Global Light Duty Vehicle Market

Market Size in USD Billion

CAGR :

%

USD

1.60 Billion

USD

2.00 Billion

2024

2032

USD

1.60 Billion

USD

2.00 Billion

2024

2032

| 2025 –2032 | |

| USD 1.60 Billion | |

| USD 2.00 Billion | |

|

|

|

|

Light Duty Vehicle Market Size

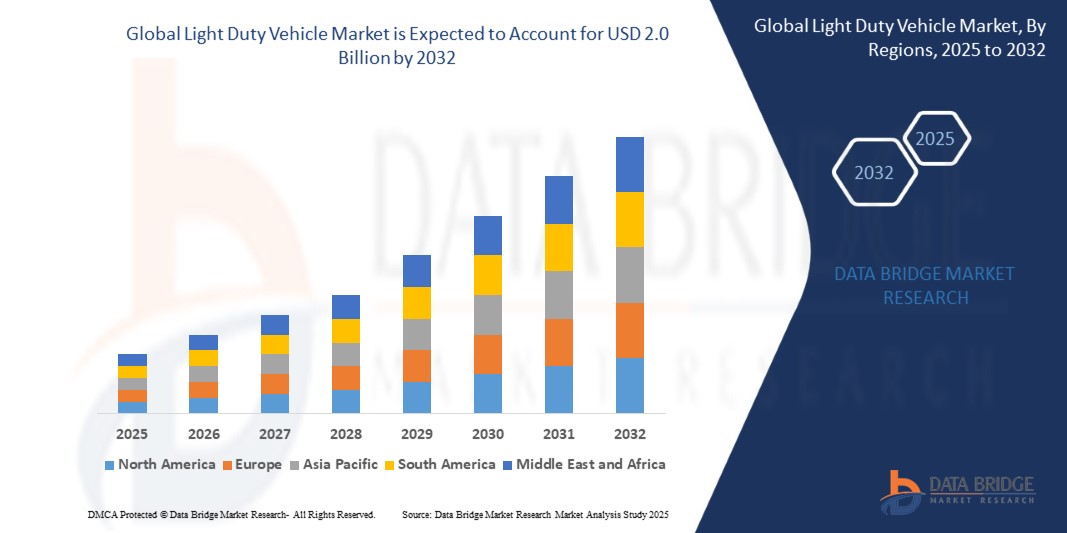

- The Global Light Duty Vehicle Market is projected to reach USD 1.6 billion in 2024 and is expected to grow to approximately USD 2.0 billion by 2032, registering a CAGR of 1.51% during the forecast period from 2025 to 2032.

- This growth is being driven by rising disposable incomes, increasing preference for personal mobility solutions, and strong government backing for electric vehicles (EVs) as part of climate and emission reduction policies. With increasing adoption of shared mobility, advanced driver-assistance systems (ADAS), and a shift toward sustainable transportation, light duty vehicles are playing a central role in meeting evolving consumer demands and regulatory standards.

Light Duty Vehicle Market Analysis

- The global demand for light duty vehicles is rising steadily as consumers, fleet operators, and governments push for greater fuel efficiency, reduced emissions, and improved urban mobility. From high-performance compact cars in North America to expanding SUV and pickup sales in Asia-Pacific, light duty vehicles are central to personal and commercial transportation worldwide.

- So, what’s fueling this momentum? A major factor is the rapid shift toward electrification and hybridization. Governments across regions—including the U.S., China, and Europe—are implementing strict emission regulations, EV subsidies, and zero-emission vehicle targets. These policy shifts are driving automakers to invest heavily in light electric vehicles (LEVs), plug-in hybrids, and alternative fuel variants.

- Urbanization and rising disposable incomes in emerging economies are also expanding the customer base for light passenger vehicles. In regions like Southeast Asia, Latin America, and parts of Africa, the market is witnessing a growing appetite for affordable, compact, and efficient models that cater to both daily commuting and small-scale business use.

- Additionally, the adoption of advanced technologies is transforming vehicle design and performance. From ADAS (advanced driver-assistance systems) and onboard diagnostics to connected infotainment systems, today's light duty vehicles are being tailored for greater safety, convenience, and user experience. This technological integration is making light vehicles more appealing to tech-savvy and younger consumers.

- On the commercial side, the booming e-commerce and logistics sectors are increasing demand for light commercial vehicles (LCVs) for last-mile delivery operations. Automakers are responding with purpose-built electric vans and mini-trucks that offer low emissions and high utility in congested urban environments

- With continued innovation in drivetrain technology, increased consumer preference for personal mobility post-COVID-19, and the global race to decarbonize transportation, the light duty vehicle market is positioned for sustained growth. Strategic partnerships, R&D investments, and evolving vehicle platforms will further reshape the competitive landscape throughout the forecast period.

Report Scope Light Duty Vehicle Market Segmentation

|

Attributes |

Light Duty Vehicle Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

|

Light Duty Vehicle Market Trends

Electrification, Urban Mobility, and Tech Integration Driving the Future of Light Duty Vehicles

- A major trend redefining the global light duty vehicle market is the rapid electrification of mobility. Governments around the world are offering subsidies, tax rebates, and zero-emission mandates, encouraging automakers to develop electric light duty vehicles (e-LDVs). Major OEMs are investing heavily in EV platforms, with new launches across hatchbacks, sedans, and compact SUVs catering to both individual and fleet users.

- In urban centers, the shift toward sustainable and shared mobility is accelerating. Cities are adopting clean transport policies, low-emission zones, and electrified public fleets. This is boosting the demand for electric vans and compact utility vehicles designed for last-mile delivery, ride-sharing, and short-distance commuting.

- Technology integration is another powerful trend. Advanced driver-assistance systems (ADAS), connected infotainment, and over-the-air (OTA) software updates are becoming standard even in entry-level light duty vehicles. Consumers increasingly expect vehicles that offer convenience, safety, and real-time connectivity, prompting OEMs to prioritize digital innovation.

- Fleet electrification is transforming logistics and service industries. From courier companies to government fleets, there's a growing preference for zero-emission LCVs that help meet ESG goals and reduce operating costs. Automakers are responding with modular, electric, and purpose-built light duty vehicle platforms optimized for cargo, passengers, and urban logistics.

- In emerging markets, rising incomes and urbanization are driving first-time vehicle ownership, especially in segments like compact cars and small pickups. These vehicles are designed for affordability, fuel efficiency, and rugged use—meeting the diverse needs of developing economies while opening up significant growth opportunities for global manufacturers.

Light Duty Vehicle Market Dynamics

Driver

Electrification and Urban Mobility Shaping Next-Gen Vehicle Demand

- Around the world, the automotive industry is undergoing a significant shift as electrification, urbanization, and policy-driven emission reductions reshape the light duty vehicle (LDV) landscape. Governments are introducing tighter CO₂ regulations, offering incentives for electric vehicles (EVs), and investing in EV charging infrastructure—all of which are propelling demand for both electric and hybrid light duty vehicles.

- Consumers are increasingly prioritizing fuel efficiency, environmental sustainability, and personal mobility, especially in urban centers where congestion and air quality are major concerns. Light duty EVs—ranging from compact cars to electric vans—are well-suited for these environments, offering lower emissions, reduced running costs, and eligibility for regulatory benefits such as tax rebates and zero-emission zone access.

- At the same time, advancements in battery technology, connectivity, and vehicle automation are adding value across the light vehicle segment. Automakers are rapidly integrating features like ADAS, smart infotainment, and OTA (over-the-air) software updates, which appeal to tech-savvy consumers and enhance long-term vehicle utility.

- Moreover, the growth of e-commerce and last-mile delivery has elevated the role of light commercial vehicles (LCVs) in logistics networks. Fleet operators are shifting toward electric LCVs to align with ESG goals, reduce fuel expenses, and comply with evolving urban delivery regulations. This has opened new growth opportunities for OEMs and suppliers focused on purpose-built, electrified light duty platforms.

Restraint/Challenge

Cost Pressures and Supply Chain Volatility in a Competitive Market

- While the long-term outlook for the global light duty vehicle market remains strong, manufacturers face persistent challenges linked to rising production costs, raw material price volatility, and global supply chain disruptions. The automotive industry continues to deal with shortages in semiconductors, battery materials, and electronic components—leading to longer lead times, delayed deliveries, and cost inflation.

- Electrification, though essential, comes with high development and infrastructure costs. OEMs must invest significantly in R&D, retooling of manufacturing plants, and battery sourcing. For many traditional automakers, balancing these capital-intensive transitions while remaining price-competitive is a major hurdle—particularly in cost-sensitive markets.

- Additionally, in several emerging economies, EV adoption is still constrained by inadequate charging infrastructure, high vehicle prices, and limited consumer awareness. While incentives exist, affordability remains a barrier for mass adoption, especially when compared to widely available and less expensive ICE (internal combustion engine) vehicles.

- As vehicle technologies become more complex and connected, the need for cybersecurity, software updates, and skilled workforce is increasing. Automakers and suppliers must not only invest in product innovation but also strengthen their service and support ecosystems to meet evolving consumer expectations and regulatory requirements.

Light Duty Vehicle Scope

The market is segmented by Fuel/Propulsion Type, Transmission, Drivetrain and Application.

- By Fuel/Propulsion Type

The global light duty vehicle market is broadly segmented by propulsion type, as fuel efficiency, emissions regulations, and cost of ownership are key purchase considerations.

Gasoline-powered vehicles continue to dominate many markets, especially in countries where fuel is affordable and infrastructure for EVs or hybrids is still limited. These vehicles offer low initial costs and wide service availability.

Diesel-powered vehicles, though declining in some regions due to emissions concerns, are still preferred for their superior torque and fuel economy, particularly in light commercial vehicles (LCVs) used for logistics and rural commuting.

Hybrid vehicles, combining internal combustion with electric motors, are gaining traction globally as a transitional technology. They offer improved fuel efficiency and lower emissions without requiring full EV infrastructure.

Electric vehicles (EVs) are the fastest-growing segment, driven by strict emission mandates, government incentives, and the growing availability of charging infrastructure. Light duty EVs—such as compact sedans, SUVs, and vans—are popular in both personal and commercial use cases.

- By Transmission

Transmission preference impacts vehicle performance, cost, and user experience. Manual transmissions remain popular in developing countries due to their lower cost, ease of maintenance, and better fuel economy in certain driving conditions. They are commonly seen in entry-level cars and rural areas. Automatic transmissions, including conventional automatics, CVTs (Continuously Variable Transmissions), and DCTs (Dual-Clutch Transmissions), are increasingly preferred in urban settings and high-end models for their driving comfort and advanced control features. The rise of autonomous and electric vehicles is also accelerating the shift toward fully automatic systems..

- By Drivetrain

The drivetrain configuration affects traction, fuel economy, and vehicle performance across different terrains. Front-Wheel Drive (FWD) is widely used in passenger cars and compact vehicles due to its cost-effectiveness, space efficiency, and good fuel economy. Rear-Wheel Drive (RWD) offers superior weight distribution and performance, especially in luxury sedans, sports cars, and certain pickups. It is ideal for heavy loads and performance-oriented driving All-Wheel Drive (AWD)/Four-Wheel Drive (4WD) systems are in high demand in SUVs, crossovers, and off-road LCVs. These configurations enhance traction and safety in rugged terrains, adverse weather, and commercial delivery environments. Growth in the SUV segment globally is contributing to increased adoption of AWD technologies...

- By Application

Light duty vehicles are deployed across various use cases based on utility and purpose. Personal Use dominates in urban and suburban areas where individual vehicle ownership is associated with convenience, comfort, and independence. Compact sedans, hatchbacks, and SUVs are preferred in this category. Commercial Use includes light cargo vans and pickups that support businesses, e-commerce deliveries, and logistics operations. Electrification of commercial fleets is becoming a major trend due to operational cost benefits. Industrial/Fleet Use covers organized vehicle fleets used in construction, mining, oil & gas, public utilities, and service sectors. These fleets require durability, load capacity, and cost efficiency, often relying on diesel or hybrid variants.

- By Vehicle Size

Vehicle size classification helps segment consumer preferences and regulatory targets. Compact light duty vehicles, such as hatchbacks and small sedans, are in high demand in densely populated urban regions due to their affordability, ease of parking, and lower emissions. Midsize vehicles strike a balance between performance, space, and fuel economy. They include sedans and crossover SUVs that appeal to families and business professionals. Full-size vehicles, including large SUVs, pickups, and passenger vans, are favored in North America and the Middle East for their space, towing capacity, and performance in rugged terrains or long-distance travel

Regional Analysis

- North America remains a mature and innovation-driven market for light duty vehicles, led by the United States. Consumer preference continues to favor pickup trucks, SUVs, and crossovers, with major automakers like Ford, GM, and Tesla heavily investing in electrification. Regulatory incentives such as EV tax credits and fuel efficiency standards under the Inflation Reduction Act are accelerating the shift toward electric light duty vehicles (e-LDVs). Canada is also aligning with zero-emission mandates, supporting growth through clean vehicle programs and urban fleet electrification. Advanced driver-assistance systems (ADAS), telematics, and smart infotainment are widely integrated across most vehicle segments.

- Europe is at the forefront of sustainable mobility, driven by stringent CO₂ emission targets and the European Union’s Fit for 55 policy. Countries like Germany, France, and the Netherlands are rapidly expanding EV charging infrastructure and enforcing internal combustion engine (ICE) bans in urban zones. Automakers such as Volkswagen, Stellantis, and Renault are pushing electric compact cars and city-focused utility vehicles to meet demand. Light commercial vehicles are also seeing electrification in last-mile delivery fleets, supported by urban logistics grants and congestion zone regulations. Regional focus on circular economy and battery recycling is further influencing vehicle design and lifecycle strategies.

- Asia-Pacific is the largest and fastest-growing market for light duty vehicles, led by China, India, and Japan. China, as the global EV hub, continues to dominate with high-volume sales of electric sedans, hatchbacks, and small SUVs, supported by government mandates, subsidies, and localized production. India is witnessing a surge in demand for compact and fuel-efficient cars, driven by rising incomes, urbanization, and a growing middle class. Japanese automakers remain focused on hybrid technology and lightweight vehicle designs, especially for domestic and Southeast Asian markets. Emerging ASEAN economies are seeing increased investment in affordable light duty EVs and cross-border vehicle exports.

- South America’s light duty vehicle market is gradually recovering, with Brazil, Argentina, and Colombia being the largest contributors. Demand is centered on compact cars and multipurpose vehicles suitable for varied road and terrain conditions. Government policies promoting biofuels (e.g., ethanol in Brazil) influence drivetrain choices. Although EV adoption is still at a nascent stage, import duties are being relaxed and public transport fleets in major cities are testing light duty electric vans and minibuses. Rising inflation and affordability constraints, however, continue to challenge faster growth in vehicle electrification and adoption of advanced features...

- Saudi Arabia and the UAE dominate the Middle East light duty vehicle market due to strong infrastructure, high-income populations, and national strategies like Vision 2030 and Smart Dubai, promoting smart mobility and EV readiness. Pickup trucks and SUVs remain preferred due to terrain and climate.

- In Africa, South Africa leads with a well-established automotive sector, followed by Egypt and Nigeria, driven by urbanization and demand for affordable, fuel-efficient vehicles. However, limited EV infrastructure and high costs hinder electric vehicle adoption across much of the region.

Light Duty Vehicle Market Share

The global light duty vehicle market is dominated by established automotive giants with extensive global reach and diversified product portfolios. Toyota, Volkswagen, and General Motors continue to lead in volume sales, supported by strong brand loyalty, wide model variety, and extensive dealer networks. These companies are also at the forefront of hybrid and electric vehicle transitions, investing heavily in EV platforms and battery technology:

- Toyota Motor Corporation (Japan)

- Volkswagen AG (Germany)

- General Motors Company (United States)

- Ford Motor Company (United States)

- Hyundai Motor Company (South Korea)

- Honda Motor Co., Ltd. (Japan)

- Stellantis N.V. (Netherlands)

- Renault Group (France)

- Nissan Motor Co., Ltd. (Japan)

- Tesla, Inc. (United States)

- BMW AG (Germany)

- Daimler AG (Mercedes-Benz Group) (Germany)

Latest Developments in Global Light Duty Vehicle Market

- In May 2025, Toyota Motor Corporation unveiled its next-generation hybrid powertrain platform, designed to improve fuel efficiency by up to 15% and reduce production costs, targeting expanded adoption in compact and midsize light duty vehicles across Asia and Europe.

- In April 2025, Volkswagen Group announced the construction of a new EV production facility in Spain dedicated to light duty electric vehicles, with a planned annual capacity of over 300,000 units by 2027 to meet growing demand in the EU region.

- In March 2025, Ford Motor Company launched the all-electric version of its best-selling light commercial van, the Transit Connect, aimed at fleet and last-mile delivery segments in North America and select European markets.

- In February 2025, BYD expanded its light duty EV lineup into Latin America with the launch of two new models designed for urban use, supported by a partnership with regional distributors and local assembly capabilities in Brazil.

- In January 2025, Stellantis N.V. introduced its new global modular platform (STLA Small) for next-gen compact light duty vehicles, compatible with both internal combustion and fully electric drivetrains, to be rolled out across Europe, India, and ASEAN markets.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL LIGHT DUTY VEHICLE MARKET

1.4 CURRENCY AND PRICING

1.5 IMPACT OF COVID-19 PANDEMIC ON THE MARKET

1.5.1 PRICE IMPACT

1.5.2 IMPACT ON DEMAND

1.5.3 IMPACT ON SUPPLY CHAIN

1.5.4 CONCLUSION

1.6 LIMITATION

1.7 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL LIGHT DUTY VEHICLE MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL LIGHT DUTY VEHICLE MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

6 IMPACT OF COVID-19 PANDEMIC ON THE MARKET

6.1 ANALYSIS ON IMPACT OF COVID-19 ON THE MARKET

6.2 AFTER MATH OF COVID-19 AND GOVERNMENT INITIATIVE TO BOOST THE MARKET

6.3 STRATEGIC DECISIONS FOR MANUFACTURERS AFTER COVID-19 TO GAIN COMPETITIVE MARKET SHARE

6.4 PRICE IMPACT

6.5 IMPACT ON DEMAND

6.6 IMPACT ON SUPPLY CHAIN

6.7 CONCLUSION

7 GLOBAL LIGHT DUTY VEHICLE MARKET, BY VEHICLE TYPE

7.1 OVERVIEW

7.2 PASSENGER CAR

7.3 VAN

7.4 SPORTS UTILITY VEHICLE (SUV)

7.5 PICK-UP

8 GLOBAL LIGHT DUTY VEHICLE MARKET, BY FUEL TYPE

8.1 OVERVIEW

8.2 DIESEL

8.3 GASOLINE

8.4 HYBRID

8.5 ELECTRIC

9 GLOBAL LIGHT DUTY VEHICLE MARKET, BY TRANSMISSION

9.1 OVERVIEW

9.2 MANUAL

9.3 AUTOMATIC

10 GLOBAL LIGHT DUTY VEHICLE MARKET, BY ENGINE CAPACITY

10.1 OVERVIEW

10.2 1.8 LT

10.3 2 LT

10.4 2.4 LT

10.5 2.5 LT

10.6 3.5 LT

10.7 3.6 LT

10.8 6.2 LT

10.9 OTHERS

11 GLOBAL LIGHT DUTY VEHICLE MARKET, BY CAPACITY

11.1 OVERVIEW

11.2 LESS THAN 60 CAPACITY

11.3 MORE THAN 60 CAPACITY

12 GLOBAL LIGHT DUTY VEHICLE MARKET, BY TRANSMISSION TYPE

12.1 OVERVIEW

12.2 FRONT WHEEL DRIVE (FWD)

12.3 REAR WHEEL DRIVE (RWD)

12.4 FOUR WHEEL DRIVE (4WD)

12.5 ALL-WELL DRIVE (AWD)

13 GLOBAL LIGHT DUTY VEHICLE MARKET, BY NUMBER OF GEARS

13.1 OVERVIEW

13.2 4 GEARS

13.3 5 GEARS

13.4 6 AND GEARS

14 GLOBAL LIGHT DUTY VEHICLE MARKET, BY SALES CHANNEL

14.1 OVERVIEW

14.2 OEM

14.3 AFTERMARKET

15 GLOBAL LIGHT DUTY VEHICLE MARKET, BY GEOGRAPHY

GLOBAL LIGHT DUTY VEHICLE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

15.1.1 NORTH AMERICA

15.1.1.1. U.S.

15.1.1.2. CANADA

15.1.1.3. MEXICO

15.1.2 EUROPE

15.1.2.1. GERMANY

15.1.2.2. FRANCE

15.1.2.3. U.K.

15.1.2.4. ITALY

15.1.2.5. SPAIN

15.1.2.6. RUSSIA

15.1.2.7. TURKEY

15.1.2.8. BELGIUM

15.1.2.9. NETHERLANDS

15.1.2.10. SWITZERLAND

15.1.2.11. REST OF EUROPE

15.1.3 ASIA PACIFIC

15.1.3.1. JAPAN

15.1.3.2. CHINA

15.1.3.3. SOUTH KOREA

15.1.3.4. INDIA

15.1.3.5. AUSTRALIA

15.1.3.6. SINGAPORE

15.1.3.7. THAILAND

15.1.3.8. MALAYSIA

15.1.3.9. INDONESIA

15.1.3.10. PHILIPPINES

15.1.3.11. REST OF ASIA PACIFIC

15.1.4 SOUTH AMERICA

15.1.4.1. BRAZIL

15.1.4.2. ARGENTINA

15.1.4.3. COLOMBIA

15.1.4.4. PERU

15.1.4.5. CHILE

15.1.4.6. VENEZUALA

15.1.4.7. ECUADOR

15.1.4.8. REST OF SOUTH AMERICA

15.1.5 MIDDLE EAST AND AFRICA

15.1.5.1. SOUTH AFRICA

15.1.5.2. EGYPT

15.1.5.3. SAUDI ARABIA

15.1.5.4. U.A.E

15.1.5.5. ISRAEL

15.1.5.6. REST OF MIDDLE EAST AND AFRICA

15.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

16 GLOBAL LIGHT DUTY VEHICLE MARKET,COMPANY LANDSCAPE

16.1 COMPANY SHARE ANALYSIS: GLOBAL

16.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

16.3 COMPANY SHARE ANALYSIS: EUROPE

16.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

16.5 MERGERS & ACQUISITIONS

16.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

16.7 EXPANSIONS

16.8 REGULATORY CHANGES

16.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

17 GLOBAL LIGHT DUTY VEHICLE MARKET , SWOT & DBMR ANALYSIS

18 GLOBAL LIGHT DUTY VEHICLE MARKET, COMPANY PROFILE

18.1 BMW AG

18.1.1 COMPANY SNAPSHOT

18.1.2 REVENUE ANALYSIS

18.1.3 GEOGRAPHIC PRESENCE

18.1.4 PRODUCT PORTFOLIO

18.1.5 RECENT DEVELOPMENTS

18.2 DAIMLER AG

18.2.1 COMPANY SNAPSHOT

18.2.2 REVENUE ANALYSIS

18.2.3 GEOGRAPHIC PRESENCE

18.2.4 PRODUCT PORTFOLIO

18.2.5 RECENT DEVELOPMENTS

18.3 FIAT CHRYSLER AUTOMOBILES N.V.

18.3.1 COMPANY SNAPSHOT

18.3.2 REVENUE ANALYSIS

18.3.3 GEOGRAPHIC PRESENCE

18.3.4 PRODUCT PORTFOLIO

18.3.5 RECENT DEVELOPMENTS

18.4 FORD MOTOR COMPANY

18.4.1 COMPANY SNAPSHOT

18.4.2 REVENUE ANALYSIS

18.4.3 GEOGRAPHIC PRESENCE

18.4.4 PRODUCT PORTFOLIO

18.4.5 RECENT DEVELOPMENTS

18.5 GENERAL MOTORS COMPANY

18.5.1 COMPANY SNAPSHOT

18.5.2 REVENUE ANALYSIS

18.5.3 GEOGRAPHIC PRESENCE

18.5.4 PRODUCT PORTFOLIO

18.5.5 RECENT DEVELOPMENTS

18.6 HONDA MOTOR COMPANY, LTD.

18.6.1 COMPANY SNAPSHOT

18.6.2 REVENUE ANALYSIS

18.6.3 GEOGRAPHIC PRESENCE

18.6.4 PRODUCT PORTFOLIO

18.6.5 RECENT DEVELOPMENTS

18.7 HYUNDAI MOTOR COMPANY

18.7.1 COMPANY SNAPSHOT

18.7.2 REVENUE ANALYSIS

18.7.3 GEOGRAPHIC PRESENCE

18.7.4 PRODUCT PORTFOLIO

18.7.5 RECENT DEVELOPMENT

18.8 NISSAN MOTOR COMPANY, LTD.

18.8.1 COMPANY SNAPSHOT

18.8.2 REVENUE ANALYSIS

18.8.3 GEOGRAPHIC PRESENCE

18.8.4 PRODUCT PORTFOLIO

18.8.5 RECENT DEVELOPMENTS

18.9 SUBARU CORPORATION

18.9.1 COMPANY SNAPSHOT

18.9.2 REVENUE ANALYSIS

18.9.3 GEOGRAPHIC PRESENCE

18.9.4 PRODUCT PORTFOLIO

18.9.5 RECENT DEVELOPMENTS

18.1 TOYOTA MOTOR CORPORATION

18.10.1 COMPANY SNAPSHOT

18.10.2 REVENUE ANALYSIS

18.10.3 GEOGRAPHIC PRESENCE

18.10.4 PRODUCT PORTFOLIO

18.10.5 RECENT DEVELOPMENTS

18.11 VOLVO

18.11.1 COMPANY SNAPSHOT

18.11.2 REVENUE ANALYSIS

18.11.3 GEOGRAPHIC PRESENCE

18.11.4 PRODUCT PORTFOLIO

18.11.5 RECENT DEVELOPMENTS

18.12 NATIONAL ELECTRIC VEHICLE SWEDEN AB

18.12.1 COMPANY SNAPSHOT

18.12.2 REVENUE ANALYSIS

18.12.3 GEOGRAPHIC PRESENCE

18.12.4 PRODUCT PORTFOLIO

18.12.5 RECENT DEVELOPMENTS

18.13 BYD AUTO CO., LTD.

18.13.1 COMPANY SNAPSHOT

18.13.2 REVENUE ANALYSIS

18.13.3 GEOGRAPHIC PRESENCE

18.13.4 PRODUCT PORTFOLIO

18.13.5 RECENT DEVELOPMENTS

18.14 CHRYSLER GROUP LLC

18.14.1 COMPANY SNAPSHOT

18.14.2 REVENUE ANALYSIS

18.14.3 GEOGRAPHIC PRESENCE

18.14.4 PRODUCT PORTFOLIO

18.14.5 RECENT DEVELOPMENTS

18.15 DAIMLER-BENZ AG

18.15.1 COMPANY SNAPSHOT

18.15.2 REVENUE ANALYSIS

18.15.3 GEOGRAPHIC PRESENCE

18.15.4 PRODUCT PORTFOLIO

18.15.5 RECENT DEVELOPMENTS

18.16 GENERAL MOTORS COMPANY

18.16.1 COMPANY SNAPSHOT

18.16.2 REVENUE ANALYSIS

18.16.3 GEOGRAPHIC PRESENCE

18.16.4 PRODUCT PORTFOLIO

18.16.5 RECENT DEVELOPMENTS

18.17 NISSAN MOTOR CO., LTD.

18.17.1 COMPANY SNAPSHOT

18.17.2 REVENUE ANALYSIS

18.17.3 GEOGRAPHIC PRESENCE

18.17.4 PRODUCT PORTFOLIO

18.17.5 RECENT DEVELOPMENTS

18.18 HYUNDAI MOTOR GROUP

18.18.1 COMPANY SNAPSHOT

18.18.2 REVENUE ANALYSIS

18.18.3 GEOGRAPHIC PRESENCE

18.18.4 PRODUCT PORTFOLIO

18.18.5 RECENT DEVELOPMENTS

18.19 KIA MOTORS CORPORATION

18.19.1 COMPANY SNAPSHOT

18.19.2 REVENUE ANALYSIS

18.19.3 GEOGRAPHIC PRESENCE

18.19.4 PRODUCT PORTFOLIO

18.19.5 RECENT DEVELOPMENTS

18.2 PSA PEUGEOT CITROËN

18.20.1 COMPANY SNAPSHOT

18.20.2 REVENUE ANALYSIS

18.20.3 GEOGRAPHIC PRESENCE

18.20.4 PRODUCT PORTFOLIO

18.20.5 RECENT DEVELOPMENTS

18.21 CHANGAN AUTOMOBILE COMPANY LIMITED

18.21.1 COMPANY SNAPSHOT

18.21.2 REVENUE ANALYSIS

18.21.3 GEOGRAPHIC PRESENCE

18.21.4 PRODUCT PORTFOLIO

18.21.5 RECENT DEVELOPMENTS

18.22 HONDA MOTOR COMPANY, LTD

18.22.1 COMPANY SNAPSHOT

18.22.2 REVENUE ANALYSIS

18.22.3 GEOGRAPHIC PRESENCE

18.22.4 PRODUCT PORTFOLIO

18.22.5 RECENT DEVELOPMENTS

18.23 TATA (JAGAUR LAND ROVER)

18.23.1 COMPANY SNAPSHOT

18.23.2 REVENUE ANALYSIS

18.23.3 GEOGRAPHIC PRESENCE

18.23.4 PRODUCT PORTFOLIO

18.23.5 RECENT DEVELOPMENTS

18.24 MAZDA MOTOR CORPORATION

18.24.1 COMPANY SNAPSHOT

18.24.2 REVENUE ANALYSIS

18.24.3 GEOGRAPHIC PRESENCE

18.24.4 PRODUCT PORTFOLIO

18.24.5 RECENT DEVELOPMENTS

18.25 MITSUBISHI CORPORATION

18.25.1 COMPANY SNAPSHOT

18.25.2 REVENUE ANALYSIS

18.25.3 GEOGRAPHIC PRESENCE

18.25.4 PRODUCT PORTFOLIO

18.25.5 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

19 CONCLUSION

20 RELATED REPORTS

21 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.