Global Wheat Protein Market

Market Size in USD Billion

CAGR :

%

USD

260.24 Billion

USD

10.15 Billion

2024

2032

USD

260.24 Billion

USD

10.15 Billion

2024

2032

| 2025 –2032 | |

| USD 260.24 Billion | |

| USD 10.15 Billion | |

|

|

|

|

Wheat Protein Market Analysis

The wheat protein market is experiencing significant growth, driven by rising consumer demand for plant-based and high-protein food products. Wheat protein, derived from wheat gluten, is widely used in bakery products, meat analogs, nutritional supplements, and pet food due to its excellent binding and texturizing properties. Advancements in wheat protein processing, such as enzymatic hydrolysis and improved extraction techniques, have enhanced the functionality, digestibility, and nutritional value of wheat protein ingredients. In addition, the increasing preference for sustainable and non-GMO plant proteins has encouraged manufacturers to invest in research and development to create innovative wheat protein solutions. Companies are expanding their production capacities to meet the surging demand, as seen with ADM’s USD 300 million investment in Illinois and Amber Wave’s establishment of North America’s largest wheat protein facility. The rise in gluten-free and high-protein diets is also shaping market dynamics, pushing companies to introduce specialized wheat protein isolates and textured proteins. With the Asia-Pacific region showing rapid growth due to changing dietary habits and increasing disposable income, the wheat protein market is expected to witness sustained expansion in the coming years.

Wheat Protein Market Size

The global Wheat Protein market size was valued at USD 260.24 Billion in 2024 and is projected to reach USD 10.15 Billion by 2032, with a CAGR of 4.61 % during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework.

Wheat Protein Market Trends

“Growing Demand for Textured Wheat Protein”

The wheat protein market is witnessing a growing trend toward textured wheat protein as demand for plant-based meat alternatives surges. Consumers seeking sustainable and high-protein diets are driving the adoption of textured wheat protein, known for its superior binding properties and meat-like texture. This trend is particularly prominent in the alternative meat industry, where companies are formulating wheat-based protein solutions to enhance product texture and nutritional value. For instance, Crespel & Deiters Group introduced a new textured wheat protein in November 2022, expanding its plant-based ingredient portfolio to cater to this rising demand. In addition, advancements in protein extraction and processing have improved the functionality of wheat protein, making it a key ingredient in vegan meat, processed foods, and nutritional supplements. As consumers increasingly seek clean-label, non-GMO, and high-protein food options, the textured wheat protein segment is expected to drive significant market growth in the coming years.

Report Scope and Wheat Protein Market Segmentation

|

Attributes |

Wheat Protein Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

ADM (U.S.), Cargill, Incorporated (U.S.), AGRANA Beteiligungs-AG (Austria), MGP (U.S.), Manildra Group (Australia), Roquette Frères (France), GLICO NUTRITION CO., LTD. (Japan), Kröner-Stärke GmbH (Germany), TEREOS (France), Crespel & Deiters Group (Germany), CropEnergies AG (Germany), Nutra Healthcare Private Limited (India), Godrej Astec (India), GLUTEN Y ALMIDONES INDUSTRIALES S.A. DE C.V (Mexico), Anhui Reapsun Food (China), BASF (Germany), ROBERTET (France), Kerry Group plc. (Ireland), and Givaudan (Switzerland) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Wheat Protein Market Definition

Wheat protein is a plant-based protein derived from wheat, primarily composed of gluten, which includes gliadin and glutenin. It is known for its elasticity, water absorption, and binding properties, making it a key ingredient in bakery products, meat alternatives, and nutritional supplements

Wheat Protein Market Dynamics

Drivers

- Rising Demand for Plant-Based Protein

The global shift toward plant-based diets is a key driver for the wheat protein market, as consumers increasingly seek sustainable, high-protein alternatives to animal-based products. With growing health consciousness, ethical concerns, and environmental awareness, the demand for vegan and vegetarian food options has surged. Wheat protein, particularly textured wheat protein and wheat gluten, plays a crucial role in meat substitutes and dairy alternatives, offering the desired texture, protein content, and functionality. For instance, Beyond Meat and Impossible Foods have incorporated wheat protein into their formulations to enhance the chewy, meat-like texture of plant-based burgers. As plant-based food innovation expands, wheat protein remains an essential ingredient, strengthening its market demand in the alternative protein industry.

- Growth of the Bakery and Processed Food Industry

The bakery and processed food sector is a significant driver for wheat protein consumption, as it enhances texture, elasticity, and moisture retention in baked goods. Vital wheat gluten is widely used in products such as bread, croissants, and pasta, helping to improve dough strength and elasticity, ensuring a better final product. In regions such as North America and Europe, the demand for high-protein and gluten-based bakery products is increasing due to the rising popularity of artisanal bread and protein-fortified snacks. For instance, brands such as Dave’s Killer Bread and Pepperidge Farm have introduced high-protein wheat-based bakery items to cater to health-conscious consumers. As the bakery industry continues to expand, the use of wheat protein as a functional ingredient will continue to rise, further propelling market growth.

Opportunities

- Rising Demand for Sports and Nutritional Supplements

The fitness and wellness industry is witnessing a strong demand for high-protein dietary supplements, driving the adoption of wheat protein isolate and hydrolyzed wheat protein. These protein variants are valued for their rich amino acid profile, easy digestibility, and functional benefits, making them a viable alternative to soy and whey protein. As consumers look for plant-based, allergen-free protein options, wheat protein is being widely incorporated into protein bars, meal replacement shakes, and functional foods. For instance, companies such as MyProtein and Garden of Life have introduced wheat protein-enriched supplements, catering to the growing vegan and vegetarian athlete community. With rising health consciousness and increasing participation in fitness activities, the nutritional supplement market presents a major growth opportunity for wheat protein manufacturers.

- Increasing Technological Advancements and Product Innovations

The wheat protein industry is benefiting from continuous research and development, leading to new and improved formulations with enhanced solubility, digestibility, and functionality. Companies are investing in the development of textured wheat proteins and hydrolyzed wheat proteins to meet the demands of various industries, including food, cosmetics, and pharmaceuticals. These advancements allow wheat protein to be used in alternative meat products, anti-aging skincare formulations, and medical nutrition. For instance, Roquette Frères has introduced high-performance wheat protein solutions tailored for plant-based meat and functional food applications. In addition, innovations in fermentation and enzymatic processing are improving the taste and texture of wheat protein-based products, making them more appealing to consumers. These advancements enhance product versatility and open new market opportunities across different sectors.

Restraints/Challenges

- Competition from Alternative Proteins

The wheat protein market faces strong competition from alternative plant-based proteins such as pea, soy, and rice protein. These proteins are gaining popularity due to their non-allergenic properties, better digestibility, and sustainability benefits. For instance, pea protein is widely used in plant-based meat alternatives because it mimics the texture of animal protein while being gluten-free, making it appealing to a broader consumer base. Companies such as Beyond Meat and Impossible Foods have opted for pea protein over wheat protein to cater to gluten-intolerant consumers and avoid allergen-related concerns. As a result, the growing adoption of pea and soy protein in vegan and functional food markets is reducing the demand for wheat-based protein ingredients, making it difficult for manufacturers to maintain market share.

- Regulatory and Labeling Issues

Wheat protein manufacturers must navigate strict regulatory requirements related to gluten content and allergen labeling, particularly in regions such as the U.S. and Europe. Governments mandate that food producers clearly declare gluten content on product labels to protect consumers with celiac disease or gluten sensitivity. For instance, the U.S. FDA’s gluten-free labeling regulation requires products containing wheat protein to meet the less than 20 parts per million (ppm) gluten threshold to be labeled as gluten-free. This regulation limits the use of wheat protein in certain health-conscious and gluten-free product segments, affecting its market positioning. In addition, compliance with stringent European food safety standards adds to operational costs, making it challenging for wheat protein manufacturers to compete with more easily regulated plant-based proteins such as pea and rice protein.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Wheat Protein Market Scope

The market is segmented on the basis of product, application, form, and concentration. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Wheat Gluten

- Wheat Protein Isolate

- Textured Wheat Protein

- Hydrolyzed Wheat Protein

Application

- Bakery and Snacks

- Pet Food

- Nutritional Bars and Drinks

- Processed Meat

- Meat Analogy

- Others

Form

- Dry

- Liquid

Concentration

- 75%

- 85%

- 95%Top of Form

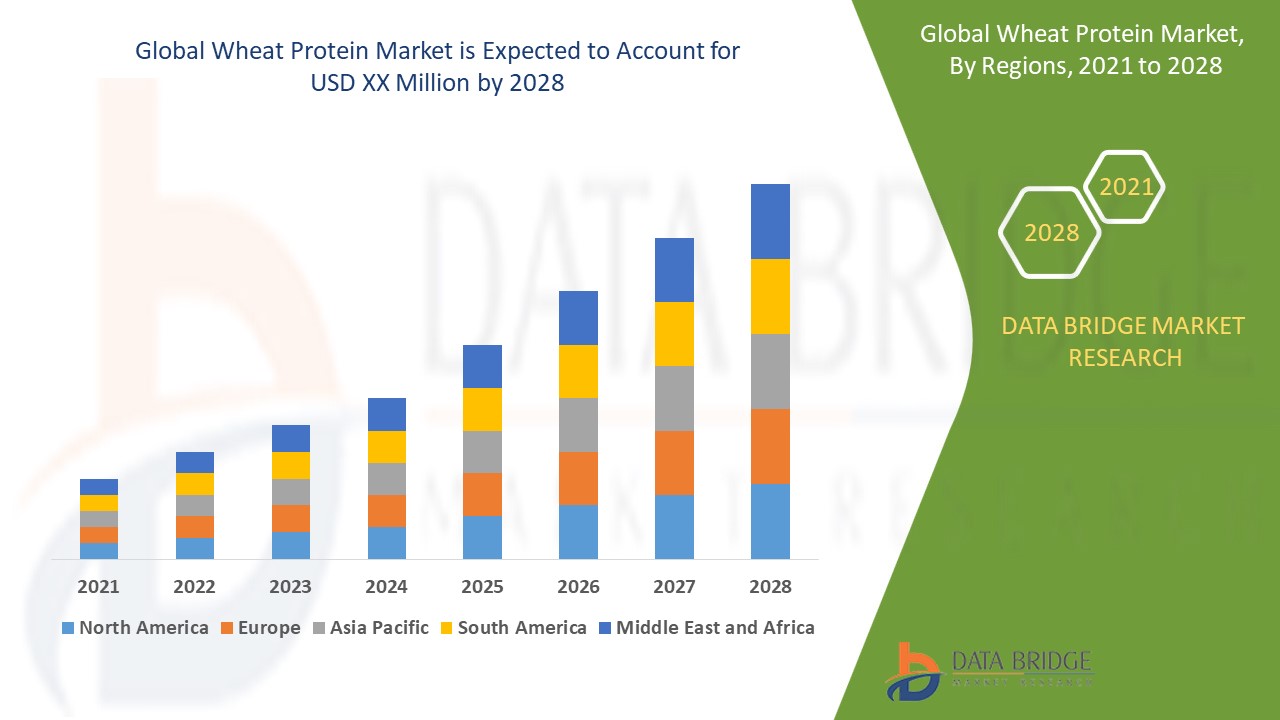

Wheat Protein Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, product, application, form, and concentration as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA)

North America dominates the wheat protein market and is expected to maintain its dominance throughout the forecast period. This growth is driven by a well-established food production chain, advanced processing technologies, and the presence of key industry players. In addition, the rising demand for plant-based protein alternatives in the food and beverage industry is further fueling market expansion. The region's strong infrastructure, coupled with continuous innovations in wheat protein applications, ensures sustained growth in the coming years.

Asia-Pacific is poised to experience fastest growth in the wheat protein market, registering the highest CAGR during the forecast period. This surge is driven by rising health consciousness, increasing adoption of protein-rich diets, and growing awareness of plant-based nutrition. In addition, rapid urbanization, changing dietary preferences influenced by Western lifestyles, and a rise in disposable income are further boosting market demand. The expanding food and beverage industry, along with increased investments in health-focused products, is expected to accelerate market expansion in the coming years.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Wheat Protein Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Wheat Protein Market Leaders Operating in the Market Are:

- ADM (U.S.)

- Cargill, Incorporated (U.S.)

- AGRANA Beteiligungs-AG (Austria)

- MGP (U.S.)

- Manildra Group (Australia)

- Roquette Frères (France)

- GLICO NUTRITION CO., LTD. (Japan)

- Kröner-Stärke GmbH (Germany)

- TEREOS (France)

- Crespel & Deiters Group (Germany)

- CropEnergies AG (Germany)

- Nutra Healthcare Private Limited (India)

- Godrej Astec (India)

- GLUTEN Y ALMIDONES INDUSTRIALES S.A. DE C.V (Mexico)

- Anhui Reapsun Food (China)

- BASF (Germany)

- ROBERTET (France)

- Kerry Group plc. (Ireland)

- Givaudan (Switzerland)

Latest Developments in Wheat Protein Market

- In January 2023, Amber Wave commenced operations at North America’s largest wheat protein facility following an investment from Summit Agricultural Group. The company is currently producing AmberPro Vital Wheat Gluten, catering to industries such as commercial bakeries, food ingredient plants, alternative meat producers, pet food processors, and specialty feed companies

- In November 2022, Crespel & Deiters Group introduced a new textured wheat protein to the market, further expanding its textured vegetable protein line

- In April 2022, ADM invested USD 300 million to expand its alternative plant-protein production capacity in Illinois in response to the rising demand for plant-based ingredients

- In February 2022, MGP Ingredients announced plans for the construction of a new manufacturing facility dedicated to textured protein production, aiming to meet the growing demand for plant-based meat alternatives

- In January 2021, MGP Ingredients, Inc., a leading provider of high-quality distilled spirits and specialized wheat proteins and starches, completed the acquisition of Luxco, Inc., along with its affiliated companies, as part of a definitive agreement. With over 60 years of heritage, Luxco was recognized as a top-tier branded beverage alcohol company across multiple categories

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Wheat Protein Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Wheat Protein Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Wheat Protein Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.