Global Physical Security Market

Market Size in USD Billion

CAGR :

%

USD

139.40 Billion

USD

255.46 Billion

2024

2032

USD

139.40 Billion

USD

255.46 Billion

2024

2032

| 2025 –2032 | |

| USD 139.40 Billion | |

| USD 255.46 Billion | |

|

|

|

|

Physical Security Market Size

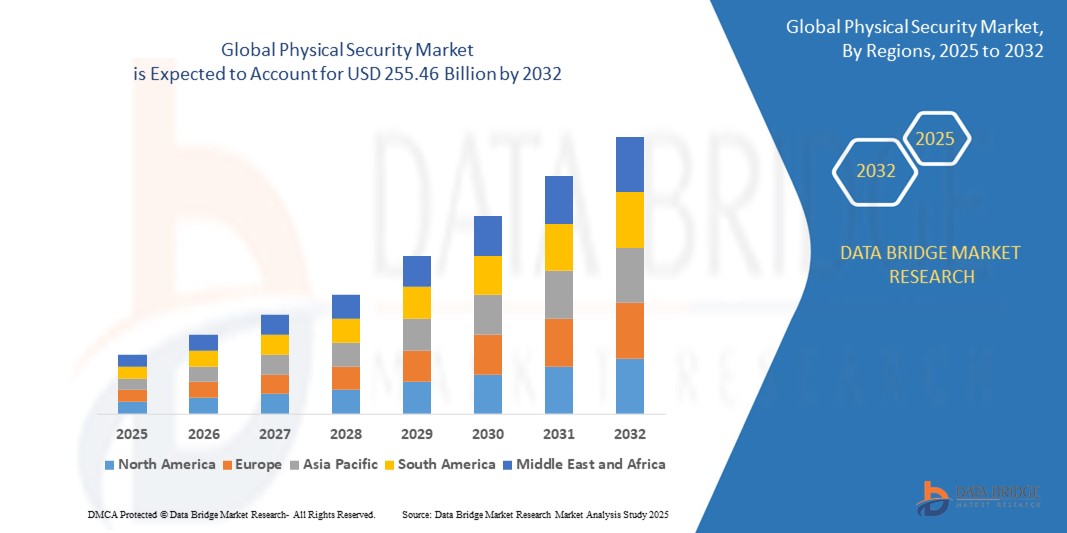

- The global physical security market size was valued at USD 139.04 billion in 2024 and is expected to reach USD 255.46 billion by 2032, at a CAGR of 7.90% during the forecast period

- This growth is driven by factors such as the factors such as the increasing incidence of security breaches, rising adoption of IP-based surveillance systems, growing demand for access control systems, and heightened awareness of physical security in critical infrastructure and public safety applications

Physical Security Market Analysis

- The physical security market is witnessing steady growth due to the integration of advanced technologies such as biometric authentication and AI-powered surveillance in commercial and industrial spaces

- Businesses are prioritizing real-time monitoring and intelligent threat detection to safeguard assets and ensure uninterrupted operations

- North America is expected to dominate the Physical Security market due to with share of 37.05 % due to significant demand for physical security systems and services

- Asia-Pacific is expected to be the fastest growing region in the Physical Security market during the forecast period due to increased spending on safety, surveillance, and monitoring across residential and commercial establishments

- The systems segment is expected to dominate the physical security market with the largest share of 44.64% in 2025 due to the increasing adoption of advanced surveillance systems, access control, and intrusion detection technologies across industries. As businesses seek more integrated security solutions, the demand for systems that combine multiple features for comprehensive protection is rising.

Report Scope and Physical Security Market Segmentation

|

Attributes |

Physical Security Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Physical Security Market Trends

“Rising Adoption of Cloud-Based Security Solutions”

- The current physical security market is seeing a clear shift toward cloud-based surveillance and access control systems

- Companies are replacing traditional on-premise setups with cloud solutions for better scalability and easier data management

- Cloud integration enables remote access to security feeds and system controls, which supports faster decision-making

- This trend is simplifying system updates and maintenance while reducing infrastructure costs for businesses

- Organizations are also using cloud platforms to centralize security operations across multiple sites

- For instance, a retail chain can monitor all store locations through one cloud dashboard, improving incident response times

- The market is also benefiting from the flexibility cloud services offer in customizing security features as per business needs

- With data encryption and real-time analytics becoming standard, cloud-based systems are building trust among end users

- In conclusion, as adoption grows, vendors are focusing on offering bundled cloud security solutions to meet rising demand across industries

Physical Security Market Dynamics

Driver

“Increasing Security Threats Across Commercial Infrastructures”

- The rising number of physical breaches such as unauthorized access and theft in commercial settings is compelling businesses to adopt modern security infrastructure such as biometric access and smart surveillance

- Sectors including retail, banking, and logistics are now actively deploying multi-device systems combining intrusion alarms and centralized video monitoring to protect assets and workforce

- For instance, in 2024 several retail chains in Europe upgraded to AI-enabled surveillance systems after repeated shoplifting incidents during operating hours and after closures

- Small and medium businesses are shifting toward integrated security frameworks that combine physical and IT security to combat both internal and external threats in real time

- Insurance firms increasingly require verified physical security installations for claim validation while declining hardware costs are helping more businesses afford these solutions

- As risks intensify across industries, organizations are scaling up their security investments to ensure operational safety and resilience

Opportunity

“Integration of Artificial Intelligence in Security Systems”

- The adoption of artificial intelligence in physical security systems is enabling real-time threat detection and proactive incident prevention across industries such as healthcare and transportation

- AI-powered video analytics can recognize behavioral anomalies, facial patterns, and unattended objects to reduce false alerts and strengthen situational control

- For instance, in 2024 a major airport in Asia deployed AI-based surveillance that identified suspicious movement near restricted zones, helping authorities intervene before a potential breach

- Vendors are developing unified security platforms that integrate data from access control, video feeds, and motion sensors to deliver intelligent, centralized oversight

- Smart city projects are increasingly incorporating AI tools to monitor large public areas such as transit stations and stadiums with improved responsiveness and resource efficiency

- In conclusion, as AI becomes more affordable and scalable, its use in both enterprise and residential physical security systems is expected to grow substantially

Restraint/Challenge

“High Initial Investment and Maintenance Costs”

- The high upfront cost of deploying advanced physical security solutions such as biometric systems and integrated surveillance often discourages small and medium businesses from early adoption

- In addition to purchasing hardware and software, companies must invest in supporting infrastructure such as control centers, secured networks, and dedicated monitoring setups

- For instance, in 2024 several mid-sized educational institutions in Latin America postponed installing modern access control systems due to budget limitations and lack of technical resources

- Frequent updates and system upgrades required to keep pace with evolving threats further increase total ownership costs and complicate long-term planning

- Skilled personnel are often needed for system maintenance and operation, and in remote areas, limited access to trained professionals makes ongoing management difficult

- In conclusion, despite the growing interest, high costs and technical complexity remain strong barriers for businesses with limited financial flexibility and internal capabilities

Physical Security Market Scope

The market is segmented on the basis of component, organization size, and vertical.

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Organization Size |

|

|

By Vertical |

|

In 2025, the systems segment is projected to dominate the market with a largest share in component segment

The systems segment is expected to dominate the physical security market with the largest share of 44.64% in 2025 due to the increasing adoption of advanced surveillance systems, access control, and intrusion detection technologies across industries. As businesses seek more integrated security solutions, the demand for systems that combine multiple features for comprehensive protection is rising. Furthermore, the growing emphasis on proactive security measures, enabled by smart systems powered by artificial intelligence and machine learning, is driving this shift. Centralized monitoring solutions are becoming more critical as companies seek to manage security across multiple locations and ensure continuous threat assessment in real-time.

The government is expected to account for the largest share during the forecast period in vertical segment

In 2025, the government segment is expected to dominate the market with the largest market share of 35.74% due to the increasing focus on national security, public safety, and infrastructure protection. Governments are investing heavily in physical security to safeguard critical assets such as transportation hubs, government buildings, and public spaces from threats such as terrorism, unauthorized access, and civil unrest. The implementation of smart city projects is further driving the deployment of surveillance systems and access control technologies. In addition, regulatory mandates and compliance requirements are pushing authorities to upgrade and standardize security infrastructure. The rising need for crowd monitoring and real-time incident response in densely populated urban areas is accelerating the adoption of integrated security systems.

Physical Security Market Regional Analysis

“North America Holds the Largest Share in the Physical Security Market”

- North America holds the largest share of the global physical security market with share of 37.05 %

- The U.S. leads the region with significant demand for physical security systems and services

- This dominance is attributed to the strong presence of global players and technology leaders based in the U.S. and Canada, with established supply chains and delivery networks

- High enterprise spending on security, driven by constant innovation and upgrades of existing infrastructure, further propels market growth

- Stringent regulations and compliance requirements around critical infrastructure protection and law enforcement modernization boost demand

“Asia-Pacific is Projected to Register the Highest CAGR in the Physical Security Market”

- The Asia Pacific region has emerged as the fastest-growing market for physical security

- Countries such as China, India, Japan, and South Korea are witnessing exponential urbanization, leading to increased spending on safety, surveillance, and monitoring across residential and commercial establishments

- Increasing instances of terrorism and regional conflicts have accelerated the adoption of security systems across governmental agencies, public venues, and transportation centers

- Homegrown manufacturers from China have made significant investments in research and development, now competing aggressively on a global scale

- Export of cost-effective IP cameras, video management systems, and access control machines from the region have disrupted traditional pricing models

- If emerging economies in the Asia Pacific continue their infrastructure-led growth trajectory supported by favorable regulations, the region is poised to surpass North America as the premier marketplace for physical security within this decade

Physical Security Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Cisco Systems Inc. (U.S.)

- Honeywell International Inc. (U.S.)

- Johnson Controls (Ireland)

- TELUS (Canada)

- Genetec Inc. (Canada)

- Bosch Sicherheitssysteme GmbH (Germany)

- HID Global Corporation, ASSA ABLOY(U.S.)

- Pelco, Inc. (U.S.)

- Hangzhou Hikvision Digital Technology Co., Ltd. (China)

- Arthur J. Gallagher & Co. (New Zealand)

- SECOM Plc (Japan)

- Allied Universal (U.S.)

- Dahua Technology (U.S.)

- STANLEY CONVERGENT SECURITY SOLUTIONS, INC. (U.S.)

- Axis Communications AB. (Sweden)

- Hanwha Techwin America. (U.S.)

- Teledyne FLIR LLC (U.K.)

- Hexagon AB (Sweden)

Latest Developments in Global Physical Security Market

- In January 2025, Spot AI, Inc. launched its Remote Security Agent, an AI-powered solution designed to enhance security in the retail sector. Building on its earlier Video AI Agents, this new offering combines smart hardware with AI to address challenges posed by rising retail crime and limitations of traditional security methods. The Remote Security Agent aims to replace costly, understaffed on-site guards and outdated remote surveillance systems, providing businesses with a more efficient and scalable approach to protecting their premises

- In April 2025, MCA, Inc. acquired Presidio, Inc.'s Physical Security Integration business (PhySec), strengthening its position as a leading provider of workplace safety and security solutions. The acquisition reflects MCA, Inc.'s commitment to delivering innovative, customizable security offerings while continuing to support clients and invest in new technologies to protect both physical and intellectual assets

- In August 2024, Rhombus Systems, a leading provider of cloud-managed physical security solutions, announced a strategic partnership with Convergint Technologies LLC, a global leader in integrated security services. This collaboration reflects Rhombus Systems’ continued commitment to expanding its global reach and delivering end-to-end, scalable security solutions. By combining Rhombus Systems’ advanced cloud-native technologies with Convergint

- In September 2022, Axis Communications launched two advanced multidirectional, dual-sensor cameras tailored for 24/7 operation in challenging lighting conditions. These cameras offer wide-angle overviews and detailed coverage, leveraging a deep learning processing unit (DLPU) based on ARTPEC-8 for enhanced data collection, analysis, and improved processing and storage capabilities

- In November 2021, ADT's foray into the rooftop solar industry through the acquisition of SunPro Solar, subsequently rebranded as "ADT Solar." This strategic move enables ADT to provide its customers with safe and interconnected solar energy solutions, expanding its service portfolio beyond traditional security offerings

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.