Global Veterinary Ct Scanner Market

Market Size in USD Million

CAGR :

%

USD

202.90 Million

USD

361.87 Million

2024

2032

USD

202.90 Million

USD

361.87 Million

2024

2032

| 2025 –2032 | |

| USD 202.90 Million | |

| USD 361.87 Million | |

|

|

|

|

Veterinary Computed Tomography (CT) Scanner Market Size

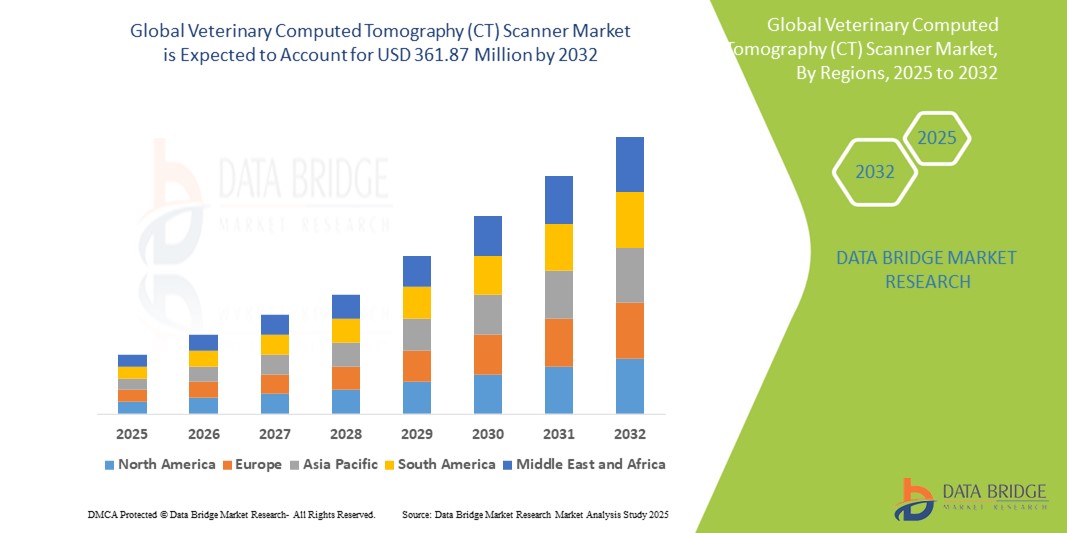

- The global veterinary computed tomography (CT) Scanner market size was valued at USD 202.90 million in 2024 and is expected to reach USD 361.87 million by 2032, at a CAGR of 7.50% during the forecast period

- The market growth is primarily driven by the increasing prevalence of animal diseases requiring advanced imaging techniques for diagnosis. The rising pet ownership and the growing expenditure on pet healthcare globally are also significant factors boosting the market

- Furthermore, technological advancements in CT scanners, such as improved image quality, faster scan times, and smaller footprints, are making the technology more accessible to veterinary clinics and hospitals, thereby fueling market expansion. The increasing adoption of minimally invasive surgical procedures in veterinary medicine, which necessitates precise pre-operative and post-operative imaging, further contributes to the demand for veterinary CT scanners

Veterinary Computed Tomography (CT) Scanner Market Analysis

- Veterinary Computed Tomography (CT) scanners, which are advanced medical imaging devices utilizing X-rays and computer processing to create detailed cross-sectional images of animals for diagnostic purposes, are increasingly being adopted in veterinary medicine due to the growing emphasis on providing advanced medical care for animals, mirroring the standards of human healthcare

- The escalating demand for veterinary CT scanners is primarily fueled by technological advancements in imaging, including improved image resolution, faster scan times, and reduced radiation exposure, making the technology more accessible and beneficial for veterinary practices. The broadening range of clinical applications in diagnosing various animal diseases also contributes significantly

- North America dominates the veterinary computed tomography (CT) scanner market with the largest revenue share of 38.5% in 2024, characterized by a well-established veterinary infrastructure, high pet ownership rates, and a strong inclination among pet owners to invest in advanced veterinary diagnostics. The presence of numerous specialized veterinary hospitals and clinics equipped with cutting-edge technology supports this dominance

- Asia-Pacific is expected to be the fastest growing region in the veterinary computed tomography (CT) scanner market during the forecast period with a CAGR of 7.9%, due to increasing pet adoption rates, rising disposable incomes enabling greater spending on pet healthcare, and a growing awareness of the benefits of advanced veterinary diagnostics among pet owners and practitioners in the region

- Small companion animals segment dominates the veterinary computed tomography (CT) scanner market with a market share of 55.5% in 2024, driven by the high prevalence of pet ownership and the increasing demand for advanced diagnostics for conditions common in dogs and cats

Report Scope and Veterinary Computed Tomography (CT) Scanner Market Segmentation

|

Attributes |

Veterinary Computed Tomography (CT) Scanner Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Veterinary Computed Tomography (CT) Scanner Market Trends

“Advancements in Imaging Technology and Integration with AI”

- A significant and accelerating trend in the global veterinary computed tomography (CT) scanner market is the continuous enhancement of imaging technology and the increasing integration of artificial intelligence (AI) to improve diagnostic accuracy and workflow efficiency. This fusion of advanced technologies is significantly enhancing the capabilities and utility of CT scanners in veterinary medicine

- For instance, the development of multi-slice CT scanners allows for faster data acquisition and higher resolution images, crucial for detailed anatomical assessment in animals. Similarly, AI algorithms are being integrated to assist in image analysis, lesion detection, and automated reporting, streamlining the diagnostic process for veterinarians

- AI integration in veterinary CT scanners enables features such as automated organ segmentation, which aids in precise measurements and comparisons over time. Some systems utilize AI to reduce image noise and artifacts, leading to clearer and more diagnostically valuable scans. Furthermore, AI-powered tools can assist in identifying subtle abnormalities that might be challenging for the human eye to detect, improving diagnostic sensitivity

- The seamless integration of advanced CT scanners with hospital information systems (HIS) and picture archiving and communication systems (PACS) facilitates centralized management of imaging data and efficient collaboration among veterinary professionals. This interconnected environment allows for quicker access to images and reports, improving overall patient care and workflow

- This trend towards more sophisticated, AI-enhanced, and interconnected imaging systems is fundamentally reshaping the standards of veterinary diagnostics. Consequently, companies are developing CT scanners with features such as dose reduction technologies, enhanced image reconstruction algorithms, and AI-powered analysis tools to meet the growing demand for precise and efficient veterinary imaging. The demand for veterinary CT scanners that offer seamless integration with AI and other digital healthcare solutions is growing rapidly across veterinary hospitals and specialty clinics, as practitioners increasingly prioritize diagnostic accuracy and workflow optimization

Veterinary Computed Tomography (CT) Scanner Market Dynamics

Driver

“Increasing Demand Due to Rising Prevalence of Animal Diseases and Advanced Veterinary Care”

- The increasing prevalence of complex animal diseases requiring advanced diagnostic imaging and the growing emphasis on providing high-quality veterinary care are significant drivers for the heightened demand for veterinary computed tomography (CT) scanners

- For instance, the rising incidence of neurological disorders, orthopedic injuries, and cancer in animals necessitates accurate and detailed imaging for diagnosis and treatment planning. The availability of advanced CT technology allows veterinarians to identify and manage these conditions more effectively, driving adoption

- As pet owners become more informed about the benefits of advanced veterinary diagnostics and are willing to invest more in their animals' health, the demand for sophisticated imaging tools such as CT scanners increases. These systems offer superior visualization of internal structures compared to traditional radiography, leading to more accurate diagnoses.

- Furthermore, the growing trend of specialization within veterinary medicine, with more practices focusing on areas such as oncology, neurology, and surgery, necessitates the use of advanced imaging for complex cases. CT scanners are becoming an indispensable tool for these specialists, driving their adoption in veterinary hospitals and referral centers

- The ability of CT scanners to provide detailed cross-sectional images, aiding in surgical planning, radiation therapy, and monitoring treatment response, further propels their adoption in veterinary practice. The increasing availability of financing options and the recognition of the clinical value of CT imaging also contribute to market growth

Restraint/Challenge

“High Initial Costs and Limited Awareness in Some Regions”

- The high initial costs associated with veterinary computed tomography (CT) scanners, coupled with the limited awareness of their benefits in certain regions, pose a significant challenge to broader market adoption. The substantial investment required for purchasing and maintaining these advanced imaging systems can be a barrier for smaller veterinary practices or those in economically constrained areas

- For instance, the cost of acquiring a new CT scanner, along with the expenses related to installation, training, and ongoing maintenance, can be prohibitive for many general veterinary clinics. This financial hurdle can limit the availability of this advanced diagnostic technology, particularly in rural or less developed regions

- Addressing the cost challenge through the development of more affordable and compact CT scanner models, as well as exploring options such as leasing or shared service models, could help improve accessibility. Furthermore, increasing awareness among veterinarians and pet owners about the clinical benefits and diagnostic advantages of CT imaging is crucial for driving demand and justifying the investment

- While the return on investment through improved diagnostic accuracy and expanded service offerings can be significant in the long run, the initial capital outlay remains a key concern for many veterinary practices. Overcoming this challenge requires a combination of technological innovation to reduce costs and educational initiatives to highlight the value proposition of veterinary CT imaging

- ·Overcoming these restraints through the introduction of more cost-effective solutions, enhanced educational outreach to the veterinary community, and demonstrating the long-term financial and clinical advantages of CT imaging will be vital for sustained market growth and wider adoption globally

Veterinary Computed Tomography (CT) Scanner Market Scope

The market is segmented on the basis of type, animal type, disease, application, end user, and slice

- By Type

On the basis of type, the veterinary CT scanner market is segmented into stationary multi-slice CT scanners and portable CT scanners. The stationary multi-slice CT scanners segment dominates the largest market revenue share, driven by their ability to provide high-resolution, detailed images and their versatility in handling a wide range of diagnostic needs in veterinary hospitals and clinics. Their established presence and comprehensive capabilities make them the preferred choice for many veterinary practices.

The portable CT scanners segment is anticipated to witness the fastest growth rate, fueled by increasing demand for on-site diagnostics, particularly in equine and livestock practices, as well as smaller clinics with space constraints. The portability and ease of use of these systems are making advanced imaging more accessible in diverse veterinary settings.

- By Animal Type

On the basis of animal type, the veterinary CT scanner market is segmented into small companion animals, equine and livestock, and other animals. The small companion animals segment holds the largest market revenue share of 55.5%, driven by the high prevalence of pet ownership and the increasing demand for advanced diagnostics for conditions common in dogs, cats, and other small pets. The growing emphasis on pet healthcare contributes significantly to this segment's dominance.

The equine and livestock and other segment is expected to witness significant growth with a CAGR of 7.5%, driven by the increasing recognition of the value of CT imaging for diagnosing musculoskeletal injuries, respiratory issues, and other conditions in these larger animals, impacting their health and economic value. Portable CT technology is particularly facilitating growth in this segment.

- By Disease

On the basis of disease, the veterinary CT scanner market is segmented into cancer, cardiovascular disease, infectious disease, appendicitis, trauma, musculoskeletal disorders, and others. The musculoskeletal disorders segment holds a significant market revenue share, driven by the frequency of lameness, fractures, and other orthopedic conditions in animals, for which CT provides detailed diagnostic information.

The cancer segment is expected to witness a rapid growth rate, fueled by the increasing use of CT for tumor staging, treatment planning, and monitoring response in veterinary oncology. The need for precise imaging in cancer management is driving the adoption of CT in this application.

- By Application

On the basis of application, the veterinary CT scanner market is segmented into neurology, oncology, orthopedics and traumatology, and other applications. The orthopedics and traumatology segment accounted for the largest market revenue share, driven by the high incidence of injuries and degenerative conditions affecting the musculoskeletal system in animals, where CT offers superior diagnostic capabilities compared to traditional radiography.

The neurology segment is expected to witness the fastest growth rate, driven by the increasing recognition of the value of CT in diagnosing complex neurological conditions such as brain tumors, spinal cord injuries, and inflammatory diseases in animals.

- By End User

On the basis of end-user, the veterinary CT scanner market is segmented into veterinary hospitals and clinics, university teaching hospitals and academic institutes. The veterinary hospitals and clinics segment accounted for the largest market revenue share, driven by the increasing adoption of advanced imaging technologies in private and specialty veterinary practices to enhance diagnostic capabilities and patient care

The university teaching hospitals and academic institutes segment is also significant, playing a crucial role in research, training, and the adoption of new imaging techniques in veterinary medicine

- By Slice

On the basis of slice, the veterinary CT scanner market is segmented into 4 slice, 8 slice, 16 slice, 32 slice, and 64 slice. The multi-slice segments collectively hold the largest market revenue share, driven by their ability to acquire data rapidly and produce high-resolution 3D images, which are essential for detailed veterinary diagnostics

The trend is towards higher slice configurations as they offer improved image quality and faster scan times, leading to better clinical outcomes and increased efficiency

Veterinary Computed Tomography (CT) Scanner Market Regional Analysis

- North America dominates the veterinary computed tomography (CT) scanner market with the largest revenue share of 38.5% in 2024, driven by a well-established veterinary infrastructure, high pet ownership rates, and a strong inclination among pet owners to invest in advanced veterinary diagnostics

- Veterinarians in the region increasingly recognize the clinical benefits of CT imaging for accurate diagnoses and treatment planning across a wide range of animal diseases. Pet owners' growing willingness to invest in comprehensive healthcare for their animals further fuels the demand for advanced diagnostic tools such as CT scanners

- This widespread adoption is supported by a strong presence of specialty veterinary hospitals and referral centers equipped with state-of-the-art imaging capabilities, as well as a higher awareness among pet owners regarding the availability and benefits of advanced veterinary diagnostics

U.S. Veterinary Computed Tomography (CT) Scanner Market Insight

The U.S. veterinary CT scanner market captured the largest revenue share of 39.5%, within North America in 2024, fueled by the high standards of veterinary care and the strong emphasis on advanced diagnostics for pets. The willingness of pet owners to invest in sophisticated medical imaging for their animals, coupled with a well-established network of specialty veterinary hospitals, drives market growth. The increasing adoption of pet insurance further supports the utilization of advanced imaging technologies such as CT scans

Europe Veterinary Computed Tomography (CT) Scanner Market Insight

The European veterinary CT scanner market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent regulations regarding animal health and welfare, and an increasing demand for advanced diagnostic capabilities in veterinary medicine. Growing urbanization and a rising pet population across European countries contribute to the adoption of CT scanners in veterinary clinics and hospitals. The integration of advanced imaging into veterinary research and educational institutions also fosters market growth

U.K. Veterinary Computed Tomography (CT) Scanner Market Insight

The U.K. veterinary CT scanner market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by a strong focus on animal welfare and a rising trend of pet owners seeking comprehensive medical care for their animals. Concerns regarding accurate and timely diagnosis of complex animal diseases are encouraging veterinary practices to invest in advanced imaging technologies. The UK's well-developed veterinary infrastructure and the increasing specialization within veterinary medicine further stimulate market growth

Germany Veterinary Computed Tomography (CT) Scanner Market Insight

The German veterinary CT scanner market is expected to expand at a considerable CAGR during the forecast period, fueled by a high awareness of advanced veterinary diagnostics and a strong emphasis on animal health. Germany's robust veterinary healthcare system, coupled with a significant pet-owning population, promotes the adoption of sophisticated imaging technologies such as CT scanners in both general and specialty practices. The integration of advanced diagnostics into veterinary research and education also contributes to market expansion

Asia-Pacific Veterinary Computed Tomography (CT) Scanner Market Insight

The Asia-Pacific veterinary CT scanner market is poised to grow at the fastest CAGR in 2024 with a CAGR of 7.9%, driven by increasing pet ownership, rising disposable incomes, and a growing awareness of advanced veterinary care in countries such as China, Japan, and India. The region's expanding veterinary infrastructure and the increasing availability of veterinary CT scanners are making advanced diagnostics more accessible. Government initiatives supporting the development of veterinary healthcare are also contributing to market growth

Japan Veterinary Computed Tomography (CT) Scanner Market Insight

The Japan veterinary CT scanner market is gaining momentum due to the country’s high level of pet ownership, advanced healthcare infrastructure, and demand for high-quality veterinary services. The emphasis on precision diagnostics and the willingness of pet owners to invest in advanced medical care are driving the adoption of CT scanners in veterinary hospitals and specialty clinics. The integration of advanced imaging with other veterinary technologies is also fueling market growth

India Veterinary Computed Tomography (CT) Scanner Market Insight

The India veterinary CT scanner market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to the country's rapidly expanding pet population, increasing urbanization, and growing awareness of advanced veterinary diagnostics. The rising disposable incomes and the increasing number of veterinary hospitals and clinics equipped with advanced technologies are key factors propelling the market in India. The growing demand for specialized veterinary services and the increasing affordability of veterinary care are also contributing to market expansion

Veterinary Computed Tomography (CT) Scanner Market Share

The Veterinary Computed Tomography (CT) Scanner industry is primarily led by well-established companies, including:

- Siemens Healthineers AG (Germany)

- GE HealthCare (U.S.)

- CANON MEDICAL SYSTEMS CORPORATION (Japan)

- Koninklijke Philips N.V. (Netherlands)

- Epica Animal Health (U.S.)

- Xoran Technologies, LLC. (U.S.)

- Hallmarq Veterinary Imaging (U.K.)

- High-Tech Corporation (Japan)

- Shenzhen Anke High-Tech Co., Ltd. (China)

- PrizMED Imaging (U.S.)

- Woorien (South Korea)

- Carestream Health (U.S.)

- Shimadzu Corporation (Japan)

- Samsung Healthcare (South Korea)

- Radscan Systems Pvt Ltd. (India)

- BMEC Imaging PVT LTD (India)

Latest Developments in Global Veterinary Computed Tomography (CT) Scanner Market

- In May 2024, Johnson Family Equine Hospital announced the expansion of their network with the addition of a new high-resolution CT scanner at their referral center in Colorado. This investment aims to enhance diagnostic capabilities for complex neurological and oncological cases in companion animals

- In October 2024, Mella Pet Care, a Chicago startup company, announced a collaboration with Vetster, a veterinary telemedicine platform, earlier this month. The partnership aims to offer users of the Mella app in the United Kingdom, Canada, and the United States access to 24/7 veterinary care through Vetster’s veterinary marketplace

- In January 2024, Canon Medical Systems announced the launch of a new compact CT scanner model specifically designed for smaller veterinary clinics, offering advanced imaging capabilities with a reduced footprint and lower upfront cost

- In September 2022, A Fort Lauderdale, Florida-based veterinary referral hospital significantly enhanced its diagnostic capabilities by installing a state-of-the-art Toshiba Aquilion 16 CT scanner ensuring advanced care for pets

- In April 2022, Improve International, a global leader in veterinary CPD, launched an innovative online computed tomography (CT) program, offering a pathway to an accredited general practitioner certificate (GPCert) from the International School of Veterinary Postgraduate Studies

- In January 2021, Heska Corporation (NASDAQ: HSKA), a leading global provider of advanced veterinary diagnostic and specialty products, completed its acquisition of Lacuna Diagnostics, Inc., a pioneer and market leader in point-of-care digital cytology technology and telemedicine services. The acquisition, for an undisclosed amount, aimed to significantly strengthen Heska's portfolio by integrating Lacuna's innovative digital telemedicine cytology platform

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.