Global Veterinary Diagnostics Market

Market Size in USD Billion

CAGR :

%

USD

3.32 Billion

USD

6.40 Billion

2024

2032

USD

3.32 Billion

USD

6.40 Billion

2024

2032

| 2025 –2032 | |

| USD 3.32 Billion | |

| USD 6.40 Billion | |

|

|

|

|

Veterinary Diagnostics Market Size

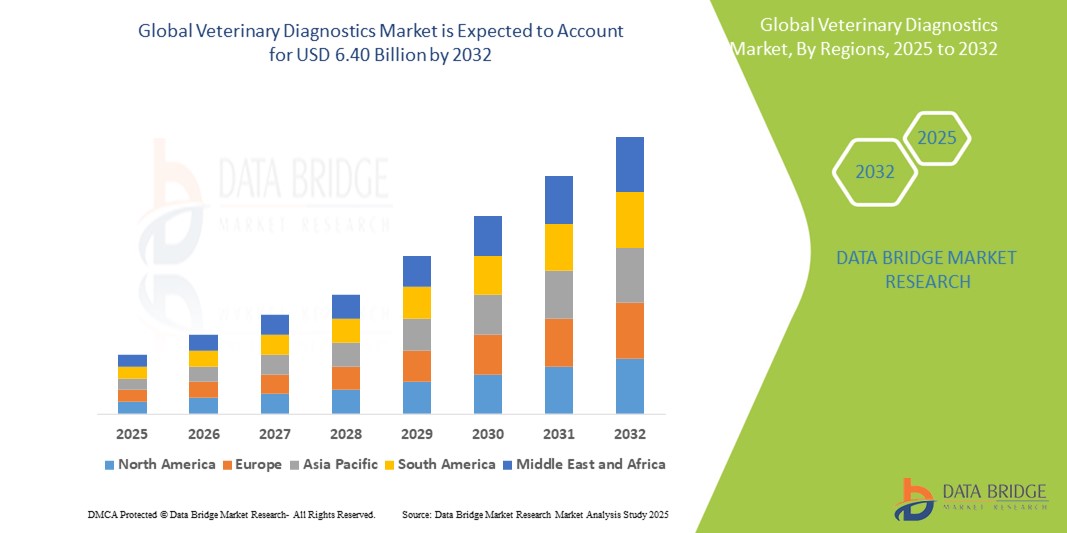

- The global veterinary diagnostics market size was valued at USD 3.32 billion in 2024 and is expected to reach USD 6.40 billion by 2032, at a CAGR of 8.55% during the forecast period

- This growth is driven by factors such as the rising prevalence of animal diseases, increasing pet ownership, and growing demand for livestock-derived products, along with advancements in diagnostic technologies

Veterinary Diagnostics Market Analysis

- Veterinary diagnostics are essential tools used to detect, monitor, and manage diseases in animals, including both companion and livestock species, through various testing methodologies such as immunodiagnostics, molecular diagnostics, and clinical biochemistry

- The demand for veterinary diagnostics is significantly driven by the rising incidence of zoonotic diseases, growing pet adoption, and increased spending on animal health

- North America is expected to dominate the veterinary diagnostics market with a market share of 38.30%, due to well-developed veterinary healthcare infrastructure, high pet ownership rates, and the presence of major diagnostic companies

- Asia-Pacific is expected to be the fastest growing region in the veterinary diagnostics market with a market share of 18.6%, during the forecast period due to the rising livestock population, increasing pet adoption, and improving animal healthcare infrastructure

- Companion Animals segment is expected to dominate the market with a market share of 59.31% due to its rising pet ownership, increasing awareness of pet health, and growing expenditure on animal healthcare

Report Scope and Veterinary Diagnostics Market Segmentation

|

Attributes |

Veterinary Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Veterinary Diagnostics Market Trends

“Integration of Advanced Diagnostic Technologies & Point-of-Care Testing”

- One prominent trend in the veterinary diagnostics market is the growing adoption of advanced technologies such as molecular diagnostics, biosensors, and point-of-care (POC) testing devices for faster and more accurate disease detection

- These innovations enable early diagnosis, real-time monitoring, and efficient treatment of animal diseases, significantly improving clinical outcomes and reducing disease spread

- For instance, portable POC testing devices allow veterinarians to conduct rapid on-site diagnostics, especially in remote or farm settings, facilitating immediate treatment decisions for livestock and companion animals

- This shift towards advanced and accessible diagnostic tools is revolutionizing veterinary care, enhancing disease management capabilities, and fueling the global demand for innovative veterinary diagnostic solutions

Veterinary Diagnostics Market Dynamics

Driver

“Rising Incidence of Zoonotic and Infectious Animal Diseases”

- The increasing prevalence of zoonotic and infectious diseases such as brucellosis, rabies, avian influenza, and bovine tuberculosis is a key driver for the veterinary diagnostics market

- These diseases pose significant threats to both animal and human health, necessitating early detection and continuous monitoring to prevent outbreaks and ensure food safety

- Governments and health organizations across the globe are emphasizing disease surveillance and control programs, leading to a higher demand for accurate and rapid veterinary diagnostic tools

For instance,

- According to the World Health Organization (WHO), over 60% of known infectious diseases in humans are zoonotic, and about 75% of emerging infectious diseases have animal origins, highlighting the importance of robust veterinary diagnostics

- As a result of the rising incidence of zoonotic and infectious diseases, the need for advanced veterinary diagnostics is increasing significantly to ensure timely interventions and protect public and animal health

Opportunity

“Emergence of AI and Big Data in Veterinary Diagnostics”

- The integration of artificial intelligence (AI) and big data analytics in veterinary diagnostics offers significant opportunities to enhance disease detection, monitor animal health trends, and optimize treatment protocols

- AI-powered diagnostic platforms can analyze vast datasets from lab tests, imaging, and clinical records to identify patterns, predict disease outbreaks, and support evidence-based veterinary decisions

- In addition, machine learning algorithms can assist in interpreting complex diagnostic results, reducing errors and enabling faster, more accurate diagnoses in both companion and livestock animals

For instance,

- In October 2024, a report by the American Veterinary Medical Association (AVMA) highlighted the growing use of AI-enabled diagnostic tools in veterinary practices, which help in real-time monitoring of livestock health and early detection of diseases such as mastitis, improving productivity and reducing losses

- The use of AI and big data in veterinary diagnostics not only enhances clinical outcomes but also contributes to precision veterinary care, offering proactive health management, cost savings, and improved animal welfare across the globe

Restraint/Challenge

“High Cost of Advanced Diagnostic Equipment and Services”

- The high cost associated with advanced veterinary diagnostic equipment and testing services presents a significant barrier to market expansion, particularly in low- and middle-income countries

- Diagnostic tools such as molecular analyzers, imaging systems, and automated testing platforms require substantial investment, making them less accessible to small clinics, rural veterinary practices, and independent livestock farmers

- This cost challenge not only restricts the adoption of cutting-edge diagnostic technologies but also limits the availability of rapid and accurate testing in under-resourced areas

For instance,

- In According to a 2023 report by the European Federation of Animal Health, veterinary diagnostic services can be cost-prohibitive for small-scale farmers and pet owners, resulting in delayed or avoided testing, which impacts disease control and treatment effectiveness

- Consequently, the financial burden associated with acquiring and maintaining sophisticated diagnostic systems hampers market penetration, creating disparities in animal healthcare quality and slowing overall market growth

Veterinary Diagnostics Market Scope

The market is segmented on the basis of product, technology, animal type, disease type, species, end user

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Technology |

|

|

By Animal Type |

|

|

By Disease Type |

|

|

By Species |

|

|

By End User

|

|

In 2025, the companion animals is projected to dominate the market with a largest share in animal type segment

The companion animals segment is expected to dominate the veterinary diagnostics market with the largest share of 59.31% in 2025 due to its rising pet ownership, increasing awareness of pet health, and growing expenditure on animal healthcare. Advances in diagnostic technologies and a higher incidence of chronic and infectious diseases in pets further drive the demand for timely and accurate diagnostics

The reagents & kits and consumables is expected to account for the largest share during the forecast period in product market

In 2025, the reagents & kits and consumables segment is expected to dominate the market with the largest market share of 53.2% due to their frequent Usage in diagnostic procedures and recurring demand for routine testing. Their critical role in various diagnostic platforms, ease of use, and continuous replenishment needs in both clinical and field settings further contribute to their market dominance

Veterinary Diagnostics Market Regional Analysis

“North America Holds the Largest Share in the Veterinary Diagnostics Market”

- North America dominates the veterinary diagnostics market with a market share of estimated 38.30%, driven, by well-developed veterinary healthcare infrastructure, high pet ownership rates, and the presence of major diagnostic companies

- U.S. holds a market share of 60.5%, due to increasing demand for advanced diagnostic services, rising awareness about animal health, and significant investment in research and development

- The favorable reimbursement policies for animal health, widespread use of companion animals, and government initiatives supporting zoonotic disease control further enhance market growth

- Moreover, the rapid adoption of innovative technologies such as molecular diagnostics and point-of-care testing in veterinary practices continues to bolster the market across North America

“Asia-Pacific is Projected to Register the Highest CAGR in the Veterinary Diagnostics Market”

- Asia-Pacific is expected to witness the highest growth rate in the veterinary diagnostics market with a market share of 18.6%, driven by the rising livestock population, increasing pet adoption, and improving animal healthcare infrastructure

- Countries such as China, India, and South Korea are key contributors, owing to the growing burden of zoonotic diseases and heightened focus on food safety and animal welfare

- China leads in investments toward livestock health management, while Japan shows steady growth due to its strong technological base and increasing demand for companion animal diagnostics

- India is projected to register the highest CAGR in the region due to its expanding veterinary care sector, increased government focus on disease prevention, and growing availability of advanced diagnostic tools in rural and urban areas

Veterinary Diagnostics Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- IDEXX (U.S.)

- Zoetis Services LLC (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Virbac (France)

- Antech Diagnostics, Inc. (U.S.)

- Neogen Corporation (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Innovative Diagnostics SAS (France)

- Randox Laboratories Ltd. (U.K.)

- Eurofins Scientific (Luxembourg)

- BioChek B.V. (Netherlands)

- ThermoGenesis Holdings, Inc. (U.S.)

- BIONOTE (South Korea)

- SKYLA CORPORATION (Taiwan)

- Innovative Diagnostics (France)

- QIAGEN (Netherlands)

- Zoetis Belgium S.A. (Belgium)

- Shenzhen Mindray Bio-Medical Electronics Co., Ltd. (China)

Latest Developments in Veterinary Diagnostics Market

- In May 2025, The UK's Competition and Markets Authority (CMA) initiated an 18-month investigation into the GBP 5 billion veterinary services market, focusing on concerns over high medicine prices and lack of transparency. Preliminary remedies include a price comparison website and caps on prescription fees

- In March 2025, Researchers developed a convolutional neural network (CNN) model using a single inertial measurement unit (IMU) sensor to detect early signs of lameness in horses. The system achieved 90% session-level accuracy, offering a cost-effective and practical solution for equine health monitoring

- March 2025, A novel AI-powered, multi-agent diagnostic system was introduced for swine disease detection. Utilizing Retrieval-Augmented Generation (RAG), the system delivers timely, evidence-based disease detection and clinical guidance, enhancing veterinary decision-making in swine health management

- In January 2024, IDEXX Laboratories introduced the In Vue Dx Cellular Analyzer, a first-of-its-kind device capable of diagnosing common cytologic abnormalities in blood and ear samples. This innovation enhances diagnostic accuracy and efficiency in veterinary practices

- In August 2022, PepiPets launched a mobile diagnostic testing service, enabling at-home diagnostic testing for pets. This service aims to improve convenience and minimize stress for both pets and their owners by eliminating the need for clinic visits

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.