Global Construction Punch List Software Market

Market Size in USD Million

CAGR :

%

USD

599.55 Million

USD

1,195.52 Million

2024

2032

USD

599.55 Million

USD

1,195.52 Million

2024

2032

| 2025 –2032 | |

| USD 599.55 Million | |

| USD 1,195.52 Million | |

|

|

|

|

Construction Punch List Software Market Size

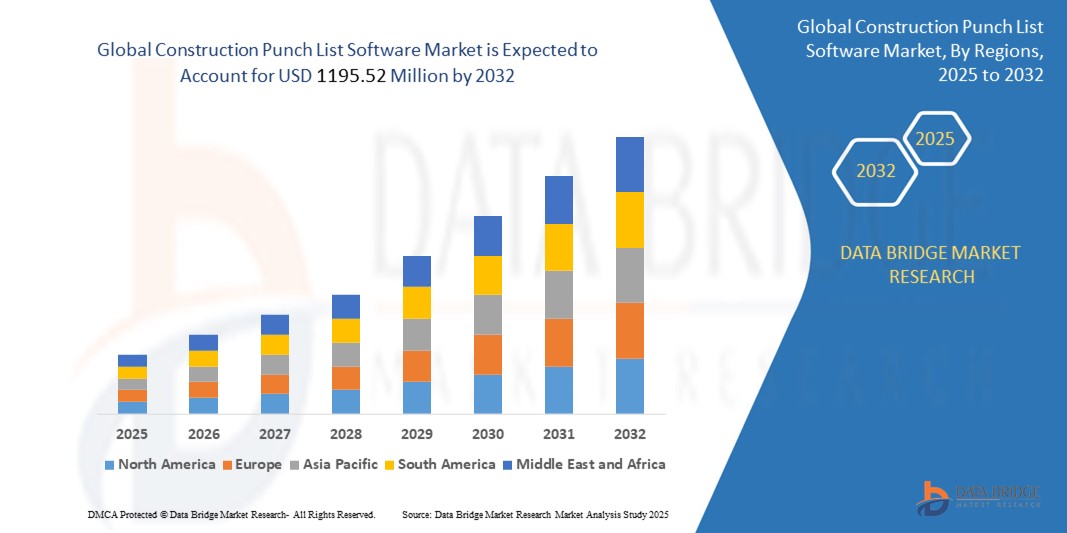

- The global construction punch list software market was valued at USD 599.55 Million in 2024 and is expected to reach USD 1195.52 Million by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 9.01%, primarily driven by increasing need for streamlined project management

- This growth is driven by rising complexity of construction projects, and the growing demand for real-time collaboration across teams

Construction Punch List Software Market Analysis

- The construction punch list software market is witnessing strong growth, driven by the increasing complexity of construction projects, the need for improved collaboration among stakeholders, and the demand for real-time issue tracking. As construction timelines tighten and expectations for quality rise, digital punch list tools are becoming essential for streamlining task management, reducing rework, and improving project delivery

- The rise in smart city development and infrastructure expansion, especially in emerging economies, is further fueling the adoption of construction punch list software. In addition, advancements in mobile technology, cloud integration, and AI-enabled solutions are enhancing software capabilities by allowing on-site updates, visual annotations, and better workflow coordination

- For instance, in November 2023, Marketwake acquired Punchlist, a no-code, visual-first feedback solution, combining it with strategic growth services to enhance collaborative project reviews and communication efficiency

- There's also a growing trend toward seamless integration with Building Information Modeling (BIM) and project management platforms, enabling better data synchronization and accuracy across construction phases. This integration supports increased transparency, accountability, and resource optimization, boosting user confidence in software adoption

- As digital transformation accelerates across the construction sector, the demand for agile, user-friendly, and mobile-compatible punch list solutions will continue to grow, making this software category a critical component of modern construction project management

Report Scope and Construction Punch List Software Market Segmentation

|

Attributes |

Construction Punch List Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis |

Construction Punch List Software Market Trends

“Adoption of Cloud-Based Construction Management Platforms”

- A major trend reshaping the construction punch list software market is the widespread adoption of cloud-based platforms for real-time data access, project tracking, and collaboration. These platforms allow project teams to work remotely, update punch lists on the go, and reduce delays caused by miscommunication

- Cloud solutions offer scalability, automatic updates, and seamless integration with other construction software tools such as scheduling, BIM, and document management systems

- For instance, in January 2024, Autodesk launched new cloud collaboration features within its Construction Cloud, allowing users to streamline punch list workflows and improve team coordination across job sites

- This trend is improving transparency, reducing paperwork, and enhancing team productivity by ensuring every stakeholder has access to the latest project data

- As cloud adoption continues to grow, it is expected to become the standard foundation for all punch list software, driving digital transformation in the construction sector

Construction Punch List Software Market Dynamics

Driver

“Rising Focus on Quality Assurance and Compliance”

- The growing emphasis on quality assurance, safety, and regulatory compliance is a primary driver for construction punch list software adoption. These tools enable detailed documentation of defects, real-time updates, and instant accountability, which are crucial for maintaining high construction standards

- Construction companies are increasingly integrating punch list software with inspection and audit systems to ensure that all deliverables meet client expectations and comply with regional building code

- Automated alerts, task assignments, and photo documentation features further improve efficiency in addressing issues before project handover

- For instance, in June 2023, Trimble added QA/QC inspection capabilities to its construction software suite, empowering teams to document issues digitally and ensure compliance more efficiently

- This focus on quality control is helping firms reduce rework, avoid penalties, and build trust with clients, supporting widespread adoption of punch list tools

Opportunity

“Growth of Modular and Prefabricated Construction”

- The rise of modular and prefabricated construction presents a lucrative opportunity for punch list software providers, as these methods require precise coordination and stringent quality checks throughout the assembly process

- As modular projects are built off-site and assembled on-site, software that ensures all components meet specifications and arrive defect-free is essential for reducing errors and maintaining timelines

- The push for faster, cost-effective, and sustainable construction methods is further encouraging developers to adopt tech-driven project management tools

- For instance, in October 2023, Procore Technologies announced new integrations with prefabrication tracking tools to support streamlined issue resolution in modular projects

- With the prefabrication trend gaining traction worldwide, tailored punch list solutions can unlock new market segments and revenue streams for software vendors

Restraint/Challenge

“Resistance to Digital Adoption among Traditional Contractors”

- A notable challenge in the construction punch list software market is the slow adoption of digital tools by traditional contractors who still rely on manual processes such as spreadsheets, paper forms, and in-person inspections

- This resistance stems from a lack of technical expertise, upfront investment concerns, and reluctance to change long-standing workflows

- Training requirements and the need for cultural shifts within construction teams further hinder smooth implementation of punch list software

- For instance, in August 2023, a survey by Construction Executive revealed that over 40% of small construction firms in North America still use manual punch list methods due to unfamiliarity with digital platforms

- Overcoming this barrier will require targeted education, user-friendly interfaces, and strong support services to encourage broader software adoption across the industry

Construction Punch List Software Market Scope

The market is segmented on the basis of deployment type, platform accessibility, integration capabilities, and subscription.

|

Segmentation |

Sub-Segmentation |

|

By Deployment Type

|

|

|

By Platform Accessibility |

|

|

By Integration Capabilities |

|

|

By Subscription |

|

Construction Punch List Software Market Regional Analysis

“North America is the Dominant Region in the Construction Punch List Software Market”

- North America has a significantly higher adoption rate of construction punch list software compared to other regions, indicating a strong market presence

- The region's mature construction industry infrastructure supports the rapid integration of digital tools for effective project management

- Construction firms in North America are actively embracing digital solutions to streamline operations and improve project outcomes

- These factors position North America as the dominant region in the construction punch list software market, with continued leadership expected in driving technological innovation

“Asia-Pacific is projected to register the Highest Growth Rate”

- Asia-Pacific is witnessing rapid urbanization, which is fueling a surge in construction activities, including residential, commercial, and large-scale infrastructure projects

- The complexity of these developments is creating a strong need for efficient project management tools such as construction punch list software to coordinate tasks and stakeholders effectively

- Countries such as China, India, and nations in Southeast Asia are driving demand through major infrastructure initiatives that require advanced digital solutions

- As construction volumes and complexities continue to grow, Asia-Pacific is expected to emerge as the fastest-growing region in the global construction punch list software market

- The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Procore Technologies (U.S.)

- Autodesk, Inc. (U.S.)

- Procore Technologies, Inc. (U.S.)

- Trimble Inc. (U.S.)

- Oracle (U.S.)

- Fieldwire (U.S.)

- Buildertrend (U.S.)

- Finalcad SARL (France)

- Deltek, Inc. (Belgium)

- Bridgit (Canada)

- UDA Technologies (U.S.)

- Smartsheet Inc. (U.S.)

- Newforma, Inc. (U.S.)

- SKYSITE Technologies, Inc. (U.S.)

- Strata Systems, Inc. (U.S.)

Latest Developments in Global Construction Punch List Software Market

- In November 2023, Marketwake, a digital marketing agency headquartered in Atlanta, acquired Punchlist, a no-code visual-first feedback management platform that simplifies team collaboration and feedback processes. This partnership combines Marketwake’s strategic growth capabilities with Punchlist’s user-friendly interface, setting the stage for more streamlined project execution

- In February 2023, Autodesk, Inc. unveiled Autodesk Build, a new construction management platform featuring punch list functionality. Following this, in March 2023, Trimble Inc. acquired eSUB, a provider of cloud-based construction management software, to enhance its offerings in punch list software

- In November 2021, Hilti Corporation acquired Fieldwire, a U.S.-based jobsite management software provider known for its field management solutions tailored to construction teams. This acquisition supported Hilti’s commitment to expanding its digital transformation efforts and strengthening its technology-driven service offerings

- In June 2021, Stanley Black & Decker acquired Buildup, a punch list, task management, and inspection software provider with mobile-friendly features that integrate visual elements directly onto project floor plans. This move allowed Stanley Black & Decker to enhance its digital construction tools and improve on-site efficiency for its users

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.