Global Digital Business Support System Market

Market Size in USD Billion

CAGR :

%

USD

6.77 Billion

USD

23.14 Billion

2024

2032

USD

6.77 Billion

USD

23.14 Billion

2024

2032

| 2025 –2032 | |

| USD 6.77 Billion | |

| USD 23.14 Billion | |

|

|

|

|

Digital Business Support System Market Size

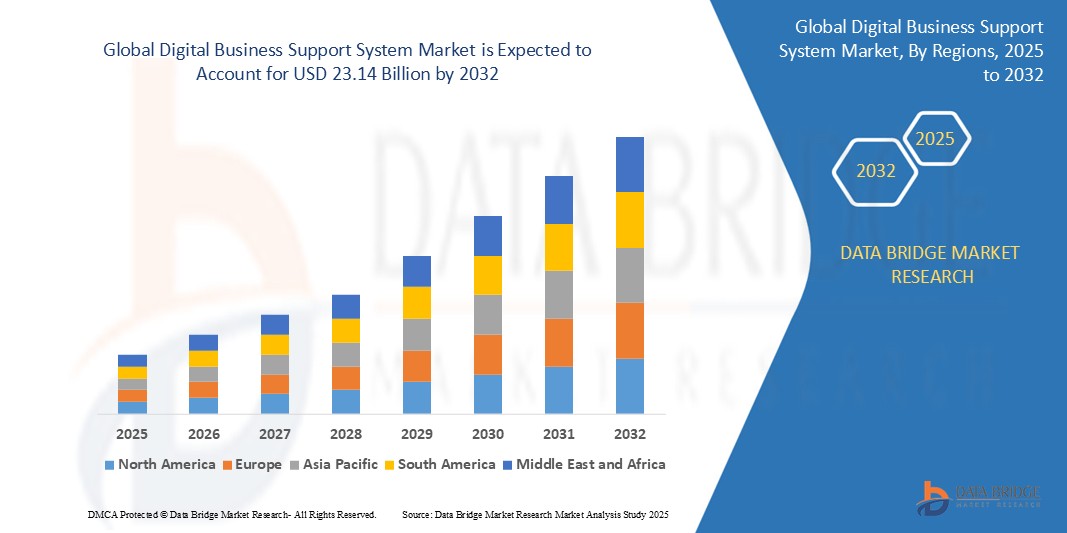

- The global digital business support system market size was valued at USD 6.77 billion in 2024 and is expected to reach USD 23.14 billion by 2032, at a CAGR of 16.60% during the forecast period

- The market growth is largely fuelled by the increasing adoption of cloud-based solutions, digital transformation across telecom sectors, and the rising need for real-time customer engagement and operational efficiency

- Advancements in technologies such as artificial intelligence, machine learning, and 5G are further enhancing the capabilities of digital BSS platforms, enabling service providers to deliver personalized and agile customer experiences

Digital Business Support System Market Analysis

- The digital business support system market is evolving rapidly as companies modernize their operations to meet changing customer expectations and service demands

- Growing demand for personalized digital experiences is pushing vendors to enhance support systems with advanced technologies and automation

- North America dominates the digital business support system market with the largest revenue share of approximately 38.5% in 2024, is primarily driven by the region's superior telecom infrastructure, high adoption rates of digital technologies, and a growing demand for cloud-based BSS solutions to manage complex digital payment transactions and e-commerce growth.

- Asia-Pacific is expected to be the fastest-growing region in the digital business support system market during the forecast period, is expected to witness the fastest growth rate during the forecast period of 2024-2032. This rapid expansion is fuelled by increasing urbanization, rising disposable incomes, aggressive 5G rollouts, and government initiatives promoting digitalization across countries such as China and India

- The solutions segment held the largest market revenue share in 2024, accounting for approximately 64.5% of the global revenue, driven by the surging demand for digital transformation within industries to enhance customer experiences and streamline operations. This segment encompasses a diverse range of functionalities, including billing, customer management, and order management, which are instrumental for modern telecom operators and service providers. The widespread adoption of mobile devices, the data-intensive nature of IoT, and the rapid proliferation of cloud computing further bolster the growth of digital BSS solutions

Report Scope and Digital Business Support System Market Segmentation

|

Attributes |

Digital Business Support System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Digital Business Support System Market Trends

“Integration of Artificial Intelligence in Business Support Systems”

- Companies are increasingly adopting artificial intelligence to automate customer support and streamline internal operations, improving overall efficiency

- Predictive analytics powered by artificial intelligence help forecast customer behavior and network performance, allowing businesses to address potential issues proactively

- For instance, AT&T uses AI-driven predictive analytics to monitor network health and prevent outages before they impact customers

- AI-powered chatbots and virtual assistants enhance user engagement by handling common queries quickly, reducing the need for human intervention

- For instance, Vodafone employs AI chatbots to manage customer service requests, providing instant support and freeing up human agents for complex issues

- Intelligent systems analyze usage patterns and preferences to deliver personalized experiences tailored to individual customers

- The integration of AI reduces manual errors and boosts operational efficiency across billing, service provisioning, and fault management processes

Digital Business Support System Market Dynamics

Driver

“Increasing Demand for Real-Time Customer Engagement and Operational Efficiency”

- Rising demand for real-time customer engagement drives companies to provide seamless service across digital channels such as mobile apps and social media

- Digital business support systems integrate customer management, billing, and service provisioning into one platform for faster response and personalized offers

- Automation of routine tasks such as billing and service activation reduces errors and turnaround times, improving operational efficiency

- Telecom and digital service companies use these systems to streamline workflows and cut operational costs

- For instance, Verizon implemented a unified digital support platform to enhance customer service speed and accuracy

- Cloud-based solutions offer scalability and flexibility, helping businesses quickly adapt to market changes and customer needs, fueling continuous innovation

Restraint/Challenge

“High Implementation Costs and Complexity of Integration”

- High costs for software licenses, hardware upgrades, and skilled personnel make implementing digital business support systems challenging for small and medium enterprises

- Integration with legacy systems is complex and time-consuming, often causing service disruptions if not managed carefully

- For instance, British Telecom faced delays and increased costs during the integration of new support systems with its existing infrastructure

- Ensuring data consistency and interoperability across different platforms can lead to operational inefficiencies

- Migrating customer data and business processes requires detailed planning to prevent service outages and data loss

- Customizing solutions for specific business needs increases deployment time and costs, discouraging some companies from upgrading their systems

Digital Business Support System Market Scope

The digital business support system (BSS) market is segmented on the basis of component, deployment mode, and end-users.

- By Component

On the basis of component, the digital business support system market is segmented into solutions and services. The solutions segment held the largest market revenue share in 2024, accounting for approximately 64.5% of the global revenue, driven by the surging demand for digital transformation within industries to enhance customer experiences and streamline operations. This segment encompasses a diverse range of functionalities, including billing, customer management, and order management, which are instrumental for modern telecom operators and service providers. The widespread adoption of mobile devices, the data-intensive nature of IoT, and the rapid proliferation of cloud computing further bolster the growth of digital BSS solutions.

The services segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by the increasing complexity of digital transformation initiatives and the growing need for specialized expertise in implementing, integrating, and managing digital BSS solutions. Enterprises are increasingly outsourcing these services due to a lack of in-house capabilities, leading to higher demand for consulting, managed services, and support and maintenance. This trend is driven by the desire for agile and scalable solutions that can adapt to evolving technological landscapes and business demands.

- By Deployment Mode

On the basis of deployment mode, the digital business support system market is segmented into public cloud, private cloud, and hybrid cloud. The Public Cloud segment is anticipated to hold the largest market share of 65% in 2024, driven by its inherent scalability, flexibility, and cost-effectiveness. The pay-as-you-go model and reduced upfront infrastructure costs make it highly attractive for businesses seeking agile operations.

The hybrid cloud segment is expected to witness the fastest growth rate from 2025 to 2032. This accelerated growth is fuelled by organizations seeking a balance between the agility of public clouds and the enhanced security and control offered by private environments. Hybrid cloud solutions enable seamless integration of legacy systems with modern cloud infrastructure, allowing businesses to optimize workloads and manage sensitive data effectively.

- By End-Users

On the basis of end-users, the digital business support system market is segmented into small enterprises, medium enterprises, and large enterprises. The Large Enterprises segment accounted for the largest market revenue share in 2024, driven by their complex operational needs, extensive customer bases, and significant investments in digital transformation initiatives. Large organizations require robust and comprehensive BSS solutions to manage vast amounts of data, streamline diverse business processes, and ensure seamless customer experiences across multiple channels.

The small & medium enterprises (SMEs) segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by their increasing adoption of cloud-based digital BSS solutions to optimize operations, improve customer engagement, and compete more effectively with larger players. The affordability, scalability, and ease of deployment offered by cloud-native BSS solutions make them highly appealing to SMEs looking to enhance efficiency without significant upfront investment. Government initiatives supporting digitalization among SMEs also contribute to this rapid growth.

Digital Business Support System Market Regional Analysis

- North America dominates the digital business support system (BSS) market, accounting for the largest market revenue share of 38.5% in 2024, is primarily driven by the region's advanced telecommunications infrastructure, early and extensive adoption of 5G technology, and rapid digital transformation initiatives across the telecom sector

- The region's robust digital economy and high demand for sophisticated cloud-based BSS solutions, which enhance operational efficiency and customer experiences, further solidify its dominant position

- Continuous investment in AI-driven solutions and 5G integration by key market players also contributes to its market leadership

U.S. Digital Business Support System Market Insight

The U.S. digital business support system market captured the largest revenue share within North America in 2024, propelled by its highly advanced telecom infrastructure, strong technology adoption rates, and a robust digital economy. The market in the U.S. is expected to remain dominant, driven by the escalating demand for digital payment transactions, which necessitates modern BSS systems for seamless revenue management and billing. The increasing adoption of cloud-based BSS solutions and advanced analytics further reinforces its leading position.

Europe Digital Business Support System Market Insight

The Europe digital business support system market is expected to witness the fastest growth rate throughout the forecast period, primarily driven by increasing digital transformation initiatives and robust investments in 5G infrastructure across the continent. European enterprises are increasingly adopting cloud-based BSS solutions, driven by their cost-effectiveness and scalability, with countries such as the UK and Germany leading in smart BSS solution deployment. Stringent data privacy regulations also encourage the adoption of compliant and secure BSS platforms.

U.K. Digital Business Support System Market Insight

The U.K. digital business support system market is expected to witness the fastest growth rate during the forecast period, fuelled by rapid 5G deployment and significant investments in cloud-based solutions. The country's strong emphasis on digital transformation and the increasing need for advanced network management and automation tools are key drivers. The U.K.'s proactive stance on digital security and compliance, especially with regulations such as GDPR, also encourages the adoption of sophisticated BSS solutions.

Germany Digital Business Support System Market Insight

The Germany digital business support system market is expected to witness the fastest growth rate during the forecast period, driven by its well-developed digital infrastructure, strong focus on innovation, and the growing demand for technologically advanced BSS solutions. The country's robust manufacturing and IT sectors are increasingly leveraging digital BSS to streamline complex operations and manage vast customer bases. A preference for secure, privacy-focused solutions aligns with local enterprise expectations, further boosting market growth.

Asia-Pacific Digital Business Support System Market Insight

The Asia-Pacific digital business support system market is expected to witness the fastest growth rate during the forecast period of 2024-2032. This rapid expansion is driven by the ongoing digital transformation in the telecom sector, increasing internet and smartphone penetration, and the diverse technological needs across countries such as China, India, and Japan. The region's extensive 5G rollout and government-backed digitalization initiatives are significant accelerators.

Japan Digital Business Support System Market Insight

The Japan digital business support system market is expected to witness the fastest growth rate due to the country’s advanced technological infrastructure, high rates of digital transformation, and demand for efficient business operations. The Japanese market places a significant emphasis on technological innovation, and the adoption of Digital BSS is driven by the increasing number of smart cities initiatives and the need for advanced solutions to manage complex telecom networks. Integration with IoT devices and the demand for robust data management are fuelling growth.

China Digital Business Support System Market Insight

The China digital business support system market accounted for the largest market revenue share in Asia Pacific in 2024, attributed to the country's massive telecom infrastructure, rapid urbanization, and advanced 5G rollout. China stands as one of the largest and fastest-growing digital economies, with a strong presence of domestic telecom giants and continuous investments in cloud-based and AI-driven BSS solutions. The sheer scale of its mobile user base and increasing demand for digital services are key factors propelling the market.

Digital Business Support System Market Share

The Digital Business Support System industry is primarily led by well-established companies, including:

- Google (U.S.)

- IBM Corporation (U.S.)

- Amazon (U.S.)

- Microsoft (U.S.)

- VMware Inc. (U.S.)

- Hewlett Packard Enterprise Development LP (U.S.)

- Dell Inc (U.S.)

- Huawei Technologies Co. Ltd. (China)

- FUJITSU (Japan)

- Nutanix (U.S.)

- NetApp (U.S.)

- Quantum Corporation (U.S.)

- Scale Computing (U.S.)

- DataCore Software (U.S.)

- Maxta (U.S.)

- SANGFOR TECHNOLOGIES (China)

- SAP SE (Germany)

Latest Developments in Global Digital Business Support System Market

- In August 2023, IBM completed the acquisition of Apptio Inc., a leader in financial and operational IT management software. This strategic move aims to enhance IBM's IT automation and AI capabilities by integrating Apptio's FinOps offerings—ApptioOne, Cloudability, and Targetprocess—with IBM's automation tools such as Turbonomic and Instana. The combined solutions provide clients with a comprehensive platform to manage, optimize, and automate technology spending decisions. In addition, Apptio's extensive dataset of anonymized IT spend will augment IBM's AI and data platform, Watsonx, unlocking new insights and innovations. This acquisition is expected to drive significant synergies across IBM's key growth areas, including automation, Red Hat, IBM Consulting, and its broader AI portfolio, thereby strengthening IBM's position in the IT automation and FinOps market

- In July 2022, Ericsson completed its acquisition of Vonage Holdings Corp., making Vonage a wholly owned subsidiary. This strategic move aims to integrate Vonage's cloud-based communication services, including Unified Communications as a Service (UCaaS) and Contact Centre as a Service (CCaaS), with Ericsson's 5G network capabilities. The acquisition is expected to create a global network platform that leverages advanced 5G network APIs, facilitating the development of innovative applications and services. By combining Ericsson's network expertise with Vonage's communication solutions, the deal is set to enhance customer experiences and drive digital transformation across industries. The integration also positions Ericsson to capitalize on new revenue streams in the rapidly growing cloud communications market

- In March 2022, Infosys announced its acquisition of oddity, a Germany-based digital experience and marketing agency. This strategic move aims to enhance Infosys' digital transformation capabilities by integrating oddity's expertise in digital commerce, marketing, and metaverse-ready solutions. The acquisition complements Infosys' previous purchase of WONGDOODY, further strengthening its creative and marketing services. By combining these assets, Infosys seeks to offer comprehensive, human-centred digital solutions to global clients, particularly Chief Marketing Officers navigating the evolving digital commerce landscape. The integration is expected to bolster Infosys' position in delivering innovative, end-to-end digital experiences across various industries

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.