Global Video Management Software Vms Market

Market Size in USD Billion

CAGR :

%

USD

11.66 Billion

USD

95.12 Billion

2024

2032

USD

11.66 Billion

USD

95.12 Billion

2024

2032

| 2025 –2032 | |

| USD 11.66 Billion | |

| USD 95.12 Billion | |

|

|

|

|

Video Management Software (VMS) Market Analysis

The Video Management Software (VMS) market is experiencing significant growth, driven by the increasing demand for advanced security solutions in various sectors, including retail, healthcare, transportation, and government. VMS platforms enable the centralized management of video surveillance systems, offering functionalities such as video recording, live streaming, and event monitoring. Advancements in cloud-based VMS solutions are revolutionizing the market by providing scalable, flexible, and cost-effective options for businesses to monitor and manage security footage remotely. Cloud integration allows for easier access to video data, better storage management, and improved scalability, which is particularly beneficial for multi-location enterprises. Another notable trend is the integration of artificial intelligence (AI) and machine learning into VMS platforms. These technologies enhance video analytics capabilities, enabling real-time detection of suspicious activities, facial recognition, and behavior analysis. For instance, Milestone Systems' merger with Arcules in 2024 highlights the shift toward combining video analytics and cloud solutions to create a more comprehensive video surveillance offering. As security concerns continue to rise globally, the VMS market is set to expand, offering increasingly sophisticated and efficient surveillance solutions for businesses and governments alike.

Video Management Software (VMS) Market Size

The global video management software (VMS) market size was valued at USD 11.66 billion in 2024 and is projected to reach USD 95.12 billion by 2032, with a CAGR of 30.00 % during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Video Management Software (VMS) Market Trends

“Increasing Shift towards Cloud-Based VMS Solutions”

The Video Management Software (VMS) market is evolving rapidly, with a prominent trend being the shift towards cloud-based VMS solutions. Cloud integration provides businesses with greater scalability, remote accessibility, and cost-effective storage options for video surveillance data. With the increasing demand for flexible and secure video management, cloud-based systems allow for easier deployment across multiple locations, offering seamless integration and enhanced user experience. For instance, Arcules, a cloud-based VMS provider, has made significant strides in offering Video Surveillance as a Service (VSaaS), which enables organizations to access their surveillance footage from anywhere, improving real-time monitoring and data analysis. This trend is transforming the market by reducing the reliance on on-site infrastructure while providing businesses with robust security management capabilities. As the need for efficient, remote surveillance grows across industries such as retail, healthcare, and transportation, the cloud-based VMS market is expected to see continued growth and widespread adoption.

Report Scope and Video Management Software (VMS) Market Segmentation

|

Attributes |

Video Management Software (VMS) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Robert Bosch GmbH (Germany), Hanwha Vision Co., Ltd. (South Korea), Honeywell International Inc. (U.S.), Schneider Electric (France), Axis Communications AB (Sweden), Johnson Controls (Ireland), Hangzhou Hikvision Digital Technology Co., Ltd. (China), NetApp (U.S.), Dahua Technology Co., Ltd (China), KEDACOM (China), Verint Systems Inc. (U.S.), LTIMindtree Limited (India), AxxonSoft. (U.S.), eInfochips (U.S.), Motorola Solutions, Inc. (Canada), Panasonic Life Solutions India Pvt. Ltd. (Japan), Panopto (U.S.), Cloudways Ltd. (U.S.), Eagle Eye Networks, (U.S.), and Arcules, Inc. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Video Management Software (VMS) Market Definition

Video Management Software (VMS) is a centralized platform designed to manage, store, and monitor video footage captured by security cameras and surveillance systems. It provides features such as video recording, live streaming, playback, and real-time monitoring, offering users the ability to access and control video feeds from multiple cameras.

Video Management Software (VMS) Market Dynamics

Drivers

- Rising Security Concerns

As security concerns rise across the globe, the need for enhanced surveillance solutions is becoming a significant market driver for video management software (VMS). Businesses, government entities, and individuals are increasingly focusing on securing properties, critical infrastructures, and public spaces. VMS platforms offer real-time monitoring, incident detection, and video playback, which are essential for ensuring the safety of people and assets. For instance, in high-security areas such as airports or government buildings, VMS allows security teams to track suspicious activities and respond instantly. The rise in urbanization and population density has amplified the need for comprehensive surveillance systems. With smart surveillance features such as facial recognition and motion detection, VMS can provide proactive monitoring, thus addressing the growing concerns over theft, vandalism, and public safety. As security becomes a top priority across sectors, the demand for advanced VMS solutions will continue to increase, making it a key driver of market growth.

- Increasing Adoption in Various Industries

The growing adoption of video management software (VMS) across a range of industries is another significant driver of market expansion. Sectors such as retail, healthcare, transportation, and education are increasingly turning to VMS to improve operational efficiency and enhance safety. In retail, for instance, VMS helps store managers track customer behavior, reduce theft, and ensure employee safety. Similarly, in healthcare, hospitals and medical facilities use VMS for monitoring patients, securing sensitive areas such as pharmacies, and complying with regulatory standards. Transportation hubs, such as airports and train stations, rely on VMS to monitor large crowds and secure high-risk areas. Educational institutions are also adopting VMS to ensure the safety of students and staff. With the integration of advanced video analytics and the ability to monitor in real time from any location, VMS platforms are becoming indispensable in these industries, driving their widespread adoption and contributing to the market’s growth.

Opportunities

- Increasing Technological Advancements

The integration of cutting-edge technologies such as artificial intelligence (AI) and machine learning into Video Management Software (VMS) is opening up new opportunities in the market. These advancements enable VMS to offer advanced video analytics, such as facial recognition, behavior analysis, and automatic anomaly detection. These features make VMS solutions more efficient in capturing and storing video data and more effective in real-time surveillance. For instance, AI-enabled VMS can instantly identify unauthorized individuals or detect suspicious activities in monitored areas, sending real-time alerts to security personnel for immediate action. This significantly enhances the ability to prevent crimes such as theft, vandalism, and even violent incidents. As businesses and governments seek more proactive, automated security systems, the demand for AI-powered VMS platforms is set to increase, presenting a substantial market opportunity for manufacturers and developers in the industry.

- Increasing Supportive Government Initiatives

Government initiatives to enhance public safety are driving the demand for advanced Video Management Software (VMS) solutions. Governments across the globe are investing heavily in surveillance infrastructure, particularly in public spaces such as streets, parks, transportation hubs, and government buildings. For instance, cities such as London, New York, and Singapore have deployed vast networks of CCTV cameras integrated with VMS systems to monitor urban environments and prevent crime. In addition to crime prevention, VMS is also being used for traffic management, crowd control, and emergency response coordination. As public sector agencies prioritize security and safety, there is a growing need for reliable, scalable VMS solutions that can handle large volumes of video data and integrate seamlessly with other smart city technologies. This presents a significant market opportunity for VMS providers to partner with governments and expand their footprint in public infrastructure projects.

Restraints/Challenges

- High Development Costs

High development costs and limited payload capacity are significant challenges in the Video Management Software (VMS) market. Developing Video Management Software (VMS) demands substantial investment in research, technology, and manufacturing, with costs rising due to the need for advanced materials and precision engineering. For instance, designing high-performance communication or imaging payloads requires intricate technological solutions, which increase both initial and operational expenses. In addition, the limited payload capacity of satellites restricts the weight and size of components that can be launched, limiting the potential for larger or more complex payloads. This results in a need for highly efficient design solutions to optimize payloads while staying within size and weight constraints. These challenges impact the growth of the market, particularly for smaller or emerging space companies aiming to compete with established players.

- Lack of Highly Skilled Workforce

The need for a highly skilled workforce is a significant challenge in the Video Management Software (VMS) market, as the development, integration, and operation of payload systems require specialized expertise in fields such as aerospace engineering, electronics, and data processing. For instance, designing payloads for scientific satellites or military applications demands a deep understanding of both cutting-edge technology and space mission requirements. However, the limited availability of qualified professionals in this niche field makes it difficult for companies to scale up operations, leading to increased costs and potential delays in satellite launches.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Video Management Software (VMS) Market Scope

The market is segmented on the basis of organization size, component, technology, and vertical. The growth amongst these segments will help you analyse meagre growth segments in the industries, and provide the users. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Organization Size

- Small and Medium-Sized Enterprises,

- Large Enterprises

Component

- Solutions

- Services

Technology

- Analog Based Video Management Software

- IP Based Video Management Software

Vertical

- Banking

- Financial Services and Insurance (BFSI)

- Government

- Healthcare and Life Sciences

- Manufacturing and Automotive

- Retail

- Transportation and Logistics

- Media and Entertainment

- Telecom and Information Technology (IT)

- Education

- Real Estate

- Energy and Utility

- Tourism and Hospitality

- Others

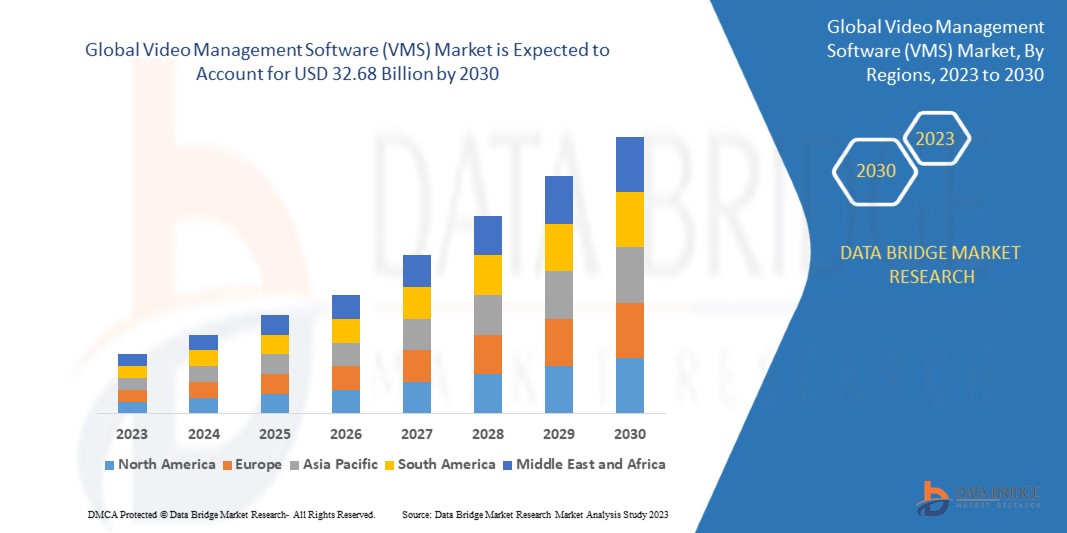

Video Management Software (VMS) Market Regional Analysis

The market is analyzed and market size insights and trends are provided by country, organization size, component, technology, and vertical. The growth amongst these segments will help you analyse meagre growth segments in the industries, and provide the users as referenced above.

The countries covered in the market report are U.S., Canada, Mexico in North America, Germany, Sweden, Poland, Denmark, Italy, U.K., France, Spain, Netherland, Belgium, Switzerland, Turkey, Russia, Rest of Europe in Europe, Japan, China, India, South Korea, New Zealand, Vietnam, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in Asia-Pacific (APAC), Brazil, Argentina, Rest of South America as a part of South America, U.A.E, Saudi Arabia, Oman, Qatar, Kuwait, South Africa, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA).

North America is dominating the video management software (VMS) market, driven by several key factors, including the aging infrastructure that necessitates modernization and the growing adoption of advanced IP-based surveillance and monitoring systems. These technologies are being increasingly deployed across various sectors for enhanced security and operational efficiency. In addition, the region benefits from the presence of major industry players, which are actively driving innovation and expanding their market reach. This combination of infrastructure upgrades and technological advancements is fueling the region's dominance in the market.

Asia-Pacific is projected to experience fastest market growth, primarily driven by the rapid adoption of cloud-based Video Management Systems (VMS) across the region. Countries such as China, India, and other emerging markets are making significant investments in infrastructure to boost economic development, which in turn is fueling the demand for advanced surveillance and monitoring solutions. The shift towards cloud technology is also enabling more scalable, efficient, and cost-effective security systems. This combination of infrastructure expansion and technological advancements is contributing to the region's strong growth trajectory in the market.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Video Management Software (VMS) Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Video Management Software (VMS) Market Leaders Operating in the Market Are:

- Robert Bosch GmbH (Germany)

- Hanwha Vision Co., Ltd. (South Korea)

- Honeywell International Inc. (U.S.)

- Schneider Electric (France)

- Axis Communications AB (Sweden)

- Johnson Controls (Ireland)

- Hangzhou Hikvision Digital Technology Co., Ltd. (China)

- NetApp (U.S.)

- Dahua Technology Co., Ltd (China)

- KEDACOM (China)

- Verint Systems Inc. (U.S.)

- LTIMindtree Limited (India)

- AxxonSoft. (U.S.)

- eInfochips (U.S.)

- Motorola Solutions, Inc. (Canada)

- Panasonic Life Solutions India Pvt. Ltd. (Japan)

- Panopto (U.S.)

- Cloudways Ltd. (U.S.)

- Eagle Eye Networks (U.S.)

- Arcules, Inc. (U.S.)

Latest Developments in Video Management Software (VMS) Market

- In April 2024, Lumana introduced an AI-powered video surveillance system that leverages artificial intelligence (AI) and distributed hybrid cloud architecture. This system includes an AI engine, video processor, video management software accessible via web browser or mobile application, and security cameras, enhancing the overall efficiency and intelligence of surveillance operations

- In July 2024, Milestone Systems announced its merger with Arcules, combining the strengths of both companies in video management software (VMS), video analytics, and Video Surveillance as a Service (VSaaS). This strategic merger aims to enhance their capabilities and expand their reach in the global surveillance market

- In October 2023, Axis Communications confirmed the sale of its subsidiary, Citilog (France), to TagMaster (Sweden), a company specializing in application-driven technology, particularly in rail and traffic solutions. The transaction is expected to close by April 30, 2024, with Axis continuing to collaborate with both Citilog and TagMaster as partners

- In July 2021, Bosch launched the FLEXIDOME panoramic 5100i camera range, offering both indoor and outdoor infrared (IR) models with 6- or 12-megapixel resolution. The cameras are equipped with a stereographic fish-eye lens and a built-in microphone array, providing enhanced surveillance capabilities for a variety of environments

- In April 2021, Bosch introduced the FLEXIDOME multi 7000i camera family, which includes both IR and non-IR models. These cameras offer 12- or 20-megapixel resolution, delivering detailed multidirectional overviews that improve security monitoring in complex environments

- In April 2021, Axis Communications announced the sale of its subsidiary, Citilog (France), to TagMaster (Sweden). The acquisition, set to close on April 30, will further strengthen TagMaster's presence in traffic and rail solutions, with Axis continuing to partner with Citilog and TagMaster in the future

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.