Global Automotive Lighting Market

Market Size in USD Billion

CAGR :

%

USD

31.32 Billion

USD

48.14 Billion

2024

2032

USD

31.32 Billion

USD

48.14 Billion

2024

2032

| 2025 –2032 | |

| USD 31.32 Billion | |

| USD 48.14 Billion | |

|

|

|

|

Automotive Lighting Market Analysis

The automotive lighting market is experiencing significant growth, driven by advancements in LED, OLED, and adaptive lighting technologies that enhance vehicle safety, aesthetics, and energy efficiency. The increasing adoption of LED lighting, due to its long lifespan, lower power consumption, and superior illumination, is transforming both exterior and interior vehicle lighting. Automakers are integrating adaptive lighting systems that adjust based on driving conditions, improving visibility and reducing accidents. The rise of electric vehicles (EVs) is also influencing the market, with manufacturers focusing on lightweight, energy-efficient lighting solutions to extend battery life. OLED technology is gaining traction for its ability to provide uniform illumination and design flexibility, allowing for sleeker, more sophisticated vehicle aesthetics. Companies such as Valeo, Koito, and HELLA are investing in smart lighting solutions, such as matrix LED and laser headlights, to enhance night driving safety. Moreover, regulatory mandates for daytime running lights (DRLs) and advanced headlamp technologies are accelerating market expansion. With increasing vehicle production, growing consumer demand for premium features, and technological innovations, the automotive lighting market is poised for sustained growth, offering opportunities for OEMs and aftermarket players to introduce cutting-edge lighting solutions that enhance safety and driving experience.

Automotive Lighting Market Size

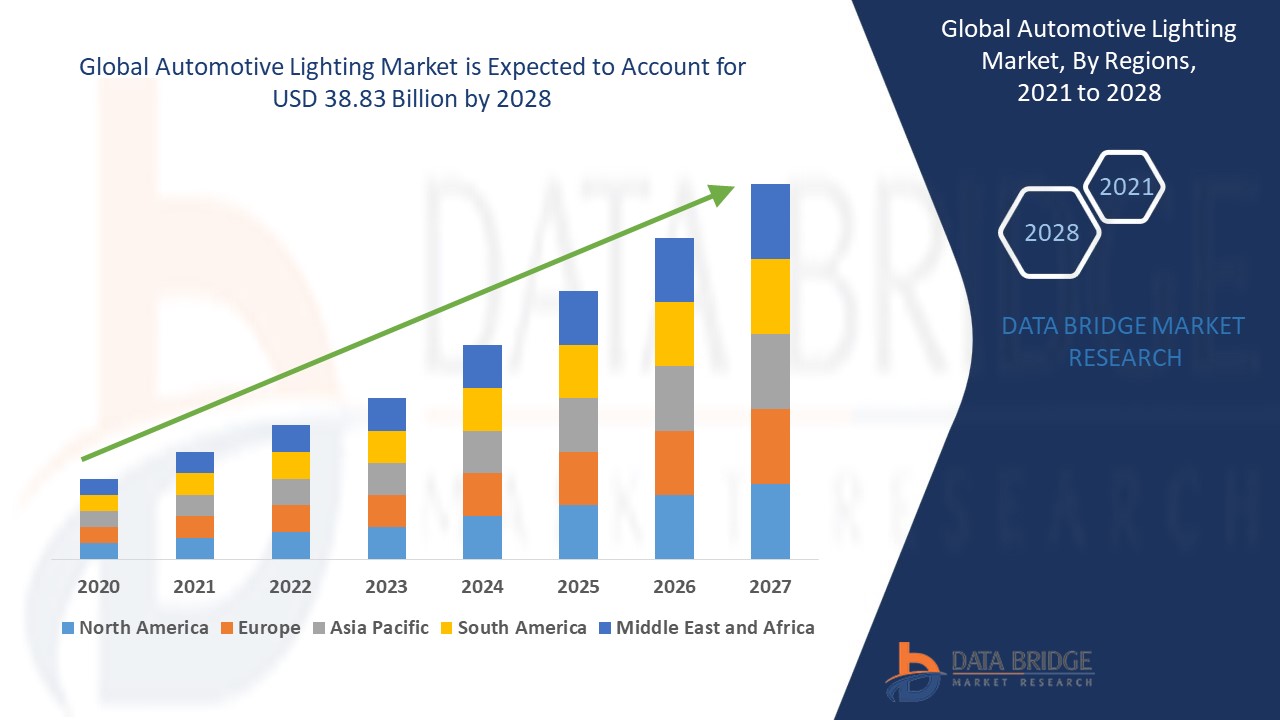

The global automotive lighting market size was valued at USD 31.32 billion in 2024 and is projected to reach USD 48.14 billion by 2032, with a CAGR of 5.52% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Automotive Lighting Market Trends

“Increasing Shift toward Adaptive Lighting Systems”

The automotive lighting market is witnessing a significant shift toward adaptive lighting systems, which enhance safety and driving comfort by adjusting illumination based on real-time road and traffic conditions. Adaptive LED and laser headlights are becoming increasingly popular, offering intelligent beam control that optimizes visibility without blinding oncoming drivers. For instance, Audi’s Matrix LED headlights automatically adjust the light distribution based on obstacles, curves, and surrounding vehicles, improving night-time driving safety. BMW’s Laserlight technology extends the headlight range, ensuring better illumination at high speeds while reducing energy consumption. In addition, smart ambient lighting in vehicle interiors, such as Mercedes-Benz’s customizable RGB LED systems, enhances the driving experience by adapting to mood and driving modes. As automakers continue to integrate AI-powered lighting control and sensor-based illumination, the demand for efficient, energy-saving, and aesthetically advanced lighting solutions is set to accelerate, reinforcing the market’s trajectory towards innovation and premium vehicle enhancements.

Report Scope and Automotive Lighting Market Segmentation

|

Attributes |

Automotive Lighting Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Wolfspeed, Inc. (U.S.), Tungsram Operations Kft. (Hungary), HELLA GmbH & Co. KGaA (Germany), Koninklijke Philips N.V. (Netherlands), HYUNDAI MOBIS (South Korea), Valeo (France), KOITO MANUFACTURING CO., LTD. (Japan), Marelli Holdings Co., Ltd. (Japan), OSRAM GmbH (Germany), STANLEY ELECTRIC CO., LTD. (Japan), ZKW (Austria), Continental AG (Germany), Antolin (Spain), Tenneco Inc. (U.S.), Lear (U.S.), GENTEX CORPORATION (U.S.), FLEX-N-GATE CORPORATION (U.S.), DENSO CORPORATION (Japan), Varroc Group (India), Lumax Industries (India), LG Electronics (South Korea), and SAMSUNG (South Korea) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Automotive Lighting Market Definition

Automotive lighting refers to the lighting system integrated into vehicles to enhance visibility, safety, and aesthetics. It includes exterior lighting such as headlights, taillights, fog lights, daytime running lights (DRLs), and turn signals, as well as interior lighting for dashboards, ambient illumination, and reading lights.

Automotive Lighting Market Dynamics

Drivers

- Rising Vehicle Production and Sales

The global rise in vehicle production and sales is a key driver for the automotive lighting market, as automakers focus on integrating advanced and efficient lighting systems to enhance vehicle safety, aesthetics, and energy efficiency. The Asia-Pacific region, particularly China and India, is witnessing a surge in automotive manufacturing due to urbanization, rising disposable incomes, and favorable government policies supporting the industry. According to the International Organization of Motor Vehicle Manufacturers (OICA), China remains the largest automobile producer, significantly boosting demand for LED headlights, daytime running lights (DRLs), and adaptive lighting technologies. Similarly, India’s expanding passenger and commercial vehicle market has pushed OEMs (Original Equipment Manufacturers) to incorporate modern lighting solutions that enhance visibility, fuel efficiency, and driver experience. The increasing focus on vehicle electrification and smart mobility solutions further accelerates the adoption of cutting-edge automotive lighting technologies.

- Growing Demand for Energy-Efficient and Adaptive Lighting

With stringent energy efficiency regulations and evolving consumer preferences, there is a growing demand for LED, OLED, and laser-based automotive lighting systems. These technologies offer lower energy consumption, longer lifespan, and enhanced brightness, making them a preferred choice for modern vehicles. Leading automakers such as Tesla, BMW, and Audi are integrating adaptive LED headlights that adjust beam intensity and angle based on road conditions, weather, and oncoming traffic. For instance, BMW’s Laserlight technology extends illumination range while reducing power consumption, contributing to improved vehicle efficiency and sustainability. In addition, Audi’s digital matrix LED headlights use smart sensors and AI algorithms to optimize lighting patterns, ensuring enhanced visibility and reduced glare for other road users. The increasing focus on vehicle safety and autonomous driving technologies is further driving the demand for intelligent and adaptive lighting solutions, positioning energy-efficient lighting as a critical market driver in the automotive industry.

Opportunities

- Increasing Technological Advancements in Smart and Connected Lighting

The rapid integration of IoT, AI-driven adaptive lighting, and vehicle-to-vehicle (V2V) communication is revolutionizing the automotive lighting industry, creating new growth opportunities for manufacturers. Automakers are increasingly focusing on smart lighting solutions that enhance driver visibility, road safety, and vehicle aesthetics. For instance, Mercedes-Benz and Audi have developed digital matrix LED headlights that can project symbols and navigation guides onto the road surface, helping drivers navigate challenging environments with greater ease. This technology improves night-time visibility and acts as a communication tool by alerting pedestrians and other road users about potential hazards. In addition, connected lighting systems integrated with autonomous driving and ADAS (Advanced Driver Assistance Systems) are becoming a critical component in modern vehicles. As the demand for smart, interactive, and energy-efficient lighting continues to grow, automakers and component suppliers are actively investing in next-generation lighting technologies, positioning this advancement as a major market opportunity.

- Increasing Stringent Safety Regulations and Government Mandates

Governments worldwide are enforcing strict vehicle safety regulations, making advanced automotive lighting systems a necessity rather than an option. Regulatory bodies such as the European Union (EU) and the U.S. National Highway Traffic Safety Administration (NHTSA) have implemented mandatory safety requirements for daytime running lights (DRLs), automatic high-beam control, and adaptive lighting systems to reduce road accidents and enhance pedestrian safety. For instance, in 2022, the EU introduced new vehicle safety standards, requiring adaptive lighting technology to be installed in new car models to optimize headlamp intensity based on road conditions and surrounding traffic. Similarly, the NHTSA has approved adaptive driving beam (ADB) headlights, which adjust beam patterns automatically to prevent glare while improving long-range visibility. These regulatory shifts are creating immense opportunities for lighting manufacturers and automotive OEMs, as they must continually innovate and develop cutting-edge lighting technologies to meet global safety and efficiency standards.

Restraints/Challenges

- Growing Competition from Aftermarket Products

The increasing availability of low-cost aftermarket automotive lighting solutions, such as LED and HID conversion kits, presents a major challenge for original equipment manufacturers (OEMs). Many consumers opt for these affordable alternatives due to their lower price compared to OEM-manufactured lighting systems. However, a significant concern is that many of these aftermarket products do not comply with government safety and regulatory standards, which can lead to issues such as excessive glare, improper beam patterns, and reduced visibility, increasing accident risks. For instance, in the U.S., the National Highway Traffic Safety Administration (NHTSA) has raised concerns about the widespread use of non-compliant HID conversion kits, which can blind oncoming drivers if not installed properly. This growing competition forces OEMs to balance affordability and innovation, ensuring their products meet safety regulations while maintaining a competitive edge in the market.

- High Manufacturing Costs

The production of advanced automotive lighting systems, particularly LED, laser, and adaptive lighting technologies, involves substantial research and development (R&D) costs and expensive raw materials. Manufacturers need to invest in precision engineering and advanced electronics to improve factors such as brightness, energy efficiency, and durability while meeting stringent safety regulations. For instance, matrix LED headlights, which are used in premium vehicles such as Audi and BMW, provide superior illumination and adaptive lighting features, but their complex design and high-end components significantly increase production costs. This creates a challenge for budget and mid-range vehicle manufacturers, who struggle to integrate high-end lighting technology while maintaining affordability for consumers. In addition, the demand for sustainable and energy-efficient lighting solutions further adds to manufacturing expenses, making cost management a crucial issue for automotive lighting companies.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Automotive Lighting Market Scope

The market is segmented on the basis of technology, application, adaptive lighting, vehicle type, EV technology, EV application, and product scale. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Technology

- Halogen

- LED

- Xenon

Application

- Exterior Lighting

- Interior Lighting

- PC Lighting

- LCV Lighting

Adaptive Lighting

- Front Adaptive Lighting

- Rear Adaptive Lighting

- Ambient Lighting

Vehicle Type

- PC (Passenger Car)

- LCV (Light Commercial Vehicle)

- HCV (Heavy Commercial Vehicle)

- EV (Electric Vehicle)

- Two-Wheelers

EV Technology

- Halogen

- LED

- Xenon

EV Application

- Exterior Lighting

- Interior Lighting

Product Scale

- OEMs (Original Equipment Manufacturers)

- Aftermarket

Automotive Lighting Market Regional Analysis

The market is analysed and market size insights and trends are provided by technology, application, adaptive lighting, vehicle type, EV technology, EV application, product scale as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Asia-Pacific is dominating the automotive lighting market and is projected to maintain its dominance throughout the forecast period. This growth is driven by the increasing production and sales of vehicles across countries such as China, India, and Japan. In addition, the rising adoption of advanced lighting technologies, including LED and adaptive lighting, is enhancing vehicle safety and aesthetics. The region’s strong presence of major automotive manufacturers and continuous innovations in vehicle lighting systems further contribute to market expansion.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Automotive Lighting Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Automotive Lighting Market Leaders Operating in the Market Are:

- Wolfspeed, Inc. (U.S.)

- Tungsram Operations Kft. (Hungary)

- HELLA GmbH & Co. KGaA (Germany)

- Koninklijke Philips N.V. (Netherlands)

- HYUNDAI MOBIS (South Korea)

- Valeo (France)

- KOITO MANUFACTURING CO., LTD. (Japan)

- Marelli Holdings Co., Ltd. (Japan)

- OSRAM GmbH (Germany)

- STANLEY ELECTRIC CO., LTD. (Japan)

- ZKW (Austria)

- Continental AG (Germany)

- Antolin (Spain)

- Tenneco Inc. (U.S.)

- Lear (U.S.)

- GENTEX CORPORATION (U.S.)

- FLEX-N-GATE CORPORATION (U.S.)

- DENSO CORPORATION (Japan)

- Varroc Group (India)

- Lumax Industries (India)

- LG Electronics (South Korea)

- SAMSUNG (South Korea)

Latest Developments in Automotive Lighting Market

- In June 2024, Melexis launched the MLX81123 IC to expand its LIN RGB family, offering a more compact SOIC8 and DFN-8 3mm x 3mm package, enabling ambient lighting in additional areas within vehicles by overcoming previous space constraints

- In January 2024, OLEDWorks introduced a new brand, Atala, within the automotive lighting industry, aiming to provide a customized approach to OLED lighting design while delivering cutting-edge solutions that meet the stringent requirements of the automotive sector

- In June 2023, Motherson, in collaboration with Marelli, inaugurated the Motherson Automotive Lighting Tool Room, marking a historic milestone as the first facility in India dedicated exclusively to automotive lighting innovation

- In April 2023, Continental AG launched its NightViu automotive lighting product line for construction and off-road vehicles, introducing 16 new products specifically designed for mining, construction, and off-road equipment applications

- In July 2022, Hella KGaA Hueck & Co., a leading German supplier of automotive lighting and electronics components, established a new vehicle lighting plant in China, focusing on the development of innovative front vehicle lighting technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.