Global Automotive Acoustic Materials Market

Market Size in USD Billion

CAGR :

%

USD

3.56 Billion

USD

5.68 Billion

2024

2032

USD

3.56 Billion

USD

5.68 Billion

2024

2032

| 2025 –2032 | |

| USD 3.56 Billion | |

| USD 5.68 Billion | |

|

|

|

|

Automotive Acoustic Materials Market Size

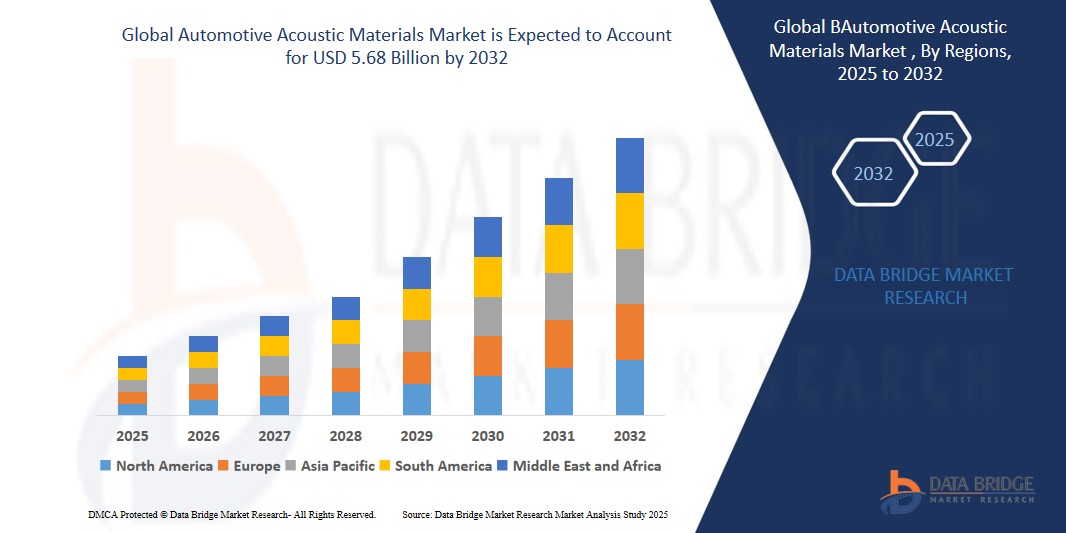

- The global Automotive Acoustic Materials market size was valued at USD 3.56 billion in 2024 and is expected to reach USD 5.68 billion by 2032, at a CAGR of 6.01% during the forecast period

- The automotive acoustic materials market is driven by rising demand for quieter, more comfortable vehicles, stringent noise regulations, and increasing adoption of electric vehicles, which require enhanced soundproofing due to the absence of engine noise and growing consumer expectations for premium cabin experience.

Automotive Acoustic Materials Market Analysis

- Automotive Acoustic Materials are specially engineered substances used to reduce noise, vibration, and harshness (NVH) in vehicles. These materials are crucial for enhancing cabin comfort and ensuring a quieter ride. Compared to standard insulation materials, they offer superior sound absorption and thermal resistance, making them ideal for modern automotive applications.

- Major factors driving the growth of the Automotive Acoustic Materials market include the rising consumer preference for quieter and more comfortable vehicles, stricter environmental and noise pollution regulations, and increased adoption of electric vehicles, which lack traditional engine noise. Additionally, the surge in demand for luxury vehicles and advanced infotainment systems is anticipated to propel market expansion during the forecast period.

- North America is expected to dominate the Automotive Acoustic Materials market due the high production of premium vehicles, strong demand for innovative acoustic solutions, and the presence of major automotive manufacturers. The shift toward electric and hybrid vehicles in the U.S. and Canada further contributes to the demand for advanced soundproofing technologies in the region.

- Asia Pacific is expected to be the fastest growing region in the Automotive Acoustic Materials market during the forecast period due to expanding automotive production in countries like China, India, and Japan. The region’s focus on lightweight materials, rapid urbanization, and growing middle-class population are boosting vehicle sales, thereby increasing the demand for acoustic materials. Government initiatives promoting EV adoption also support market growth.

- The underbody and engine bay acoustics segment is expected to dominate the Automotive Acoustic Materials market, with a market share of 35.9% during the forecast period. This dominance is attributed to the increasing need for thermal insulation and sound damping in these areas, especially in EVs, where acoustic treatments play a crucial role in enhancing ride quality and efficiency.

Report Scope and Automotive Acoustic Materials Market Segmentation

|

Attributes |

Automotive Acoustic Materials Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automotive Acoustic Materials Market Trends

“Advancement in Noise-Reducing Technologies for Electric Vehicles (EVs)”

- Automotive Acoustic Materials technologies are evolving rapidly to meet the unique needs of electric vehicles, focusing on enhancing soundproofing and NVH (Noise, Vibration, Harshness) reduction for quieter cabins. These materials are also crucial for countering road, wind, and motor noise, offering superior comfort for drivers and passengers.

- Technological advancements in lightweight sound-absorbing foams, composites, and multi-layer acoustic materials are enabling car manufacturers to create EVs with reduced sound interference while improving the overall driving experience.

- For instance, in March 2025, Ford introduced a new acoustic composite material for its electric vehicle models, enhancing the cabin’s quietness without adding weight. This innovation is expected to improve the consumer experience, particularly in urban and highway driving.

- This trend is driven by growing consumer demand for quieter electric vehicles, an essential feature for the rise of EVs, especially with their naturally quieter engines compared to internal combustion vehicles.

Automotive Acoustic Materials Market Dynamics

Driver

“Rising Demand for Quieter, More Comfortable Vehicle Interiors”

- The growing consumer preference for vehicles with premium, noise-free cabins is pushing automakers to invest in advanced automotive acoustic materials that provide superior sound insulation and noise reduction.

- With increasing adoption of high-end audio systems, infotainment, and advanced driver assistance systems (ADAS) in vehicles, demand for materials that dampen external and internal noise is surging.

- Materials like high-performance foams, damping pads, and sound-absorbing composites are being widely integrated into vehicle interiors to create quieter and more comfortable driving environments.

For instance,

- In February 2025, Toyota introduced a new line of sound-dampening materials in their hybrid vehicles, improving cabin comfort and enhancing the overall driving experience. This has contributed to a noticeable improvement in customer satisfaction.

- Consumers increasingly view reduced cabin noise as a significant part of vehicle comfort, making automotive acoustic materials a key factor in the design of luxury, electric, and hybrid vehicles.

Opportunity

“Integration of Advanced Acoustic Materials in Autonomous Vehicles”

- As the development of autonomous vehicles accelerates, there is a growing opportunity for automotive acoustic materials to enhance not only noise reduction but also the overall in-cabin experience for passengers. With autonomous vehicles expected to feature long commutes or entertainment systems, reducing noise distractions will become a key factor for improved user experience.

- Manufacturers are exploring advanced acoustic materials that improve both noise insulation and sound clarity, crucial for audio systems used in autonomous vehicles.

For instance,

- In March 2025, Audi introduced a prototype autonomous vehicle with an advanced acoustic material system integrated into its interior. This system significantly reduced wind and road noise, creating a quieter environment that enhances the experience of in-vehicle entertainment and virtual reality interfaces.

- As the autonomous vehicle market grows, manufacturers will continue to invest in high-performance acoustic materials to support noise reduction and increase comfort, creating new revenue opportunities in this segment.

Restraint/Challenge

“High Cost and Manufacturing Complexity of Acoustic Materials”

- Despite the growing demand for advanced automotive acoustic materials, the high manufacturing costs and complexity of production processes remain significant challenges. The cost of raw materials such as specialized foams, composites, and soundproofing technologies adds to the overall production cost of vehicles.

- These materials require advanced manufacturing techniques to ensure they deliver the desired level of sound insulation while maintaining vehicle performance and safety standards.

For instance,

- In January 2024, General Motors faced challenges in scaling up the production of advanced sound-dampening materials for their electric vehicle models due to high production costs and limited supplier capacity.

- Moreover, the recyclability and long-term durability of some advanced acoustic materials remain areas of concern, particularly as manufacturers focus on sustainable vehicle production and reducing environmental impact. Ensuring these materials are both effective and environmentally friendly presents an ongoing challenge for the industry.

Automotive Acoustic Materials Market Scope

The global automotive acoustic materials market is segmented on the basis of application, material type, components, electric vehicle type and vehicle type.

|

Segmentation |

Sub-Segmentation |

|

By Application |

|

|

By Material Type |

|

|

By Components |

|

|

By Electric Vehicle Type |

|

|

By Vehicle Type |

|

In 2025, the Underbody and Engine Bay Acoustics is projected to dominate the market with a largest share in by type segment

The underbody and engine bay acoustics segment is expected to dominate the Automotive Acoustic Materials market, with a market share of 35.9% during the forecast period. The increasing demand for lightweight, energy-efficient materials that reduce noise and vibration. Enhanced acoustic solutions in these areas improve vehicle performance, driving comfort, and fuel efficiency, particularly in electric vehicles.

The Acrylonitrile Butadiene Styrene (ABS) is expected to account for the largest share during the forecast period in Automotive Acoustic Materials market

In 2025, the acrylonitrile butadiene styrene (ABS) segment in the Automotive Acoustic Materials Market is projected to hold the largest share of approximately 35.87%. the Automotive Acoustic Materials market is driven by its superior impact resistance, durability, and excellent sound absorption properties. ABS is widely used in vehicle interiors, particularly in components like door panels and dashboards, to reduce noise, enhance passenger comfort, and improve overall vehicle acoustics.

Automotive Acoustic Materials Market Regional Analysis

“North America Holds the Largest Share in the Automotive Acoustic Materials Market”

- North America leads the Automotive Acoustic Materials market, driven by a robust automotive manufacturing ecosystem, high demand for premium vehicles, and advancements in electric vehicle (EV) technologies.

- The U.S. is the dominant player, with major automakers like Ford, General Motors, and Tesla adopting advanced acoustic materials to enhance cabin comfort and reduce NVH (Noise, Vibration, Harshness) levels in electric and hybrid vehicles.

- The region benefits from technological innovations, stringent noise regulations, and rising consumer expectations for quieter, more comfortable driving experiences.

- Government initiatives to promote EV adoption and the increasing integration of noise-reducing materials in automotive manufacturing further fuel market growth in North America.

“Asia-Pacific is Projected to Register the Highest CAGR in the Automotive Acoustic Materials Market”

- Asia-Pacific is expected to witness the highest growth rate in the Automotive Acoustic Materials market due to the increasing demand for electric vehicles and a booming automotive industry, particularly in China, Japan, and India.

- China and Japan are major contributors, with significant investments in EV production and a growing focus on reducing NVH in vehicles to meet rising consumer expectations for quiet and comfortable rides.

- Japan’s legacy in automotive manufacturing, coupled with advanced acoustics technologies, positions it as a leader in developing innovative materials for soundproofing in vehicles.

- The region’s rapid urbanization, increased demand for premium and electric vehicles, and strong automotive R&D infrastructure are key drivers for the region's growth in the automotive acoustic materials market.

Automotive Acoustic Materials Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Huntsman International LLC (USA)

- 3M (USA)

- Covestro AG (Germany)

- BASF SE (Germany)

- Dow (USA)

- DuPont (USA)

- LyondellBasell Industries Holdings B.V. (Netherlands)

- Henkel Adhesives Technologies India Private Limited (India)

- Sika AG (Switzerland)

- TORAY INDUSTRIES, INC. (Japan)

- HARMAN International (USA)

- ROCKWOOL International A/S (Denmark)

- Tex Tech Industries (USA)

- FABRI-TECH COMPONENTS, Inc. (USA)

- Thomas Publishing Company (USA)

- Saint-Gobain Ecophon AB (Sweden)

- Sumitomo Riko Company Limited (Japan)

- UFP Technologies, Inc. (USA)

- Johns Manville (USA)

- NIHON TOKUSHU TORYO CO.,LTD. (Japan)

Latest Developments in Global Automotive Acoustic Materials Market

- On March 8, 2024, Autoneum announced the expansion of its production capacities in the Asian growth markets China and India with two new plants in the Chinese province of Jilin and Pune in Western India. This move aims to strengthen its presence in the growing automotive acoustic materials market in Asia.

- On November 2, 2022, Huntsman introduced ACOUSTIFLEX® VEF BIO, a bio-based viscoelastic foam technology for automotive molded acoustic applications. Comprising up to 20% bio-based content from vegetable oils, this innovation reduces the carbon footprint of automotive carpet back-foaming by up to 25% compared to Huntsman's existing systems. It's also suitable for dash and wheel arch insulation.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.