Global Banking Hardware Maintenance Software Support And Helpdesk Support Services Market

Market Size in USD Billion

CAGR :

%

USD

12.16 Billion

USD

22.67 Billion

2024

2032

USD

12.16 Billion

USD

22.67 Billion

2024

2032

| 2025 –2032 | |

| USD 12.16 Billion | |

| USD 22.67 Billion | |

|

|

|

|

Banking Hardware Maintenance, Software Support and Helpdesk Support Services Market Size

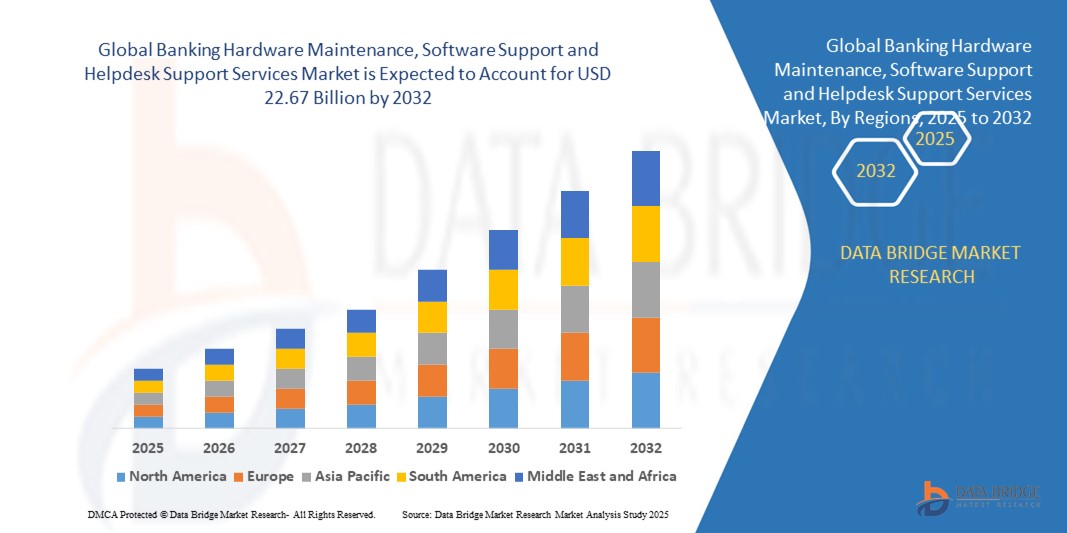

- The global banking hardware maintenance, software support and helpdesk support services market size was valued at USD 12.16 billion in 2024 and is expected to reach USD 22.67 billion by 2032, at a CAGR of 8.10% during the forecast period

- The market growth is largely fuelled by the increased digitalization of banking operations, rising adoption of self-service technologies such as ATMs and kiosks, and the growing demand for uninterrupted banking services and system reliability

- The increasing reliance on digital banking platforms and the need to ensure 24/7 system availability are prompting financial institutions to invest heavily in comprehensive support services, which include preventive hardware maintenance, real-time software troubleshooting, and dedicated helpdesk operations

Banking Hardware Maintenance, Software Support and Helpdesk Support Services Market Analysis

- Increasing focus on cybersecurity and regulatory compliance is encouraging banks to invest in proactive maintenance and support services

- Rapid transformation in banking infrastructure, along with the integration of Artificial Intelligence and Internet of Things into banking systems, is driving the demand for specialized software and hardware support solutions

- North America dominated the banking hardware maintenance, software support and helpdesk support services market with the largest revenue share of 38.26% in 2024, driven by the strong presence of financial institutions and their continued focus on enhancing digital infrastructure and operational efficiency

- Asia-Pacific region is expected to witness the highest growth rate in the global banking hardware maintenance, software support and helpdesk support services market, driven by expanding banking networks in rural and semi-urban areas, rising ATM and self-service kiosk installations, and the growing need for localized, multilingual customer support solutions across diverse banking environments

- The ATM – maintenance service costs segment dominated the market with the largest market revenue share of 39.4% in 2024, driven by the high dependency on automated teller machines for cash transactions and 24/7 banking services. Banks prioritize ATM maintenance to ensure uninterrupted service availability and minimize downtime, which is critical for customer satisfaction and operational efficiency

Report Scope and Banking Hardware Maintenance, Software Support and Helpdesk Support Services Market Segmentation

|

Attributes |

Banking Hardware Maintenance, Software Support and Helpdesk Support Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Expansion of AI-Enabled Predictive Maintenance Solutions |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Banking Hardware Maintenance, Software Support and Helpdesk Support Services Market Trends

Increasing Demand for Integrated IT Support Services in Banking Infrastructure

- The rising complexity of banking operations and digital platforms is driving a surge in demand for integrated hardware, software, and helpdesk support services. Financial institutions are increasingly adopting centralized IT support to streamline performance, minimize downtime, and maintain regulatory compliance, especially as the sector shifts toward hybrid and remote banking models

- Banks are prioritizing comprehensive service contracts that offer bundled maintenance and support solutions, including proactive system monitoring and issue resolution. These services ensure minimal disruptions to operations and enhance the reliability of ATM networks, data centers, and customer interfaces

- The trend is also driven by digital transformation initiatives, where cloud-based banking solutions and cybersecurity enhancements are expanding the need for constant technical support. Service providers are integrating real-time monitoring and AI-based diagnostics to preempt failures and reduce incident response times

- For instance, in 2024, a major Southeast Asian bank partnered with a global IT firm to implement an integrated hardware-software support model across its regional branches. This led to a 28% improvement in system uptime and reduced ticket resolution time by 36%

- As banks adopt open banking, mobile platforms, and artificial intelligence tools, support service providers are evolving to deliver agile, on-demand support. The future of the market lies in scalable, predictive service models that reduce costs and improve customer satisfaction

Banking Hardware Maintenance, Software Support and Helpdesk Support Services Market Dynamics

Driver

Growing Emphasis on Operational Continuity and Uptime in Banking Networks

• Financial institutions are under immense pressure to provide uninterrupted access to banking services across digital and physical platforms. As customer expectations for 24/7 service availability grow, banks are investing in robust support systems to maintain operational continuity. This is particularly critical for ATM uptime, secure online banking, and interbank transaction processing

• With the expansion of digital banking and the proliferation of self-service technologies, the demand for timely maintenance and software troubleshooting has surged. Ensuring seamless function of both legacy and modern infrastructure is essential to avoid revenue loss, service delays, and customer dissatisfaction

• Government regulations and industry standards are also pushing banks to prioritize system availability and data integrity. As a result, the need for dedicated support contracts that guarantee response time and escalation protocols has intensified across retail and commercial banking

• For instance, in 2023, a leading European bank reported a 22% reduction in service interruptions after expanding its outsourced hardware and software support services, ensuring continuous system performance across branches and digital channels

• The push for zero downtime and real-time service has turned support services into a strategic asset. Vendors offering integrated and tiered response capabilities are best positioned to meet growing industry demands and secure long-term contracts

Restraint/Challenge

High Service Costs and Legacy Infrastructure Complexity

• The cost associated with ongoing maintenance of outdated banking hardware and customized legacy software platforms remains a major challenge. Many banks, particularly mid-sized institutions, find it financially burdensome to secure end-to-end support for aging systems that require specialized attention and regular patching

• Legacy systems often lack compatibility with modern tools, resulting in longer resolution times and increased dependency on vendor-specific technicians. This lack of interoperability increases overall support costs and limits operational flexibility when migrating to new platforms

• In addition, the shortage of skilled professionals with experience in maintaining old banking systems further compounds the issue. The learning curve and high costs associated with training or outsourcing these services restrict scalability and impact efficiency

• For instance, in 2022, several credit unions across North America highlighted budget overruns caused by maintaining aging ATM networks, with support services accounting for over 35% of their IT expenditure

• To address this, banks need to prioritize infrastructure modernization, phase-out outdated systems, and seek support providers that offer migration pathways and cost-effective hybrid support models for both old and new technologies

Banking Hardware Maintenance, Software Support and Helpdesk Support Services Market Scope

The market is segmented on the basis of service type, application, and components.

- By Service Type

On the basis of service type, the banking hardware maintenance, software support and helpdesk support services market is segmented into ATM – maintenance service costs, ATM – operational support service costs, digital signage systems, and queue management system. The ATM – maintenance service costs segment dominated the market with the largest market revenue share of 39.4% in 2024, driven by the high dependency on automated teller machines for cash transactions and 24/7 banking services. Banks prioritize ATM maintenance to ensure uninterrupted service availability and minimize downtime, which is critical for customer satisfaction and operational efficiency.

The digital signage systems segment is expected to witness the fastest growth rate from 2025 to 2032, supported by growing demand for enhanced in-branch customer communication and real-time service updates. These systems provide banks with dynamic content delivery, aiding in brand promotion and queue control. Integration with centralized management platforms further enhances their utility across multi-branch banking networks.

- By Application

On the basis of application, the market is segmented into currency sorters, detectors and counters, banking kiosk, end user devices, and peripherals. The banking kiosk segment held the largest market revenue share in 2024 due to increased deployment of self-service solutions aimed at reducing wait times and improving customer service efficiency. Kiosks play a vital role in handling routine banking tasks such as account updates, cheque deposits, and document printing.

The currency detectors and counters segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by heightened focus on fraud detection, cash handling accuracy, and regulatory compliance. These devices are increasingly supported by maintenance contracts and software updates to ensure optimal performance and data tracking.

- By Components

On the basis of components, the market is segmented into hardware and software. The hardware segment dominated the market in 2024, owing to the widespread installation and upkeep of physical banking infrastructure, including ATMs, kiosks, and cash recyclers. Demand for periodic hardware maintenance and replacement of legacy systems contributes significantly to service costs.

The software segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the increased adoption of digital banking platforms and automation technologies. Banks are investing in remote diagnostics, software patching, and helpdesk support to ensure system security, reduce outages, and enhance user experience.

Banking Hardware Maintenance, Software Support and Helpdesk Support Services Market Regional Analysis

• North America dominated the banking hardware maintenance, software support and helpdesk support services market with the largest revenue share of 38.26% in 2024, driven by the strong presence of financial institutions and their continued focus on enhancing digital infrastructure and operational efficiency

• The region benefits from early adoption of advanced banking systems, increasing investments in cybersecurity, and robust demand for 24/7 technical support across urban and suburban branches

• High demand for seamless user experience, along with stringent regulatory compliance requirements, is compelling banks to outsource maintenance and support services, thereby contributing to the growth of the market across the region

U.S. Banking Hardware Maintenance, Software Support and Helpdesk Support Services Market Insight

The U.S. market captured the largest revenue share in 2024 within North America, supported by the rapid digitization of banking services and high dependency on ATMs and end-user kiosks for financial transactions. The growing preference for managed service providers offering comprehensive hardware and software support packages is accelerating market growth. Rising demand for real-time troubleshooting, software patching, and maintenance of critical banking equipment is driving continuous investment in technical support infrastructure.

Europe Banking Hardware Maintenance, Software Support and Helpdesk Support Services Market Insight

The Europe market is expected to witness the fastest growth rate from 2025 to 2032, led by the rising modernization of legacy banking infrastructure and growing reliance on third-party maintenance providers. With increasing regulatory scrutiny and data protection mandates, banks across the region are turning to managed services to ensure system availability and compliance. The growing adoption of self-service kiosks and queue management systems across retail banking further adds to the service demand.

U.K. Banking Hardware Maintenance, Software Support and Helpdesk Support Services Market Insight

The U.K. market is expected to witness the fastest growth rate from 2025 to 2032, driven by the country’s shift towards hybrid banking models combining physical branches and digital channels. As banks prioritize customer satisfaction, the need for uninterrupted system operation and proactive IT support is increasing. Financial institutions are increasingly investing in outsourced maintenance and helpdesk services to reduce downtime, enhance efficiency, and meet evolving consumer expectations.

Germany Banking Hardware Maintenance, Software Support and Helpdesk Support Services Market Insight

Germany is expected to witness the fastest growth rate from 2025 to 2032, backed by strong demand for automated banking solutions and robust IT support frameworks. German banks are investing in secure, scalable software and hardware support services to address growing cyber threats and maintain uninterrupted banking services. The country’s emphasis on industrial-grade infrastructure and regulatory compliance ensures consistent demand for high-quality maintenance and support systems.

Asia-Pacific Banking Hardware Maintenance, Software Support and Helpdesk Support Services Market Insight

The Asia-Pacific market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid financial inclusion, rising ATM penetration, and increasing adoption of banking kiosks in developing economies such as India, Indonesia, and the Philippines. The need for reliable hardware servicing and remote software support in semi-urban and rural regions is propelling market expansion. Local banks are partnering with global service providers to improve service reliability and reduce operational costs.

Japan Banking Hardware Maintenance, Software Support and Helpdesk Support Services Market Insight

The Japan market is expected to witness the fastest growth rate from 2025 to 2032, high ATM usage rates, and emphasis on technological reliability. Banks in Japan prioritize uptime and efficiency, driving demand for real-time technical support and software updates. The integration of biometric systems and AI-driven kiosks further adds to the complexity and maintenance needs of banking infrastructure, promoting the use of specialized service providers.

China Banking Hardware Maintenance, Software Support and Helpdesk Support Services Market Insight

China accounted for the largest revenue share in Asia-Pacific in 2024, fueled by its expansive banking network, strong digital transformation strategies, and government initiatives promoting financial inclusion. With increasing use of smart ATMs, touch-based kiosks, and digital signage systems, the demand for end-to-end support services is surging. Local service providers are expanding their portfolios to meet the growing needs of both state-owned and private banks across urban and rural regions.

Banking Hardware Maintenance, Software Support and Helpdesk Support Services Market Share

The Banking Hardware Maintenance, Software Support and Helpdesk Support Services industry is primarily led by well-established companies, including:

- Diebold Nixdorf, Incorporated (U.S.)

- NCR Corporation (U.S.)

- Oki Electric Industry Co., Ltd. (Japan)

- Loomis AB (Sweden)

- Glory Global Solutions (International) Limited (U.K.)

- Hitachi, Ltd. (Japan)

- CashLink Global Systems Pvt. Ltd. (India)

- Cardtronics (U.S.)

Latest Developments in Global Banking Hardware Maintenance, Software Support and Helpdesk Support Services Market

- In January 2023, The United Heritage Credit Union (UHCU) partnered with NCR Corporation to implement NCR's ATM as a Service solution, managing their ATM fleet more efficiently. This model offers financial institutions improved efficiency, streamlined operations, and an enhanced customer experience by simplifying ATM management and service delivery

- In September 2022, Diebold Nixdorf collaborated with PKO Bank Polski to introduce the DN Series self-service solution, enhancing in-branch experiences. As part of the PKO Koncept initiative, the DN Series combines regional aesthetics with advanced technology, featuring a fourth-generation recycling module and comprehensive cash management for a modern, user-friendly self-service experience available 24/7

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.