Global Automotive Rubber Molded Components Market

Market Size in USD Billion

CAGR :

%

USD

53.55 Billion

USD

82.93 Billion

2024

2032

USD

53.55 Billion

USD

82.93 Billion

2024

2032

| 2025 –2032 | |

| USD 53.55 Billion | |

| USD 82.93 Billion | |

|

|

|

|

Automotive Rubber Molded Components Market Size

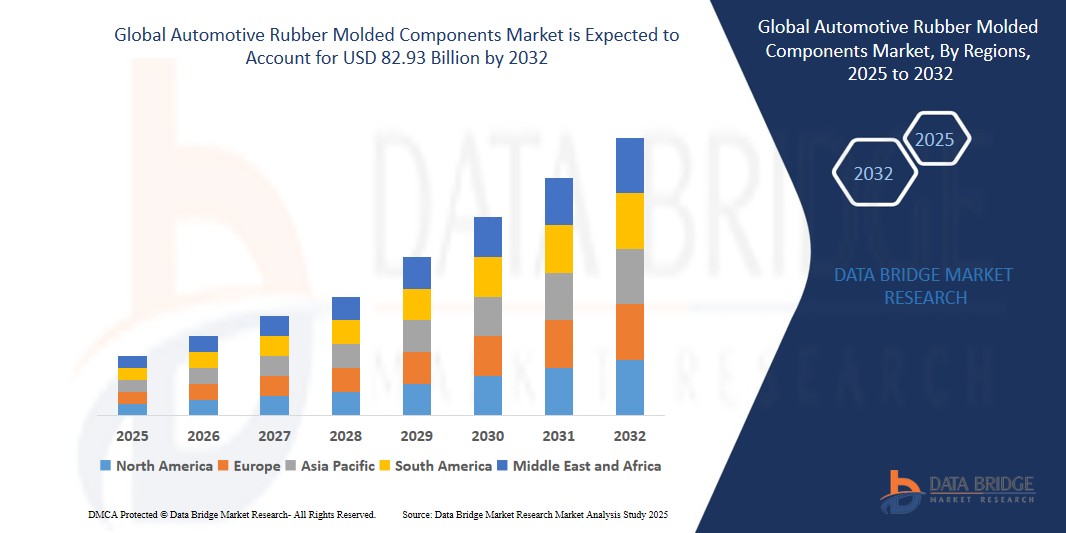

- The Global Automotive Rubber Molded Components Market size was valued at USD 53.55 billion in 2024 and is expected to reach USD 82.93 billion by 2032, at a CAGR of 5.6% during the forecast period

- This growth is driven by increasing trend of electric vehicles along with the new energy vehicles.

Automotive Rubber Molded Components Market Analysis

- Automotive rubber molded components are formed when uncured rubber materials are cured under a high amount of pressure with inserts of metal, textiles or plastics in the required shape of the components. The methods used in the rubber molding procedure can be defined as compression, injection and transfer molding. These different components are useful in a number of different parts of the vehicles.

- The automotive rubber molded components market has a huge potential to grow over the forecast period of 2025 to 2032, owing to the increasing trend of electric vehicles along with the new energy vehicles is propelling the demand for EPDM rubber-molded components. In addition, the significant increase in demand for vehicles, which has accordingly increased the sale of automotive rubber-molded components along with rapid industrialization and globalization and introduction of the latest and cost efficient technologies are also largely influencing the growth of the automotive rubber molded components market.

- Asia-Pacific leads the automotive rubber molded components market because of the appearance of China and India as a significant automotive component manufacturing hubs along with the authorities support for FDI in these emerging nations encouraging local players to participate in rubber molding market.

- Ethylene Propylene Diene Monomer (EPDM) segment is expected to dominate the market with a significant share due to its superior resistance to heat, oxidation, UV rays, and weathering. Its widespread use in sealing systems and under-the-hood applications makes it a preferred material in automotive rubber molded components, especially in extreme environmental conditions.

Report Scope and Automotive Rubber Molded Components Market Segmentation

|

Attributes |

Automotive Rubber Molded Components Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automotive Rubber Molded Components Market Trends

“Accelerating Demand from Electric and New Energy Vehicles”

- The rapid transition toward electric vehicles (EVs) and alternative energy-powered transportation is significantly influencing the automotive components industry. Among the key beneficiaries are rubber molded components, particularly those made from EPDM, which is favored for its resistance to heat, UV rays, and weathering.

- As EVs require more specialized insulation and sealing materials to ensure efficiency and performance, manufacturers are increasingly integrating high-grade rubber parts into battery enclosures, under-hood components, and weather strips.

For instance,

- In April 2023, the International Energy Agency (IEA) reported that electric car sales had exceeded 10 million units in 2022 a sharp rise from 6.6 million in 2021. The report also highlighted that China alone accounted for nearly 60% of global EV sales.

- This consistent rise in electric and hybrid vehicle sales is anticipated to drive sustained demand for durable rubber molded components over the coming years.

Automotive Rubber Molded Components Market Dynamics

Driver

“Expanding Vehicle Production Driven by Urbanization and Economic Growth”

- Global vehicle production is witnessing steady growth, particularly in emerging economies where urbanization and rising income levels are fostering automobile purchases.

- Automotive rubber molded components like gaskets, hoses, and seals are essential across all vehicle types, and their demand grows in parallel with overall vehicle manufacturing.

For instance,

- According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), global vehicle production reached approximately 85.4 million units in 2022, marking a notable increase from 80.1 million units in 2021. This uptick reflects the industry's recovery post-pandemic and indicates strong underlying demand.

- In regions like Southeast Asia and Latin America, expanding infrastructure and a rising middle class are fueling vehicle sales, creating additional opportunities for component suppliers.

Opportunity

“Rising Demand for Lightweight Vehicles and Sustainable Fuel Technologies”

- Automakers are under growing pressure to meet fuel economy standards and reduce emissions, which has accelerated the shift toward lightweight materials and alternate fuel technologies.

- Rubber molded components offer both durability and weight reduction, making them ideal replacements for heavier metal parts in sealing systems, vibration control, and fluid transfer systems.

For instance,

- In March 2022, Tesla announced enhancements in its manufacturing process that incorporated more lightweight rubber and polymer-based parts to optimize energy efficiency in its new vehicle models.

- As the industry moves toward sustainable mobility solutions, the adoption of rubber molded parts in hybrid and alternative fuel vehicles is expected to increase, opening new application areas for suppliers.

Restraint/Challenge

“Supply Chain Disruptions and Raw Material Price Fluctuations”

- One of the key challenges facing the automotive rubber molded components market is the instability in raw material costs and availability. Both natural rubber and synthetic alternatives like SBR and EPDM are subject to price volatility due to supply constraints, geopolitical factors, and global trade dynamics.

- The situation was exacerbated during the COVID-19 pandemic.

For instance,

- In May 2021, several Southeast Asian countries key producers of natural rubber imposed lockdowns and export restrictions, leading to supply shortages and increased raw material prices globally.

- Even in the post-pandemic period, manufacturers continue to face logistical issues and rising shipping costs, which hinder timely delivery and inflate production expenses.

- This unpredictability in material sourcing remains a pressing concern, especially for companies operating in price-sensitive markets or relying on just-in-time inventory systems.

Automotive Rubber Molded Components Market Scope

Automotive rubber molded components market is segmented on the basis of material type, component type and vehicle type.

|

Segmentation |

Sub-Segmentation |

|

By Material Type |

|

|

By Component Type |

|

|

By Vehicle Type |

|

In 2025, Ethylene Propylene Diene Monomer (EPDM)is projected to dominate the market with a largest share in Material Type segment

Ethylene Propylene Diene Monomer (EPDM) segment is expected to dominate the market with a significant share due to its superior resistance to heat, oxidation, UV rays, and weathering. Its widespread use in sealing systems and under-the-hood applications makes it a preferred material in automotive rubber molded components, especially in extreme environmental conditions.

The Passenger cars is expected to account for the largest share during the forecast period

Passenger cars segment is anticipated to lead the market owing to the increasing global demand for personal vehicles and growing focus on safety and comfort. The rising production of passenger cars, especially in emerging economies, along with the integration of advanced rubber components to reduce NVH (Noise, Vibration, and Harshness), fuels the dominance of this vehicle type in the market.

Automotive Rubber Molded Components Market Regional Analysis

“Asia-Pacific Holds the Largest Share and is Projected to Register the Highest CAGR in the Automotive Rubber Molded Components Market”

- Asia-Pacific leads the global automotive rubber molded components market, accounting for the largest market share and also projected to register the fastest CAGR during the forecast period from 2021 to 2028.

- This dominance is primarily attributed to the presence of major automotive production hubs such as China, India, Japan, and South Korea, which have emerged as key manufacturing and export centers for automotive components, including rubber molded parts.

- China, in particular, continues to play a pivotal role, supported by favorable government policies, robust industrial infrastructure, and increasing foreign direct investment (FDI) inflows in the automotive sector. In September 2021, the Chinese government reaffirmed its commitment to boosting new energy vehicles (NEVs), which rely heavily on lightweight and durable rubber molded components, by extending tax exemptions and subsidies.

- India is also experiencing significant growth due to the expansion of domestic vehicle production and government initiatives like “Make in India,” which promote local manufacturing. In February 2022, India’s Union Budget allocated increased funding for road infrastructure and electric mobility, positively impacting the auto components sector.

- Furthermore, the availability of low-cost labor, raw materials, and a well-established supply chain ecosystem gives the region a competitive edge, attracting global companies to establish production bases in Asia-Pacific.

- The surge in demand for electric and hybrid vehicles, coupled with rising vehicle ownership among middle-income groups and rapid urbanization, continues to fuel market growth.

- Notably, Japan remains a highly advanced market in terms of technology integration in automotive manufacturing. In October 2022, Toyota Motor Corporation announced the expansion of its research investment in rubber sealing technologies to enhance electric vehicle efficiency, further emphasizing the region’s innovation-led growth.

- Overall, the Asia-Pacific region not only dominates in volume but is also projected to register the highest compound annual growth rate (CAGR), making it the most influential region in the global automotive rubber molded components market.

Automotive Rubber Molded Components Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Continental AG (Germany)

- Sumitomo Riko Company Limited(Japan)

- SKF(Sweden)

- ALP(India)

- Bohra Rubber Pvt. Ltd. (India)

- NOK CORPORATION(Japan)

- HUTCHINSON (France)

- Trinity Auto Engineering Pvt. Limited(India)

- Freudenberg SE(Germany)

- Trelleborg AB (Sweden)

- VISCON RUBBER INDUSTRIES (India)

- Cooper Standard(United States)

- Steele Rubber Products(United States)

- Rubber The Right Way (United States)

- Timco Rubber (United States)

- Dana Limited (United States)

- TOYODA GOSEI Co. Ltd. (Japan)

- Tubular Products(United States)

- CGR Products (United States)

- Minnesota Rubber and Plastics(United States)

Latest Developments in Global Automotive Rubber Molded Components Market

- In March 2025, Continental AG, a leading German automotive components manufacturer, announced the expansion of its automotive rubber components production facility in Hanover, Germany. The expansion focuses on increasing the output of high-performance EPDM seals and hoses tailored for electric vehicles. This move supports Continental’s sustainability roadmap and responds to the growing demand for EV-compatible rubber components in the European market.

- In January 2025, Sumitomo Riko Company Limited, headquartered in Japan, unveiled its new Advanced Anti-Vibration Rubber Components at the Tokyo Auto Salon 2025. These components are engineered to support electric and hybrid powertrains by improving ride comfort and reducing noise, vibration, and harshness (NVH). The new product line is expected to be mass-produced by Q4 2025.

- In November 2024, Freudenberg Sealing Technologies, part of Freudenberg Group, announced the development of next-generation rubber gaskets that are highly resistant to bio-based fuels and high-temperature environments. These components aim to support the global shift towards sustainable fuel systems and will be tested in collaboration with European automakers through early 2025.

- In September 2024, Trelleborg AB, a Swedish polymer engineering company, completed the acquisition of a mid-sized Asian rubber molding firm to strengthen its production capacity in Southeast Asia. This strategic acquisition is aligned with Trelleborg’s goal of increasing its presence in cost-effective manufacturing hubs to serve the fast-growing Asia-Pacific automotive market more efficiently.

- In July 2024, NOK Corporation introduced a new high-precision rotary oil seal designed for electric drivetrains, during the Automotive Engineering Exposition 2024 in Yokohama, Japan. The new seal uses advanced fluororubber material that ensures durability and leakage prevention in high-speed, low-friction e-powertrain applications, meeting emerging OEM requirements.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.