Global Security System Integrators Market

Market Size in USD Billion

CAGR :

%

USD

12.45 Billion

USD

28.90 Billion

2024

2032

USD

12.45 Billion

USD

28.90 Billion

2024

2032

| 2025 –2032 | |

| USD 12.45 Billion | |

| USD 28.90 Billion | |

|

|

|

|

Security system integrators Market Size

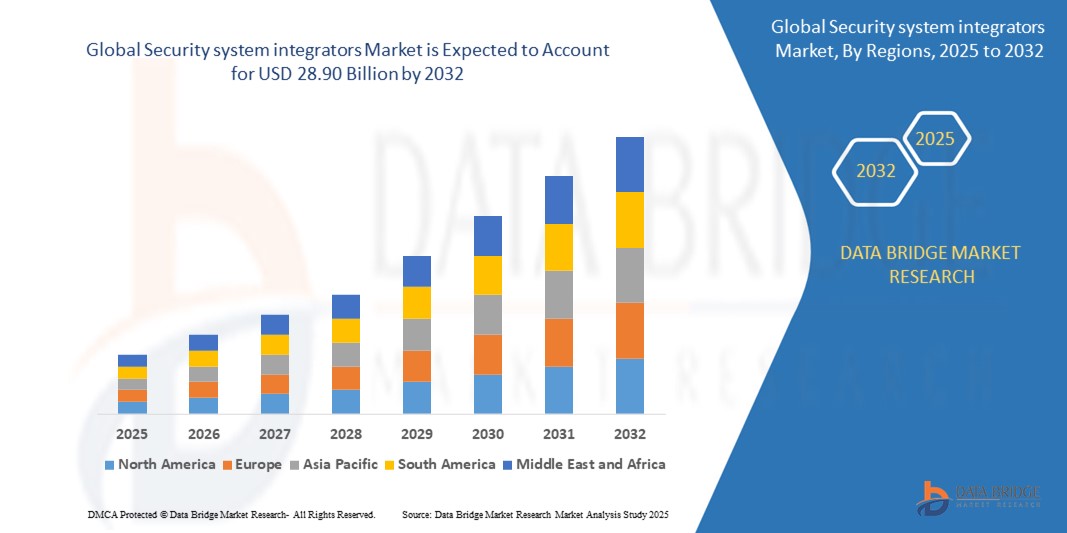

- The global Security system integrators market size was valued at USD 12.45 billion in 2024 and is expected to reach USD 28.90 billion by 2032, at a CAGR of 11.1% during the forecast period

- This growth is driven by increasing demand for integrated security solutions, rising cyber and physical security threats, and the growing adoption of cloud-based security systems across enterprises.

Security system integrators Market Analysis

- Security system integrators provide comprehensive solutions by combining hardware, software, and services to deliver unified security systems tailored to organizational needs.

- The market is propelled by the rising complexity of security threats, the need for seamless integration of disparate security systems, and advancements in AI and IoT-driven security technologies.

- North America dominates the market due to its advanced security infrastructure, high adoption of integrated solutions, and the presence of key players like Johnson Controls, Siemens, and Honeywell.

- Asia-Pacific is projected to exhibit the fastest growth, fueled by rapid urbanization, increasing cybersecurity threats, and government initiatives promoting smart city projects in countries like China, India, and Japan.

- The government segment is expected to hold a significant market share of approximately 25.8% in 2025, driven by the need to secure critical infrastructure and comply with stringent regulations.

Report Scope and Security system integrators Market Segmentation

|

Attributes |

Security system integrators Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Security system integrators Market Trends

“Adoption of AI and IoT-Driven Security Integration and Smart City Solutions”

- The integration of AI and IoT technologies is a key trend, enabling real-time monitoring, predictive analytics, and automated threat response in integrated security systems.

- Security system integrators are increasingly focusing on smart city projects, combining video surveillance, access control, and cybersecurity solutions to enhance urban safety.

- For instance, in October 2024, Honeywell partnered with a leading smart city project in Singapore to deploy AI-driven integrated security solutions, enhancing public safety and operational efficiency.

- These innovations are driving the adoption of integrated security systems across industries.

Security system integrators Market Dynamics

Driver

“Rising Cyber and Physical Security Threats”

- The surge in cyberattacks and physical security breaches has accelerated the demand for integrated security solutions to protect critical infrastructure and sensitive data.

- Security system integrators provide unified platforms that combine cybersecurity, surveillance, and access control, reducing vulnerabilities.

- For instance, the 2024 Global Threat Report noted that 68% of organizations faced hybrid security threats, underscoring the need for integrated systems.

- Growing regulatory requirements for data and infrastructure protection further fuel market growth.

Opportunity

“Growth of Cloud-Based Security Integration Solutions”

- Cloud-based security systems offer scalability, cost-efficiency, and seamless integration with hybrid environments, supporting organizations’ digital transformation efforts.

- These solutions enable centralized management of security systems, enhancing protection across distributed workforces.

- For instance, in April 2024, Cisco launched Secure Connect, a cloud-based platform for integrating cybersecurity and physical security systems.

- The increasing adoption of cloud-based solutions by SMEs offers significant growth opportunities.

Restraint/Challenge

“Complexity of Integration and High Initial Costs”

- Integrating diverse security systems, such as surveillance, access control, and cybersecurity, with existing IT infrastructure poses significant challenges, particularly for organizations with legacy systems.

- Compliance with regulations like GDPR, NIST, and ISO 27001 requires advanced integration, increasing costs.

- For instance, the 2024 Cybersecurity Outlook Report highlighted a 150% rise in hybrid threats, emphasizing the need for advanced integration despite complexities.

- The shortage of skilled security integration professionals further complicates deployment and management.

Security system integrators Market Scope

The market is segmented based on component, deployment, organization size, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Deployment |

|

|

By Organization Size |

|

|

By End User |

|

In 2025, the government segment is projected to dominate the end-user segment

The government segment is expected to hold a market share of approximately 25.82% in 2025, driven by the need to secure critical infrastructure and comply with national security regulations.

The cloud deployment segment is expected to account for the largest share during the forecast period in the deployment market

In 2025, the cloud deployment segment is projected to account for a market share of 58.71%, driven by its scalability, flexibility, and ability to support distributed security environments.

“North America Holds the Largest Share in the Security system integrators Market”

- North America dominates the market due to its advanced security ecosystem, widespread adoption of integrated solutions, and the presence of leading vendors like Johnson Controls, Honeywell, and Cisco.

- The U.S. holds a significant share, driven by stringent regulations, high threat prevalence, and robust infrastructure investments.

- The region benefits from significant advancements in AI and IoT-driven security technologies..

“Asia-Pacific is Projected to Register the Highest CAGR in the Security system integrators Market”

- Asia-Pacific’s growth is driven by rapid urbanization, increasing security threats, and government initiatives for smart city development in countries like China, India, and Japan.

- India is projected to exhibit the highest CAGR due to its expanding IT sector and growing adoption of cloud-based security solutions.

- The region’s growing BFSI and manufacturing industries further accelerate market growth..

Security system integrators Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Johnson Controls (U.S.)

- Honeywell International Inc. (U.S.)

- Siemens AG (Germany)

- Schneider Electric (France)

- Cisco Systems, Inc. (U.S.)

- Bosch Security Systems (Germany)

- ADT Inc. (U.S.)

- Axis Communications AB (Sweden)

- Tyco International (Ireland)

- Hikvision Digital Technology Co., Ltd. (China)

Latest Developments in Global Security system integrators Market

- In February 2023, Siemens partnered with Microsoft Azure to enhance its security system integration offerings. This collaboration integrated Siemens’ AI-driven security solutions with Azure’s cloud infrastructure, enabling real-time threat detection and seamless integration of physical and cybersecurity systems. The partnership aimed to address the growing complexity of securing smart buildings and critical infrastructure.

- In September 2023, Johnson Controls launched OpenBlue Security, a comprehensive platform designed to integrate video surveillance, access control, and cybersecurity across cloud and on-premises environments. This solution emphasized AI-driven analytics and zero-trust principles, targeting enterprises with complex security needs.

- In January 2024, Honeywell introduced its Pro-Watch Integrated Security Suite, tailored for the government and BFSI sectors. The platform combines advanced video analytics, access control, and intrusion detection, ensuring compliance with regulations like FISMA and GDPR. The solution offers real-time monitoring and automated threat response to enhance security.

- In April 2024, Cisco launched Secure Connect, a cloud-based security integration platform designed to unify cybersecurity and physical security systems. This platform enables organizations to centrally manage security operations across distributed environments, offering features like automated threat detection and integration with existing security tools.

- In November 2024, Bosch Security Systems announced a strategic partnership with a leading smart city project in Dubai to deploy AI-driven integrated security solutions. The collaboration focused on combining video surveillance, access control, and cybersecurity to enhance urban safety and operational efficiency, reinforcing Bosch’s position in the market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.