Global Whey Protein Market

Market Size in USD Billion

CAGR :

%

USD

6.73 Billion

USD

12.55 Billion

2024

2032

USD

6.73 Billion

USD

12.55 Billion

2024

2032

| 2025 –2032 | |

| USD 6.73 Billion | |

| USD 12.55 Billion | |

|

|

|

|

What is the Global Whey Protein Market Size and Growth Rate?

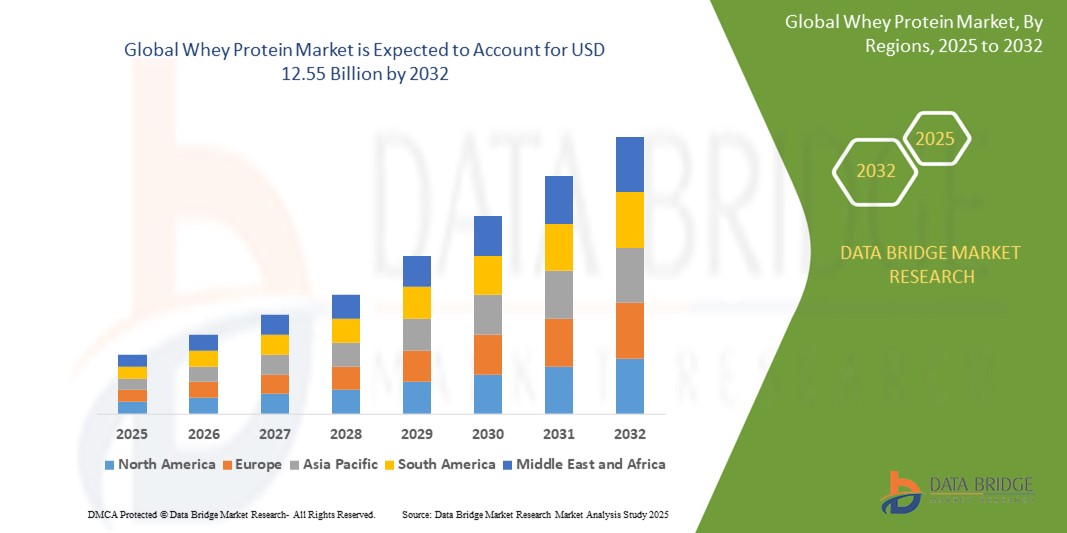

- The global whey protein market size was valued at USD 6.73 billion in 2024 and is expected to reach USD 12.55 billion by 2032, at a CAGR of 8.11% during the forecast period

- The global whey protein market is witnessing substantial growth, driven by the increasing demand for high-quality protein supplements and the rising awareness of the health benefits associated with whey protein consumption

- Whey protein, a byproduct of cheese production, is recognized for its superior amino acid profile and rapid digestibility, making it a preferred choice for athletes, fitness enthusiasts, and individuals seeking to enhance their nutritional intake

What are the Major Takeaways of Whey Protein Market?

- The market is further propelled by the growing trend towards fitness and healthy lifestyles, coupled with the expanding applications of whey protein in various industries such as food & beverages, dietary supplements, and personal care

- Moreover, advancements in processing technologies and the development of innovative whey protein products are contributing to market expansion

- North America dominated the whey protein market with the largest revenue share of 39.87% in 2024, driven by high consumer awareness regarding fitness, protein-rich diets, and clean-label nutrition products

- Asia-Pacific is expected to grow at the fastest CAGR of 15.36% from 2025 to 2032, driven by a combination of rising disposable incomes, fitness culture expansion, and urbanization. Increased awareness of nutritional benefits, growing sports participation, and demand for infant and clinical nutrition products are accelerating whey protein adoption across countries

- The Isolates segment dominated the market with the largest revenue share of 36.7% in 2024, driven by its high protein content (typically above 90%), fast absorption rate, and minimal fat and lactose content. These features make isolates ideal for post-workout recovery and clinical nutrition

Report Scope and Whey Protein Market Segmentation

|

Attributes |

Whey Protein Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Whey Protein Market?

“Personalized Nutrition and Functional Formulations”

- A dominant trend shaping the global whey protein market is the growing consumer demand for personalized nutrition and functional ingredient enhancements. Brands are formulating products tailored to specific health needs such as muscle recovery, weight management, and immune support, often enriched with vitamins, minerals, or botanical extracts

- For instance, in February 2024, Optimum Nutrition launched a range of “goal-specific” whey protein powders targeting different user profiles—lean muscle building, weight loss, and endurance support—underscoring the shift towards consumer-focused innovations

- Consumers are also showing a preference for clean-label, organic, and allergen-free options. Products made without artificial sweeteners, soy, or gluten are increasingly popular, particularly among fitness-conscious and vegan/vegetarian demographics

- The inclusion of adaptogens, probiotics, and collagen peptides in whey formulations is gaining traction, offering added functional benefits beyond traditional protein intake

- Companies such as MyProtein and Glanbia Nutritionals are investing in AI-based platforms to predict ingredient combinations aligned with emerging fitness and wellness trends, thereby shortening product development cycles and enhancing relevance

- This shift toward customization, functionality, and natural formulations is enhancing consumer trust and driving the expansion of whey protein in sports nutrition, clinical nutrition, and everyday wellness markets

What are the Key Drivers of Whey Protein Market?

- Rising health awareness and fitness culture, especially post-pandemic, is a key driver accelerating protein supplementation across various age groups and demographics. Consumers are increasingly incorporating whey protein into their daily diets for energy, strength, and metabolism management

- In March 2024, Nestlé Health Science expanded its premium whey line “Vital Proteins” into Asia-Pacific markets, leveraging regional demand for functional food and supplements

- The proliferation of e-commerce platforms, fitness apps, and DTC (Direct-to-Consumer) models is making whey protein more accessible and convenient. Many brands now offer subscription services and personalized bundles, boosting repeat purchases

- Rising disposable incomes, especially in emerging markets, are supporting the adoption of premium and specialized whey variants such as isolate, hydrolysate, and grass-fed options

- Increasing participation in sports, bodybuilding, and recreational fitness activities, along with endorsement by health influencers, is propelling the market further into the mainstream

- In addition, sustainability initiatives, such as using whey derived from organic dairy or upcycled streams, are enhancing brand differentiation and consumer loyalty

Which Factor is challenging the Growth of the Whey Protein Market?

- A major challenge is lactose intolerance and allergen concerns, which limit the appeal of traditional whey among certain population segments. Consumers with dairy sensitivities often opt for plant-based alternatives, creating competitive pressure

- A 2023 survey by the Global Food Sensitivity Association reported that 34% of potential users avoid whey due to concerns over digestive discomfort or allergic reactions, highlighting a barrier to wider adoption

- Another concern is the price sensitivity of high-quality whey protein products. Premium offerings, especially hydrolysates and organic variants, can be cost-prohibitive for budget-conscious consumers in developing markets

- Sustainability-related scrutiny is increasing, with critics pointing to the environmental impact of dairy farming. This could influence younger, eco-conscious buyers to consider plant-based or lab-grown protein alternatives

- Market fragmentation and misleading product claims also affect consumer trust. Inconsistent labeling or exaggerated health benefits may lead to skepticism or brand switching

- Addressing these challenges requires transparent marketing, third-party certifications, and innovation in lactose-free, allergen-friendly, and cost-effective formulations to ensure market resilience and growth

How is the Whey Protein Market Segmented?

The market is segmented on the basis of type, application, price, distribution channel, and end users.

• By Type

On the basis of type, the whey protein market is segmented into Isolates, Concentrates, Demineralized, and Hydrolysate. The Isolates segment dominated the market with the largest revenue share of 36.7% in 2024, driven by its high protein content (typically above 90%), fast absorption rate, and minimal fat and lactose content. These features make isolates ideal for post-workout recovery and clinical nutrition.

The Hydrolysate segment is expected to witness the fastest CAGR from 2025 to 2032 due to its superior digestibility, reduced allergen potential, and increasing application in infant formula and medical nutrition. Hydrolysates are pre-digested, making them suitable for sensitive individuals and advanced sports nutrition formulations.

• By Application

Based on application, the whey protein market is categorized into Nutritional, Personal Care, Food, Feed, Infant Formula, Sports and Performance Nutrition, and Functional/Fortified Food. The Sports and Performance Nutrition segment led the market with the highest revenue share of 31.2% in 2024, owing to the rising fitness trend, gym culture, and increased protein supplementation among athletes and bodybuilders.

The Functional/Fortified Food segment is projected to grow at the fastest rate from 2025 to 2032, driven by growing demand for high-protein snacks, beverages, and dairy alternatives. The trend of adding whey protein to everyday food items is expanding consumer reach beyond traditional fitness enthusiasts.

• By Price

On the basis of price, the market is segmented into Premium, Economy, and Low. The Economy segment accounted for the largest revenue share of 43.5% in 2024, attributed to high-volume sales across emerging markets and widespread availability in retail chains. These products often offer basic formulations with competitive pricing, appealing to the mass market.

Meanwhile, the Premium segment is anticipated to record the fastest CAGR from 2025 to 2032, as consumers increasingly seek organic, grass-fed, clean-label, and specialty whey variants. This is particularly true among urban and affluent demographics demanding higher quality and transparency.

• By Distribution Channel

On the basis of distribution channel, the whey protein market is divided into Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online Stores, and Others. The Supermarkets/Hypermarkets segment dominated the market with the highest revenue share of 38.6% in 2024, supported by extensive shelf presence, product variety, and attractive in-store promotions.

The Online Stores segment is expected to register the fastest CAGR from 2025 to 2032, fueled by the shift in consumer buying patterns towards digital platforms. E-commerce offers convenience, detailed product comparisons, and access to DTC (Direct-to-Consumer) brands offering customization and subscription plans.

• By End Users

On the basis of end users, the market is segmented into Athletes, Bodybuilders, and Lifestyle Users. The Bodybuilders segment led the market in 2024 with the largest revenue share of 41.8%, driven by consistent protein supplementation to support muscle gain, fat loss, and recovery. This user group is highly brand-loyal and tends to favor concentrated and isolate variants.

The Lifestyle Users segment is expected to witness the fastest growth rate from 2025 to 2032, as mainstream consumers increasingly adopt whey protein for general wellness, weight management, and nutritional supplementation. This includes working professionals, older adults, and health-conscious families.

Which Region Holds the Largest Share of the Whey Protein Market?

- North America dominated the whey protein market with the largest revenue share of 39.87% in 2024, driven by high consumer awareness regarding fitness, protein-rich diets, and clean-label nutrition products

- The region’s strong demand stems from the popularity of performance nutrition, gym culture, and the rising consumption of protein-enriched snacks, shakes, and supplements

- In addition, favorable government support for dairy processing, a mature sports nutrition industry, and the presence of major players such as Optimum Nutrition, Glanbia, and Hilmar Ingredients fuel growth

U.S. Whey Protein Market Insight

The U.S. market led within North America in 2024, underpinned by growing preferences for functional food and on-the-go protein formats. Consumers are increasingly opting for whey isolates and hydrolysates due to their superior absorption and health benefits. The popularity of keto, paleo, and high-protein diets, coupled with DTC sales channels, is driving segment expansion. Innovations in flavor, formulation, and packaging continue to attract new demographics, including aging populations and plant-curious flexitarians.

Europe Whey Protein Market Insight

The Europe market is projected to grow at a healthy CAGR through 2032, supported by increasing adoption of sports and clinical nutrition and shifting focus toward sustainability. Consumers prefer natural, organic, and low-lactose products with clean labeling. Regulatory support for high-protein content in fortified foods, coupled with high per capita dairy consumption, contributes to regional growth. Key countries such as Germany, France, and the U.K. are advancing innovations in whey-based RTD beverages and snacks.

U.K. Whey Protein Market Insight

The U.K. market is expected to see notable growth due to rising interest in weight management, protein-enhanced food, and low-sugar beverages. Government campaigns addressing obesity and healthier lifestyles have led to the reformulation of products with reduced sugars and higher nutritional value. Growing gym memberships, sports participation, and urban youth demand are driving the adoption of whey protein bars, RTD shakes, and fortified cereals.

Germany Whey Protein Market Insight

Germany’s market is expanding steadily, driven by demand for clean-label, lactose-free, and high-purity whey products. German consumers show strong preferences for sustainable sourcing, transparent labeling, and organic certifications. This has pushed manufacturers toward premium whey isolates and plant-integrated blends. Clinical nutrition and elderly health products are also gaining traction, reflecting the country’s aging population and health-conscious ethos.

Which Region is the Fastest Growing Region in the Whey Protein Market?

Asia-Pacific is expected to grow at the fastest CAGR of 15.36% from 2025 to 2032, driven by a combination of rising disposable incomes, fitness culture expansion, and urbanization. Increased awareness of nutritional benefits, growing sports participation, and demand for infant and clinical nutrition products are accelerating whey protein adoption across countries such as China, India, and Japan. E-commerce, urban retail chains, and fitness centers are making whey products more accessible to the expanding middle class in emerging economies.

Japan Whey Protein Market Insight

Japan’s market is experiencing steady growth due to increasing demand for compact, functional, and clean nutritional products. A strong culture around longevity and wellness is driving demand for low-lactose, low-calorie, and collagen-fortified whey proteins. Japan’s focus on convenience and premium quality has spurred innovations in single-serve whey protein formats and RTD beverages.

China Whey Protein Market Insight

China captured the largest revenue share in Asia-Pacific in 2024, thanks to its large health-conscious population, increasing protein supplementation trends, and the growth of domestic sports nutrition brands. Chinese millennials and Gen Z consumers are favoring flavored whey blends and snackable protein formats. International and local players are leveraging TCM-inspired functional ingredients and advanced e-commerce platforms to capture market share and drive premiumization.

Which are the Top Companies in Whey Protein Market?

The whey protein industry is primarily led by well-established companies, including:

- Glanbia PLC. (Ireland)

- NOW Foods (U.S.)

- Nutiva Inc (U.S.)

- The Simply Good Foods Company (U.S.)

- Iovate Health Sciences International Inc. (Canada)

- MusclePharm (U.S.)

- Kerry Group Plc. (Ireland)

- CytoSport, Inc. (U.S.)

- Nature's Bounty (U.S.)

- Reliance Private Label Supplements (U.S.)

- Herbalife International of America, Inc. (U.S.)

- Danone SA (France)

- GNC Holdings, LLC (U.S.)

- Orgain Inc. (U.S.)

- True Nutrition (U.S.)

What are the Recent Developments in Global Whey Protein Market?

- In July 2024, GHOST, a lifestyle brand recognized for its sports nutrition products, energy drinks, supplements, and apparel, unveiled the GHOST WHEY x OREO “MINT”, an innovative flavor collaboration that elevates its protein portfolio. This launch reflects the brand’s commitment to combining taste innovation with performance nutrition

- In September 2023, Naturell India Pvt. Ltd., the parent company of Max Protein, introduced two new offerings—Max Protein Whey Protein and Max Protein Plant Protein—with the whey variant available in indulgent flavors such as Irish Chocolate and Kulfi. This expansion underscores Max Protein’s strategy to cater to evolving consumer palates while maintaining a strong nutritional profile

- In November 2023, FrieslandCampina Ingredients, a global leader in protein solutions, launched Nutri Whey ProHeat, a microparticulated and heat-stable whey protein developed for the medical nutrition sector. This innovation demonstrates the company's focus on functional protein ingredients tailored for specialized health applications

- In January 2023, Molvest Group inaugurated a new milk protein concentrate production facility in Russia, aimed at reducing reliance on imports and strengthening domestic protein manufacturing. This move enhances local supply chains and supports national food security objectives

- In June 2022, Fonterra’s NZMP introduced its Grade A Whey Protein Concentrate, targeting the growing cultured dairy product segment. This product release aligns with NZMP’s goal to capitalize on rising demand for high-quality protein ingredients in fermented dairy applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Whey Protein Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Whey Protein Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Whey Protein Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.