Global Digital Banking Market

Market Size in USD Billion

CAGR :

%

USD

9,800.46 Billion

USD

17,413.97 Billion

2024

2032

USD

9,800.46 Billion

USD

17,413.97 Billion

2024

2032

| 2025 –2032 | |

| USD 9,800.46 Billion | |

| USD 17,413.97 Billion | |

|

|

|

|

Digital Banking Market Size

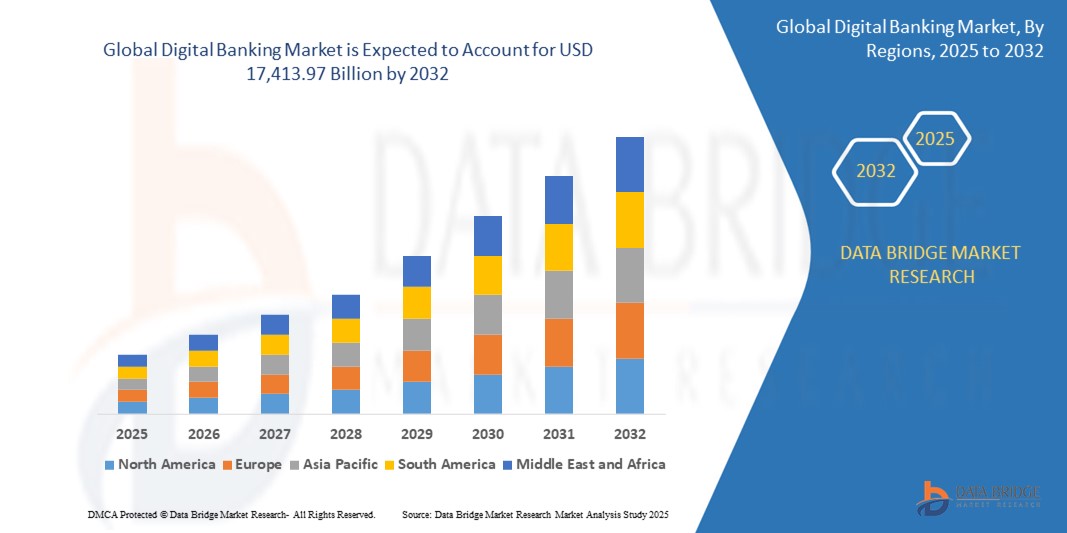

- The global digital banking market was valued at USD 9,800.46 billion in 2024 and is expected to reach USD 17,413.97 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 8.7%, primarily driven by the increasing adoption of digital financial services

- This growth is driven by factors such as rising smartphone penetration, growing demand for seamless banking experiences, regulatory support for digital banking initiatives, and advancements in AI-driven financial solutions

Digital Banking Market Analysis

- Digital banking encompasses a broad range of financial services that leverage technology to provide seamless, efficient, and secure banking experiences. It includes online banking, mobile banking, digital payments, and AI-driven financial services

- The demand for digital banking is significantly driven by the increasing adoption of smartphones, internet penetration, and the shift toward cashless transactions. The growing emphasis on financial inclusion and regulatory support for digital banking initiatives further accelerates market expansion

- North America stands out as one of the dominant regions for digital banking, driven by its well-established financial infrastructure, widespread adoption of fintech solutions, and regulatory frameworks that encourage innovation

- For instance, the number of digital banking users in the U.S. has steadily increased. From traditional banks adopting digital transformation to the rise of neobanks and fintech startups, North America not only leads in adoption but also drives innovation in the global digital banking ecosystem

- Globally, digital banking platforms rank among the most crucial components of modern financial services, playing a pivotal role in ensuring efficiency, security, and accessibility in banking operations. The integration of AI, blockchain, and cloud computing continues to redefine the banking experience

Report Scope and Digital Banking Market Segmentation

|

Attributes |

Digital Banking Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Digital Banking Market Trends

“Increased Adoption of AI, Blockchain, and Cloud Integration”

- One prominent trend in the global digital banking market is the growing adoption of artificial intelligence (AI), blockchain, and cloud-based banking solutions

- These advanced technologies enhance the efficiency, security, and personalization of digital banking services by automating financial processes, improving fraud detection, and enabling seamless real-time transactions

- For instance, AI-powered chatbots and virtual assistants are revolutionizing customer service by providing instant support, fraud prevention, and financial recommendations, reducing the need for physical bank visits

- Blockchain integration is improving transparency and security in digital transactions, minimizing fraud risks, and enhancing cross-border payment processing

- Cloud-based banking solutions allow financial institutions to scale operations efficiently, ensuring secure data storage, streamlined compliance, and reduced infrastructure costs

- This trend is reshaping the banking sector, leading to greater financial inclusion, enhanced customer experiences, and increased demand for secure, tech-driven banking solutions worldwide

Digital Banking Market Dynamics

Driver

“Growing Need Due to Digital Transformation in Banking”

- The rising demand for convenient, secure, and efficient banking solutions is significantly contributing to the rapid adoption of digital banking worldwide

- As consumers and businesses shift towards cashless transactions, mobile banking, and online financial services, the need for seamless and secure digital banking platforms continues to grow

- Traditional banking models are evolving, with financial institutions investing in AI-driven automation, blockchain security, and cloud-based banking infrastructures to enhance customer experiences and operational efficiency

- The ongoing advancements in fintech solutions further highlight the demand for real-time payment systems, AI-powered fraud detection, and biometric authentication, ensuring faster, safer, and more personalized banking experiences

- As more individuals and businesses adopt digital-first banking approaches, the demand for innovative banking solutions rises, driving market expansion and financial inclusivity

For instance,

- In March 2023, according to a report published by the World Bank, nearly 76% of adults globally had access to a digital banking account, reflecting the increasing shift toward digital financial inclusion. This trend acts as a key driver for the global digital banking market, as financial institutions continue to expand their digital offerings

- In October 2022, a report from McKinsey & Company highlighted that over 90% of banking interactions in North America and Europe occur digitally, emphasizing the growing consumer preference for mobile banking apps, AI-driven chatbots, and digital payments

- As a result of the increasing demand for digital financial services, enhanced cybersecurity, and AI-driven banking experiences, the global digital banking market is experiencing rapid growth, reshaping the future of the financial industry

Opportunity

“Transforming Banking with Artificial Intelligence Integration”

- AI-powered digital banking platforms are revolutionizing the financial services industry by enabling hyper-personalized experiences, enhanced security, and intelligent automation of banking operations

- AI algorithms can analyze vast amounts of real-time financial data to detect fraudulent activities, recommend personalized financial products, and automate customer service, thereby enhancing decision-making and improving customer satisfaction

- In addition, AI integration assists in credit scoring, risk assessment, and loan approvals, enabling financial institutions to serve underbanked populations more efficiently and accurately

For instance,

- In January 2025, according to a report published by PwC, AI is expected to contribute over USD 1 trillion to the global banking industry by 2030, primarily by enhancing productivity, personalizing banking experiences, and reducing operational costs

- In October 2023, a study by Accenture highlighted that banks using AI-powered chatbots and virtual agents have achieved up to 30% cost savings in customer support operations, while significantly improving customer engagement and satisfaction

- The integration of AI in digital banking not only streamlines internal processes but also leads to faster transaction times, predictive financial insights, and reduced human error

Restraint/Challenge

“High Infrastructure and Compliance Costs Hindering Market Penetration”

- The high cost of implementing and maintaining digital banking infrastructure presents a significant challenge for the market, especially for small and mid-sized financial institutions and in developing economies

- Building secure, scalable digital platforms involves substantial investment in cybersecurity, cloud infrastructure, AI systems, and compliance with complex regulatory frameworks, which can strain financial and technical resources

- This cost barrier may prevent smaller banks and credit unions from competing with larger, tech-savvy institutions or fintechs, thereby limiting innovation and market inclusivity

For instance,

- In November 2024, according to a report by Capgemini Research Institute, over 65% of small and mid-sized banks cited budget constraints and high implementation costs as primary obstacles to advancing their digital banking capabilities

- In September 2023, a study by Deloitte found that compliance costs for digital banking had increased by 20% year-over-year, especially in regions with stricter financial data privacy laws, such as the EU and parts of Asia-Pacific

- As a result, limited access to capital and high operational costs can lead to delays in digital transformation, reduce competitiveness, and create unequal access to modern banking services

- To overcome this challenge, industry players are exploring strategic partnerships, modular banking solutions, and shared digital platforms to reduce costs and broaden access to digital financial services

Digital Banking Market Scope

The market is segmented on the basis of services, deployment type, technology, and industries,

|

Segmentation |

Sub-Segmentation |

|

By Services |

|

|

By Deployment Type |

|

|

By Technology |

|

|

By Industries

|

|

Digital Banking Market Regional Analysis

“North America is the Dominant Region in the Digital Banking Market”

- North America dominates the global digital banking market, fueled by a robust financial ecosystem, rapid adoption of advanced fintech solutions, and a high concentration of tech-savvy consumers

- The U.S. holds a significant share due to its mature banking sector, widespread use of digital channels, and strong regulatory support for innovation in financial services

- The presence of major digital banks, fintech startups, and established financial institutions investing heavily in AI, blockchain, and cybersecurity technologies has accelerated digital transformation across the region

- In addition, well-developed infrastructure, favourable open banking regulations, and the growing shift towards contactless payments and mobile banking platforms contribute to the region’s dominance

- The increasing consumer demand for 24/7 banking access, seamless digital experiences, and personalized financial services is pushing banks to enhance their digital capabilities, driving further market expansion

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the digital banking market, driven by rapid digitalization, expanding internet penetration, and the growing adoption of smartphones and mobile financial services

- Countries such as China, India, and Indonesia are emerging as key markets due to their large unbanked populations, increasing financial inclusion initiatives, and rising demand for convenient, accessible banking solutions

- India, with its government-led initiatives like Digital India and UPI (Unified Payments Interface), has become a global leader in real-time digital transactions. The surge in fintech innovation and partnerships between banks and technology providers is further fueling growth

- China continues to dominate with tech giants like Alibaba and Tencent, whose digital wallets and financial ecosystems have revolutionized mobile banking and payments

- The region is also experiencing significant foreign direct investment (FDI) in fintech, along with regulatory reforms aimed at encouraging digital banking licenses and innovation

- As digital infrastructure continues to improve and smartphone adoption increases, Asia-Pacific's digital banking sector is poised for sustained, accelerated growth, offering vast opportunities for both incumbents and new entrants

Digital Banking Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Appway AG (Switzerland)

- The Bank of New York Mellon Corporation (U.S.)

- CREALOGIX AG (Switzerland)

- ebankIT (Portugal)

- ETRONIKA (Lithuania)

- Fidor Solutions AG (Germany)

- Finastra (U.K.)

- Halcom (Slovenia)

- ieDigital (U.K.)

- Infosys Limited (India)

- Intellect Design Arena Ltd (India)

- Temenos Headquarters SA (Switzerland)

- NETinfo Plc (Cyprus)

- NF Innova (Serbia)

- Oracle (U.S.)

- SAP (Germany)

- Sopra Steria (France)

- Tata Consultancy Services Limited (India)

- Technisys (Argentina / now part of SoFi, U.S.)

- Worldline (France)

Latest Developments in Global Digital Banking Market

- In December 2022, Finastra formed a partnership with Veem, a global online payments platform, to enhance financial institutions’ capabilities. This collaboration allowed banks and other entities to modernize their payment systems and provide customers with advanced digital accounts receivable (AR) and accounts payable (AP) solutions for improved efficiency

- In November 2022, Finastra partnered with Modefin, a digital banking platform, to deliver innovative fintech solutions tailored for banks across the African and Indian markets, aiming to enhance digital transformation and expand financial inclusion in these rapidly growing regions

- In April 2022, Fiserv, Inc. acquired Finxact to strengthen its digital capabilities, enabling financial institutions to offer innovative and differentiated digital banking services that enhance customer experience and support agile product delivery

- In July 2021, Temenos partnered with UBL to deliver and implement a next-generation digital banking solution. The collaboration aimed to drive UBL’s digital transformation across all channels, products, and customer segments, supporting both its domestic operations and international expansion

- In April 2021, NCR collaborated with Google Cloud to expand the cloud availability of its digital banking software portfolio. This included NCR’s channel services for retail banking and its payment processing platform, enhancing scalability, performance, and accessibility for financial institutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL DIGITAL BANKING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL DIGITAL BANKING MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 MULTIVARIATE MODELLING

2.2.6 STANDARDS OF MEASUREMENT

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 VENDOR SHARE ANALYSIS

2.2.9 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.10 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL DIGITAL BANKING MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 INDUSTRY ANALYSIS & FUTURISTIC SCENARIO

5.2 PENETRATION AND GROWTH POSPECT MAPPING

5.3 COMPETITOR KEY PRICING STRATEGIES

5.4 TECHNOLOGY ANALYSIS

5.4.1 KEY TECHNOLOGIES

5.4.2 COMPLEMENTARY TECHNOLOGIES

5.4.3 ADJACENT TECHNOLOGIES

FIGURE 1 TECHNOLOGY MATRIX

Company Product/Service offered

5.5 COMPANY COMPETITIVE ANALYSIS

5.5.1 STRATEGIC DEVELOPMENT

5.5.2 TECHNOLOGY IMPLEMENTATION PROCESS

5.5.2.1. CHALLENGES

5.5.2.2. INHOUSE IMPLEMENTATION/OUTSOURCED (THIRD PARTY) IMPLEMENTATION

5.5.3 TECHNOLOGY SPEND OF COMPANY

5.5.4 CUSTOMER BASE

5.5.5 SERVICE POSITIONING

5.5.6 CUSTOMER FEEDBACK/RATING (B2B OR B2C)

5.5.7 APPLICATION REACH

5.5.8 SERVICE PLATFORM MATRIX

FIGURE 2 COMPANY COMPARATIVE ANALYSIS

Parameters Company A

Market Share

Growth (%)

Target Audience

Price Structure

Market Strategies

Customer Feedback

Service Positioning

Customer Feedback/Rating

Strategic Development

Acquisitions & its value (USD Million)

Application Reach

FIGURE 3 COMPANY SERVICE PLATFORM MATRIX

5.6 FUNDING DETAILS—INVESTOR DETAILS , REASON OF INVESTMENT FROM INVESTOR

5.7 USED CASES & ITS ANALYSIS

FIGURE 4 USED CASE ANALYSIS

Company Product/Service offered

6 GLOBAL DIGITAL BANKING MARKET, BY BANKING TYPE

6.1 OVERVIEW

6.2 RETAIL BANKING

6.2.1 BY TECHNOLOGY

6.2.1.1. INTERNET OF THINGS

6.2.1.2. CHATBOTS

6.2.1.3. MACHINE LEARNING

6.2.1.4. BIG DATA AND ADVANCE ANALYTICS

6.2.1.5. ROBOTIC PROCESS AUTOMATION (RPA)

6.2.1.6. OTHERS

6.3 CORPORATE BANKING

6.3.1 BY TECHNOLOGY

6.3.1.1. INTERNET OF THINGS

6.3.1.2. CHATBOTS

6.3.1.3. MACHINE LEARNING

6.3.1.4. BIG DATA AND ADVANCE ANALYTICS

6.3.1.5. ROBOTIC PROCESS AUTOMATION (RPA)

6.3.1.6. OTHERS

6.4 INVESTMENT BANKING

6.4.1 BY TECHNOLOGY

6.4.1.1. INTERNET OF THINGS

6.4.1.2. CHATBOTS

6.4.1.3. MACHINE LEARNING

6.4.1.4. BIG DATA AND ADVANCE ANALYTICS

6.4.1.5. ROBOTIC PROCESS AUTOMATION (RPA)

6.4.1.6. OTHERS

7 GLOBAL DIGITAL BANKING MARKET, BY SERVICE TYPE

7.1 OVERVIEW

7.2 TRANSACTIONAL

7.2.1 CASH DEPOSIT AND WITHRAWAL

7.2.2 LOANS

7.2.3 FUND TRANSFER

7.2.4 AUTO-DEBIT/AUTO CREDIT SERVICES

7.3 NON-TRANSACTIONAL

7.3.1 INFORMATION SECURITY

7.3.2 FINANCIAL PLANNING

7.3.3 RISK MANAGEMENT

7.3.4 STOCK ADVISORY

8 GLOBAL DIGITAL BANKING MARKET, BY OFFERING

8.1 OVERVIEW

8.2 SOLUTIONS

8.2.1 PAYMENTS/TRANSACTION MONITORING

8.2.2 CUSTOMER AND OMNI CHANNEL MANAGEMENT

8.2.3 RISK MANAGEMENT

8.2.4 ANTI-MONEY LAUNDERING AND FRAUD DETECTION

8.2.5 PROCESSING SERVICES

8.2.6 OTHERS

8.3 SERVICES

8.3.1 BUSINESS PROCESS-AS-A-SERVICE (BPAAS)

8.3.2 SOFTWARE-AS-A-SERVICE (SAAS)

8.3.3 PLATFORM-AS-A-SERVICE (PAAS)

8.3.4 INFRASTRUCTUREAS-A-SERVICE (IAAS)

9 GLOBAL DIGITAL BANKING MARKET, BY DEPLOYMENT MODEL

9.1 OVERVIEW

9.2 CLOUD

9.2.1 HYBRID

9.2.2 PUBLIC

9.2.3 PRIVATE

9.3 ON-PREMISE

10 GLOBAL DIGITAL BANKING MARKET, BY BANKING MODE

10.1 OVERVIEW

10.2 WINDOWS

10.3 LINUX

10.4 MAC

10.5 MOBILE

10.5.1 ANDROID

10.5.2 IPHONE & IPAD

11 GLOBAL DIGITAL BANKING MARKET, BY OPERATING MODEL

11.1 OVERVIEW

11.2 ONLINE BANKING

11.3 MOBILE BANKING

12 GLOBAL DIGITAL BANKING MARKET, BY END USER

12.1 OVERVIEW

12.2 INDIVIDUALS

12.2.1 BY OFFERING

12.2.1.1. SOLUTION

12.2.1.1.1. PAYMENTS/TRANSACTION MONITORING

12.2.1.1.2. CUSTOMER AND OMNI CHANNEL MANAGEMENT

12.2.1.1.3. RISK MANAGEMENT

12.2.1.1.4. ANTI-MONEY LAUNDERING AND FRAUD DETECTION

12.2.1.1.5. PROCESSING SERVICES

12.2.1.1.6. OTHERS

12.2.1.2. SERVICES

12.2.1.2.1. BUSINESS PROCESS-AS-A-SERVICE (BPAAS)

12.2.1.2.2. SOFTWARE-AS-A-SERVICE (SAAS)

12.2.1.2.3. PLATFORM-AS-A-SERVICE (PAAS)

12.2.1.2.4. INFRASTRUCTUREAS-A-SERVICE (IAAS)

12.3 CORPORATES

12.3.1 BY OFFERING

12.3.1.1. SOLUTION

12.3.1.1.1. PAYMENTS/TRANSACTION MONITORING

12.3.1.1.2. CUSTOMER AND OMNI CHANNEL MANAGEMENT

12.3.1.1.3. RISK MANAGEMENT

12.3.1.1.4. ANTI-MONEY LAUNDERING AND FRAUD DETECTION

12.3.1.1.5. PROCESSING SERVICES

12.3.1.1.6. OTHERS

12.3.1.2. SERVICES

12.3.1.2.1. BUSINESS PROCESS-AS-A-SERVICE (BPAAS)

12.3.1.2.2. SOFTWARE-AS-A-SERVICE (SAAS)

12.3.1.2.3. PLATFORM-AS-A-SERVICE (PAAS)

12.3.1.2.4. INFRASTRUCTUREAS-A-SERVICE (IAAS)

12.3.2 BY OWNERSHIP

12.3.2.1. PUBLIC

12.3.2.2. PRIVATE

12.4 INVESTMENT INSTITUTIONS

12.4.1 BY OFFERING

12.4.1.1. SOLUTION

12.4.1.1.1. PAYMENTS/TRANSACTION MONITORING

12.4.1.1.2. CUSTOMER AND OMNI CHANNEL MANAGEMENT

12.4.1.1.3. RISK MANAGEMENT

12.4.1.1.4. ANTI-MONEY LAUNDERING AND FRAUD DETECTION

12.4.1.1.5. PROCESSING SERVICES

12.4.1.1.6. OTHERS

12.4.1.2. SERVICES

12.4.1.2.1. BUSINESS PROCESS-AS-A-SERVICE (BPAAS)

12.4.1.2.2. SOFTWARE-AS-A-SERVICE (SAAS)

12.4.1.2.3. PLATFORM-AS-A-SERVICE (PAAS)

12.4.1.2.4. INFRASTRUCTUREAS-A-SERVICE (IAAS)

12.5 GOVERNMENT

12.5.1 BY OFFERING

12.5.1.1. SOLUTION

12.5.1.1.1. PAYMENTS/TRANSACTION MONITORING

12.5.1.1.2. CUSTOMER AND OMNI CHANNEL MANAGEMENT

12.5.1.1.3. RISK MANAGEMENT

12.5.1.1.4. ANTI-MONEY LAUNDERING AND FRAUD DETECTION

12.5.1.1.5. PROCESSING SERVICES

12.5.1.1.6. OTHERS

12.5.1.2. SERVICES

12.5.1.2.1. BUSINESS PROCESS-AS-A-SERVICE (BPAAS)

12.5.1.2.2. SOFTWARE-AS-A-SERVICE (SAAS)

12.5.1.2.3. PLATFORM-AS-A-SERVICE (PAAS)

12.5.1.2.4. INFRASTRUCTUREAS-A-SERVICE (IAAS)

13 GLOBAL DIGITAL BANKING MARKET, BY REGION

13.1 GLOBAL DIGITAL BANKING MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

13.2 NORTH AMERICA

13.2.1 U.S.

13.2.2 CANADA

13.2.3 MEXICO

13.3 EUROPE

13.3.1 GERMANY

13.3.2 FRANCE

13.3.3 U.K.

13.3.4 ITALY

13.3.5 SPAIN

13.3.6 RUSSIA

13.3.7 TURKEY

13.3.8 BELGIUM

13.3.9 NETHERLANDS

13.3.10 SWITZERLAND

13.3.11 REST OF EUROPE

13.4 ASIA PACIFIC

13.4.1 JAPAN

13.4.2 CHINA

13.4.3 SOUTH KOREA

13.4.4 INDIA

13.4.5 AUSTRALIA

13.4.6 SINGAPORE

13.4.7 THAILAND

13.4.8 MALAYSIA

13.4.9 INDONESIA

13.4.10 PHILIPPINES

13.4.11 REST OF ASIA PACIFIC

13.5 SOUTH AMERICA

13.5.1 BRAZIL

13.5.2 ARGENTINA

13.5.3 REST OF SOUTH AMERICA

13.6 MIDDLE EAST AND AFRICA

13.6.1 SOUTH AFRICA

13.6.2 EGYPT

13.6.3 SAUDI ARABIA

13.6.4 U.A.E

13.6.5 ISRAEL

13.6.6 REST OF MIDDLE EAST AND AFRICA

14 GLOBAL DIGITAL BANKING MARKET,COMPANY LANDSCAPE

14.1 COMPANY SHARE ANALYSIS: GLOBAL

14.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

14.3 COMPANY SHARE ANALYSIS: EUROPE

14.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

14.5 MERGERS & ACQUISITIONS

14.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

14.7 EXPANSIONS

14.8 REGULATORY CHANGES

14.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

15 GLOBAL DIGITAL BANKING MARKET, SWOT AND DBMR ANALYSIS

16 GLOBAL DIGITAL BANKING MARKET, COMPANY PROFILE

16.1 INTELLECT DESIGN ARENA LIMITED

16.1.1 COMPANY SNAPSHOT

16.1.2 REVENUE ANALYSIS

16.1.3 PRODUCT PORTFOLIO

16.1.4 RECENT DEVELOPMENTS

16.2 ORACLE CORPORATION

16.2.1 COMPANY SNAPSHOT

16.2.2 REVENUE ANALYSIS

16.2.3 PRODUCT PORTFOLIO

16.2.4 RECENT DEVELOPMENTS

16.3 SAP SE

16.3.1 COMPANY SNAPSHOT

16.3.2 REVENUE ANALYSIS

16.3.3 PRODUCT PORTFOLIO

16.3.4 RECENT DEVELOPMENTS

16.4 TEMENOS AG

16.4.1 COMPANY SNAPSHOT

16.4.2 REVENUE ANALYSIS

16.4.3 PRODUCT PORTFOLIO

16.4.4 RECENT DEVELOPMENTS

16.5 TATA CONSULTANCY SERVICES

16.5.1 COMPANY SNAPSHOT

16.5.2 REVENUE ANALYSIS

16.5.3 PRODUCT PORTFOLIO

16.5.4 RECENT DEVELOPMENTS

16.6 FIDOR SOLUTIONS AG

16.6.1 COMPANY SNAPSHOT

16.6.2 REVENUE ANALYSIS

16.6.3 PRODUCT PORTFOLIO

16.6.4 RECENT DEVELOPMENTS

16.7 SOPRA BANKING SOFTWARE

16.7.1 COMPANY SNAPSHOT

16.7.2 REVENUE ANALYSIS

16.7.3 PRODUCT PORTFOLIO

16.7.4 RECENT DEVELOPMENTS

16.8 TECHNISYS S.A.

16.8.1 COMPANY SNAPSHOT

16.8.2 REVENUE ANALYSIS

16.8.3 PRODUCT PORTFOLIO

16.8.4 RECENT DEVELOPMENTS

16.9 SAB

16.9.1 COMPANY SNAPSHOT

16.9.2 REVENUE ANALYSIS

16.9.3 PRODUCT PORTFOLIO

16.9.4 RECENT DEVELOPMENTS

16.1 ETRONIKA

16.10.1 COMPANY SNAPSHOT

16.10.2 REVENUE ANALYSIS

16.10.3 PRODUCT PORTFOLIO

16.10.4 RECENT DEVELOPMENTS

16.11 APPWAY AG

16.11.1 COMPANY SNAPSHOT

16.11.2 REVENUE ANALYSIS

16.11.3 PRODUCT PORTFOLIO

16.11.4 RECENT DEVELOPMENTS

16.12 MELLON CORPORATION

16.12.1 COMPANY SNAPSHOT

16.12.2 REVENUE ANALYSIS

16.12.3 PRODUCT PORTFOLIO

16.12.4 RECENT DEVELOPMENTS

16.13 EBANK IT

16.13.1 COMPANY SNAPSHOT

16.13.2 REVENUE ANALYSIS

16.13.3 PRODUCT PORTFOLIO

16.13.4 RECENT DEVELOPMENTS

16.14 CREALOGIX AG

16.14.1 COMPANY SNAPSHOT

16.14.2 REVENUE ANALYSIS

16.14.3 PRODUCT PORTFOLIO

16.14.4 RECENT DEVELOPMENTS

16.15 FINASTRA

16.15.1 COMPANY SNAPSHOT

16.15.2 REVENUE ANALYSIS

16.15.3 PRODUCT PORTFOLIO

16.15.4 RECENT DEVELOPMENTS

16.16 IEDIGITAL

16.16.1 COMPANY SNAPSHOT

16.16.2 REVENUE ANALYSIS

16.16.3 PRODUCT PORTFOLIO

16.16.4 RECENT DEVELOPMENTS

16.17 NF INNOVA

16.17.1 COMPANY SNAPSHOT

16.17.2 REVENUE ANALYSIS

16.17.3 PRODUCT PORTFOLIO

16.17.4 RECENT DEVELOPMENTS

16.18 NCR CORPORATION

16.18.1 COMPANY SNAPSHOT

16.18.2 REVENUE ANALYSIS

16.18.3 PRODUCT PORTFOLIO

16.18.4 RECENT DEVELOPMENTS

16.19 NCINO

16.19.1 COMPANY SNAPSHOT

16.19.2 REVENUE ANALYSIS

16.19.3 PRODUCT PORTFOLIO

16.19.4 RECENT DEVELOPMENTS

16.2 MULESOFT

16.20.1 COMPANY SNAPSHOT

16.20.2 REVENUE ANALYSIS

16.20.3 PRODUCT PORTFOLIO

16.20.4 RECENT DEVELOPMENTS

16.21 ALKAMI

16.21.1 COMPANY SNAPSHOT

16.21.2 REVENUE ANALYSIS

16.21.3 PRODUCT PORTFOLIO

16.21.4 RECENT DEVELOPMENTS

16.22 D3 BANKING TECHNOLOGY

16.22.1 COMPANY SNAPSHOT

16.22.2 REVENUE ANALYSIS

16.22.3 PRODUCT PORTFOLIO

16.22.4 RECENT DEVELOPMENTS

16.23 COR FINANCIAL SOLUTION LTD

16.23.1 COMPANY SNAPSHOT

16.23.2 REVENUE ANALYSIS

16.23.3 PRODUCT PORTFOLIO

16.23.4 RECENT DEVELOPMENTS

16.24 VSOFT CORPORATION

16.24.1 COMPANY SNAPSHOT

16.24.2 REVENUE ANALYSIS

16.24.3 PRODUCT PORTFOLIO

16.24.4 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDIES AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST.

17 CONCLUSION

18 QUESTIONNAIRE

19 RELATED REPORTS

20 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.