Global Digital Experience Platform Market

Market Size in USD Billion

CAGR :

%

USD

14.20 Billion

USD

35.16 Billion

2024

2032

USD

14.20 Billion

USD

35.16 Billion

2024

2032

| 2025 –2032 | |

| USD 14.20 Billion | |

| USD 35.16 Billion | |

|

|

|

|

Digital Experience Platform Market Size

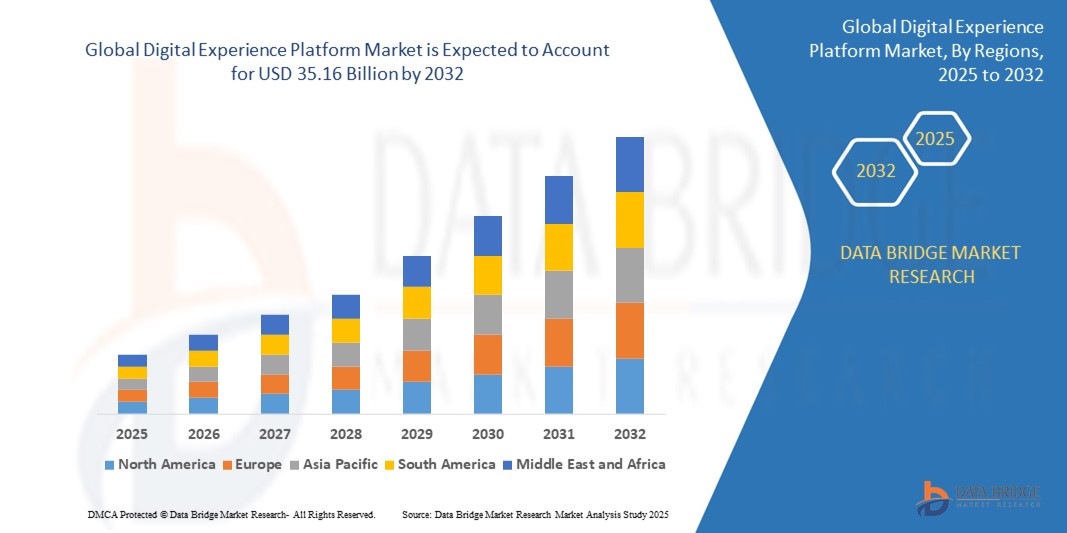

- The global digital experience platform market size was valued at USD 14.20 billion in 2024 and is expected to reach USD 35.16 billion by 2032, at a CAGR of 12.00% during the forecast period

- The market growth is largely fuelled by the increasing adoption of digital transformation strategies across enterprises, growing demand for personalized customer experiences, and the proliferation of omnichannel engagement platforms

- Rising integration of AI, machine learning, and real-time analytics into digital experience platforms is enhancing customer engagement and operational efficiency, further driving market expansion

Digital Experience Platform Market Analysis

- The market is witnessing strong momentum due to the rising need for businesses to deliver consistent and integrated digital experiences across multiple touchpoints such as web, mobile, social, and kiosks

- Organizations are increasingly deploying digital experience platforms (DXPs) to enhance customer engagement, streamline content management, and gain actionable insights through advanced analytics and AI capabilities

- North America dominated the digital experience platform (DXP) market with the largest revenue share of 39.8% in 2024, driven by the region’s strong adoption of cloud services, advanced IT infrastructure, and increased focus on customer-centric digital transformation

- Asia-Pacific region is expected to witness the highest growth rate in the global digital experience platform market, driven by rapid digital transformation across industries, growing mobile and internet penetration, and increased investments in customer experience technologies in countries such as China, India, and Japan

- The platform segment dominated the market with the largest market revenue share of 68.5% in 2024, driven by its role in unifying customer data, content management, and personalization features into a centralized system. Enterprises increasingly rely on these platforms to deliver consistent and personalized digital experiences across web, mobile, and social channels. The growing demand for integrated solutions that enhance engagement, improve operational efficiency, and support multi-touchpoint interactions continues to fuel this segment’s dominance

Report Scope and Digital Experience Platform Market Segmentation

|

Attributes |

Digital Experience Platform Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Digital Experience Platform Market Trends

“AI-Powered Personalization Becoming Core to DXP Deployment”

- AI and machine learning are increasingly embedded into DXPs to deliver real-time, hyper-personalized experiences across multiple digital touchpoints

- Businesses use AI to tailor content and product recommendations, driving higher engagement and conversions

- Platforms such as Adobe Experience Cloud and Sitecore offer built-in AI tools that analyze customer behavior to deliver dynamic content

- Personalization through AI helps reduce bounce rates and increase average session duration and user satisfaction

- Brands benefit from predictive analytics to better understand customer needs and provide contextual experiences

- For instance, Companies such as Amazon utilize AI-driven personalization extensively, adjusting homepage content and product suggestions in real-time based on user activity and preferences.

Digital Experience Platform Market Dynamics

Driver

“Rising Demand for Omnichannel Customer Engagement”

- Customers expect consistent experiences across web, mobile, email, and social platforms, pushing demand for centralized DXPs

- DXPs unify content and customer data across platforms, enabling seamless brand communication

- Sectors such as retail and healthcare are investing heavily in DXPs to maintain cohesive engagement strategies

- Omnichannel capabilities help businesses enhance brand loyalty and retain customers over the long term

- Real-time customer insights support better decision-making and marketing personalization

- For instance, Nike leverages a digital experience platform to unify its mobile app, website, and physical stores, delivering a consistent user journey and reinforcing its brand identity.

Restraint/Challenge

“High Implementation Costs and Complexity”

- Deploying a digital experience platform requires substantial financial investment, which can deter smaller organizations

- Integration with legacy systems often leads to long deployment timelines and high consulting expenses

- Customization needs may demand advanced IT skills and dedicated in-house teams or external vendors

- Costly upgrades and ongoing maintenance can burden businesses with recurring operational expenses

- Complex platform architecture can slow down internal adoption and limit scalability for certain enterprises

- For instance, many small and mid-sized businesses struggle with adopting Salesforce Experience Cloud due to high setup and integration costs, often opting for lighter alternatives with reduced capabilities.

Digital Experience Platform Market Scope

The digital experience platform market is segmented into five notable segments based on component, deployment model, organization size, application, and vertical.

- Component

On the basis of component, the digital experience platform market is segmented into platform and services. The platform segment dominated the market with the largest market revenue share of 68.5% in 2024, driven by its role in unifying customer data, content management, and personalization features into a centralized system. Enterprises increasingly rely on these platforms to deliver consistent and personalized digital experiences across web, mobile, and social channels. The growing demand for integrated solutions that enhance engagement, improve operational efficiency, and support multi-touchpoint interactions continues to fuel this segment’s dominance.

The services segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by rising adoption among enterprises requiring consulting, deployment, and managed services. Companies are increasingly seeking expert support to customize digital experience strategies and ensure seamless implementation of platforms within existing IT ecosystems.

- Deployment Model

On the basis of deployment model, the digital experience platform market is segmented into cloud and on-premises. The cloud segment held the largest market revenue share in 2024, driven by its scalability, faster time to market, and cost-efficiency. Cloud-based digital experience platforms enable businesses to manage content, user data, and analytics in real-time while ensuring accessibility across geographies and devices. The ability to seamlessly integrate with AI-driven tools and CRM systems further enhances the appeal of cloud solutions.

The on-premises segment is expected to witness the fastest growth rate from 2025 to 2032, supported by organizations with regulatory or compliance requirements that necessitate local data storage and system control, such as financial institutions and government bodies.

- Organization Size

On the basis of organization size, the digital experience platform market is segmented into small and medium enterprise and large enterprise. The large enterprise segment dominated the market in 2024 due to higher IT budgets and the pressing need to deliver advanced digital experiences at scale. These organizations typically implement comprehensive DXPs to drive personalized marketing campaigns, optimize digital sales funnels, and improve customer retention.

The small and medium enterprise segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the growing availability of cost-effective, cloud-based platforms tailored to the needs of agile, growth-oriented businesses. The increasing awareness of the importance of customer experience in competitive differentiation is further boosting SME adoption.

- Application

On the basis of application, the digital experience platform market is segmented into business to customer and business to business. The business to customer segment captured the largest revenue share in 2024, as B2C brands prioritize delivering seamless and personalized customer journeys across digital channels. From retail to travel, organizations are increasingly leveraging DXPs to manage dynamic content, track customer behavior, and launch targeted campaigns.

The business-to-business segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising importance of digital engagement in B2B commerce and services. Enhanced account-based marketing, tailored user portals, and integration with sales and service platforms are critical to this segment’s growth.

- Vertical

On the basis of vertical, the digital experience platform market is segmented into retail, BFSI, travel and hospitality, IT and telecom, healthcare, manufacturing, media and entertainment, and education. The retail segment accounted for the largest share of the market in 2024, driven by the industry's rapid digital transformation and the need for personalized, omnichannel customer experiences. Retailers are leveraging DXPs to unify e-commerce, mobile apps, in-store data, and loyalty programs.

The healthcare segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the demand for digital patient engagement, telemedicine platforms, and secure content delivery. Healthcare providers increasingly rely on DXPs to improve patient experience and streamline administrative workflows.

Digital Experience Platform Market Regional Analysis

• North America dominated the digital experience platform (DXP) market with the largest revenue share of 39.8% in 2024, driven by the region’s strong adoption of cloud services, advanced IT infrastructure, and increased focus on customer-centric digital transformation

• Enterprises across industries in the region are heavily investing in DXPs to streamline omnichannel customer engagement and personalize user journeys through AI-driven insights

• The region’s leadership is further supported by the presence of key DXP vendors and a tech-savvy consumer base, fueling the demand for integrated and scalable digital experience solutions across both B2B and B2C landscapes

U.S. Digital Experience Platform Market Insight

The U.S. digital experience platform market held the largest revenue share of 82% within North America in 2024, attributed to rapid enterprise digitization and the proliferation of touchpoints across industries. Businesses are leveraging DXPs to deliver consistent and personalized user experiences across web, mobile, and IoT platforms. The increasing adoption of automation, real-time data analytics, and omnichannel content management is accelerating market growth. The growing demand for cloud-based and API-first platforms, particularly in sectors such as retail, healthcare, and BFSI, continues to shape the DXP landscape in the U.S.

Europe Digital Experience Platform Market Insight

The Europe digital experience platform market is expected to witness the fastest growth rate from 2025 to 2032, propelled by stringent data privacy regulations such as GDPR and the need for secure, compliant, and personalized customer experiences. The rise in digital commerce and enterprise investments in omnichannel platforms are contributing to market expansion. Countries such as Germany, France, and the U.K. are increasingly adopting DXPs to modernize citizen services and enhance engagement across industries. The integration of AI and machine learning to improve customer journeys is also boosting adoption in the region.

U.K. Digital Experience Platform Market Insight

The U.K. digital experience platform market is expected to witness the fastest growth rate from 2025 to 2032, driven by the increasing digitization of services, especially in retail, education, and government sectors. Enterprises are focusing on delivering cohesive and customized experiences across online and offline channels. The U.K.'s well-established digital infrastructure and consumer expectations for seamless digital interactions are fueling DXP investments. Moreover, the country’s strong e-commerce market is further amplifying the demand for platforms that can orchestrate dynamic content and optimize digital customer journeys.

Germany Digital Experience Platform Market Insight

The Germany digital experience platform market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s commitment to digital transformation across manufacturing, automotive, and public sectors. Organizations are adopting DXPs to align with Industry 4.0 initiatives, enhance B2B engagements, and create connected customer experiences. Germany’s emphasis on data sovereignty, system integration, and scalable digital architecture is driving the implementation of modular and composable DXP frameworks that support agility and compliance.

Asia-Pacific Digital Experience Platform Market Insight

The Asia-Pacific digital experience platform market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid digitization, growing internet penetration, and a booming e-commerce sector. Countries such as China, India, and Japan are witnessing strong demand for DXPs as enterprises seek to improve customer engagement, unify data, and accelerate digital transformation. The rise of mobile-first consumer behavior, coupled with increased adoption of AI-powered personalization engines, is further boosting the regional market.

Japan Digital Experience Platform Market Insight

The Japan digital experience platform market is expected to witness the fastest growth rate from 2025 to 2032, as businesses prioritize digital innovation and customer-centric strategies. The country’s advanced technology ecosystem and focus on automation and customer satisfaction are encouraging the adoption of DXPs. Japan's retail and finance sectors are leading the way in deploying platforms that unify user data and enhance omnichannel engagement. In addition, the growing focus on seamless UX across mobile, web, and in-store channels is propelling demand for robust and flexible DXP solutions.

China Digital Experience Platform Market Insight

The China digital experience platform market accounted for the largest revenue share in Asia-Pacific in 2024, owing to the rapid digital transformation of consumer services, particularly in e-commerce and financial sectors. The integration of DXPs with AI, big data, and localized content delivery is enabling Chinese enterprises to offer hyper-personalized experiences. Government support for digital infrastructure, the widespread adoption of mobile technologies, and the presence of major tech players are accelerating the growth of DXPs across China’s business ecosystem.

Digital Experience Platform Market Share

The Digital Experience Platform industry is primarily led by well-established companies, including:

- Adobe (U.S.)

- Oracle (U.S.)

- SAP SE (Germany)

- IBM (U.S.)

- Microsoft (U.S.)

- Salesforce Inc., (U.S.)

- Open Text Corporation. (Canada)

- SWEETYET DEVELOPMENT LIMITED (U.K.)

- Sitecore (U.S.)

- Acquia Inc., (U.S.)

- Jahia Solutions Group SA (Switzerland)

- Optimizely, Inc (U.S.)

- Squiz (Australia)

- Bloomreach, Inc. (U.S.)

- Firelay Liferay Services (U.S.)

- Kentico Software (Czech Republic)

- censhare GmbH(Germany)

Latest Developments in Global Digital Experience Platform Market

- In June 2024, Adobe unveiled the Adobe Experience Platform (AEP) AI Assistant, a cutting-edge tool for improving workflow efficiency. Leveraging generative AI, it empowers experienced professionals to streamline content creation and insights generation. This AI-powered assistant also extends the accessibility of enterprise applications, making them more usable for a wider audience, thus enhancing the overall digital experience and business productivity

- In May 2024, Acquia expanded its global digital experience platform by launching Acquia Digital Experience Optimization (DXO). This new offering enhances the efficiency of marketing, sales, and revenue generation for companies, helping them optimize their digital strategies. DXO is designed to refine customer interactions and business outcomes by integrating intelligent marketing tools and analytics, making it easier for companies to maximize their digital reach and profitability

- In April 2024, Progress announced key upgrades to its infrastructure software, unveiling the latest version of Progress Sitefinity (15.1). The release integrates AI-powered features, including conversion propensity scoring and content classification, enabling users to improve customer data modeling and streamline content management. These features are designed to boost return on investment (ROI) and enhance productivity, providing organizations with deeper insights into customer behaviors

- In February 2021, Sitecore partnered with Microsoft to enhance its digital experience platform in the UAE. This collaboration focuses on delivering scalable and reliable personalized digital experiences, combining Microsoft’s cloud capabilities with Sitecore’s experience management. The partnership enables businesses in the region to create tailored, data-driven experiences, improving customer engagement and streamlining the management of digital content across multiple channels

- In October 2020, SAP SE introduced a customer data platform at the SAP customer experience live conference. This platform enables businesses to create 360-degree consumer profiles by integrating data from various sources, including internal databases, web, and social media channels. The solution focuses on anonymizing consumer data to protect privacy while empowering companies to leverage insights from diverse datasets for enhanced personalization and customer experience

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.