Global Core Hr Software Market

Market Size in USD Billion

CAGR :

%

USD

15.40 Billion

USD

28.40 Billion

2024

2032

USD

15.40 Billion

USD

28.40 Billion

2024

2032

| 2025 –2032 | |

| USD 15.40 Billion | |

| USD 28.40 Billion | |

|

|

|

|

Core HR Software Market Size

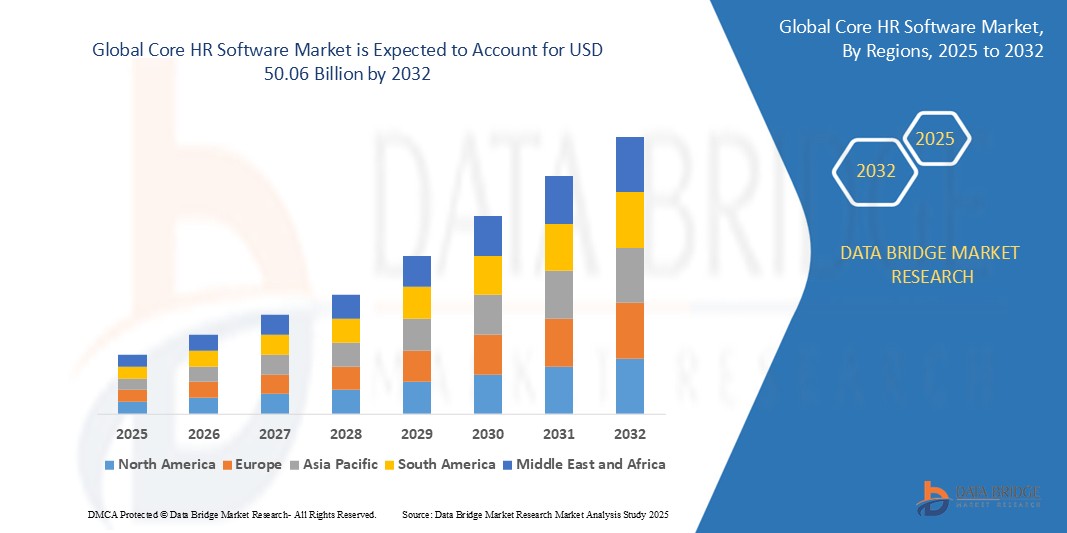

- The global core HR software market size was valued at USD 23.00 billion in 2024 and is expected to reach USD 50.06 billion by 2032, at a CAGR of 10.21% during the forecast period

- This growth is driven by factors such as the increasing demand for streamlined HR operations, employee self-service, and centralized workforce management solutions

Core HR Software Market Analysis

- The management, simplification, and automation of departmental tasks are accomplished using human resource software, also referred to as human resource information system software or human capital management software. There are numerous HR solutions on the market, including HCM, HRMS, HRIS, talent management systems, and more

- This software's functions include managing payroll and benefits administration, storing employee data, and monitoring the business's legal and regulatory employment requirements. HR software is basically software that stores employee data and allows easy access through a centralized database

- North America is expected to dominate the core HR software’s market with 34.5% due to presence of major HR software providers and a high adoption rate of cloud-based solutions

- Asia-Pacific is expected to be the fastest growing region in the core HR software market during the forecast period due to rapid economic development, leading to increased investments in HR technology to manage expanding workforces

- On premises segment is expected to dominate the market with a market share due to its high preference of many organizations for maintaining control over their HR data and systems within their IT infrastructure

Report Scope and Core HR Software Market Segmentation

|

Attributes |

Core HR Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Core HR Software Market Trends

“Integration of AI and Automation in Core HR Software”

- AI and machine learning are increasingly integrated into core HR software to automate repetitive tasks, improve accuracy, and provide deep insights into workforce trends. These technologies enable HR software to perform complex data analyses, such as predicting employee turnover and identifying high-potential talent, enhancing decision-making processes

- AI-driven tools, such as chatbots, are being used to provide instant employee support, improving engagement and satisfaction.

- For instance, Oracle's integration of generative AI capabilities aims to augment HR functions such as job description creation and employee performance objectives, boosting productivity and enhancing the employee experience

- Automation streamlines routine HR tasks such as onboarding, benefits administration, and leave management, allowing HR teams to focus on strategic initiatives and employee development. This shift towards automation is transforming HR processes, making them more efficient and less time-consuming

- The adoption of analytics-driven HR software solutions is rising as organizations recognize the importance of data-driven decision-making in HR management. Advanced analytics capabilities enable organizations to derive insights from employee data, predict workforce trends, and make informed HR strategies

- Organizations adopting AI-integrated core HR software can gain a competitive edge by demonstrating a commitment to advanced technology and data-driven decision-making, attracting top talent and improving overall organizational performance

Core HR Software Market Dynamics

Driver

“Digital Transformation and Cloud Adoption”

- Cloud-based HR software continues to dominate the market, offering scalable, flexible, and cost-effective solutions. Companies prefer cloud solutions for their ease of access, minimal IT infrastructure requirements, and ability to integrate seamlessly with other business systems

- The increase in remote and hybrid work arrangements has necessitated robust HR software solutions. Cloud-based HR systems facilitate remote access to HR functions, supporting organizations in managing a distributed workforce effectively

- Cloud solutions eliminate the need for substantial upfront investments in hardware and infrastructure, making HR technology more accessible to a wider range of businesses, particularly small and medium enterprises (SMEs)

- Cloud-based HR software allows organizations to scale their HR operations as needed, accommodating growth and changes in business requirements without significant additional investments

- Cloud solutions offer seamless integration with other business systems, enhancing data flow and operational efficiency across the organization

Opportunity

“Data-Driven Decision Making through Analytics”

- Data-driven decision making (DDDM) leverages data analytics to guide business strategies, enhancing accuracy, efficiency, and competitiveness. Organizations across various sectors are increasingly adopting DDDM to inform their decisions and drive growth

- Data analytics helps organizations streamline operations by identifying inefficiencies and optimizing processes.

- For Instance, Walmart employs predictive analytics to manage inventory, ensuring products are stocked based on anticipated demand, which reduces waste and improves customer satisfaction Access to real-time data allows businesses to make informed strategic decisions that align with market trends and consumer behaviour

- Analyzing customer data enables companies to tailor their offerings to individual preferences, enhancing customer satisfaction and loyalty

- Data analytics not only assesses current performance but also forecasts future trends, aiding proactive decision-making

Restraint/Challenge

“High Implementation Costs”

- Deploying core HR software requires substantial investment in software licensing, customization, and integration with existing systems, which can be prohibitive for small and medium-sized enterprises (SMEs)

- The implementation of new HR software necessitates comprehensive training programs for HR staff and end-users, which can incur additional costs and time. Resistance to change among employees can further complicate the adoption process

- Organizations often have specific HR processes that require custom modifications to standard software solutions, leading to increased costs and extended implementation timelines

- Regular updates, system maintenance, and support services add to the total cost of ownership, impacting the organization's budget and resource allocation

- Organizations may be hesitant to invest in core HR software due to uncertainties regarding the ROI, especially if the perceived benefits do not align with the substantial costs involved.

Core HR Software Market Scope

The market is segmented on the basis of component, deployment type, organization size, and verticals.

|

Segmentation |

Sub-Segmentation |

|

By Component |

|

|

By Deployment Type |

|

|

By Organization Size |

|

|

By Vertical

|

|

In 2025, the on-premises is projected to dominate the market with a largest share in deployment type segment

The on-premises segment is expected to dominate the core HR software market with the largest share in 2025 due to its preference of many organizations for maintaining control over their HR data and systems within their IT infrastructure. On-premise solutions offer greater customization, enhanced security, and compliance with strict data regulations, which appeals to enterprises with specific security requirements or complex HR processes.

The telecom and information technology (IT) is expected to account for the largest share during the forecast period in vertical market

In 2025, the telecom and information technology (IT) segment is expected to dominate the market with the largest market share due to its industry's rapid growth and high demand for efficient human resource management. Companies in this sector often have large, diverse workforces and complex HR needs, driving the adoption of advanced HR software solutions to streamline operations, manage talent, and ensure compliance.

Core HR Software Market Regional Analysis

“North America Holds the Largest Share in the Core HR Software Market”

- North America holds the largest market share in the global core HR software market with 34.5%, driven by the presence of major HR software providers and a high adoption rate of cloud-based solutions

- The region is at the forefront of integrating artificial intelligence and machine learning into HR software, enhancing functionalities such as recruitment, talent management, and employee engagement

- Stringent labor laws and data protection regulations in countries such as the U.S. and Canada necessitate advanced HR solutions to ensure compliance and efficient workforce management

- Large enterprises in North America are investing significantly in HR technology to streamline operations, improve employee experience, and gain a competitive edge in talent acquisition and retention

- The North American market is expected to maintain its dominance throughout the forecast period, with continued growth in demand for integrated HR solutions

“Asia-Pacific is Projected to Register the Highest CAGR in the Core HR Software Market”

- Countries such as China, India, Japan, and South Korea are experiencing rapid economic development, leading to increased investments in HR technology to manage expanding workforces

- The shift towards digitalization in the Asia Pacific region is accelerating the adoption of cloud-based HR solutions, facilitating efficient HR operations and data management

- The rise of small and medium-sized enterprises (SMEs) in emerging economies is driving the demand for scalable and cost-effective HR software solutions

- Supportive government policies and initiatives promoting digital infrastructure and technology adoption are contributing to the growth of the HR software market in the region

- The Asia Pacific region is projected to witness the highest compound annual growth rate (CAGR) during the forecast period, reflecting its expanding HR software market

Core HR Software Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- ADP, Inc. (U.S.)

- Ceridian HCM, Inc. (U.S.)

- The Access Group (U.K.)

- EmployWise (India)

- IBM (U.S.)

- Oracle (U.S.)

- Paychex Inc. (U.S.)

- Paycom. (U.S.)

- SAP SE (Germany)

- SumTotal Systems, LLC. (U.S.)

- UKG Inc. (U.S.)

- Workday, Inc. (U.S.)

- Peopleworks (U.S.)

- Ramco Systems. (India)

- Emportant. (India)

- TrustRadius. (U.S.)

- Cezanne HR Limited. (U.K.)

- Vibe HCM, Inc. (U.S.)

- TriNet Group, Inc. (U.S.)

Latest Developments in Global Core HR Software Market

- In June 2023, Workday announced the expansion of its partnership with Samsung SDS, a system integrator and cloud-based HR technology provider, to drive business and deliver unified HCM for HR professionals in the region

- In June 2023, UKG acquired Immedis, a workforce management, and HR payroll solution provider, to transform the global payroll landscape by launching UKG One View, a multi-country payroll solution

- In April 2023, Oracle announced enhancements to Oracle ME, an employee experience platform, Oracle Grow, an innovative AI-driven offering that unifies learning, skill development, and career advancement into a personalized journey, empowering individuals to pursue self-guided learning opportunities

- In March 2023, Ceridian announced that Center Parcs UK & Ireland chose Dayforce to enhance its workforce efficiency, boost employee engagement, and ensure regulatory compliance. With Dayforce’s extensive workforce management features, including time and attendance tracking, intelligent scheduling, task management, and people analytics, Center Parcs aims to empower and retain its front-line workers effectively

- In October 2022, ADP announced the launch of Voice of the Employee, an employee survey solution to help employers to collect employee feedback throughout the employee lifecycle and improve the employee workplace experience

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.