Global Application Security Market

Market Size in USD Billion

CAGR :

%

USD

10.70 Billion

USD

15.60 Billion

2024

2032

USD

10.70 Billion

USD

15.60 Billion

2024

2032

| 2025 –2032 | |

| USD 10.70 Billion | |

| USD 15.60 Billion | |

|

|

|

|

Application Security Market Size

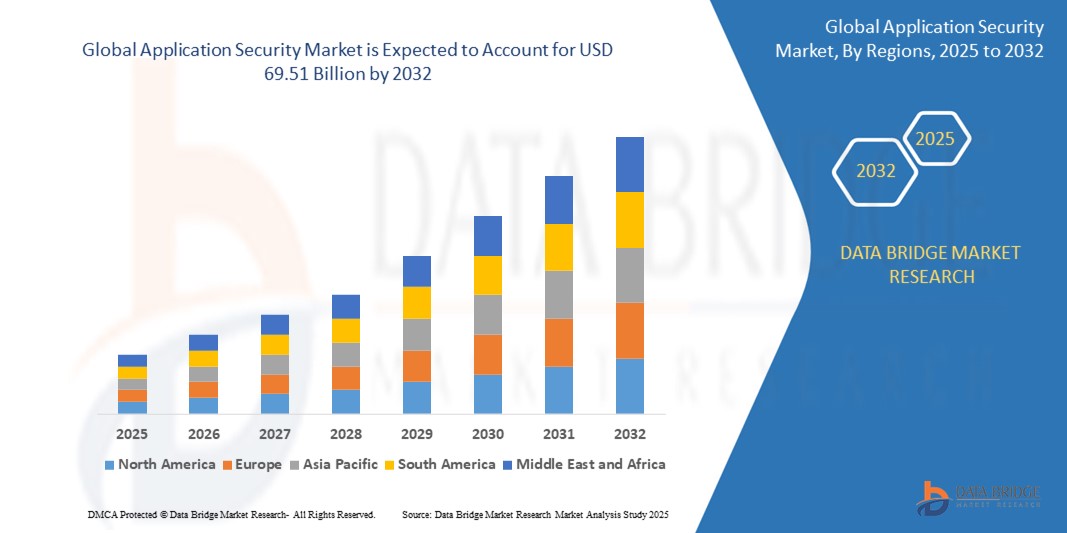

- The global application security market size was valued at USD 10.70 billion in 2024 and is expected to reach USD 69.51 billion by 2032, at a CAGR of 26.35 % during the forecast period

- This growth is driven by factors such as the increasing adoption of digital technologies, cloud computing, and mobile applications across industries, creating a larger attack surface for cyber threats.

Application Security Market Analysis

- The global application security market is experiencing significant growth, driven by the increasing reliance on digital platforms and the rising frequency of cyberattacks targeting applications. Organizations are investing in robust security measures to protect sensitive data and ensure compliance with stringent regulations

- The integration of artificial intelligence and machine learning technologies into application security solutions is enhancing threat detection and response capabilities. These advancements enable organizations to proactively identify vulnerabilities and mitigate potential risks in real-time

- North America is expected to dominate the application security market due to its strong presence of key industry players, advanced cybersecurity infrastructure, and high demand for data protection across various sectors

- Asia-Pacific is expected to be the fastest growing region in the application security market during the forecast period due to rapid digitalization, increasing cyber threats, and growing investments in cybersecurity across multiple industries

- The web app segment is expected to dominate the application security market with the largest share of 62.5% in 2025 due to its widespread use of web applications across various industries, including e-commerce, banking, and healthcare. Web applications are prime targets for cybercriminals because they are accessible over the internet, making them more vulnerable to attacks such as SQL injection, cross-site scripting (XSS), and cross-site request forgery (CSRF).

Report Scope and Application Security Market Segmentation

|

Attributes |

Application Security Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Application Security Market Trends

“Rise of DevSecOps Integration in Application Security”

- DevSecOps is being integrated into Continuous Integration/Continuous Deployment (CI/CD) pipelines, automating security testing at each development stage

- For instance, GitLab has embedded security scanning tools into their CI/CD pipeline to detect vulnerabilities early in the development process

- By embedding security into the development process, DevSecOps allows for the identification and mitigation of vulnerabilities early, reducing the risks of late-stage fixes

- For instance, Netflix applies DevSecOps to its development cycles to ensure security is continuously monitored and threats are addressed before the code is deployed

- Real-time feedback through automated security tools enables quick identification and remediation of security issues, leading to faster responses to emerging threats

- For instance, Google's use of automated security tests within their DevSecOps pipeline ensures vulnerabilities are detected immediately, reducing the impact of potential breaches

- DevSecOps fosters collaboration among development, security, and operations teams, ensuring that security is prioritized across all aspects of software development and deployment

Application Security Market Dynamics

Driver

“Increasing Cybersecurity Threats and Data Breaches”

- The rise in cyber threats such as ransomware, phishing, and advanced persistent threats (APTs) is leading to a higher demand for robust application security solutions

- For instance, the WannaCry ransomware attack (2017) affected hundreds of thousands of organizations globally, emphasizing the need for advanced protection

- As organizations adopt new technologies such as cloud computing, mobile applications, and IoT, they create larger attack surfaces for cybercriminals to exploit. This has made securing applications more critical than ever to protect sensitive data

- The Equifax breach (2017) exposed personal data of 147 million individuals, underscoring the vulnerability of applications and boosting the need for better application security. Such breaches have driven organizations to invest in security measures to prevent similar incidents

- Organizations are increasingly aware that a single successful attack can lead to significant financial, operational, and reputational losses

- For instance, The Target breach (2013), which resulted in a $18.5 million settlement, highlights the severe consequences of insufficient security

- As cybersecurity threats continue to evolve, businesses are prioritizing security at every stage of their software development lifecycle. This shift has contributed significantly to the growth of the application security market as companies adopt measures such as vulnerability scanning, secure coding, and penetration testing

Opportunity

“Integration of Artificial Intelligence (AI) and Machine Learning (ML)”

- Artificial Intelligence (AI) and Machine Learning (ML) present a major opportunity for the application security market by enhancing threat detection, real-time monitoring, and automated incident response.

- AI can continuously analyze vast amounts of data in real-time, identifying potential vulnerabilities before they are exploited by attackers

- For instance, AI-powered tools can monitor application behavior to detect unusual activities that could indicate a security breach.

- Machine learning algorithms can adapt and improve over time, learning from new threats and becoming better at predicting and preventing security breaches

- For instance, Cylance, which uses AI to prevent malware by identifying and blocking threats based on predictive models that improve as the system learns from past attacks.

- AI-powered security tools can automate repetitive security tasks such as vulnerability scanning and patch management, allowing security teams to focus on more complex issues

- For instance, tools such as Qualys leverage AI to automate vulnerability scanning, helping organizations continuously monitor and secure their applications with minimal manual intervention.

- The rapid advancement of AI and ML in the cybersecurity domain is opening new avenues for securing applications. As these technologies evolve, they will play an even more significant role in shaping the future of application security, helping organizations implement intelligent, adaptive, and autonomous security solutions.

Restraint/Challenge

“High Cost of Implementation and Maintenance”

- One of the primary challenges limiting the growth of the application security market is the high cost associated with the implementation and maintenance of security solutions

- Deploying robust application security tools requires significant upfront investment in software, hardware, and specialized personnel, which can be a financial burden for many organizations

- For small and medium-sized enterprises (SMEs), the high costs associated with enterprise-grade security solutions can be prohibitive

- For instance, a small business may struggle to afford advanced security technologies such as encryption software or automated vulnerability scanning tools, leaving them more vulnerable to cyberattacks

- Even larger enterprises face challenges in justifying the high cost of implementation, particularly when the return on investment (ROI) from security tools is not immediately evident

- For instance, is when organizations invest in comprehensive security platforms that require long-term commitments, but the tangible benefits, such as avoiding breaches, are often difficult to quantify

- Maintaining these solutions often requires a dedicated team of skilled cybersecurity professionals, which further drives up operational costs. As cybersecurity threats evolve, security teams must continuously update and optimize systems to ensure they remain effective

- For instance, constant patching and updates are necessary to keep up with new vulnerabilities, adding to the long-term costs of maintaining these systems

Application Security Market Scope

The market is segmented on the basis of solution, service, testing, deployment, organization, and end-user.

|

Segmentation |

Sub-Segmentation |

|

By Solution |

|

|

By Service |

|

|

By Testing |

|

|

By Deployment |

|

|

By Organization |

|

|

By End-user |

|

In 2025, the web app is projected to dominate the market with a largest share in solution segment

The web app segment is expected to dominate the application security market with the largest share of 62.5% in 2025 due to its widespread use of web applications across various industries, including e-commerce, banking, and healthcare. Web applications are prime targets for cybercriminals because they are accessible over the internet, making them more vulnerable to attacks such as SQL injection, cross-site scripting (XSS), and cross-site request forgery (CSRF).

The static application security testing is expected to account for the largest share during the forecast period in testing market

In 2025, the static application security testing segment is expected to dominate the market with the largest market share of 76.5% due to its early-stage vulnerability detection capabilities of SAST tools, which analyze the source code or binaries of an application without executing the program.

Application Security Market Regional Analysis

“North America Holds the Largest Share in the Application Security Market”

- North America region is projected to dominate the application security market

- North America is anticipated to hold the largest market share of 39.8%. This dominance is due to the presence of major industry players and strong cybersecurity infrastructure in the U.S. and Canada

- The region’s financial services, healthcare, and government sectors, which handle sensitive data, are significant markets for application security solutions

- North America benefits from a high concentration of skilled cybersecurity professionals, which facilitates the deployment of advanced security measures across industries

- The region’s emphasis on data privacy regulations and ongoing digital transformation drives the continuous demand for application security solutions

“Asia-Pacific is Projected to Register the Highest CAGR in the Application Security Market”

- Asia Pacific is projected to experience the fastest growth. The region’s rapid digitalization across industries such as banking, e-commerce, and manufacturing is fuelling the need for enhanced application protection

- Countries such as China, India, Japan, and South Korea are witnessing significant increases in online transactions and digital activities, which exposes them to greater cyber risks

- Growing investments in IT infrastructures in developing nations in the region provide a substantial market opportunity for application security vendors

- The large talent pool of developers and IT professionals in Asia Pacific contributes to the region’s fast-paced adoption of security solutions, as many global delivery models are shifting application development activities to this region

Application Security Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- VERACODE (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- Synopsys, Inc (U.S.)

- IBM (U.S.)

- WhiteHat Security (U.S.)

- Qualys, Inc (U.S.)

- Checkmarx Ltd. (Israel)

- Acunetix (Malta)

- Rapid7 (U.S.)

- Trustwave Holdings, Inc. (U.S.)

- High-Tech Bridge SA (Switzerland)

- Contrast Security (U.S.)

- SiteLock (U.S.)

- Pradeo (France)

- Fasoo, Inc (South Korea)

- Oracle (U.S.)

- Micro Focus (U.K.)

- Positive Technologies (Russia)

Latest Developments in Global Application Security Market

- In November 2023, Require Security (U.S.) launched Falcon, an advanced runtime application security product designed to counter emerging AI-driven cybersecurity threats. Falcon employs AI-powered techniques to deliver automated protection for third-party and open-source dependencies in Node.js applications. It offers zero-trust security controls, providing real-time alerts to security operations teams when unauthorized access attempts occur. This solution enhances organizations' ability to monitor and understand the behavior of their open-source libraries, thereby strengthening their security posture and safeguarding sensitive data from software supply chain attacks. By offering deeper insights into application behavior, Falcon sets a new standard for runtime application security tools, addressing the challenges faced by technology companies utilizing open-source libraries

- In October 2023, Checkmarx (U.S.) launched the Checkmarx Tech Partnership Program, aiming to integrate best-in-class partner capabilities with its AI-powered Checkmarx One platform. This initiative enhances application security across the software development lifecycle (SDLC) by incorporating tools for SDLC integration, runtime and cloud security, vulnerability management, and emerging technologies. The program includes partnerships with companies such as AWS, ServiceNow, Sysdig, GitLab, JetBrains, and Mobb.ai, enabling seamless integration and support. By centralizing and simplifying discovery in these key areas, the program helps organizations shift everywhere—from code to cloud—while maintaining a unified AppSec posture. This approach aims to reduce vulnerability noise, improve remediation processes, and build trust between security and development teams, ultimately leading to better security outcomes

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.