Global Protein Supplements Market

Market Size in USD Billion

CAGR :

%

USD

11.91 Billion

USD

26.48 Billion

2024

2032

USD

11.91 Billion

USD

26.48 Billion

2024

2032

| 2025 –2032 | |

| USD 11.91 Billion | |

| USD 26.48 Billion | |

|

|

|

|

Protein Supplements Market Size

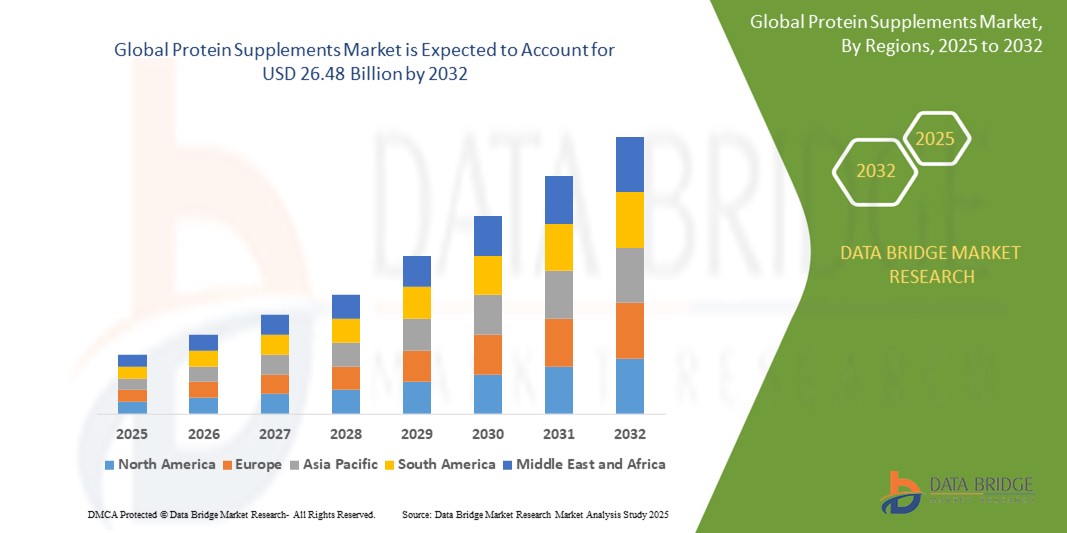

- The global protein supplements market size was valued at USD 11.91 billion in 2024 and is expected to reach USD 26.48 billion by 2032, at a CAGR of 10.50% during the forecast period

- The market growth is primarily driven by the increasing consumer awareness regarding health and wellness, coupled with a rising participation in sports and fitness activities worldwide.

- Furthermore, the growing demand for convenient and on-the-go nutritional options and the rising adoption of plant-based diets are significantly boosting the protein supplements industry

Protein Supplements Market Analysis

- Protein supplements, available in various forms such as powders, bars, and ready-to-drink beverages, are crucial for muscle building, recovery, and overall well-being, becoming essential components of modern diets for athletes, fitness enthusiasts, and the general population

- The escalating demand for protein supplements is majorly fueled by the increasing focus on protein-enriched diets, the growing trend of health-conscious lifestyles, and the rising geriatric population seeking to maintain muscle mass and health

- North America dominates the protein supplements market with the largest revenue share of 41.9% in 2024, characterized by high consumer awareness, a well-established fitness industry, and a strong presence of key market players

- Asia-Pacific is expected to be the fastest-growing region in the protein supplements market during the forecast period from 2024 to 2032, owing to increasing urbanization, rising disposable incomes, and a growing inclination towards health and fitness, especially in countries such as China and India

- The animal-based segment is dominating the market with the largest revenue share of 61.6% in 2024, owing to its comprehensive nutritional benefits and strong scientific evidence supporting its health advantages

Report Scope and Protein Supplements Market Segmentation

|

Attributes |

Protein Supplements Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Protein Supplements Market Trends

“Emphasis on Personalization and Functional Formulations”

- A significant and accelerating trend in the global protein supplements market is the deepening integration of personalized nutrition approaches and the development of formulations with added functional ingredients

- For instance, many companies are now offering protein products specifically designed for different needs, such as collagen-based proteins for skin and joint health, protein with added digestive enzymes or probiotics for gut health, or blends incorporating adaptogens for stress management

- The rise of online diagnostic tools and personalized recommendation platforms further supports this trend, allowing consumers to identify specific deficiencies or goals and choose supplements accordingly

- This seamless integration of protein into broader wellness regimens, often including other beneficial compounds, creates a more comprehensive and appealing offering

- This trend towards more intelligent, intuitive, and interconnected nutritional solutions is fundamentally reshaping user expectations for dietary supplementation

- The demand for protein supplements that offer personalized and functional benefits is growing rapidly across various consumer segments, as individuals increasingly prioritize tailored health solutions and comprehensive well-being

Protein Supplements Market Dynamics

Driver

“Growing Health and Wellness Awareness Coupled with Active Lifestyles”

- The increasing prevalence of health and wellness concerns among consumers worldwide, coupled with the accelerating adoption of active lifestyles and participation in fitness activities, is a significant driver for the heightened demand for protein supplements

- As individuals become more conscious of their dietary choices and seek to optimize their physical health, protein's role in muscle maintenance, recovery, weight management, and satiety becomes more recognized

- For instance, the continuous growth in gym memberships, the popularity of various sports and the rise of online fitness communities and influencers actively promoting protein consumption are all contributing factor

- Consumers are proactively seeking enhanced nutrition for performance, weight management, and overall vitality, leading them to incorporate protein supplements into their daily routines

- Furthermore, the convenience offered by various protein supplement formats, such as ready-to-drink shakes and protein bars, perfectly aligns with busy modern lifestyles, providing easy and quick access to essential nutrients

Restraint/Challenge

“Concerns Regarding Product Quality, Authenticity, and Regulatory Scrutiny”

- Concerns surrounding the quality control, potential for adulteration, and the accuracy of labeling in protein supplements pose a significant challenge to broader market penetration and consumer trust

- For instance, recent reports from India in 2024 highlighted that nearly 70% of popular supplements contained incorrect protein information, and some also had harmful contaminants such as pesticide residue and fungal aflatoxins, prompting the Food Safety and Standards Authority of India (FSSAI) to announce tighter regulations

- Addressing these concerns through robust quality assurance, stringent third-party testing, and transparent ingredient sourcing is crucial for building and maintaining consumer trust. Companies such as August and Level Home, in the smart lock analogy, emphasize their advanced encryption methods

- While prices are gradually becoming more competitive with increased production and market maturity, the perceived premium for high-quality, transparently sourced protein can still hinder widespread adoption

- Overcoming these challenges through enhanced quality control measures, consumer education on recognizing verified products and understanding labels, and the development of more affordable yet high-quality protein options will be vital for sustained market growth.

Protein Supplements Market Scope

The market is segmented on the basis of type, source, form, gender, age group, application, and distribution channel.

- By Type

On the basis of type, the protein supplements market is segmented into whey protein, soy protein, casein protein, egg protein, pea protein, and others. The whey protein segment is expected to dominate the market, driven by its comprehensive amino acid profile, rapid absorption, and established reputation for muscle growth and recovery. Its widespread availability and versatility in various product forms also contribute to its leading position.

The pea protein segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the accelerating shift towards plant-based diets, its hypoallergenic properties, and increasing consumer demand for sustainable and allergen-friendly protein sources. Its growing use in both sports nutrition and functional food applications is also a key driver.

- By Source

On the basis of source, the protein supplements market is segmented into plant-based and animal-based. The animal-based segment held the largest market revenue share of 61.6% in 2024, primarily due to the long-standing popularity and proven efficacy of traditional sources such as whey and casein, especially among athletes and bodybuilders.

The plant-based segment is expected to witness the fastest CAGR of 9.3% from 2025 to 2032, driven by the increasing global adoption of vegan and vegetarian lifestyles, growing environmental concerns, and a rising awareness of the health benefits associated with plant-derived proteins.

- By Form

On the basis of form, the protein supplements market is segmented into ready to drink, protein powder, protein bar, and others. The protein powder segment held the largest market revenue share of 56.6% in 2024, attributed to its cost-effectiveness, high protein concentration, and versatility in being mixed with various beverages and recipes, making it a staple for a broad range of consumers.

The ready-to-drink (RTD) segment is expected to witness the fastest CAGR of 9% from 2025 to 2032, propelled by the increasing consumer preference for convenient, on-the-go nutrition solutions that fit busy lifestyles, along with continuous innovation in flavors and functional formulations.

- By Gender

On the basis of gender, the protein supplements market is segmented into male and female. The male segment is expected to dominate the market in 2025, largely due to a historically higher engagement in bodybuilding and intense physical activities, and a greater emphasis on muscle mass gain.

The female segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by the increasing participation of women in fitness, a growing understanding of protein's benefits for weight management, satiety, and overall health, and the availability of female-targeted products.

- By Age Group

On the basis of age group, the protein supplements market is segmented into millennials, generation X, and baby boomers. The millennials segment is expected to dominate the market in 2025, owing to their strong focus on health and wellness, active lifestyles, and early adoption of dietary supplements and fitness trends.

The baby boomers segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by increasing awareness of protein's role in healthy aging, muscle retention (to combat sarcopenia), and overall vitality as they seek to maintain an active lifestyle.

- By Application

On the basis of application, the protein supplements market is segmented into sports nutrition and functional food. The functional food segment accounted for the largest market revenue share of 35.8% in 2024, driven by the growing consumer demand for everyday food products fortified with protein for general health, satiety, and convenience, extending protein consumption beyond just sports enthusiasts.

The sports nutrition segment is expected to witness the fastest CAGR of 8.7% from 2025 to 2032, fueled by the high consumption among athletes, bodybuilders, and fitness enthusiasts for performance enhancement, muscle recovery, and growth.

- By Distribution Channel

On the basis of distribution channel, the protein supplements market is segmented into supermarkets and hypermarkets, drug stores, online, convenience stores, specialist sport stores, health and nutritionist stores, and others. The online segment held the largest market revenue share of 60.9% in 2024, driven by the wide product selection, competitive pricing, convenience of home delivery, and the increasing preference for online shopping among health-conscious consumers.

The supermarket segment is expected to witness the fastest CAGR of 8.8% from 2025 to 2032, as analyze consumer sentiment to identify product and brand preferences, enabling them to stock favored items and apply premium pricing when customers are willing to pay more for their preferred choices.

Protein Supplements Market Regional Analysis

- North America dominates the protein supplements market with the largest revenue share of 41.9% in 2024, characterized by high consumer awareness, a well-established fitness industry, and a strong presence of key market players

- Consumers in the region highly value the diverse range of protein products, including innovative plant-based options, and their seamless integration into active lifestyles

- This widespread adoption is further supported by a strong presence of key market players, aggressive marketing campaigns, and a culture that increasingly prioritizes dietary supplements for performance, weight management, and overall well-being

U.S. Protein Supplements Market Insight

The U.S. protein supplements market captured a significant revenue share within North America in 2024, fueled by the swift uptake of fitness trends and the expanding awareness of health and wellness. Consumers are increasingly prioritizing the enhancement of their diets through high-quality protein for muscle growth, recovery, and overall health. The growing preference for diverse protein forms, including plant-based options, combined with robust demand for convenient ready-to-drink products and protein bars, further propels the protein supplements industry.

Europe Protein Supplements Market Insight

The European protein supplements market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by growing consumer knowledge of protein's health advantages and the increasing popularity of convenient protein products. The rise of fitness-focused diets and advancements in protein fortification in functional foods are also fostering the adoption of protein supplements. European consumers are increasingly drawn to plant-based protein options and are integrating protein into everyday foods, reflecting a broader shift towards proactive health management. The region is experiencing significant growth across various applications, with protein supplements being incorporated into both sports nutrition and general wellness products.

U.K. Protein Supplements Market Insight

The U.K. protein supplements market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the escalating trend of health and fitness consciousness and a desire for enhanced well-being and convenience. Additionally, concerns regarding balanced diets and nutrient intake are encouraging both individuals and athletes to choose protein supplements. The UK’s embrace of active lifestyles, alongside its robust e-commerce and retail infrastructure, is expected to continue to stimulate market growth, with a growing demand for plant-based and clean-label protein products.

Germany Protein Supplements Market Insight

The German protein supplements market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of healthy nutrition and the demand for high-quality, scientifically backed solutions. Germany’s well-developed health infrastructure, combined with its emphasis on quality and sustainability, promotes the adoption of protein supplements, particularly for sports nutrition and active lifestyles. The integration of protein supplements into functional foods and the strong preference for transparent, clean-label products aligning with local consumer expectations are also becoming increasingly prevalent.

Asia-Pacific Protein Supplements Market Insight

The Asia-Pacific protein supplements market is poised to grow at the fastest CAGR of over 9.8% in 2024, driven by increasing urbanization, rising disposable incomes, and growing health awareness in countries such as China, Japan, and India. The region's growing inclination towards healthier lifestyles, supported by government initiatives promoting fitness and nutrition, is driving the adoption of protein supplements. Furthermore, as APAC emerges as a significant manufacturing hub for protein ingredients and finished products, the affordability and accessibility of protein supplements are expanding to a wider consumer base.

Japan Protein Supplements Market Insight

The Japan protein supplements market is gaining momentum due to the country’s high health consciousness, rapid urbanization, and demand for convenient, high-quality nutrition. The Japanese market places a significant emphasis on product purity and efficacy, and the adoption of protein supplements is driven by the increasing number of individuals engaging in fitness activities and seeking healthy aging solutions. The integration of protein supplements with other functional ingredients and the growing popularity of plant-based protein sources are fueling growth. Moreover, Japan's aging population is likely to spur demand for easier-to-use, nutritious protein solutions in both sports nutrition and general wellness segments.

China Protein Supplements Market Insight

The China protein supplements market accounted for the largest market revenue share in Asia Pacific in 2025, attributed to the country's expanding middle class, rapid urbanization, and high rates of health and fitness adoption. China stands as one of the largest and fastest-growing markets for health and wellness products, and protein supplements are becoming increasingly popular among gym-goers, athletes, and the general population. The push towards national health initiatives (e.g., Healthy China 2030) and the availability of diverse and increasingly affordable protein options, alongside strong domestic manufacturers and robust e-commerce channels, are key factors propelling the market in China.

Protein Supplements Market Share

The protein supplements industry is primarily led by well-established companies, including:

- Glanbia PLC (Ireland)

- Now Health International (U.S.)

- Nutiva.Inc (U.S.)

- The Simply Good Foods Company (U.S.)

- Iovate Health Sciences International Inc. (Canada)

- MusclePharm Corporation (U.S.)

- Kerry Group Plc (Ireland)

- CytoSport, Inc. (U.S.)

- The Nature's Bounty Co. (U.S.)

- Reliance Vitamin Company, Inc. (U.S.)

- Herbalife Nutrition, Inc. (U.S.)

- Danone SA (France)

- GNC Holdings, LLC (U.S.)

- Orgain Inc. (U.S.)

- True Nutrition (U.S.)

Latest Developments in Global Protein Supplements Market

-

In June 2024, Nestlé introduced a new range of plant-based protein powders under its Garden of Life brand, catering to vegan consumers and prioritizing clean-label formulations. These products focus on natural ingredients, ensuring high-quality nutrition without artificial additives. Designed for health-conscious individuals, the new line supports sustainable and ethical consumption while delivering essential protein benefits. Nestlé’s expansion in plant-based nutrition reinforces its commitment to innovation in wellness products

- In April 2024, Glanbia Plc launched a personalized protein subscription service under its Optimum Nutrition brand, utilizing AI to recommend customized protein blends. This service tailors formulations based on individual health goals, dietary preferences, and fitness needs, enhancing user experience and nutritional benefits. By integrating AI-driven insights, Glanbia optimizes protein intake for consumers seeking precision nutrition. The initiative reflects the growing demand for personalized wellness solutions in the sports and active nutrition market

- In March 2023, Myprotein collaborated with leading fitness apps to integrate protein intake tracking, enhancing consumer engagement and loyalty. This partnership enables users to monitor their protein consumption seamlessly, optimizing their nutrition and fitness goals. By leveraging app-based tracking, Myprotein strengthens its presence in the health and wellness sector, offering a more personalized experience for fitness enthusiasts. The integration supports informed dietary choices, reinforcing Myprotein’s commitment to innovation in sports nutrition

- In January 2023, Orgain introduced a new line of organic protein bars featuring clean-label ingredients, catering to health-conscious consumers across North America and Europe. These bars prioritize natural, high-quality components, ensuring a nutritious and convenient snack option. Designed for individuals seeking wholesome nutrition, the product aligns with growing demand for organic and transparent food choices. Orgain’s expansion in the organic protein market reinforces its commitment to sustainability and wellness

- In November 2022, PepsiCo expanded its Muscle Milk brand by introducing ready-to-drink protein shakes, catering to on-the-go consumers seeking convenient nutrition. These shakes provide a balanced blend of protein and essential nutrients, supporting active lifestyles and muscle recovery. By enhancing accessibility and ease of consumption, PepsiCo strengthens Muscle Milk’s presence in the sports nutrition market. The expansion aligns with growing consumer demand for portable, high-protein beverages

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Protein Supplements Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Protein Supplements Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Protein Supplements Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.