Global Runway Lighting System Market

Market Size in USD Billion

CAGR :

%

USD

4.95 Billion

USD

7.48 Billion

2024

2032

USD

4.95 Billion

USD

7.48 Billion

2024

2032

| 2025 –2032 | |

| USD 4.95 Billion | |

| USD 7.48 Billion | |

|

|

|

|

Runway Lighting System Market Size

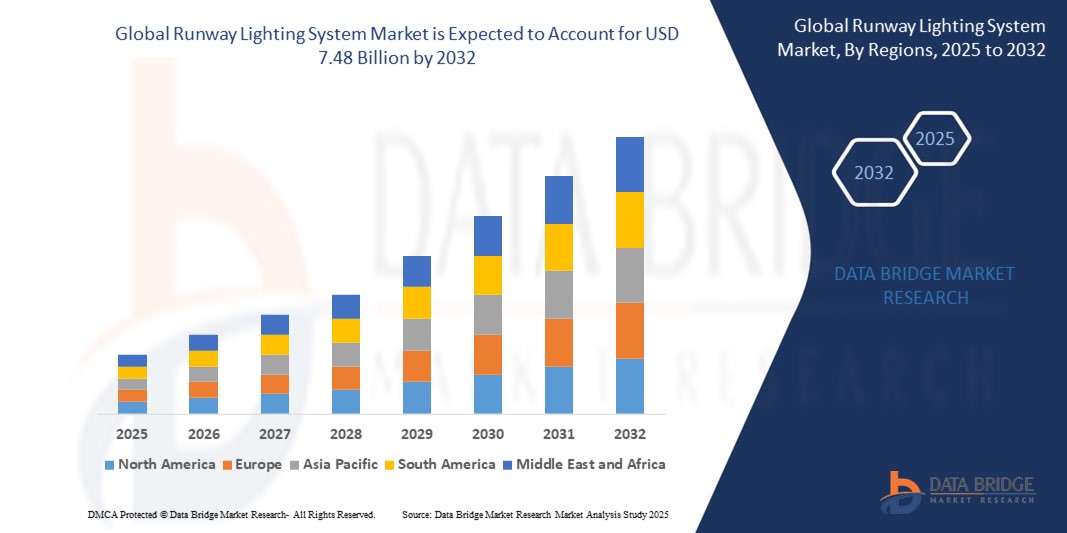

- The global runway lighting system market size was valued at USD 4.95 billion in 2024 and is expected to reach USD 7.48 billion by 2032, at a CAGR of 5.30% during the forecast period

- The market growth is primarily driven by increasing air traffic, modernization of airport infrastructure, and the adoption of energy-efficient lighting technologies, particularly LED-based systems

- Rising safety regulations and the need for enhanced visibility during adverse weather conditions are further propelling the demand for advanced runway lighting systems, positioning them as critical components of airport safety and efficiency

Runway Lighting System Market Analysis

- Runway lighting systems, essential for safe aircraft operations during takeoff, landing, and taxiing, are increasingly integral to modern airport infrastructure due to their role in ensuring visibility and operational safety in low-visibility conditions

- The growing demand for runway lighting systems is fueled by global airport expansion projects, stringent aviation safety standards, and the shift toward sustainable, energy-efficient LED lighting solutions

- Asia-Pacific dominated the runway lighting system market with the largest revenue share of 38.5% in 2023, driven by rapid airport development, increasing air passenger traffic, and government investments in aviation infrastructure, particularly in countries such as China and India

- North America is expected to be the fastest-growing region during the forecast period due to ongoing airport modernization programs, technological advancements in lighting systems, and a strong presence of key industry players in the U.S. and Canada

- The minimum runway lighting segment dominated the largest market revenue share of 62.3% in 2024, driven by its critical role in ensuring safe aircraft operations during low-visibility conditions, such as fog or night operations, across both commercial and military airports

Report Scope and Runway Lighting System Market Segmentation

|

Attributes |

Runway Lighting System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Runway Lighting System Market Trends

“Increasing Adoption of Smart and Energy-Efficient Lighting Solutions”

- The global runway lighting system market is experiencing a significant trend toward the integration of smart and energy-efficient technologies, particularly LED-based systems.

- LED lighting systems offer superior energy efficiency, longer lifespan, and lower maintenance costs compared to traditional non-LED systems, making them highly attractive for airport operator

- Smart lighting systems with real-time monitoring and adaptive control capabilities are being deployed to dynamically adjust light intensity based on weather conditions, air traffic volume, and visibility requirements

- For instances, companies such as ADB SAFEGATE have introduced advanced LED-based runway centerline lighting systems that enhance pilot visibility and operational efficiency

- These technologies align with global sustainability goals, reducing energy consumption and carbon emissions, which is a key focus for airports worldwide

- The integration of IoT and AI in runway lighting systems enables predictive maintenance, identifying potential issues before they cause operational disruptions, thereby improving safety and reliability

Runway Lighting System Market Dynamics

Driver

“Growing Air Traffic and Airport Modernization”

- The rising global demand for air travel, driven by increasing passenger traffic and cargo transport, is a major driver for the runway lighting system market

- Runway lighting systems, including runway edge lights, threshold lights, and end lights, are critical for ensuring safe aircraft operations during takeoff, landing, and taxiing, especially in low-visibility conditions

- Government regulations and aviation safety standards, such as those set by the International Civil Aviation Organization (ICAO) and the Federal Aviation Administration (FAA), mandate the use of advanced lighting systems, boosting market growth

- The proliferation of airport modernization and expansion projects, particularly in the Asia-Pacific region, is fueling demand for sophisticated runway lighting systems to accommodate larger aircraft and higher traffic volumes

- The development of 5G technology and IoT connectivity is enabling faster data transmission and more advanced lighting control systems, enhancing operational efficiency

Restraint/Challenge

“High Installation Costs and Regulatory Compliance”

- The high initial investment required for installing and upgrading runway lighting systems, including hardware, software, and integration, poses a significant barrier, particularly for smaller and regional airports

- Retrofitting existing airport infrastructure with modern LED or smart lighting systems can be complex and costly, deterring adoption in budget-constrained regions

- Compliance with stringent and varying regulatory standards across countries, such as those from ICAO and FAA, adds complexity and cost to implementation, especially for international airport operators

- Data security and privacy concerns related to smart lighting systems, which collect and transmit operational data, raise challenges regarding potential cyber threats and compliance with data protection regulations

- These factors can limit market growth, particularly in emerging markets where financial constraints and regulatory fragmentation are more pronounced

Runway Lighting System market Scope

The market is segmented on the basis of type, technology, intensity, use of light, and end user.

- By Type

On the basis of type, the global runway lighting system market is segmented into minimum runway lighting and supplementary runway lighting. The minimum runway lighting segment dominated the largest market revenue share of 62.3% in 2024, driven by its critical role in ensuring safe aircraft operations during low-visibility conditions, such as fog or night operations, across both commercial and military airports.

The supplementary runway lighting segment is expected to witness the fastest growth rate from 2025 to 2031, fueled by increasing airport modernization projects and the need for enhanced visual guidance systems to support complex runway operations and larger aircraft.

- By Technology

On the basis of technology, the global runway lighting system market is segmented into LED and non-LED. The LED segment is expected to hold the largest market revenue share of 68.7% in 2024, driven by its energy efficiency, longer lifespan, and lower maintenance costs compared to traditional lighting solutions such as halogen or incandescent. The adoption of LED technology aligns with global sustainability goals and regulatory mandates for energy-efficient airport infrastructure.

The non-LED segment is anticipated to experience steady growth from 2025 to 2031, particularly in smaller or older airports where cost constraints delay the transition to LED systems, though their market share is expected to decline gradually.

- By Intensity

On the basis of intensity, the global runway lighting system market is segmented into high, medium, and low. The high-intensity segment is expected to hold the largest market revenue share of 55.4% in 2024, owing to its critical application in guiding pilots during adverse weather conditions and low-visibility scenarios, ensuring safe takeoff and landing operations.

The medium-intensity segment is projected to witness significant growth from 2025 to 2031, driven by its increasing use in smaller airports and regional hubs where cost-effective yet reliable lighting solutions are needed to support growing air traffic.

- By Use of Light

On the basis of use of light, the global runway lighting system market is segmented into runway edge lights, runway threshold lights, runway end lights, and others. The runway edge lights segment dominated the market with a revenue share of 48.6% in 2024, driven by their essential role in defining runway boundaries and ensuring safe navigation for pilots during takeoff, landing, and taxiing.

The runway threshold lights segment is expected to experience the fastest growth rate from 2025 to 2031, fueled by rising investments in airport expansion and the need for precise visual cues to guide pilots during critical landing phases.

- By End User

On the basis of end user, the global runway lighting system market is segmented into military, commercial, and other. The commercial segment held the largest market revenue share of 70.2% in 2024, driven by the high volume of commercial airports worldwide and increasing air passenger traffic, necessitating advanced lighting systems for safe and efficient operations.

The military segment is anticipated to witness rapid growth of 8.9% from 2025 to 2031, fueled by increased military expenditures and the need for robust, high-intensity lighting systems, including infrared-compatible lights for night vision operations at military airbases.

Runway Lighting System Market Regional Analysis

- Asia-Pacific dominated the runway lighting system market with the largest revenue share of 38.5% in 2023, driven by rapid airport development, increasing air passenger traffic, and government investments in aviation infrastructure, particularly in countries such as China and India

- Consumers and airport operators prioritize runway lighting systems for enhancing aviation safety, improving visibility in adverse weather, and ensuring efficient aircraft operations, particularly in regions with high air traffic volumes

- Growth is supported by advancements in lighting technology, such as energy-efficient LED systems and smart lighting controls, alongside rising adoption in both commercial and military airport segments

Japan Runway Lighting System Market Insight

Japan’s runway lighting system market is expected to witness rapid growth due to strong demand for high-quality, technologically advanced lighting systems that enhance aviation safety and operational efficiency. The integration of LED runway edge lights and smart control systems in OEM airport projects and aftermarket upgrades accelerates market penetration. The country’s focus on modernizing aviation infrastructure and supporting high air traffic volumes contributes to growth.

China Runway Lighting System Market Insight

China holds the largest share of the Asia-Pacific runway lighting system market, propelled by rapid urbanization, increasing air traffic, and significant investments in airport infrastructure. The demand for advanced LED-based runway lighting systems, such as runway threshold lights and end lights, is driven by the need for enhanced safety and energy efficiency. Strong domestic manufacturing capabilities and government support for smart airport initiatives enhance market accessibility and growth.

U.S. Runway Lighting System Market Insight

The U.S. runway lighting system market market is expected to witness significant growth, fueled by a robust aviation industry, significant investments in airport modernization, and stringent safety regulations. The demand for advanced LED-based runway lighting systems, including runway edge lights and threshold lights, is driven by the need for energy efficiency and enhanced visibility. The presence of major manufacturers and aftermarket service providers further boosts market expansion.

Europe Runway Lighting System Market Insight

The Europe runway lighting system market is expected to witness significant growth, supported by regulatory emphasis on aviation safety and operational efficiency. Countries such as Germany, France, and the U.K. show strong adoption of advanced lighting systems, such as LED runway edge lights and smart control systems, to improve visibility and reduce energy consumption. The growth is prominent in both new airport installations and retrofit projects, driven by environmental concerns and increasing air traffic.

U.K. Runway Lighting System Market Insight

The U.K. market for runway lighting systems is expected to witness rapid growth, driven by increasing air traffic and a focus on enhancing airport safety and efficiency in urban and regional airports. The adoption of high-intensity LED runway edge lights and threshold lights is growing due to their durability and low maintenance costs. Evolving aviation regulations balancing safety and visibility requirements further encourage the uptake of advanced lighting solutions.

Germany Runway Lighting System Market Insight

Germany is expected to witness rapid growth in the runway lighting system market, attributed to its advanced aviation infrastructure and high focus on safety and energy efficiency. German airports prioritize technologically advanced LED systems, such as runway end lights and precision approach path indicators (PAPI), to enhance pilot visibility and reduce operational costs. The integration of these systems in both commercial and military airports supports sustained market growth.

Runway Lighting System Market Share

The runway lighting system industry is primarily led by well-established companies, including:

- ABB (Switzerland)

- Signify Holding (Netherlands)

- Honeywell International Inc. (U.S.)

- Cree, Inc. (U.S.)

- ADB SAFEGATE (Belgium)

- Carmanah Technologies Corp. (Canada)

- Abacus Lighting (U.K.)

- OCEM Airfield Technology (Italy)

- atg airports limited (U.K.)

- vosla GmbH (Germany)

- Youyang Airport Lighting Equipment Inc. (China)

- Airsafe Airport Equipment Co.,Ltd. (China)

- Eaton (Ireland)

- HELLA GmbH & Co. KGaA (Germany)

- OSRAM GmbH (Germany)

- Astronics Corporation (U.S.)

- Avlite (Australia)

- Avionics Limited (U.K.)

- Siemens (Germany)

What are the Recent Developments in Global Runway Lighting System Market?

- In October 2024, Honeywell Automation India Limited was awarded a contract to supply its advanced Airfield Ground Lighting (AGL) system for Noida International Airport (NIA). The project includes the design, installation, commissioning, and maintenance of the AGL system on runway 10L-28R and associated taxiways. Honeywell’s intelligent lighting technology enhances visual guidance for aircraft, improving safety and streamlining operations—especially in low-visibility conditions. The system automatically adjusts lighting based on aircraft surveillance data, boosting pilot situational awareness. This initiative supports India’s aviation modernization and aligns with NIA’s goal of delivering a seamless and secure passenger experience

- In October 2023, Avlite Systems introduced a new range of energy-efficient LED runway lights, reinforcing the aviation industry's transition toward sustainable and cost-effective lighting technologies. These advanced systems are designed to improve visibility, reduce energy consumption, and lower maintenance costs—key priorities for modern airports. Avlite’s LED solutions also support compliance with international safety standards and are well-suited for both permanent and expeditionary airfield installations

- In July 2023, Honeywell International Inc. announced a significant expansion of its presence in India’s aviation sector by launching a 41,000-square-foot Airfield Ground Lighting (AGL) manufacturing facility in Gurugram. This initiative aligns with the ‘Make in India’ program and aims to support multiple new airport projects across the country. The advanced LED-based AGL systems are designed to enhance runway safety, improve energy efficiency, and reduce maintenance costs. These systems are FAA-certified and ICAO-compliant, showcasing Honeywell’s commitment to sustainable and high-performance airport infrastructure in one of the world’s fastest-growing aviation markets

- In March 2023, the Federal Aviation Administration (FAA) announced a major investment to upgrade runway and taxiway lighting systems at 82 airports across the United States. This initiative, part of President Biden’s Bipartisan Infrastructure Law, reflects a growing shift toward energy-efficient LED technology in airfield lighting. These upgrades aim to enhance visibility, reduce maintenance costs, and improve safety during low-visibility and nighttime operations

- In January 2023, ADB SAFEGATE introduced its LED Smart Runway Centerline Lighting (SRCL) system, a cutting-edge solution aimed at improving runway safety and operational efficiency. The SRCL system offers pilots a sharper and more reliable visual reference for the runway centerline, especially during low-visibility conditions. By leveraging advanced LED technology, it enhances visibility, reduces maintenance needs, and supports sustainable airport operations

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.