Global Automotive Software Market

Market Size in USD Billion

CAGR :

%

USD

38.19 Billion

USD

140.67 Billion

2024

2032

USD

38.19 Billion

USD

140.67 Billion

2024

2032

| 2025 –2032 | |

| USD 38.19 Billion | |

| USD 140.67 Billion | |

|

|

|

|

Automotive Software Market Size

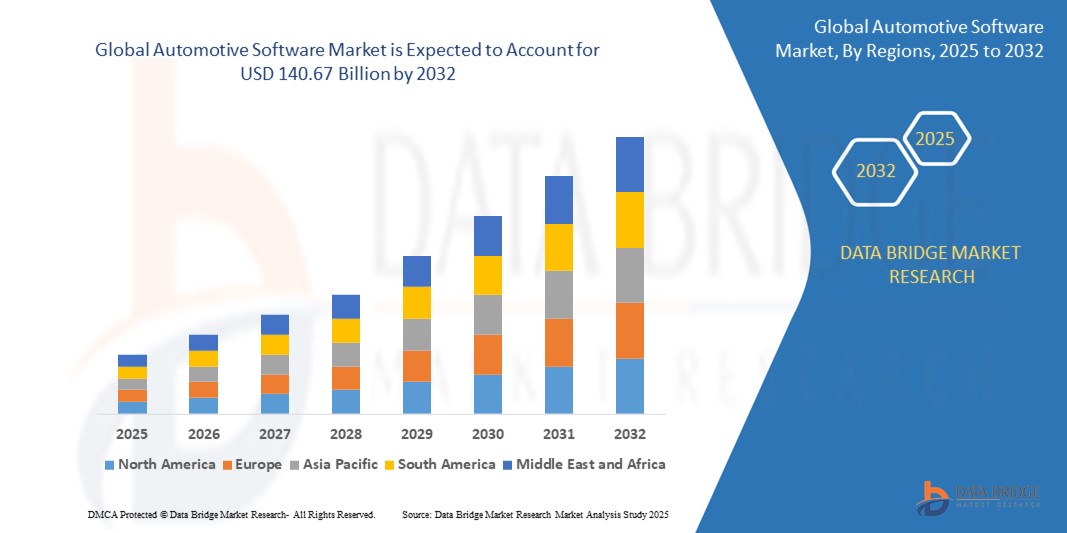

- The global automotive software market size was valued at USD 38.19 billion in 2024 and is expected to reach USD 140.67 billion by 2032, at a CAGR of 17.70% during the forecast period

- The surge in market growth is attributed to the increasing integration of software-defined vehicles (SDVs), rising penetration of electrification, and the evolution of advanced driver assistance systems (ADAS) across global automotive ecosystems

- In addition, the growing adoption of AI-powered features, vehicle connectivity, and OTA (over-the-air) updates is encouraging automakers to shift focus from hardware-centric to software-centric vehicle architectures, fueling substantial industry growth

Automotive Software Market Analysis

- Automotive Software encompasses systems for engine control, infotainment, ADAS, and vehicle connectivity, playing a pivotal role in enabling safer, smarter, and more efficient driving experiences. As automakers move towards SDVs, software has become a core differentiator in vehicle performance and consumer appeal

- The demand for real-time operating systems, autonomous driving algorithms, and cloud-based vehicle management solutions is growing rapidly, driven by increasing consumer expectations and stringent regulations for safety and emissions

- Moreover, collaboration between OEMs and software providers, such as partnerships for middleware platforms, vehicle operating systems, and mobility services, is shaping the future landscape of the automotive industry, solidifying software's position as a cornerstone of vehicle innovation

- North America dominates the automotive software market with the largest revenue share of 36.01% in 2024, driven the presence of major automotive manufacturers and technology companies, coupled with the increasing demand for connected vehicles, advanced safety features, infotainment systems, and significant investments in autonomous driving technologies in the region

- Asia Pacific automotive software market is projected to be the fastest-growing region with the highest CAGR throughout the forecast period. This rapid growth is driven by increasing vehicle production and sales, rising adoption of connected vehicle technologies, and government initiatives promoting smart mobility in countries such as China, India, and South Korea

- Application software held the largest share at 47.5% in 2024, driven by its core role in infotainment systems, ADAS, telematics, and HMI functionalities. This software is responsible for delivering user interfaces, navigation, real-time diagnostics, and interactive media

Report Scope and Automotive Software Market Segmentation

|

Attributes |

Automotive Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Automotive Software Market Trends

“Shift Towards Software-Defined Vehicles and Enhanced In-Car Experiences”

- A significant and accelerating trend in the global automotive software market is the fundamental shift towards software-defined vehicles (SDVs). In SDVs, software plays a much more central role, controlling infotainment and connectivity and core vehicle functions, allowing for greater flexibility and the introduction of new features through software updates

- For instance, Volkswagen announced in February 2024 its push towards SDVs with its VW.OS platform, aiming to unify vehicle software architecture across models and enable dynamic updates

- Another key trend is the increasing complexity and sophistication of in-car infotainment systems. Consumers are demanding more integrated and personalized digital experiences within their vehicles, driving the need for advanced software solutions for navigation, entertainment, and communication

- In April 2024, Tata Motors integrated the HARMAN Ignite Store, expanding access to app-based features and enhancing the in-car experience for Indian users

- Furthermore, cybersecurity for connected vehicles is a paramount and growing trend. As vehicles become more connected and software-reliant, ensuring their security against cyber threats is crucial, leading to significant developments in automotive cybersecurity software and regulations

- The adoption of Over-The-Air (OTA) updates is also a major trend, allowing manufacturers to continuously improve vehicle software, fix bugs, and introduce new features remotely, enhancing the lifespan and functionality of vehicles without requiring physical visits to service centers

- This trend towards software-defined vehicles, enhanced in-car experiences, and robust cybersecurity is fundamentally reshaping the automotive industry. Consequently, companies are heavily investing in research and development of advanced automotive software solutions

- The demand for automotive software that enables connectivity, automation, personalization, and continuous improvement through updates is growing rapidly across all vehicle segments, reflecting the increasing recognition of software as a core differentiator in modern vehicles

Automotive Software Market Dynamics

Driver

“Increasing Demand for Connectivity, Automation, and Enhanced Features”

- The increasing consumer demand for connectivity features, such as internet access, advanced navigation, and seamless smartphone integration within vehicles, is a significant driver for the heightened demand for automotive software

- For instance, KPIT Technologies partnered with U.S. carmakers in May 2024 to integrate generative AI into vehicles, enhancing in-car voice assistants and personalization features

- In addition, regulatory requirements for vehicle emissions and safety standards are driving the integration of more complex software systems in vehicles for engine control, advanced driver-assistance systems (ADAS), and safety features

- The continuous evolution of in-car infotainment systems, with demands for richer graphics, more interactive interfaces, and seamless integration of various services, necessitates advanced software capabilities

- Furthermore, the ongoing development and increasing adoption of autonomous driving technologies are heavily reliant on complex and sophisticated automotive software for perception, decision-making, and control

Restraint/Challenge

“Cybersecurity Concerns, Complexity, and Talent Shortages”

- Concerns surrounding the cybersecurity of connected vehicles pose a significant challenge to the broader adoption and advancement of automotive software. The risk of hacking and data breaches in increasingly connected vehicles raises anxieties among consumers and necessitates robust security measures

- For instance, In January 2024, WhiteHat Security reported a 25% increase in cyberattacks targeting automotive software, underscoring the need for robust defensive programming and regular vulnerability testing

- Another significant challenge is the increasing complexity of automotive software. Modern vehicles can have millions of lines of code controlling various functions, making development, integration, and testing highly complex and demanding

- Talent shortages in the automotive software engineering domain present a considerable challenge for the industry. The need for skilled software developers, cybersecurity experts, and AI/ML engineers in the automotive sector is growing rapidly, and attracting and retaining this talent is crucial for sustained innovation

- Economic strain and cost increases in the automotive industry can also impact the pace of software development and integration, particularly for smaller players in the market

Automotive Software Market Scope

The market is segmented on the basis of offering, organization size, software layer, EV utility, vehicle type, and end-user.

• By Offering

The automotive software market is segmented into solutions and services. In 2024, the solutions segment dominated the market with a 68.9% revenue share, driven by the growing need for integrated systems that support real-time diagnostics, vehicle automation, and infotainment features. Software solutions help automakers meet evolving compliance, safety, and customer expectations. These platforms support modular development, OTA updates, and cloud integration, making them highly adaptable for next-generation vehicles.

The services segment covering consulting, integration, and maintenance is witnessing rapid growth as OEMs and Tier 1 suppliers increasingly outsource to manage complex software infrastructure efficiently.

• By Organization Size

Based on organization size, the market includes large-scale organizations, medium-scale organizations, and small-scale organizations. In 2024, large-scale organizations held the largest market share at 61.2%, owing to their extensive R&D investments, in-house capabilities, and strategic partnerships with software providers. These organizations are at the forefront of autonomous driving, V2X communication, and AI-driven safety technologies. Their dominance is also supported by large-scale production and long-standing relationships with global OEMs.

The medium-scale organization segment is projected to grow fastest, driven by increasing opportunities in agile software development and collaborative ecosystems that foster innovation among nimble automotive tech firms.

• By Software Layer

The software layer segment comprises operating system, middleware, and application software. In 2024, application software held the largest share at 47.5%, driven by its core role in infotainment systems, ADAS, telematics, and HMI functionalities. This software is responsible for delivering user interfaces, navigation, real-time diagnostics, and interactive media. As vehicles become smarter, application layers are increasingly integrated with AI and voice assistants.

The middleware segment is expected to register the highest CAGR, as it serves as a vital bridge between hardware and applications enhancing modularity, scalability, and interoperability in increasingly complex automotive environments.

• By EV Utility

The EV utility segment is divided into charging management, battery management, and vehicle-to-grid (V2G). In 2024, the battery management segment dominated with a 53.7% revenue share, driven by the rising adoption of electric vehicles and the critical need for monitoring battery performance, temperature, and safety. Battery management software ensures efficiency, lifespan extension, and optimal performance.

The V2G segment is gaining momentum and is expected to grow at the fastest pace, fueled by smart grid integration and the ability of EVs to feed energy back to the grid, a vital part of the transition to renewable energy ecosystems.

• By Vehicle Type

On the basis of vehicle type, the market is segmented into passenger cars, electric vehicles (EVs), light commercial vehicles (LCVs), and heavy-duty vehicles (HDVs). The passenger car segment led in 2024 with a 48.6% market share, fueled by widespread consumer demand for infotainment, safety, and connectivity features. Advanced automotive software in this segment supports ADAS, over-the-air updates, and seamless smartphone integration.

The electric vehicles segment is projected to grow at the fastest rate, as EV-specific software manages powertrains, charging systems, and energy regeneration areas where software intelligence plays a crucial role in performance and user experience.

• By End-User

The end-user segment includes ADAS and safety systems, communication systems, infotainment systems, body control and comfort systems, engine management and powertrain, vehicle management and telematics, autonomous driving, HMI applications, and others. In 2024, ADAS and safety systems held the highest market share at 24.9%, driven by increasing regulatory mandates and consumer preference for collision avoidance, lane assist, and adaptive cruise control. These software systems are integral to road safety and semi-autonomous functionality.

The autonomous driving segment is poised for the fastest growth, as OEMs invest in full-stack self-driving capabilities, computer vision, and machine learning to achieve Level 4 and 5 autonomy.

Automotive Software Market Regional Analysis

- North America dominates the automotive software market with the largest revenue share of 36.01% in 2024, driven the presence of major automotive manufacturers and technology companies, coupled with the increasing demand for connected vehicles, advanced safety features, infotainment systems, and significant investments in autonomous driving technologies in the region

- North America is a significant market for EVs and autonomous vehicles. Both of these segments heavily rely on software for powertrain control, battery management, autonomous driving features, and connectivity, which propels the growth of the market in the region.

U.S. Automotive Software Market Insight

The U.S. automotive software market captured the largest revenue share within North America in 2024. This is fueled by a high adoption rate of connected vehicles, strong consumer demand for advanced in-car technologies, and the presence of leading technology companies actively developing and integrating automotive software solutions.

Canada Automotive Software Market Insight

The Canada automotive software market is experiencing significant growth, influenced by similar trends as the U.S. market, including increasing demand for connected vehicles and advanced driver-assistance systems. The market benefits from its close integration with the U.S. automotive industry and a growing consumer interest in technologically advanced vehicles.

Asia Pacific Automotive Software Market Insight

The Asia Pacific automotive software market is projected to be the fastest-growing region with the highest CAGR throughout the forecast period. This rapid growth is driven by increasing vehicle production and sales, rising adoption of connected vehicle technologies, and government initiatives promoting smart mobility in countries such as China, India, and South Korea. The region's emergence as a major automotive manufacturing hub and a growing consumer preference for technologically advanced vehicles contribute significantly to this growth.

China Automotive Software Market Insight

The China automotive software market is a major contributor to the Asia Pacific region and is expected to be the fastest-growing market globally. This growth is fueled by the country's large automotive production, rapid adoption of electric and connected vehicles, and strong government support for the development of intelligent vehicle technologies and autonomous driving.

Japan Automotive Software Market Insight

The Japan automotive software market is experiencing steady growth, driven by its well-established automotive industry and a strong focus on innovation and technological advancements in vehicles. The increasing demand for advanced safety features, sophisticated infotainment systems, and the development of autonomous driving technologies are key factors driving market expansion in Japan.

Europe Automotive Software Market Insight

The Europe automotive software market is experiencing substantial growth, driven by stringent safety regulations, increasing demand for connected vehicles, and advancements in electric and autonomous vehicle technologies. Countries such as Germany and the UK, with their strong automotive manufacturing bases and a focus on innovation, are significant contributors to the European market.

U.K. Automotive Software Market Insight

The U.K. automotive software market is growing at a considerable pace, driven by increasing demand for connected cars, electric vehicles, and advanced driver-assistance systems. The government's focus on promoting innovation in the automotive sector and the presence of several automotive technology companies contribute to the market's growth.

Germany Automotive Software Market Insight

The Germany automotive software market is expected to expand significantly, fueled by the country's strong automotive industry and its leadership in developing advanced automotive technologies. The high demand for premium vehicles with sophisticated software features, including autonomous driving functionalities and advanced connectivity, drives the growth of the automotive software market in Germany.

Automotive Software Market Share

The automotive software industry is primarily led by well-established companies, including:

- LUXOFT, A DXC TECHNOLOGY COMPANY (Switzerland)

- Vector Informatik GmbH (Germany)

- Sigma Software (Ukraine)

- NVIDIA Corporation (U.S.)

- Aptiv (U.S.)

- Elektrobit (Germany)

- KPIT (India)

- NXP Semiconductors (Netherlands)

- aiMotive (Hungary)

- Siemens (Germany)

- Intellias (Ukraine)

- Hexagon AB (Sweden)

- OXBOTICA (U.K.)

- Lynx Software Technologies (U.S.)

- Renesas Electronics Corporation (Japan)

- Intel Corporation (U.S.)

- Blackberry Limited (Canada)

- Airbiquity Inc. (U.S.)

- Green Hills Software (U.S.)

- Robert Bosch GmbH (Germany)

- Wind River Systems, Inc. (U.S.)

- Alphabet Inc. (U.S.)

- Autonet Mobile, Inc. (U.S.)

- MONTAVISTA SOFTWARE LLC. (U.S.)

- Microsoft (U.S.)

Latest Developments in Global Automotive Software Market

- In May 2024, KPIT Technologies partnered with several leading U.S. automobile manufacturers to integrate its advanced generative AI technology into vehicles, aiming to revolutionize driver-vehicle interaction and deliver smarter, safer, and more efficient mobility experiences

- In April 2024, Tata Motors, India’s leading automotive company, selected the HARMAN Ignite Store as its official in-car app platform, aiming to deliver a seamless, secure, and enriched user experience while expanding its reach across global markets

- In April 2024, the BMW Group and Tata Technologies announced the formation of a joint venture to develop automotive software and IT solutions, establishing new development centers in Indian cities such as Pune, Bengaluru, and Chennai to boost innovation and digital capabilities

- In March 2024, Wipro Limited collaborated with General Motors and Magna to launch SDVerse, a B2B platform designed to simplify the procurement and sale of automotive software, aiming to connect automotive companies with innovative software providers through a streamlined matchmaking process

- In January 2022, Aptiv initiated a partnership with Sophia Velastegui to fast-track the development of mobility software by leveraging advanced AI technologies, intending to enhance product innovation and deliver improved vehicle performance and user experience

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.