Global Veterinary Antimicrobial Susceptibility Testing Market

Market Size in USD Billion

CAGR :

%

USD

41.68 Billion

USD

62.72 Billion

2024

2032

USD

41.68 Billion

USD

62.72 Billion

2024

2032

| 2025 –2032 | |

| USD 41.68 Billion | |

| USD 62.72 Billion | |

|

|

|

|

Veterinary Antimicrobial Susceptibility Testing Market Size

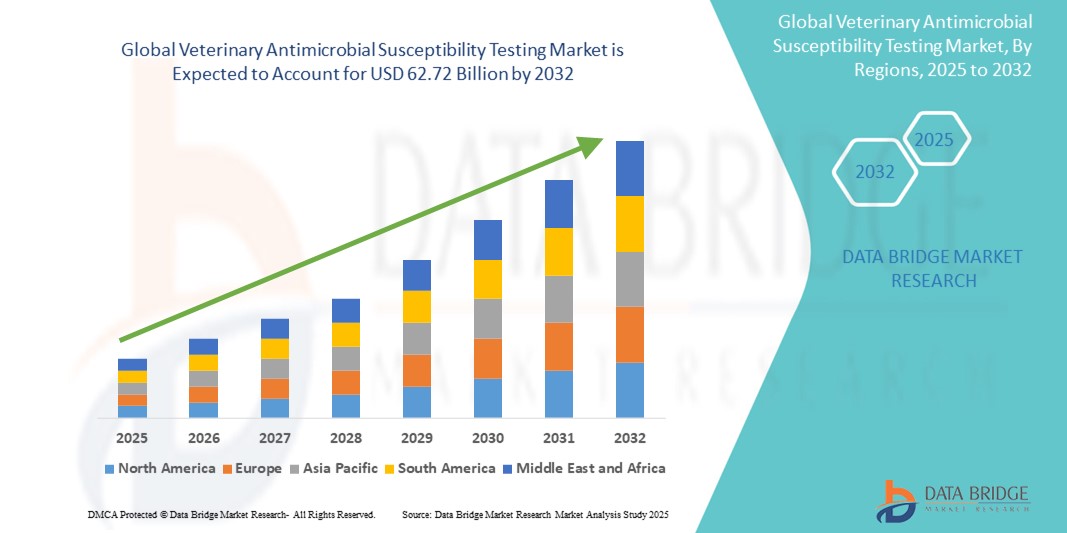

- The global veterinary antimicrobial susceptibility testing market size was valued at USD 41.68 billion in 2024 and is expected to reach USD 62.72 billion by 2032, at a CAGR of 5.24% during the forecast period

- The market growth is largely fueled by increasing awareness regarding antimicrobial resistance (AMR) and the crucial role of accurate diagnostic tools in guiding effective animal treatment, which is driving greater adoption of susceptibility testing in veterinary practices

- Furthermore, the rising global population of companion and livestock animals, along with a growing emphasis on animal health and food safety, is establishing susceptibility testing as an essential component of veterinary diagnostics. These converging factors are accelerating the demand for efficient AST methods, thereby significantly boosting the industry's growth

Veterinary Antimicrobial Susceptibility Testing Market Analysis

- Veterinary antimicrobial susceptibility testing (AST), which determines the most effective antibiotic treatment for infections in animals, is becoming an increasingly critical component of veterinary diagnostics in both livestock and companion animal sectors due to growing concerns over antimicrobial resistance and the need for targeted therapy

- The escalating demand for veterinary AST is primarily fueled by increasing regulatory initiatives promoting responsible antimicrobial use in animals, growing awareness among veterinarians and pet owners, and the rising prevalence of zoonotic diseases and animal infections

- North America dominated the veterinary antimicrobial susceptibility testing market with the largest revenue share of 39.2% in 2024, characterized by a robust veterinary healthcare infrastructure, strong regulatory frameworks, and widespread adoption of advanced diagnostic technologies, particularly in the United States where stringent monitoring of antimicrobial usage in livestock drives market expansion

- Asia-Pacific is expected to be the fastest growing region in the veterinary antimicrobial susceptibility testing market during the forecast period due to expanding veterinary services, increasing livestock production, and rising awareness of antimicrobial stewardship

- The disks and plate segment dominated the veterinary antimicrobial susceptibility testing market with a market share of 42.1% in 2024, driven by its cost-effectiveness, ease of use, and widespread acceptance in clinical veterinary settings for evaluating bacterial resistance patterns

Report Scope and Veterinary Antimicrobial Susceptibility Testing Market Segmentation

|

Attributes |

Veterinary Antimicrobial Susceptibility Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Veterinary Antimicrobial Susceptibility Testing Market Trends

“Enhanced Precision Through AI and Automation Integration”

- A significant and accelerating trend in the global veterinary antimicrobial susceptibility testing (AST) market is the growing integration of artificial intelligence (AI) and automation technologies into diagnostic platforms, significantly improving the precision, speed, and efficiency of AST procedures

- For instance, companies are developing AI-driven platforms that automate sample analysis and result interpretation, reducing manual errors and enhancing consistency across tests. Systems such as Becton, Dickinson and Company’s Phoenix™ M50 integrate AI to optimize antimicrobial panel testing and deliver faster, more accurate susceptibility results

- AI integration in veterinary AST enables predictive analytics for resistance trends, aiding in epidemiological surveillance and antibiotic stewardship. Automated systems can flag unusual resistance patterns, suggest tailored treatment options, and generate alerts for emerging AMR threats, supporting timely interventions by veterinarians

- The seamless integration of AST platforms with digital veterinary health records and laboratory information systems ensures centralized management of data, enabling faster clinical decisions and better monitoring of antimicrobial usage across animal populations

- This trend toward more intelligent, automated, and data-integrated AST workflows is reshaping expectations for veterinary diagnostics, prompting companies such as BioMérieux and Thermo Fisher Scientific to invest in AI-enhanced AST tools that provide both high-throughput and highly accurate resistance profiling

- The demand for smart veterinary AST systems is growing rapidly across both livestock and companion animal segments, as stakeholders prioritize speed, reliability, and evidence-based treatment decisions to combat rising antimicrobial resistance globally

Veterinary Antimicrobial Susceptibility Testing Market Dynamics

Driver

“Rising AMR Awareness and Regulatory Push Toward Prudent Antimicrobial Use”

- The growing awareness of antimicrobial resistance (AMR) as a critical public health issue, combined with stronger regulatory pressures to reduce indiscriminate antibiotic use in animals, is a major driver of the veterinary AST market

- For instance, in April 2024, the European Medicines Agency expanded its veterinary antimicrobial usage monitoring framework, encouraging the adoption of standardized AST to guide responsible treatment protocols in livestock. Such efforts are expected to accelerate the adoption of AST technologies during the forecast period

- As global veterinary professionals and animal health organizations seek more targeted antibiotic therapies, AST enables evidence-based treatment decisions that align with AMR mitigation strategies. This shift is especially prominent in high-output agricultural economies where antibiotic stewardship is tightly linked to food safety and export compliance

- Furthermore, increasing demand for pet healthcare and preventive diagnostics is pushing AST adoption in the companion animal segment. The rise of veterinary reference laboratories and portable point-of-care AST devices is enhancing test accessibility across clinical settings

- Technological advancements in rapid AST kits, cloud-based result sharing, and simplified workflows are making susceptibility testing more feasible for routine veterinary use, helping veterinarians tailor treatments and improve animal outcomes while preserving antimicrobial efficacy

Restraint/Challenge

“Limited Infrastructure and Cost Constraints in Developing Regions”

- The limited availability of veterinary diagnostic infrastructure in several developing regions poses a significant challenge to widespread adoption of antimicrobial susceptibility testing

- Many clinics lack access to specialized equipment, trained personnel, or standardized protocols required to implement AST effectively

- For instance, in low-income countries, logistical issues such as sample transport delays, insufficient cold chain systems, and inconsistent laboratory capacities often hinder timely and reliable AST, restricting its use to urban or better-resourced areas

- In addition, the high initial investment and operational costs associated with automated AST systems and consumables can deter adoption, particularly among small-scale veterinary practices and livestock owners operating on tight budgets

- While lower-cost manual methods such as disk diffusion are more accessible, their longer turnaround times and dependence on technician skill can limit diagnostic accuracy and clinical utility

- Bridging this gap requires international support, public–private partnerships, and investment in affordable, field-deployable AST solutions tailored to low-resource settings

Veterinary Antimicrobial Susceptibility Testing Market Scope

The market is segmented on the basis of product type, animal type, and end user.

- By Product Type

On the basis of product type, the veterinary antimicrobial susceptibility testing market is segmented into disks and plates, culture media, accessories and consumables, and automated antimicrobial susceptibility testing instruments. The disks and plates segment dominated the market with the largest revenue share of 42.1% in 2024, attributed to its wide usage in veterinary microbiology laboratories due to cost-effectiveness, ease of implementation, and compliance with standardized methods such as CLSI and EUCAST. Veterinary practitioners and diagnostic labs widely prefer this segment as it offers reliable results for routine bacterial susceptibility profiling in both companion and food-producing animals.

The automated antimicrobial susceptibility testing instruments segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for rapid and accurate results, reduction in human error, and rising adoption of high-throughput diagnostic workflows. These instruments are gaining traction in reference laboratories and research institutes where automation enhances efficiency, consistency, and data traceability for surveillance and antimicrobial stewardship initiatives.

- By Animal Type

On the basis of animal type, the veterinary antimicrobial susceptibility testing market is segmented into food-producing animals and companion animals. The food-producing animals segment held the largest market share in 2024, driven by stringent government regulations surrounding antimicrobial usage in livestock, rising demand for meat safety and quality assurance, and the growing necessity of monitoring resistance in zoonotic pathogens. Surveillance of antibiotic resistance in poultry, swine, and cattle has become a key public health priority, thereby supporting segment dominance.

The companion animals segment is projected to grow at the fastest rate during the forecast period, supported by the increasing number of pet ownerships globally, growing veterinary healthcare expenditure, and heightened awareness regarding the responsible use of antibiotics in pets. Rising diagnostics in small animal clinics and the proliferation of point-of-care testing technologies also contribute to this segment's growth.

- By End User

On the basis of end user, the veterinary antimicrobial susceptibility testing market is segmented into veterinary reference laboratories, veterinary research institutes and universities, and others. The veterinary reference laboratories segment dominated the market in 2024, owing to their advanced diagnostic capabilities, broad test menus, and key role in AMR surveillance programs. These laboratories serve as centralized hubs for regional and national veterinary antimicrobial resistance testing and provide highly standardized and validated AST services.

The veterinary research institutes and universities segment is expected to register the highest growth rate from 2025 to 2032. This growth is supported by increased academic funding for antimicrobial resistance research, global collaborations to study AMR trends in animal health, and the integration of advanced AST technologies into research curricula and veterinary training programs.

Veterinary Antimicrobial Susceptibility Testing Market Regional Analysis

- North America dominated the veterinary antimicrobial susceptibility testing market with the largest revenue share of 39.2% in 2024, characterized by a robust veterinary healthcare infrastructure, strong regulatory frameworks, and widespread adoption of advanced diagnostic technologies

- Stakeholders in the region, including veterinary professionals and regulatory bodies, place high importance on antimicrobial stewardship and evidence-based treatment decisions, fueling the adoption of AST solutions across both livestock and companion animal sectors

- This widespread implementation is further supported by government-led AMR surveillance programs, growing investments in diagnostic innovations, and the presence of major market players offering advanced AST platforms, establishing North America as a key hub for veterinary antimicrobial testing technologies

U.S. Veterinary Antimicrobial Susceptibility Testing Market Insight

The U.S. veterinary antimicrobial susceptibility testing market captured the largest revenue share of 79% in 2024 within North America, fueled by heightened awareness of antimicrobial resistance (AMR) and strong regulatory mandates surrounding antibiotic use in animals. The country’s advanced veterinary infrastructure, robust livestock industry, and widespread access to reference laboratories support extensive adoption of AST. Moreover, federal initiatives such as the National Action Plan for Combating Antibiotic-Resistant Bacteria are encouraging veterinary professionals to implement AST to guide targeted treatments, further driving market growth.

Europe Veterinary Antimicrobial Susceptibility Testing Market Insight

The Europe veterinary antimicrobial susceptibility testing market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by strict antimicrobial usage regulations enforced by the European Medicines Agency (EMA) and the growing importance of animal health monitoring. The region is witnessing rising demand for evidence-based diagnostics across both food-producing and companion animal sectors. With increasing government-funded AMR surveillance programs, the adoption of susceptibility testing is surging in veterinary labs, universities, and livestock operations across Europe.

U.K. Veterinary Antimicrobial Susceptibility Testing Market Insight

The U.K. veterinary antimicrobial susceptibility testing market is anticipated to grow at a noteworthy CAGR during the forecast period, propelled by national strategies targeting antimicrobial stewardship in animals. The government’s commitment to reducing antibiotic use in livestock and encouraging responsible veterinary practices is fostering demand for susceptibility testing. The country’s well-established veterinary research ecosystem and regulatory support for diagnostic testing contribute to greater adoption across both rural farms and urban pet clinics.

Germany Veterinary Antimicrobial Susceptibility Testing Market Insight

The Germany veterinary antimicrobial susceptibility testing market is expected to expand at a considerable CAGR during the forecast period, driven by strong public awareness campaigns on AMR and a comprehensive network of veterinary institutions. Germany’s emphasis on food safety, animal welfare, and sustainable farming practices encourages the integration of AST in livestock management. In addition, government-backed monitoring initiatives and the adoption of automated testing instruments in veterinary labs are enhancing diagnostic efficiency and compliance with EU standards.

Asia-Pacific Veterinary Antimicrobial Susceptibility Testing Market Insight

The Asia-Pacific veterinary antimicrobial susceptibility testing market is poised to grow at the fastest CAGR of 23.5% during the forecast period of 2025 to 2032, driven by increasing livestock production, rising pet ownership, and government efforts to combat AMR. Countries such as China, Japan, and India are seeing rapid advancements in veterinary healthcare infrastructure and diagnostic capacity. The region's expanding pharmaceutical and diagnostic manufacturing base also makes AST products more accessible and affordable, contributing to their broader adoption.

Japan Veterinary Antimicrobial Susceptibility Testing Market Insight

The Japan veterinary antimicrobial susceptibility testing market is gaining momentum due to the country's advanced healthcare systems, focus on AMR reduction, and widespread use of diagnostic technologies. Veterinary professionals in Japan emphasize precision treatment, leading to increased use of susceptibility testing in companion animal and livestock sectors. Moreover, government collaboration with international health agencies to tackle AMR strengthens the regulatory and diagnostic framework supporting AST market growth.

India Veterinary Antimicrobial Susceptibility Testing Market Insight

The India veterinary antimicrobial susceptibility testing market accounted for the largest revenue share in Asia Pacific in 2024, driven by the country’s growing veterinary diagnostics industry, expanding livestock sector, and increasing awareness of responsible antibiotic usage. Rising initiatives under the “One Health” approach and the development of veterinary labs under government-backed schemes are propelling market growth. The presence of cost-effective local manufacturers and demand for disease control in poultry, cattle, and aquaculture further support AST adoption in India.

Veterinary Antimicrobial Susceptibility Testing Market Share

The veterinary antimicrobial susceptibility testing industry is primarily led by well-established companies, including:

- BD (U.S.)

- Synbiosis (U.S.)

- Zhuhai DL Biotech Co., Ltd. (China)

- Mast Group Ltd. (U.K.)

- HiMedia Laboratories (India)

- Thermo Fisher Scientific Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Creative Diagnostics (U.S.)

- Genefluidics, Inc. (U.S.)

- ROSCO DIOGNISTICA (Germany)

- Erba Mannheim (U.S.)

- Liofilchem S.r.l. (Italy)

- Alifax S.r.l. (Italy)

- MERLIN Gesellschaft für mikrobiologische Diagnostika mbH (Germany)

- BIOMÉRIEUX (France)

- Merck KGaA (U.S.)

- Danaher (U.S.)

- Accelerate Diagnostics, Inc. (U.S.)

- NuMedii, Inc. (U.S.)

What are the Recent Developments in Global Veterinary Antimicrobial Susceptibility Testing Market?

- In April 2023, BioMérieux, a global leader in in-vitro diagnostics, expanded its veterinary diagnostic capabilities by launching an advanced version of its VITEK® 2 Compact system, tailored specifically for veterinary microbiology labs. This system streamlines AST workflows and provides rapid, standardized susceptibility results, helping veterinarians make faster and more informed treatment decisions. The upgrade demonstrates BioMérieux’s commitment to supporting antimicrobial stewardship through automated, reliable, and scalable testing solutions for both companion and food-producing animals

- In March 2023, Thermo Fisher Scientific Inc. announced the development of a next-generation antimicrobial susceptibility testing panel designed for veterinary pathogens. The new panel includes updated breakpoints aligned with global surveillance guidelines, ensuring enhanced diagnostic accuracy. This innovation reflects the company’s proactive approach to combating antimicrobial resistance by providing precise tools that help guide targeted antibiotic therapy in animal health practices

- In March 2023, IDEXX Laboratories, Inc., a prominent player in veterinary diagnostics, launched a cloud-connected platform for AST result reporting. This digital innovation enables seamless sharing of antimicrobial susceptibility results between veterinary clinics and reference labs, improving diagnostic turnaround and data accessibility. The move emphasizes IDEXX’s focus on integrating digital solutions to improve efficiency and antibiotic stewardship in veterinary medicine

- In February 2023, Liofilchem S.r.l., an Italy-based manufacturer of microbiological diagnostic products, introduced its Liofilchem MIC Test Strip (MTS) veterinary range, specifically targeting resistance monitoring in livestock and companion animals. The launch of these easy-to-use strips enhances on-site diagnostic capabilities for veterinarians, offering a reliable alternative for semi-quantitative AST in both clinical and field settings

- In January 2023, Becton, Dickinson and Company (BD) collaborated with a European consortium of veterinary research institutes to pilot an AI-driven AST interpretation tool. This initiative aims to reduce manual interpretation errors and deliver consistent susceptibility readings across veterinary labs. The project highlights the rising influence of AI in veterinary diagnostics and BD’s strategic investment in tools that enhance accuracy, efficiency, and antimicrobial resistance monitoring in the global veterinary space

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.