1. INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

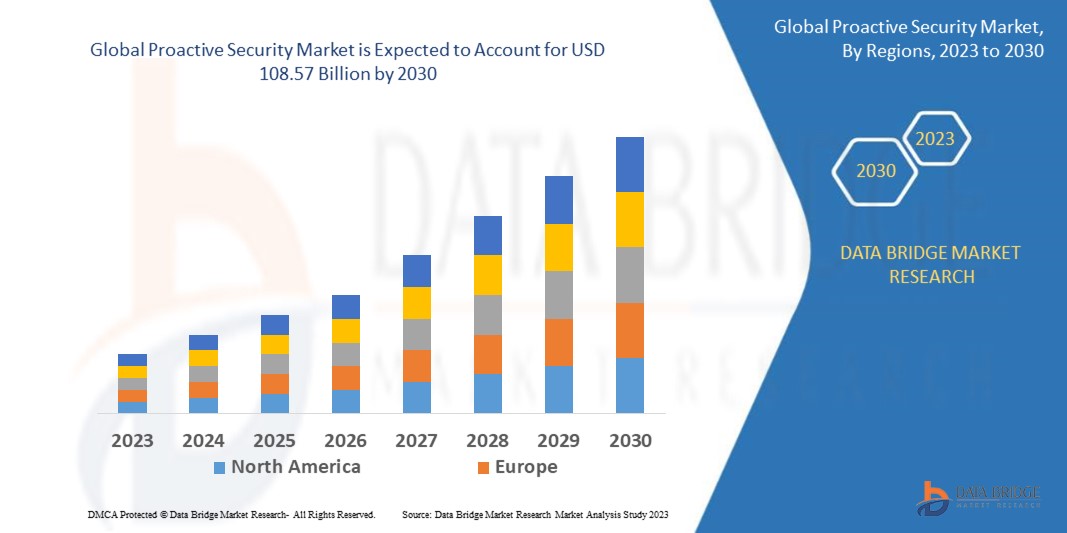

1.3 OVERVIEW OF GLOBAL PROACTIVE SECURITY MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2. MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL PROACTIVE SECURITY MARKET

2.3 VENDOR POSITIONING GRID

2.4 TECHNOLOGY LIFE LINE CURVE

2.5 MARKET GUIDE

2.6 MULTIVARIATE MODELLING

2.7 TOP TO BOTTOM ANALYSIS

2.8 STANDARDS OF MEASUREMENT

2.9 VENDOR SHARE ANALYSIS

2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.12 GLOBAL PROACTIVE SECURITY MARKET: RESEARCH SNAPSHOT

2.13 ASSUMPTIONS

3. MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4. EXECUTIVE SUMMARY

5. PREMIUM INSIGHTS

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL LANDSCAPE

5.4 VALUE CHAIN ANALYSIS

5.5 COMPANY COMPARITIVE ANALYSIS

5.6 KEY STRATEGIC INITIATIVES

5.7 PATENT ANALYSIS

6. GLOBAL PROACTIVE SECURITY MARKET, BY OFFERING

6.1 OVERVIEW

6.2 SOLUTION

6.2.1 SECURITY MONITORING

6.2.2 SECURITY ANALYTICS

6.2.3 RISK AND VULNERABILITY MANAGEMENT

6.2.4 ATTACK SIMULATION

6.2.5 SECURITY ORCHESTRATION

6.2.6 ADVANCED MALWARE PROTECTION (AMP)

6.2.7 VIDEO MANAGEMENT SYSTEM

6.2.7.1. BY TECHNOLOGY

6.2.7.1.1. ANALOG BASED VMS

6.2.7.1.2. IP BASED VMS

6.3 SERVICES

6.3.1 MANAGED SERVICES

6.3.2 PROFESSIONAL SERVICES

6.3.2.1. CONSULTING

6.3.2.2. DESIGNING

6.3.2.3. TRAINING AND EDUCATION

6.3.2.4. INTEGRATION AND IMPLEMENTATION

6.3.2.5. SUPPORT AND MAINTENANCE

7. GLOBAL PROACTIVE SECURITY MARKET, BY DEPLOYMENT MODEL

7.1 OVERVIEW

7.2 CLOUD

7.3 ON PREMISES

8. GLOBAL PROACTIVE SECURITY MARKET, BY ORGANIZATION SIZE

8.1 OVERVIEW

8.2 LARGE ENTERPRISES

8.2.1 BY DEPLOYMENT MODEL

8.2.1.1. CLOUD

8.2.1.2. ON PREMISES

8.3 SMALL AND MEDIUM SIZED ENTERPRISE (SMES)

8.3.1 BY DEPLOYMENT MODEL

8.3.1.1. CLOUD

8.3.1.2. ON PREMISES

9. GLOBAL PROACTIVE SECURITY MARKET, BY END USER

9.1 OVERVIEW

9.2 GOVERNMENT AND DEFENSE

9.2.1 BY OFFERING

9.2.1.1. SOLUTION

9.2.1.1.1. SECURITY MONITORING

9.2.1.1.2. SECURITY ANALYTICS

9.2.1.1.3. RISK AND VULNERABILITY MANAGEMENT

9.2.1.1.4. ATTACK SIMULATION

9.2.1.1.5. SECURITY ORCHESTRATION

9.2.1.1.6. ADVANCED MALWARE PROTECTION (AMP)

9.2.1.1.7. VIDEO MANAGEMENT SYSTEM

9.2.1.2. SERVICES

9.2.1.2.1. MANAGED SERVICES

9.2.1.2.2. PROFESSIONAL SERVICES

9.3 BANKING, FINANCIAL SERVICES AND INSURANCE (BFSI)

9.3.1 BY OFFERING

9.3.1.1. SOLUTION

9.3.1.1.1. SECURITY MONITORING

9.3.1.1.2. SECURITY ANALYTICS

9.3.1.1.3. RISK AND VULNERABILITY MANAGEMENT

9.3.1.1.4. ATTACK SIMULATION

9.3.1.1.5. SECURITY ORCHESTRATION

9.3.1.1.6. ADVANCED MALWARE PROTECTION (AMP)

9.3.1.1.7. VIDEO MANAGEMENT SYSTEM

9.3.1.2. SERVICES

9.3.1.2.1. MANAGED SERVICES

9.3.1.2.2. PROFESSIONAL SERVICES

9.4 IT AND TELECOMMUNICATION

9.4.1 BY OFFERING

9.4.1.1. SOLUTION

9.4.1.1.1. SECURITY MONITORING

9.4.1.1.2. SECURITY ANALYTICS

9.4.1.1.3. RISK AND VULNERABILITY MANAGEMENT

9.4.1.1.4. ATTACK SIMULATION

9.4.1.1.5. SECURITY ORCHESTRATION

9.4.1.1.6. ADVANCED MALWARE PROTECTION (AMP)

9.4.1.1.7. VIDEO MANAGEMENT SYSTEM

9.4.1.2. SERVICES

9.4.1.2.1. MANAGED SERVICES

9.4.1.2.2. PROFESSIONAL SERVICES

9.5 MANUFACTURING

9.5.1 BY OFFERING

9.5.1.1. SOLUTION

9.5.1.1.1. SECURITY MONITORING

9.5.1.1.2. SECURITY ANALYTICS

9.5.1.1.3. RISK AND VULNERABILITY MANAGEMENT

9.5.1.1.4. ATTACK SIMULATION

9.5.1.1.5. SECURITY ORCHESTRATION

9.5.1.1.6. ADVANCED MALWARE PROTECTION (AMP)

9.5.1.1.7. VIDEO MANAGEMENT SYSTEM

9.5.1.2. SERVICES

9.5.1.2.1. MANAGED SERVICES

9.5.1.2.2. PROFESSIONAL SERVICES

9.6 HEALTHCARE AND LIFE SCIENCES

9.6.1 BY OFFERING

9.6.1.1. SOLUTION

9.6.1.1.1. SECURITY MONITORING

9.6.1.1.2. SECURITY ANALYTICS

9.6.1.1.3. RISK AND VULNERABILITY MANAGEMENT

9.6.1.1.4. ATTACK SIMULATION

9.6.1.1.5. SECURITY ORCHESTRATION

9.6.1.1.6. ADVANCED MALWARE PROTECTION (AMP)

9.6.1.1.7. VIDEO MANAGEMENT SYSTEM

9.6.1.2. SERVICES

9.6.1.2.1. MANAGED SERVICES

9.6.1.2.2. PROFESSIONAL SERVICES

9.7 RETAIL AND E-COMMERCE

9.7.1 BY OFFERING

9.7.1.1. SOLUTION

9.7.1.1.1. SECURITY MONITORING

9.7.1.1.2. SECURITY ANALYTICS

9.7.1.1.3. RISK AND VULNERABILITY MANAGEMENT

9.7.1.1.4. ATTACK SIMULATION

9.7.1.1.5. SECURITY ORCHESTRATION

9.7.1.1.6. ADVANCED MALWARE PROTECTION (AMP)

9.7.1.1.7. VIDEO MANAGEMENT SYSTEM

9.7.1.2. SERVICES

9.7.1.2.1. MANAGED SERVICES

9.7.1.2.2. PROFESSIONAL SERVICES

9.8 MEDIA AND ENTERTAINMENT

9.8.1 BY OFFERING

9.8.1.1. SOLUTION

9.8.1.1.1. SECURITY MONITORING

9.8.1.1.2. SECURITY ANALYTICS

9.8.1.1.3. RISK AND VULNERABILITY MANAGEMENT

9.8.1.1.4. ATTACK SIMULATION

9.8.1.1.5. SECURITY ORCHESTRATION

9.8.1.1.6. ADVANCED MALWARE PROTECTION (AMP)

9.8.1.1.7. VIDEO MANAGEMENT SYSTEM

9.8.1.2. SERVICES

9.8.1.2.1. MANAGED SERVICES

9.8.1.2.2. PROFESSIONAL SERVICES

9.9 ENERGY AND UTILITIES

9.9.1 BY OFFERING

9.9.1.1. SOLUTION

9.9.1.1.1. SECURITY MONITORING

9.9.1.1.2. SECURITY ANALYTICS

9.9.1.1.3. RISK AND VULNERABILITY MANAGEMENT

9.9.1.1.4. ATTACK SIMULATION

9.9.1.1.5. SECURITY ORCHESTRATION

9.9.1.1.6. ADVANCED MALWARE PROTECTION (AMP)

9.9.1.1.7. VIDEO MANAGEMENT SYSTEM

9.9.1.2. SERVICES

9.9.1.2.1. MANAGED SERVICES

9.9.1.2.2. PROFESSIONAL SERVICES

9.10 TRAVEL AND HOSPITALITY

9.10.1 BY OFFERING

9.10.1.1. SOLUTION

9.10.1.1.1. SECURITY MONITORING

9.10.1.1.2. SECURITY ANALYTICS

9.10.1.1.3. RISK AND VULNERABILITY MANAGEMENT

9.10.1.1.4. ATTACK SIMULATION

9.10.1.1.5. SECURITY ORCHESTRATION

9.10.1.1.6. ADVANCED MALWARE PROTECTION (AMP)

9.10.1.1.7. VIDEO MANAGEMENT SYSTEM

9.10.1.2. SERVICES

9.10.1.2.1. MANAGED SERVICES

9.10.1.2.2. PROFESSIONAL SERVICES

9.11 EDUCATION

9.11.1 BY OFFERING

9.11.1.1. SOLUTION

9.11.1.1.1. SECURITY MONITORING

9.11.1.1.2. SECURITY ANALYTICS

9.11.1.1.3. RISK AND VULNERABILITY MANAGEMENT

9.11.1.1.4. ATTACK SIMULATION

9.11.1.1.5. SECURITY ORCHESTRATION

9.11.1.1.6. ADVANCED MALWARE PROTECTION (AMP)

9.11.1.1.7. VIDEO MANAGEMENT SYSTEM

9.11.1.2. SERVICES

9.11.1.2.1. MANAGED SERVICES

9.11.1.2.2. PROFESSIONAL SERVICES

9.12 OTHERS

10. GLOBAL PROACTIVE SECURITY MARKET, BY REGION

10.1 GLOBAL PROACTIVE SECURITY MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

10.1.1 NORTH AMERICA

10.1.1.1. U.S.

10.1.1.2. CANADA (INCLUDING ONTARIO)

10.1.1.3. MEXICO

10.1.2 EUROPE

10.1.2.1. GERMANY

10.1.2.2. FRANCE

10.1.2.3. U.K.

10.1.2.4. ITALY

10.1.2.5. SPAIN

10.1.2.6. RUSSIA

10.1.2.7. TURKEY

10.1.2.8. BELGIUM

10.1.2.9. NETHERLANDS

10.1.2.10. SWITZERLAND

10.1.2.11. SWEDEN

10.1.2.12. DENMARK

10.1.2.13. POLAND

10.1.2.14. REST OF EUROPE

10.1.3 ASIA PACIFIC

10.1.3.1. JAPAN

10.1.3.2. CHINA

10.1.3.3. SOUTH KOREA

10.1.3.4. INDIA

10.1.3.5. AUSTRALIA AND NEW ZEALAND

10.1.3.6. SINGAPORE

10.1.3.7. THAILAND

10.1.3.8. MALAYSIA

10.1.3.9. INDONESIA

10.1.3.10. PHILIPPINES

10.1.3.11. TAIWAN

10.1.3.12. VIETNAM

10.1.3.13. REST OF ASIA PACIFIC

10.1.4 SOUTH AMERICA

10.1.4.1. BRAZIL

10.1.4.2. ARGENTINA

10.1.4.3. REST OF SOUTH AMERICA

10.1.5 MIDDLE EAST AND AFRICA

10.1.5.1. SOUTH AFRICA

10.1.5.2. SAUDI ARABIA

10.1.5.3. EGYPT

10.1.5.4. ISRAEL

10.1.5.5. KUWAIT

10.1.5.6. QATAR

10.1.5.7. REST OF MIDDLE EAST AND AFRICA

10.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

11. GLOBAL PROACTIVE SECURITY MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: GLOBAL

11.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

11.3 COMPANY SHARE ANALYSIS: EUROPE

11.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

11.5 MERGERS & ACQUISITIONS

11.6 NEW PRODUCT DEVELOPMENT & APPROVALS

11.7 EXPANSIONS

11.8 REGULATORY CHANGES

11.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

12. GLOBAL PROACTIVE SECURITY MARKET, SWOT ANALYSIS

13. GLOBAL PROACTIVE SECURITY MARKET, COMPANY PROFILE

13.1 IBM

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT DEVELOPMENTS

13.2 CISCO

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT DEVELOPMENTS

13.3 MCAFEE, LLC

13.3.1 COMPANY SNAPSHOT;IA;

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT DEVELOPMENTS

13.4 PALO ALTO NETWORKS

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT DEVELOPMENTS

13.5 SECURONIX

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT DEVELOPMENTS

13.6 LOGRHYTHM, INC.

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT DEVELOPMENTS

13.7 RAPID7

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT DEVELOPMENTS

13.8 FIREEYE, INC

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT DEVELOPMENTS

13.9 ORACLE

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT DEVELOPMENTS

13.10 DELL, INC.

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT DEVELOPMENTS

13.11 QUALYS, INC.

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT DEVELOPMENTS

13.12 THREATCONNECT

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT DEVELOPMENTS

13.13 TRUSTWAVE HOLDINGS, INC.

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT DEVELOPMENTS

13.14 ALIENVAULT, INC. (AT&T CYBERSECURITY)

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT DEVELOPMENTS

13.15 FIREMON, LLC.

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT DEVELOPMENTS

13.16 FUJITSU

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT DEVELOPMENTS

13.17 DELINEA

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT DEVELOPMENTS

13.18 SWIMLANE INC.

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT DEVELOPMENTS

13.19 SKYBOX SECURITY, INC.

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCT PORTFOLIO

13.19.4 RECENT DEVELOPMENTS

13.20 SOFTSYS HOSTING

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 PRODUCT PORTFOLIO

13.20.4 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

14. RELATED REPORTS

15. QUESTIONNAIRE

16. ABOUT DATA BRIDGE MARKET RESEARCH