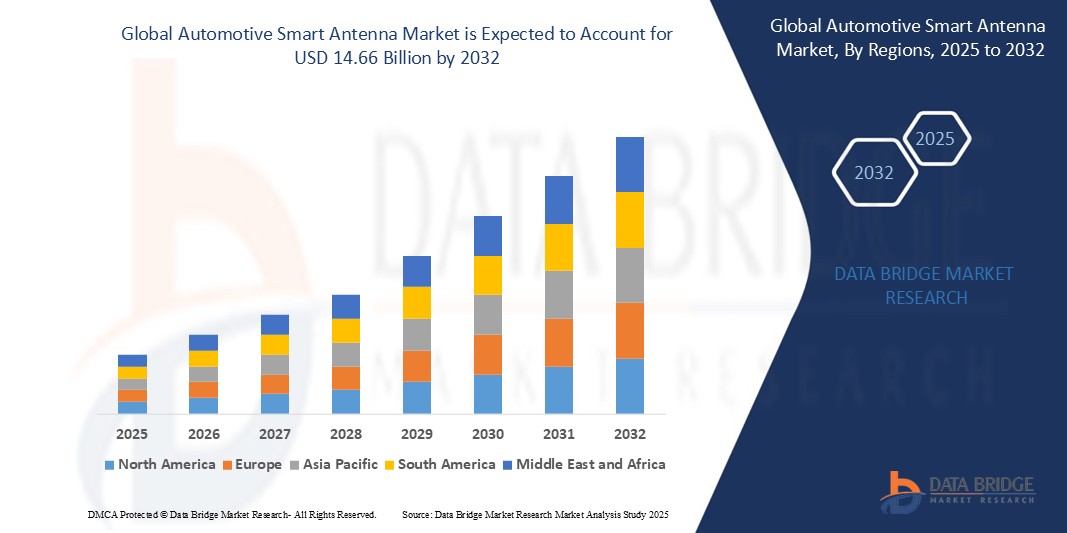

- The global automotive smart antenna market size was valued at USD 4.69 billion in 2024 and is expected to reach USD 14.66 billion by 2032, at a CAGR of 15.30% during the forecast period

- The market growth is largely fueled by increasing demand for connected and autonomous vehicles, which require advanced antenna systems for seamless communication, enhanced navigation, and improved safety features

- The rising government regulations and standards on vehicle safety and emission controls are pushing automotive manufacturers to implement smarter antenna solutions, which enhance vehicle-to-everything (V2X) communication, enabling real-time data exchange between vehicles and infrastructure

Automotive Smart Antenna Market Analysis

- Automotive smart antennas, offering electronic or digital access control for doors and gates, are increasingly vital components of modern home security and automation systems in both residential and commercial settings due to their enhanced convenience, remote access capabilities, and seamless integration with smart home ecosystems

- The escalating demand for automotive smart antennas is primarily fueled by the widespread adoption of smart home technologies, growing security concerns among consumers, and a rising preference for the convenience of keyless entry

- North America dominates the automotive smart antenna market with the largest revenue share of 21.11% in 2024, driven by rapid adoption of connected vehicle technologies and advanced automotive manufacturing infrastructure

- Asia-Pacific is expected to be the fastest growing region in the automotive smart antenna market during the forecast period due to rapid urbanization, rising disposable incomes, and increasing vehicle production

- The ICE (internal combustion engine) vehicle segment accounted for the largest market share in 2024, holding over 81.33% of the market. This dominance is attributed to the vast existing fleet of ice vehicles globally and their continued production, leading to a higher volume of smart antenna installations for infotainment, navigation, and telematics systems

Report Scope and Automotive Smart Antenna Market Segmentation

|

Attributes |

Automotive Smart Antenna Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Smart Antenna Market Trends

“Advancing Vehicle Connectivity with 5G Smart Antennas”

- Automakers are increasingly adopting 5G-enabled smart antennas to enhance real-time data transmission and connectivity features in vehicles

- These advanced antennas support multiple communication standards, including Wi-Fi, Bluetooth, and GPS, facilitating seamless vehicle-to-everything communication

- For instance, companies such as Continental AG and TE Connectivity have introduced compact, modular smart antennas optimized for electric vehicle platforms, combining telematics, connectivity, and infotainment into a single module

- The adoption of 5G smart antennas is also driven by the need for over-the-air software updates, remote diagnostics, and enhanced infotainment systems in modern vehicles

- Collaborations between automotive manufacturers and telecom companies are facilitating the development of intelligent antenna systems that meet the growing connectivity demands of today's vehicles

- This trend underscores the automotive industry's shift towards more connected and autonomous vehicles, with 5G smart antennas playing a pivotal role in enabling advanced communication capabilities

Automotive Smart Antenna Market Dynamics

Driver

“Rising Demand for Connected Vehicle Features”

- The growing consumer demand for enhanced in-vehicle connectivity is pushing automakers to equip vehicles with smart antennas that combine multiple communication technologies such as satellite radio, cellular networks, Wi-Fi, and Bluetooth into one compact unit

- This integration simplifies vehicle design by reducing the need for separate antennas while improving signal quality and network reliability, making it easier for drivers to enjoy seamless navigation and entertainment

- For instance, luxury car manufacturers have started including smart antennas that support over-the-air software updates, remote diagnostics, and streaming services, ensuring cars stay updated and connected without visiting service centers

- The move toward autonomous and semi-autonomous driving is accelerating this demand since smart antennas are critical for real-time data exchange between vehicles and infrastructure, enhancing safety and traffic management

- Automotive companies are partnering with technology firms to develop modular smart antennas that can adapt to new wireless standards, future-proofing vehicles and improving connectivity over time

- As consumers expect more connected and intelligent vehicles, smart antenna systems have become essential components, enabling modern cars to deliver advanced communication and enhanced user experiences

Restraint/Challenge

“High Cost of Smart Antenna Systems”

- The high cost of automotive smart antenna systems is a major barrier to widespread adoption, especially for budget-friendly vehicles and emerging markets where cost sensitivity is high

- Smart antennas are complex devices that combine many functions into one unit, requiring advanced materials and precise manufacturing, which makes them more expensive than traditional antennas

- Integrating these antennas with a vehicle’s existing electronics demands careful testing and calibration, adding to design costs and development time for automakers

- Strict safety and regulatory standards further increase the investment and time needed to bring these smart antenna systems to market without compromising quality

- The fast pace of wireless technology evolution, such as moving from older networks to newer ones, forces frequent updates to antenna designs, creating ongoing expenses that can discourage smaller manufacturers

- Due to their high initial and upkeep costs, smart antennas may face slower adoption in price-sensitive vehicle segments, posing a challenge to overall market expansion

Automotive Smart Antenna Market Scope

The global automotive smart antenna market is segmented on the basis of frequency, component, and vehicle type.

- By Frequency

On the basis of frequency, the automotive smart antenna market is segmented into high frequency, very high frequency, and ultra high frequency. The ultra high frequency (UHF) segment held the largest market share in 2024. This dominance is driven by the increasing demand for modern vehicles equipped with advanced infotainment systems and high-speed data transmission capabilities, which UHF antennas efficiently support. This includes applications crucial for LTE, wi-fi, and bluetooth.

The ultra high frequency (UHF) segment is also projected to exhibit the fastest CAGR from 2025 to 2030. This rapid growth is fueled by the escalating adoption of 5g technology and its integration into vehicles, which heavily relies on uhf for faster and more reliable communication. The demand for advanced driver-assistance systems (ADAS) and sophisticated infotainment systems also contributes significantly to this segment's accelerated growth.

- By Component

On the basis of component, the automotive smart antenna market is segmented into transceivers, electronic control unit (ecu), wiring harness, and others. The transceivers segment is estimated to hold the largest market share in 2024. This is due to transceivers being fundamental to both sending and receiving wireless signals, making them a critical component for all communication protocols within smart antennas. Their importance grows with the increasing demand for integrated connectivity solutions in modern vehicles.

The electronic control unit (ecu) segment is anticipated to witness the fastest CAGR from 2025 to 2030. This growth is driven by the increasing complexity of smart antenna systems, which require sophisticated ecus to manage multiple functions such as signal processing, data routing, and communication with other vehicle systems. The evolution of connected and autonomous driving technologies further amplifies the need for powerful and advanced ecus.

- By Vehicle Type

On the basis of vehicle type, the automotive smart antenna market is segmented into ICE vehicle and electric vehicle. The ice (internal combustion engine) vehicle segment accounted for the largest market share in 2024, holding over 81.33% of the market. This dominance is attributed to the vast existing fleet of ice vehicles globally and their continued production, leading to a higher volume of smart antenna installations for infotainment, navigation, and telematics systems.

The electric vehicle (EV) segment is expected to witness the fastest CAGR from 2025 to 2032. This rapid growth is fueled by the global shift towards electrification in the automotive industry, increasing consumer adoption of EVS, and the inherent demand for advanced connectivity and communication features in these technologically forward vehicles, including v2x (vehicle-to-everything) communication.

Automotive Smart Antenna Market Regional Analysis

- North America dominates the automotive smart antenna market with the largest revenue share of 21.11% in 2024, driven by rapid adoption of connected vehicle technologies and advanced automotive manufacturing infrastructure

- The region hosts major OEMS and technology innovators fueling ongoing development of advanced smart antenna solutions. Increasing consumer demand for vehicle security, convenience, and smart home ecosystem integration propels market growth.

U.S. Automotive Smart Antenna Market Insight

The U.S. Automotive smart antenna market captured the largest revenue share within North America in 2025, fueled by the swift uptake of connected devices and the expanding trend of smart vehicle integration. Consumers and OEMS are prioritizing enhanced vehicle security and convenience features, including keyless entry and remote monitoring systems. The growing preference for integrated smart ecosystems and increasing investments in automotive R&D further support market growth. Additionally, strong infrastructure and regulatory frameworks promote adoption of innovative smart antenna technologies.

Europe Automotive Smart Antenna Market Insight

The European automotive smart antenna market is projected to expand at a substantial CAGR throughout the forecast period, driven by stringent vehicle safety regulations and rising demand for connected and electric vehicles. Increasing urbanization and consumer preference for energy-efficient, smart mobility solutions foster adoption. European automakers’ focus on integrating smart antenna systems into advanced driver-assistance systems (ADAS) and infotainment platforms is further accelerating market growth. The region’s strong emphasis on sustainability and digitalization also supports technology adoption.

U.K. Automotive Smart Antenna Market Insight

the U.K. Automotive smart antenna market is expected to grow significantly, propelled by rising smart vehicle sales and government initiatives encouraging electric and connected vehicle adoption. Growing consumer awareness about vehicle security and convenience features, coupled with advancements in vehicle-to-everything (v2x) communication, are key market drivers. The U.K.’s well-established automotive sector and increasing collaboration between tech firms and automakers support innovation and market expansion.

Germany Automotive Smart Antenna Market Insight

Germany’s automotive smart antenna market is set to expand at a notable CAGR, driven by the country’s leadership in automotive manufacturing and engineering innovation. The demand for sophisticated connectivity solutions in luxury and commercial vehicles, alongside growing investments in electric and autonomous vehicles, bolsters growth. Germany’s focus on sustainability and smart mobility initiatives further encourages the integration of advanced smart antenna technologies. Increasing consumer expectations for seamless connectivity and security reinforce market expansion.

Asia-Pacific Automotive Smart Antenna Market Insight

The Asia-pacific automotive smart antenna market is poised to grow at the fastest CAGR globally, supported by rapid urbanization, rising disposable incomes, and increasing vehicle production in countries such as China, Japan, and India. Government policies promoting smart mobility and electric vehicles, alongside the emergence of APAC as a manufacturing hub for automotive components, are key growth factors. The rising adoption of connected car technologies and increasing consumer demand for vehicle safety and convenience solutions further drive the market.

Japan Automotive Smart Antenna Market Insight

Japan’s automotive smart antenna market is gaining momentum due to its high-tech automotive culture and early adoption of connected vehicle technologies. The country’s aging population and demand for user-friendly, secure vehicle access systems contribute to market growth. Integration of smart antennas with other in-vehicle IoT devices and advanced infotainment systems supports expansion. Japan’s strong focus on R&D and government backing for autonomous and electric vehicles further enhance market prospects.

China Automotive Smart Antenna Market Insight

China accounted for the largest market revenue share in Asia-pacific in 2025, driven by rapid urbanization, technological adoption, and growing domestic vehicle production. The country’s expanding middle class and government initiatives toward smart cities and electric vehicles accelerate smart antenna demand. Affordable, locally manufactured solutions and increasing penetration of connected vehicles across commercial and passenger vehicle segments boost market growth. China’s status as a global automotive manufacturing hub positions it as a key growth engine for the smart antenna market.

Automotive Smart Antenna Market Share

The automotive smart antenna industry is primarily led by well-established companies, including:

- Laird Connectivity (U.S.)

- MD ELEKTRONIK (Germany)

- WISI group (Germany)

- Airgain, Inc. (U.S.)

- Continental AG (Germany)

- Ficosa Internacional SA (Spain)

- SCHAFFNER HOLDING AG (Switzerland)

- TE Connectivity (Switzerland),

- DENSO CORPORATION (Japan)

- HELLA GmbH & Co. KGaA (Germany)

- Calearo Antenne SPA (Italy)

- INPAQ Technology Co., Ltd. (Taiwan)

- Yokowo co., ltd (Japan)

- HARADA INDUSTRY CO., LTD (Japan)

- LOROM INDUSTRIAL CO. LTD. (China)

- Taoglas (Dublin), KDPOF (Spain)

- STMicroelectronics (Switzerland)

Latest Developments in Global Automotive Smart Antenna Market

- In January 2024, Ficosa Group collaborated with Indie Semiconductor, a provider of automotive semiconductor solutions, to develop and market automotive camera systems that utilize neural network-based artificial intelligence (AI) processing. This partnership aims to combine Ficosa's expertise in high-volume vision solutions with Indie Semiconductor's proven vision processing technology, enhancing the capabilities of automotive camera systems for improved safety and performance in vehicles

- In September 2024, Denso Corporation announced plans to construct a new facility by expanding the existing Zenmyo Plant located in Nishio City, Aichi Prefecture. The total investment for this project is approximately 69 Million yen. The new plant will focus on manufacturing large-scale integrated electronic control units (ECUs) essential for electrification and advanced driver assistance systems (ADAS)

- In May 2023, TE Connectivity Corporation introduced the ANT-5GW-FPC series of cellular adhesive flexible printed circuit antennas, developed in collaboration with Linx Technologies. These antennas feature an independent dipole internal/embedded design, providing a versatile solution for various applications. The flexible nature and adhesive backing of the antennas facilitate easy installation within RF-transparent enclosures, allowing for effective environmental sealing that protects the antenna from potential damage

- In May 2020, Airgain, Inc. launched their new product, high-power user equipment (HPUE) antenna-modem platform for the First Responder Network Authority (FirstNet) network using a module from Assure Wireless. This platform will enable superior performance for 4G and 5G communications. This will enhance the company’s product portfolio

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.