O envelhecimento populacional na Polónia, Alemanha e Suíça está a impulsionar significativamente os mercados da Nutrição Parentérica Domiciliária (HPN) e da Nutrição Enteral Domiciliária (HEN). Na Polónia, a mudança demográfica está a resultar numa maior prevalência de doenças crónicas, como a diabetes, as doenças cardiovasculares e o cancro, que requerem frequentemente suporte nutricional a longo prazo. Os doentes idosos apresentam frequentemente dificuldades com a ingestão de nutrientes devido a dificuldades de deglutição e distúrbios gastrointestinais, aumentando a procura de HEN e HPN. Estas terapêuticas proporcionam cuidados contínuos e personalizados no domicílio, melhorando a qualidade de vida e reduzindo as readmissões hospitalares.

Aceda ao relatório completo em https://www.databridgemarketresearch.com/reports/poland-germany-and-switzerland-home-parenteral-nutrition-and-home-enteral-nutrition-market

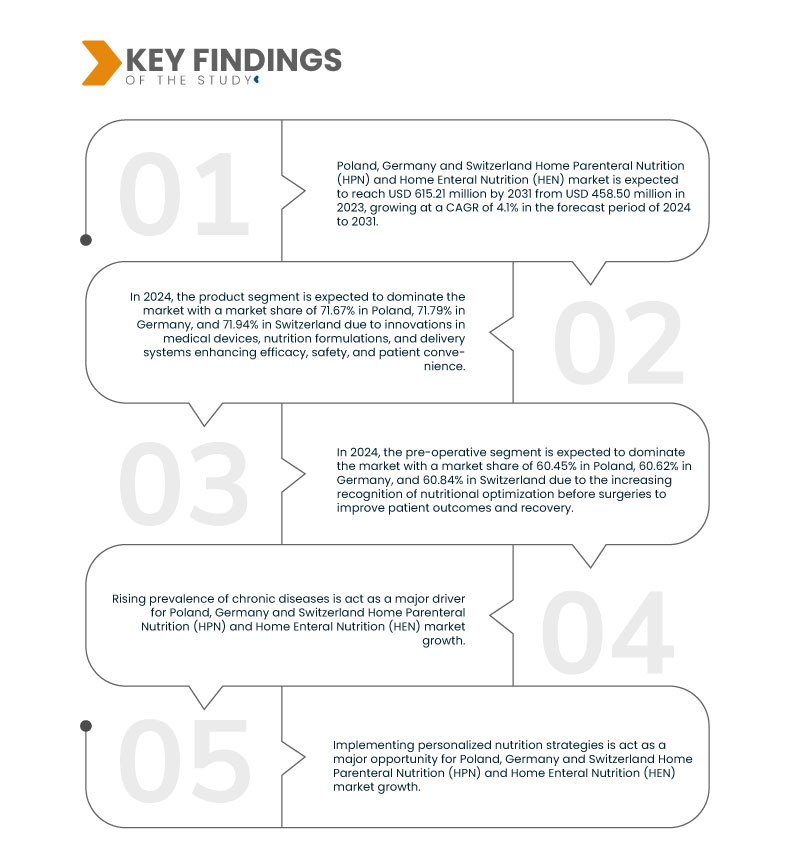

A Data Bridge Market Research analisa que o mercado de Nutrição Parentérica Domiciliária (HPN) e Nutrição Enteral Domiciliária (HEN) da Polónia, Alemanha e Suíça deverá atingir os 615,21 milhões de dólares até 2031, face aos 458,50 milhões de dólares em 2023, crescendo a um CAGR de 4,1% no período previsto de 2024 a 2031.

Principais conclusões do estudo

Aumento da prevalência de doenças crónicas

A crescente prevalência de doenças crónicas, como o cancro, as doenças gastrointestinais e as doenças metabólicas, tem implicações significativas para os mercados da Nutrição Parentérica Domiciliária (HPN) e da Nutrição Enteral Domiciliária (HEN) na Polónia, Alemanha e Suíça. Estas condições crónicas levam frequentemente a dificuldades na ingestão e absorção de nutrientes, tornando o suporte nutricional a longo prazo essencial para controlar os sintomas e melhorar os resultados dos doentes. As terapias HPN e HEN desempenham um papel crucial no enfrentamento destes desafios, fornecendo soluções nutricionais personalizadas que atendem às necessidades específicas dos doentes com doenças crónicas.

Âmbito do Relatório e Segmentação de Mercado

Métrica de Reporte

|

Detalhes

|

Período de previsão

|

2024 a 2031

|

Ano base

|

2023

|

Ano Histórico

|

2022 (personalizável para 2016–2021)

|

Unidades quantitativas

|

Receita em milhões de dólares americanos

|

Segmentos abrangidos

|

Produto e Serviços (Produto e Serviços), Tipo de Cuidados (Cuidados Pré-Operatórios e Cuidados Pós-Operatórios), Tipo de Doente (Problemas Neurológicos, Cancro, Função Intestinal Anormal, Doença de Crohn , Gastroparesia e Outros), Canal de Distribuição (Canal B2B e Canal B2C)

|

Países abrangidos

|

Polónia, Alemanha e Suíça

|

Participantes do mercado abrangidos

|

Fresenius SE & Co. KGaA (Alemanha), Nestlé (Suíça), Abbott (EUA), B. Braun SE (Alemanha), Baxter (EUA), CSL (Austrália), Nutricia (Holanda) e Pfizer Inc. (EUA), entre outras.

|

Pontos de dados abordados no relatório

|

Para além dos insights sobre os cenários de mercado, tais como o valor de mercado, a taxa de crescimento, a segmentação, a cobertura geográfica e os principais participantes, os relatórios de mercado selecionados pela Data Bridge Market Research incluem também análises aprofundadas de especialistas, epidemiologia dos doentes, análise de pipeline, análise de preços e estrutura regulamentar.

|

Análise de Segmentos

Polónia, Alemanha e Suíça O mercado da Nutrição Parentérica Domiciliária (HPN) e da Nutrição Enteral Domiciliária (HEN) está segmentado em quatro segmentos notáveis que se baseiam em produtos e serviços, tipo de cuidados, tipo de paciente e canal de distribuição.

- Com base em produtos e serviços, o mercado de Nutrição Parentérica Domiciliária (HPN) e Nutrição Enteral Domiciliária (HEN) da Polónia, Alemanha e Suíça está segmentado em produtos e serviços

Em 2024, prevê-se que o segmento de produtos domine o mercado da Nutrição Parentérica Domiciliária (HPN) e da Nutrição Enteral Domiciliária (HEN) na Polónia, Alemanha e Suíça.

Em 2024, prevê-se que o segmento de produtos domine o mercado com uma quota de mercado de 71,67% na Polónia, 71,79% na Alemanha e 71,94% na Suíça, devido às inovações em dispositivos médicos, formulações nutricionais e sistemas de administração, melhorando a eficácia, a segurança e a conveniência do doente.

- Com base no tipo de cuidados, o mercado de Nutrição Parentérica Domiciliária (HPN) e Nutrição Enteral Domiciliária (HEN) da Polónia, Alemanha e Suíça está segmentado em cuidados pré-operatórios e cuidados pós-operatórios

Em 2024, prevê-se que o segmento pré-operatório domine o mercado da Nutrição Parentérica Domiciliária (HPN) e da Nutrição Enteral Domiciliária (HEN) da Polónia, Alemanha e Suíça.

Em 2024, prevê-se que o segmento pré-operatório domine o mercado com uma quota de mercado de 60,45% na Polónia, 60,62% na Alemanha e 60,84% na Suíça, devido ao crescente reconhecimento da otimização nutricional antes das cirurgias para melhorar os resultados e a recuperação dos doentes.

- Com base no tipo de paciente, o mercado de Nutrição Parentérica Domiciliária (HPN) e Nutrição Entérica Domiciliária (HEN) da Polónia, Alemanha e Suíça está segmentado em problemas neurológicos, cancro, função intestinal anormal, doença de Crohn, gastroparesia e outros. Em 2024, prevê-se que o segmento dos problemas neurológicos domine o mercado com uma quota de mercado de 28,20% na Polónia, 28,50% na Alemanha e 28,90% na Suíça.

- Com base no canal de distribuição, o mercado de Nutrição Parentérica Domiciliária (HPN) e Nutrição Enteral Domiciliária (HEN) da Polónia, Alemanha e Suíça está segmentado em canal B2B e canal B2C. Em 2024, prevê-se que o segmento dos canais B2B domine o mercado com uma quota de mercado de 65,16% na Polónia, 65,31% na Alemanha e 65,50% na Suíça.

Principais jogadores

A Data Bridge Market Research reconhece as seguintes empresas como os principais participantes do mercado de Nutrição Parentérica Domiciliária (HPN) e Nutrição Entérica Domiciliária (HEN) na Polónia, Alemanha e Suíça: Fresenius SE & Co. KGaA (Alemanha), Nestlé (Suíça), Abbott (EUA), B. Braun SE (Alemanha), Baxter (EUA).

Desenvolvimentos de mercado

- Em fevereiro de 2024, a Fresenius Kabi avançou na sua colaboração com a Sociedade Europeia de Medicina de Cuidados Intensivos (ESICM) para melhorar a investigação e a formação médica em cuidados intensivos, apoiando iniciativas educativas e o desenvolvimento profissional. Esta parceria estratégica reforçou a posição da Fresenius Kabi na nutrição clínica, promovendo a inovação e a expertise, impulsionando, em última análise, melhores resultados para os doentes e reforçando a liderança da empresa no setor da saúde.

- Em abril de 2023, a Fresenius Medical Care recebeu o Prémio CIO 100 pela sua ferramenta inovadora de previsão de hipotensão intradialítica em doentes em hemodiálise. Este sucesso destacou o compromisso da Fresenius Kabi com os avanços tecnológicos, melhorando as suas soluções de nutrição clínica através da integração de análises preditivas para melhorar os resultados dos doentes.

- Em março de 2022, a Fresenius Kabi adquiriu uma participação maioritária na mAbxience e comprou a Ivenix para impulsionar o crescimento estratégico nos biofármacos e na MedTech. Isto fortaleceu a divisão de Nutrição Clínica da Fresenius Kabi, melhorando a sua oferta de produtos e expandindo as suas capacidades tecnológicas, melhorando, em última análise, os cuidados prestados aos doentes e o alcance do mercado.

- Em outubro de 2023, a Nestlé anunciou uma colaboração com a Amwell para melhorar os resultados dos doentes através de soluções de nutrição digital. A sua primeira iniciativa, o Programa de Cuidados Automatizados em Nutrição Cirúrgica Avançada, combinou a tecnologia virtual da Amwell com a bebida Impact ADVANCED RECOVERY da Nestlé para apoiar a recuperação cirúrgica. Esta colaboração beneficiou a Nestlé ao reforçar a sua posição no mercado da Nutrição Enteral Domiciliária (HEN), demonstrando o seu compromisso em integrar a nutrição e a tecnologia para melhorar os resultados clínicos.

- Em fevereiro de 2022, a Nestlé apoiou a Semana de Sensibilização para as Sondas Alimentares, de 7 a 11 de fevereiro de 2022, para destacar os benefícios das sondas alimentares como intervenções que salvam vidas. A empresa partilhou informações sobre os seus produtos de nutrição médica, incluindo suplementos nutricionais, alimentações por sonda e espessantes alimentares. Esta iniciativa aumentou a consciencialização sobre a alimentação por sonda e a importância da nutrição médica, beneficiando a Nestlé Health Science ao demonstrar a sua experiência e empenho na melhoria dos cuidados prestados aos doentes. Com este esforço, fortaleceram a sua relação com os profissionais de saúde e o público

- Em junho de 2024, a Abbott anunciou a autorização da FDA para dois novos sistemas CGM de venda livre, o Lingo e o Libre Rio, baseados na sua tecnologia FreeStyle Libre. O Lingo foi criado para consumidores que procuram melhorar a saúde e o bem-estar, enquanto o Libre Rio é para adultos com diabetes tipo 2 que controlam a sua condição através de mudanças no estilo de vida.

- Em março de 2024, a Abbott, o Real Madrid e a Fundação Real Madrid prolongaram a sua parceria até à época 2026-27, com foco na saúde e nutrição para crianças de todo o mundo. Esta extensão irá reforçar o papel da Abbott no fornecimento de educação nutricional e rastreio da malnutrição nas Escolas Sociais Desportivas da Fundação Real Madrid, reforçando o seu compromisso com a saúde global e reforçando a sua reputação de marca.

- Em janeiro de 2024, a Abbott, líder global em nutrição baseada na ciência, anunciou hoje o lançamento da sua nova marca PROTALITY™. O batido nutricional de alta proteína é o primeiro produto desta linha a apoiar o crescente número de adultos interessados em seguir a perda de peso mantendo a massa muscular e uma boa nutrição

- Em maio de 2023, a Abbott revelou novos programas no seu esforço contínuo para aumentar a diversidade nos ensaios clínicos e nos cuidados de saúde para grupos sub-representados. Estas adições à iniciativa Diversidade em Ensaios Clínicos expandem as parcerias, bolsas de estudo e esforços para incluir participantes diversificados nos ensaios clínicos da Abbott. Esta iniciativa não só melhorará os resultados de saúde para as populações sub-representadas, como também aumentará a compreensão da empresa sobre o desempenho dos seus produtos em diversos grupos de doentes, conduzindo, em última análise, a soluções de saúde mais inclusivas e eficazes.

- Em junho de 2022, a Easterseals recebeu uma doação de 750.000 dólares do Fundo Abbott para lançar o Projeto sobre Educação e Equidade em Saúde Comunitária. Esta iniciativa piloto de três anos, que decorre até 2025, tem como alvo as barreiras sistémicas à educação e à saúde em comunidades com poucos investimentos. Este projeto não só demonstra o compromisso da Abbott em melhorar o acesso à saúde e à educação, como também está alinhado com os seus objetivos de responsabilidade social corporativa, promovendo a boa vontade e a perceção positiva da marca.

- Em janeiro de 2023, a Nutricia lança o Fortimel PlantBased Energy, a sua bebida nutricional médica pioneira à base de plantas, que visa satisfazer as necessidades nutricionais de indivíduos que seguem dietas veganas, vegetarianas ou flexitarianas, bem como aqueles com alergia à proteína do leite de vaca. Desenvolvido para apoiar doentes com risco de desnutrição devido a doença, este suplemento pronto a beber oferece um perfil nutricional completo, apresentando proteínas vegetais de alta qualidade derivadas de fontes de ervilha e soja. Disponível nos sabores Manga & Maracujá e Mocha (Café & Chocolate), o produto foi clinicamente comprovado por aumentar a ingestão de proteína e energia, ao mesmo tempo que demonstrou uma elevada adesão dos doentes ao longo de um período de estudo de 4 semanas. A Nutricia, alavancando a expertise da Danone em nutrição vegetal, lança o Fortimel PlantBased Energy inicialmente em vários países europeus, com planos para uma distribuição mais ampla ao longo de 2023. Esta inovação reforça o compromisso da Nutricia em fornecer soluções nutricionais personalizadas, alinhadas com as diversas preferências alimentares e necessidades médicas.

Para obter informações mais detalhadas sobre o relatório de mercado Nutrição Parentérica Domiciliária (HPN) e Nutrição Enteral Domiciliária (HEN) da Polónia, Alemanha e Suíça , clique aqui – https://www.databridgemarketresearch.com/reports/poland-germany-and-switzerland-home-parenteral-nutrition-and-home-enteral-nutrition-market