Global Automotive Acoustic Engineering Services Market

Market Size in USD Billion

CAGR :

%

USD

11.54 Billion

USD

22.60 Billion

2024

2032

USD

11.54 Billion

USD

22.60 Billion

2024

2032

| 2025 –2032 | |

| USD 11.54 Billion | |

| USD 22.60 Billion | |

|

|

|

|

Automotive Acoustic Engineering Services Market Size

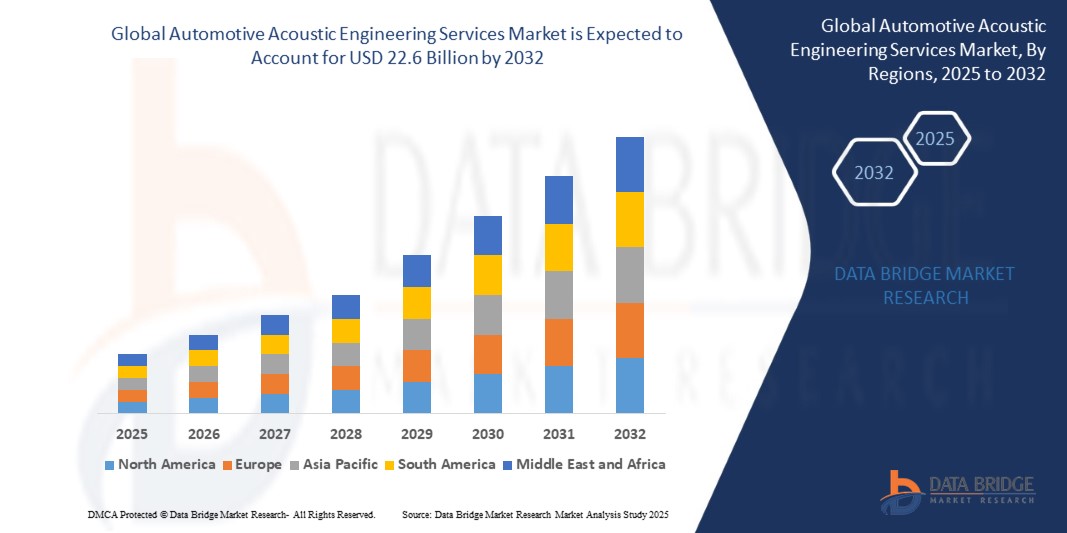

- The global Automotive Acoustic Engineering Services market size is estimated to be valued at USD 11.54 billion in 2025 and is projected to reach USD 22.6 billion by 2032, at a CAGR of 10.1% during the forecast period.

- This growth is driven by the increasing demand for enhanced cabin comfort, stringent noise regulations, and the rise of electric and hybrid vehicles requiring specialized acoustic solutions.

Automotive Acoustic Engineering Services Market Analysis

- The Automotive Acoustic Engineering Services market encompasses processes like designing, development, and testing to manage noise, vibration, and harshness (NVH) and optimize sound quality in vehicles, addressing applications such as interior cabins, powertrains, and body structures across passenger cars, commercial vehicles, and electric vehicles.

- The demand for automotive acoustic engineering services is significantly driven by consumer preferences for quieter cabins, with 65% of consumers prioritizing comfort in 2024, and regulatory mandates like NHTSA’s minimum sound requirements for electric vehicles (63.8–68.9 dB(A) at 30 kmph).,

- North America is expected to dominate the Automotive Acoustic Engineering Services market, holding a 34.0% market share in 2024, due to advanced automotive infrastructure and high demand for premium vehicles.

- Asia Pacific is expected to be the fastest-growing region due to rising vehicle production and stringent noise regulations in countries like China and India, projected to grow at a CAGR of 11.0%.

- The Passenger Cars segment is expected to dominate the market with a market share of 40.0% in 2025 due to high production volumes and consumer demand for luxury features.

Report Scope and Automotive Acoustic Engineering Services Market Segmentation

|

Attributes |

Automotive Acoustic Engineering Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automotive Acoustic Engineering Services Market Trends

“Integration of Virtual Prototyping and Simulation in Acoustic Testing”

- A notable trend is the growing adoption of virtual prototyping tools and Computer-Aided Engineering (CAE) for acoustic simulation during the early design stages of vehicle development.

- These tools help reduce the need for physical prototypes, lowering R&D costs and accelerating time-to-market for OEMs.

For instance, in July 2023, Siemens introduced updates to its Simcenter portfolio, enabling better acoustic simulations through AI-enhanced NVH modeling and analysis tools.

- This trend supports the shift toward more sustainable, efficient product development in the automotive sector.

Automotive Acoustic Engineering Services Market Dynamics

Driver

“Surge in Demand for Quiet Electric and Hybrid Vehicles”

- With the rise of EVs and hybrids, there's increasing attention on minimizing cabin noise, as the absence of internal combustion engines makes other sources like road, wind, and mechanical noise more noticeable.

- Automakers are investing in acoustic engineering to improve cabin sound quality and customer satisfaction.

For instance, in February 2024, Tesla enhanced its acoustic engineering practices for the Model S and Model X by incorporating noise-dampening materials and active sound control technologies.

- This shift fuels the demand for advanced acoustic testing and NVH (Noise, Vibration, Harshness) solutions.

Opportunity

“Expansion of ADAS and Autonomous Vehicles Creating New Acoustic Requirements”

- Autonomous vehicles rely heavily on sensor-based systems, requiring enhanced acoustic signal clarity for object detection, alerts, and communication systems.

- Acoustic engineers are developing intelligent sound design strategies for both internal cabin ambiance and external communication systems (e.g., AVAS – Acoustic Vehicle Alerting Systems).

In October 2023, AVL opened a new NVH competence center in Germany to focus on sound design for electric and autonomous vehicles, catering to new regulatory requirements

- This opens up opportunities for service providers specializing in acoustic software modeling, signal processing, and hardware integration.

Restraint/Challenge

“High Costs Associated with Acoustic Testing Facilities and Equipment”

- Setting up an anechoic chamber, testing rigs, and high-fidelity simulation software requires significant investment, posing a barrier to entry for smaller firms and Tier 2/3 suppliers.

- The expense associated with full-vehicle acoustic testing and simulation limits broader adoption in cost-sensitive markets.

According to a 2023 report by Brüel & Kjær, setting up a full-scale NVH testing lab can exceed $5 million, depending on the scope and equipment.

- This financial barrier slows market penetration, especially in emerging economies with limited R&D budgets.

Automotive Acoustic Engineering Services Market Scope

The market is segmented on the basis process, offering, application, vehicle type, and propulsion type.

|

Segmentation |

Sub-Segmentation |

|

By Process |

|

|

By Offering |

|

|

By Application |

|

|

By Vehicle Type

|

|

|

By Propulsion Type |

|

In 2025, the Passenger Cars segment is projected to dominate the market with the largest share in the vehicle type segment

The Passenger Cars segment is expected to dominate the Automotive Acoustic Engineering Services market with the largest share of 56.22% in 2025 due to the high production volume and consumer demand for enhanced driving comfort and cabin quietness. Rising consumer expectations for premium acoustic experiences, particularly in EVs, and OEMs’ increasing focus on brand-specific sound design are driving service adoption. Additionally, stricter noise regulations in urban environments are pushing manufacturers to invest in acoustic optimization for passenger cars.

The Powertrain is expected to account for the largest share during the forecast period in the application segment

In 2025, the Powertrain segment is expected to lead the application market with the largest market share of 51.31%, driven by the critical need to manage vibrations and noise from engines, transmissions, and electric drive units. As electrification advances, powertrain NVH becomes more complex due to high-frequency tonal noise from electric motors. Manufacturers are increasingly adopting advanced acoustic simulation and testing services to enhance vehicle performance and reduce noise emissions. For instance, AVL and Siemens are investing in next-gen NVH testing platforms to address emerging EV powertrain challenges.

Automotive Acoustic Engineering Services Market Regional Analysis

“North America Holds the Largest Share in the Automotive Acoustic Engineering Services Market”

- North America leads the global automotive acoustic engineering services market due to its well-established automotive industry, stringent vehicle noise regulations, and early adoption of advanced NVH (Noise, Vibration, and Harshness) technologies.

- The U.S. remains the dominant contributor, supported by major OEMs like Ford, GM, and Tesla investing heavily in acoustic optimization, particularly for electric vehicles where powertrain noise dynamics differ significantly from ICE vehicles.

- Additionally, growing consumer preference for quieter cabin experiences and the proliferation of premium and luxury vehicles further drive demand for specialized acoustic services.

- Technological innovations, such as AI-integrated NVH simulation platforms and partnerships with acoustic solution providers like Siemens Digital Industries and Brüel & Kjær, further strengthen the regional market.

“Asia-Pacific is Projected to Register the Highest CAGR in the Automotive Acoustic Engineering Services Market”

- The Asia-Pacific region is expected to witness the fastest growth in the automotive acoustic engineering services market, fueled by rising automotive production, growing EV penetration, and increasing consumer focus on comfort.

- China, India, Japan, and South Korea are key markets driving growth. China leads in EV production, necessitating advanced acoustic engineering to mitigate motor whine and road noise, while Japan’s precision engineering ecosystem accelerates innovation in NVH tools.

- In India, the rise of automotive R&D centers and regulatory moves toward stricter noise standards are pushing local and international OEMs to invest in acoustic testing services.

- Notably, in 2024, Hyundai and Toyota expanded their NVH research labs in South Korea and Japan, respectively, to support quieter electric vehicle development, underscoring the region’s growing focus on acoustic optimization.

Automotive Acoustic Engineering Services Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Schaeffler Group (Germany)

- AVL List GmbH (Austria)

- Autoneum (Switzerland)

- Harman International (U.S.)

- Continental AG (Germany)

- Bertrandt AG (Germany)

- EDAG Engineering GmbH (Germany)

- Siemens AG (Germany)

- FEV Group GmbH (Germany)

- Head Acoustics GmbH (Germany)

Latest Developments in Global Automotive Acoustic Engineering Services Market

- In March 2025, AVL, a global leader in automotive development and testing solutions, announced the enhancement of its AVL VSound platform, designed to simulate and optimize vehicle acoustics virtually. The upgraded tool integrates AI to predict NVH behavior in early development phases, improving speed and precision in acoustic engineering services for electric and hybrid vehicles.

- In January 2025, Siemens Digital Industries Software unveiled a significant update to its Simcenter Testlab software, enabling faster and more detailed acoustic testing. The new release supports the integration of psychoacoustic parameters for a more refined cabin sound experience, tailored to EV-specific NVH challenges.

- In December 2024, Bertrandt AG expanded its acoustic test facilities in Germany to accommodate increasing demand for EV-specific sound design and NVH optimization. The upgraded facility includes semi-anechoic chambers and simulation environments tailored for e-motor harmonics and battery system noise profiling.

- In October 2024, EDAG Group partnered with Brüel & Kjær to develop a comprehensive acoustic engineering package specifically for autonomous and electric vehicles. This collaboration leverages Brüel & Kjær’s NVH measurement tools with EDAG’s vehicle integration expertise to deliver end-to-end acoustic solutions from concept to validation.

- In August 2024, Mahle Powertrain announced the establishment of a new acoustic test chamber in the UK focused on hybrid and electric powertrain systems. This facility supports full vehicle and component-level acoustic evaluations, enabling OEMs to meet tightening noise regulations while enhancing in-cabin comfort.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.