Global Automotive Windshield Market

Market Size in USD Billion

CAGR :

%

USD

32.27 Billion

USD

61.97 Billion

2024

2032

USD

32.27 Billion

USD

61.97 Billion

2024

2032

| 2025 –2032 | |

| USD 32.27 Billion | |

| USD 61.97 Billion | |

|

|

|

|

Automotive Windshield Market Size

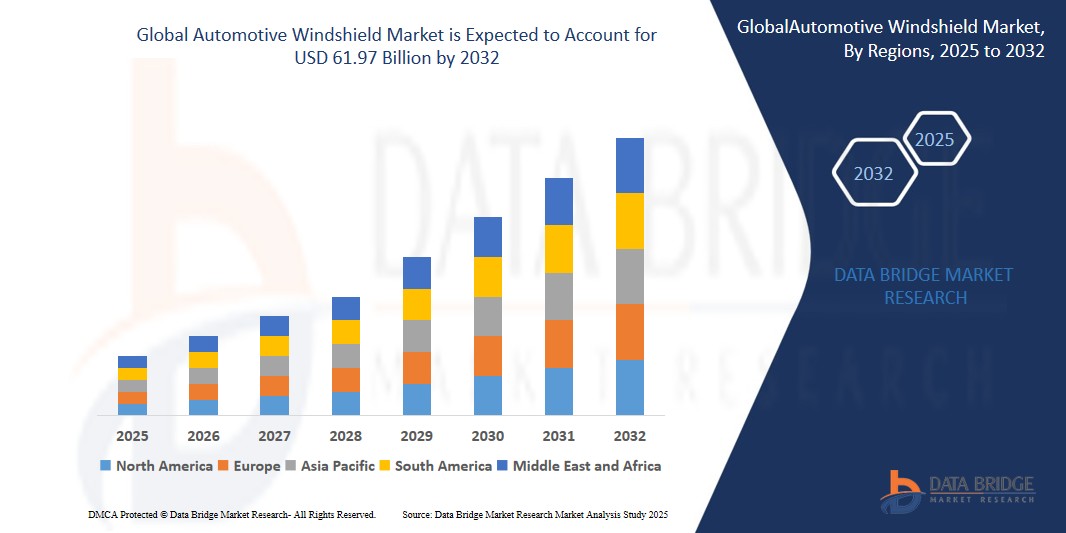

- The global Automotive Windshield market size was valued at USD 32.27 billion in 2024 and is expected to reach USD 61.97 billion by 2032, at a CAGR of 9.8% during the forecast period

- The automotive windshield industry is expected to be driven by the adoption of HUD technology and growing vehicle production. Furthermore, with the advent of gorilla glass in the automotive market, demand for glass-based car windshields is projected to escalate.

Automotive Windshield Market Analysis

- A windshield in an automobile is a piece of glass that shields the occupants from the elements such as sunshine, pollution, wind, and dust. It's a windscreen made of laminated glass with potassium oxide, magnesium oxide, and aluminium oxide in it. The protective windshield also provides comfort by managing the vehicle's interior temperature. Manufacturers can now use the windshield as a display, with all relevant data displayed right on the windshield, following recent technical advancements.

- The factors such as glass vehicle windshield’s improved tolerance to chemicals, heat, and water, technological advancement and significant increase in the sales of passenger cars will cushion the growth of automotive windshield market.

- Asia Pacific is expected to dominate the Automotive Windshield market due to the growing vehicle production, increasing awareness among people about protection from UV rays and the rise in the utilization of windshield for display purpose in this region.

- Europe is anticipated to be the fastest-growing region in the Automotive Windshield market, this is because of the high investment of leading players in research and development activities for the manufacturing of advanced windshield which will further satisfy government regulations and growing consumer demand.

- The front windshield segment is predicted to hold the largest market share of 63.2% in the Automotive Windshield market during the forecast period. The front windshield position segment in the Automotive Windshield Market is driven by its essential role in structural integrity, occupant safety, and visibility. Increased adoption of ADAS features and demand for lightweight, durable glass further boost growth in this segment.

Report Scope and Automotive Windshield Market Segmentation

|

Attributes |

Automotive Windshield Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automotive Windshield Market Trends

“Integration of Advanced Location-Based Services and IoT Solutions”

- Automotive Windshield technologies are increasingly integrating with Internet of Things (IoT) devices to enhance real-time asset tracking, navigation, and environmental monitoring in various sectors, including retail, healthcare, and logistics. These innovations improve customer experience and operational efficiency.

- IoT-enabled Automotive Windshield solutions are transforming industries by providing smarter, automated systems that offer real-time data insights, predictive analytics, and seamless user experiences. The combination of these technologies is driving the widespread adoption of Automotive Windshield services.

- For instance, in January 2025, Google announced a partnership with Walmart to integrate real-time in-store navigation with IoT-enabled devices, providing customers with personalized shopping experiences and efficient store navigation through a smartphone app. This integration is expected to boost Automotive Windshield adoption in retail.

This trend is driven by the increasing demand for connected devices, automation, and personalized services, particularly in the retail, healthcare, and smart city sectors, where real-time data and location accuracy are crucial.

Automotive Windshield Market Dynamics

Driver

“Rising Adoption of Real-Time Indoor Navigation in Retail and Healthcare”

- The increasing demand for indoor navigation solutions in retail and healthcare is boosting the market. Retailers are using these systems for inventory tracking, personalized promotions, and improving customer experience, while hospitals benefit from improved patient navigation and asset management.

- The use of real-time Automotive Windshield systems is growing rapidly due to advancements in Bluetooth Low Energy (BLE) technology, which enhances accuracy and reduces energy consumption, making it more affordable and scalable for wide adoption.

For instance,

- For instance, In March 2025, Zebra Technologies partnered with a major healthcare provider to implement a real-time asset tracking and navigation system in its hospitals, leading to improved operational efficiency and reduced patient wait times.

- The increasing need for operational efficiency, combined with advancements in Automotive Windshield technologies, continues to drive the adoption of these solutions across multiple sectors.

Opportunity

“Expansion of Smart Automotive Windshields in Electric Vehicles (EVs)”

- The growth of the EV market is driving demand for advanced automotive windshields with integrated smart features, such as heads-up displays, navigation systems, and solar panels for energy efficiency.

- Smart windshields are being increasingly designed to improve driving safety and efficiency, offering enhanced user experiences in EVs, aligning with sustainable and connected vehicle trends.

For instance,

- For instance, in March 2025, Tesla has introduced advanced smart windshields in its latest electric vehicle models, integrating augmented reality (AR) displays that provide real-time data, navigation, and driving assistance, enhancing safety and the overall driving experience.

- The expansion of smart automotive windshields in the EV market presents significant opportunities for manufacturers. By offering features that improve safety, energy efficiency, and connectivity, companies are positioning themselves at the forefront of an evolving automotive landscape.

Restraint/Challenge

“High Cost of Advanced Materials and Technology Integration”

- The high cost of advanced materials, such as laminated glass and smart coatings, hinders the widespread adoption of innovative automotive windshields. This makes it difficult for manufacturers to maintain affordability while offering advanced features.

- Additionally, the integration of technologies like heads-up displays and augmented reality (AR) into windshields requires significant investment in R&D and manufacturing processes, further driving up costs for automakers and limiting adoption across mid-range vehicle segments.

For instance,

- For instance, In April 2025, AGC Inc., a leading glass manufacturer, announced the development of a cost-effective solution for incorporating AR technology into automotive windshields. This innovation is expected to lower the price of smart windshields and make the technology more accessible.

- Despite advancements in windshield technology, high costs related to advanced materials and technology integration remain a key challenge for the automotive windshield market. Companies like AGC are addressing these challenges, aiming to make cutting-edge features more affordable for a broader range of vehicles.

Automotive Windshield Market Scope

The market is segmented on the position, vehicle type, glass type, material type, electric vehicle type and sales channel.

|

Segmentation |

Sub-Segmentation |

|

By Position |

|

|

By Vehicle Type |

|

|

By Glass Type |

|

|

By Material Type |

|

|

By Electric Vehicle Type |

|

|

By Sales Channel |

|

In 2025, the front windshield is projected to dominate the market with a largest share in by position segment

The front windshield segment is expected to dominate the Automotive Windshield market, with a market share of 63.2% during the forecast period. The increasing demand for enhanced safety features and advanced driver-assistance systems (ADAS) is driving growth in the front windshield segment. Windshields now integrate sensors, cameras, and displays, improving visibility, driving safety, and overall vehicle performance in modern automotive designs.

The Passenger Cars is expected to account for the largest share during the forecast period in Automotive Windshield market

In 2025, the passenger cars segment in the Automotive Windshield Market is projected to hold the largest share of approximately 31.10%. Rising consumer demand for more fuel-efficient, aesthetically appealing, and technologically advanced passenger cars is boosting the windshield market. The growing adoption of smart windshields with features like heads-up displays and energy-efficient coatings contributes to the market’s expansion within passenger vehicles.

Automotive Windshield Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Automotive Windshield Market”

- Asia-Pacific is home to major automotive manufacturing hubs, such as China, Japan, and India, where high production volumes of vehicles drive substantial demand for automotive windshields. The region's large-scale vehicle production contributes to its dominant market share.

- A rapidly expanding middle class and increasing disposable incomes, Asia-Pacific sees rising demand for passenger vehicles. This surge in vehicle ownership directly influences the demand for automotive windshields, solidifying the region's position as a market leader

- Asia-Pacific is witnessing significant advancements in automotive technology, including smart windshields and ADAS (advanced driver assistance systems). The integration of these technologies into vehicles boosts demand for high-tech windshields, further strengthening the region's automotive windshield market.

- The region houses several prominent automotive manufacturers, including Toyota, Hyundai, and Tata Motors, which continue to produce vehicles for domestic and international markets. Their operations and product launches in Asia-Pacific directly contribute to the expansion of the automotive windshield market.

“Europe is Projected to Register the Highest CAGR in the Automotive Windshield Market”

- Europe has an advance for sustainability and green energy has led to a surge in electric vehicle (EV) adoption, particularly in countries like Germany and France. This trend is driving the need for advanced automotive windshields, supporting the region's market growth.

- European countries, including the UK and Germany, enforce stringent vehicle safety standards, increasing the demand for high-quality, durable windshields. Regulations promoting safety features like ADAS (Advanced Driver Assistance Systems) are also boosting the demand for advanced windshield technologies.

- European automakers, especially in countries like Germany, Sweden, and Italy, are leading in incorporating cutting-edge technologies into their vehicles. This includes innovations such as smart windshields and augmented reality displays, contributing to the growth of the automotive windshield market.

- European Union policies, such as the Green Deal and emissions reduction targets, are encouraging automakers to innovate. Countries like the Netherlands and Sweden are investing in eco-friendly transportation solutions, fostering the demand for advanced, lightweight windshields in the region.

Automotive Windshield Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Central Glass Co., Ltd.

- Saint-Gobain Glass India

- AGC Inc.

- SGG

- Nippon Sheet Glass Co., Ltd

- DURA AUTOMOTIVES SYSTEMS

- Sisecam

- GAURDIAN INDUSTRIES

- Magna international Inc

- T&S Autoglass

- NordGlass Sp. z o.o.

- Fuyao Group

- All Star Auto Glass

- Olimpia Auto Glass Inc.

- PPG Industries Inc.

- Shatterprufe

- OGIS GmbH

- Glaston Corporation

- Xinyi Glass Holdings Limited

Latest Developments in Global Automotive Windshield Market

- In March 2025, Tesla introduced advanced smart windshields in its latest electric vehicle models. These windshields incorporate augmented reality (AR) displays that provide real-time navigation, driving assistance, and enhanced safety features, revolutionizing the driving experience.

- In April 2025, Saint-Gobain unveiled a new line of laminated automotive windshields designed to enhance both durability and energy efficiency. This innovative technology offers better heat insulation and noise reduction, improving the overall driving comfort for consumers.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.