North America Aesthetic & Cosmetic Surgery Devices Market, By Type (Breast Implant/Mammary Implants, Implants for the Body and Custom Made Implants), Raw Material (Polymers, Metals, and Biomaterials), End User (Clinics, Hospitals, Dermatology Clinics and others), Distribution Channel (Direct Tender, Retail Pharmacies), Country (U.S., Canada, Mexico) Industry Trends and Forecast to 2028.

Market Analysis and Insights: North America Aesthetic and Cosmetic Surgery Devices Market

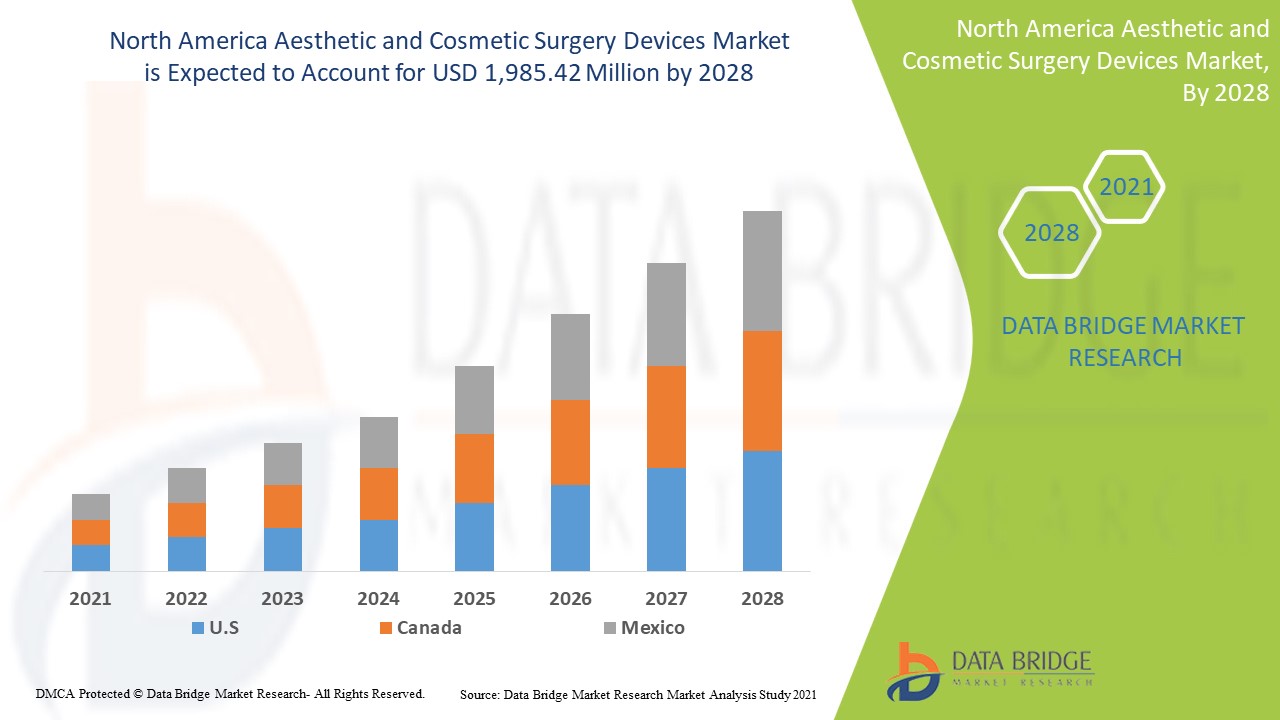

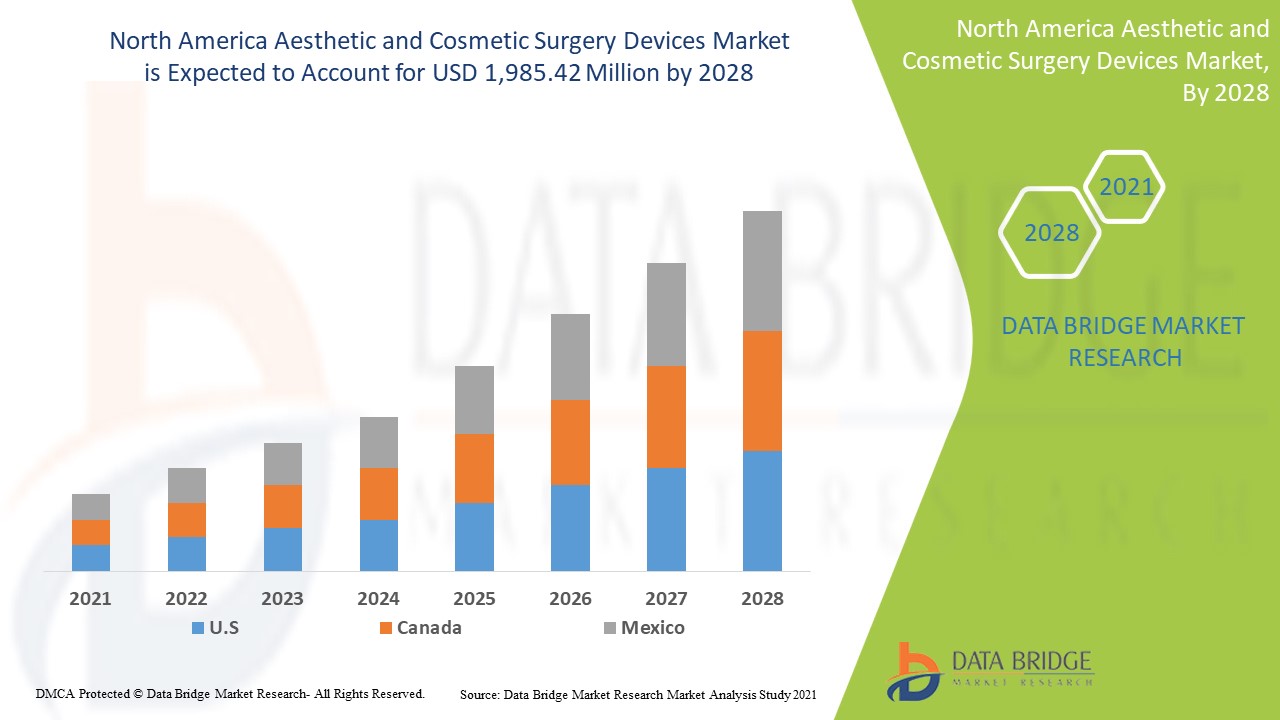

Aesthetic & cosmetic surgery devices market is expected to gain market growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyses that the market is growing with a CAGR of 7.0% in the forecast period of 2021 to 2028 and is expected to reach USD 1,985.42 million by 2028. Increasing usage of aesthetic & cosmetic surgery devices’ products, growing geriatric populace are the major drivers which propelled the demand of the market in the forecast period.

Advancement in healthcare infrastructure effectively help the growth of the aesthetic & cosmetic surgery devices market. However, the complications associated with the aesthetic & cosmetic surgery devices may hamper the future growth of aesthetic & cosmetic surgery devices market. The partnerships and acquisitions by major market players act as opportunity for the growth of aesthetic & cosmetic surgery devices market.

Aesthetic & cosmetic surgery devices market is growing tremendously across the globe due to the growing geriatric population across globe. The presence of wide range of aesthetic & cosmetic surgery devices products is satisfying the need of the surgeons during aesthetic & cosmetic surgery. The increased technological advancement leads to increased product launch by key market players of the aesthetic & cosmetic surgery devices market. Major factors driving the growth of this market are rising per capita income, technological advancement and growing awareness about reconstructive breast surgeries among other and the factor which hampers the growth of this market are escalating product recall and high cost of treatment among more.

The aesthetic & cosmetic surgery devices market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

North America Aesthetic & Cosmetic Surgery Devices Market Scope and Market Size

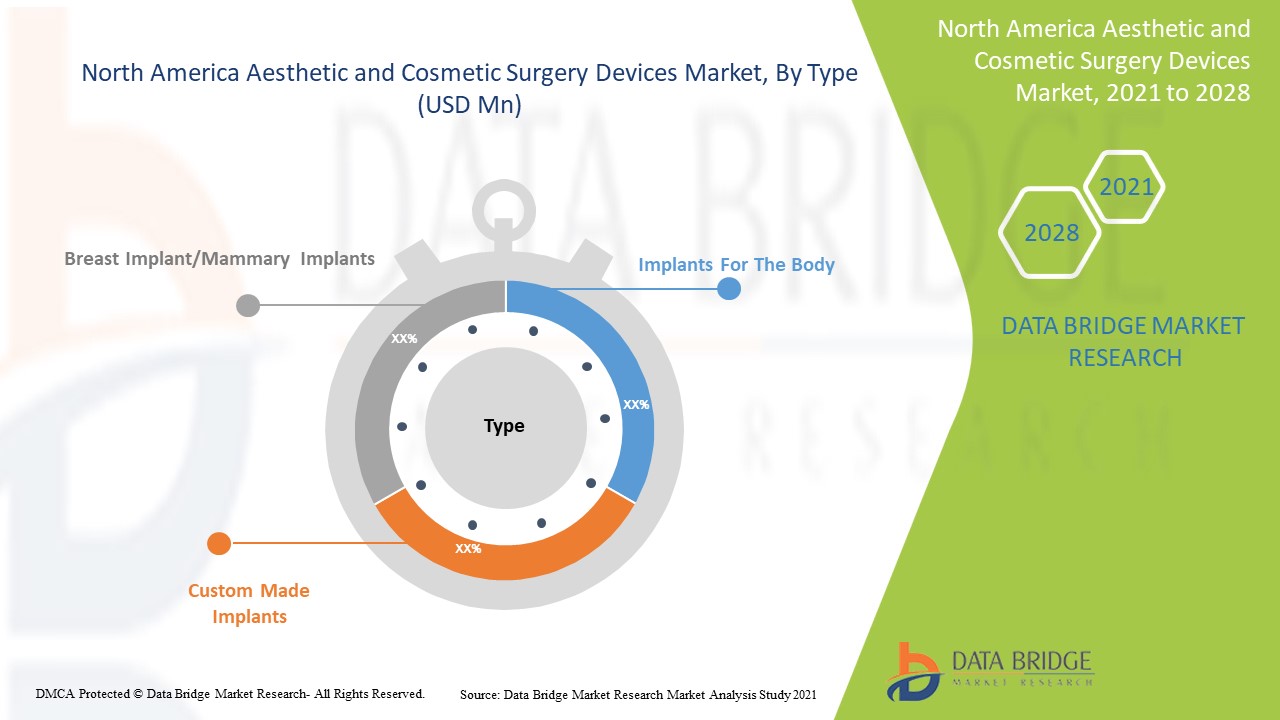

Aesthetic & cosmetic surgery devices market is segmented on the basis of type, raw material, end user and distribution channel. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of type, the aesthetic & cosmetic surgery devices market is segmented into breast implant/mammary implants, implants for the body and custom made implants. In 2021, breast implant/mammary implants are dominating the market due to the rising prevalence & incidence of breast cancer across the globe.

- On the basis of raw material, the aesthetic & cosmetic surgery devices market is segmented into polymers, metals, and biomaterials. In 2021, polymers are dominating the market due to the rising healthcare expenditure and increasing demand of various polymer aesthetic & cosmetic surgery devices.

- On the basis of end user, the aesthetic & cosmetic surgery devices market is segmented into clinics, hospitals, dermatology clinics and others. In 2021, hospitals segment is dominating the market as it provides patients with best and accessible healthcare services.

- On the basis of distribution channel, the aesthetic & cosmetic surgery devices market is segmented into direct tender and retail pharmacies. In 2021, direct tender segment is dominating the market because direct tender holds the largest market share along with highest CAGR because most of the service providers buy the devices from manufacturers, and it is noticed that revenue from direct sales is higher; so it is influential as well as growing in the market.

Aesthetic & Cosmetic Surgery Devices Market Country Level Analysis

The aesthetic & cosmetic surgery devices market is analysed and market size information is provided by type, raw material, end user and distribution channel referenced above.

The countries covered in the North America aesthetic & cosmetic surgery devices market report are the U.S., Canada, and Mexico.

North America is expected to dominate the market due to the high adoption of aesthetic & cosmetic surgery devices by the patients in the region. The U.S is dominating in the market and leading the growth in the North America market due to increased presence of key market players in the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of North America brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Increasing Acquisition and Merger in Aesthetic & Cosmetic Surgery Devices Market is Creating New Opportunities for Players

Aesthetic & cosmetic surgery devices market also provides you with detailed market analysis for every country growth. Additionally, it provides data regarding acquisition and agreement among the major market plyers and start-up companies. Moreover, growing impact of research and development activities on aesthetic & cosmetic surgery devices market growth pace. The data is available for historic period 2010 to 2019.

Competitive Landscape and Aesthetic & Cosmetic Surgery Devices Market Share Analysis

Aesthetic & cosmetic surgery devices market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to aesthetic & cosmetic surgery devices market.

The major players covered in the report Johnson & Johnson Services, Inc., Allergan (A Subsidiary of abbvie INC.), Airxpanders, Inc., Bonashmedical, Cereplas, Coloplast Corp, DPS Technology Development Ltd, Establishment Labs S.A., GC Aesthetics, Hansbiomed co. Ltd, Ideal Implant Incorporated, Implantech, Koken Co., Ltd., Laboratoires Arion, PMT Corporation, Polytech Health & Aesthetics Gmbh, Rigicon Inc., Sebbin, Shanghai Kangning Medical Supplies Ltd., Sientra, Inc., Silimed, Stryker, Surgisil LLP, Wanhe, Xilloc Medical B.V., Integra Lifesciences, Lipoelastic A.S., Defygravity, and Karl Storz Se & Co. Kg among others domestic and North America players. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Growing contract, partnership and acquisition by key players accelerating the aesthetic & cosmetic surgery devices market growth.

For instance,

- In May 2020, AbbVie Inc. has completed its acquisition of Allergan. This acquisition has helped AbbVie Inc. to increase its market and demand for its product in future as the acquisition has combined the product portfolio of the companies thereby strengthening their business.

- In June 2019, Establishment Labs S.A. collaborated with the Ipomia, a firm which is engaged in manufacturing to create a line of bras, that is, post-op bras exclusively for women who receive breast surgery with Motiva Implants. This new collaboration has increased the credibility of the company in the market.

Collaboration, joint ventures and other strategies by the market player is enhancing the company footprints in the aesthetic & cosmetic surgery devices market which also provides the benefit for organisation growth pace.

SKU-