Asia-Pacific Aesthetic & Cosmetic Surgery Devices Market, By Type (Breast Implant/Mammary Implants, Implants for the Body and Custom Made Implants), Raw Material (Polymers, Metals and Biomaterials), End User (Clinics, Hospitals, Dermatology Clinics and Others), Distribution Channel (Direct Tender, Retail Pharmacies), Country(China, Japan, India, South Korea, Australia, Singapore, Thailand, Malaysia, Indonesia, Philippines, Vietnam, rest of Asia Pacific). Industry Trends and Forecast to 2028.

Market Analysis and Insights: Asia-Pacific Aesthetic and Cosmetic Surgery Devices Market

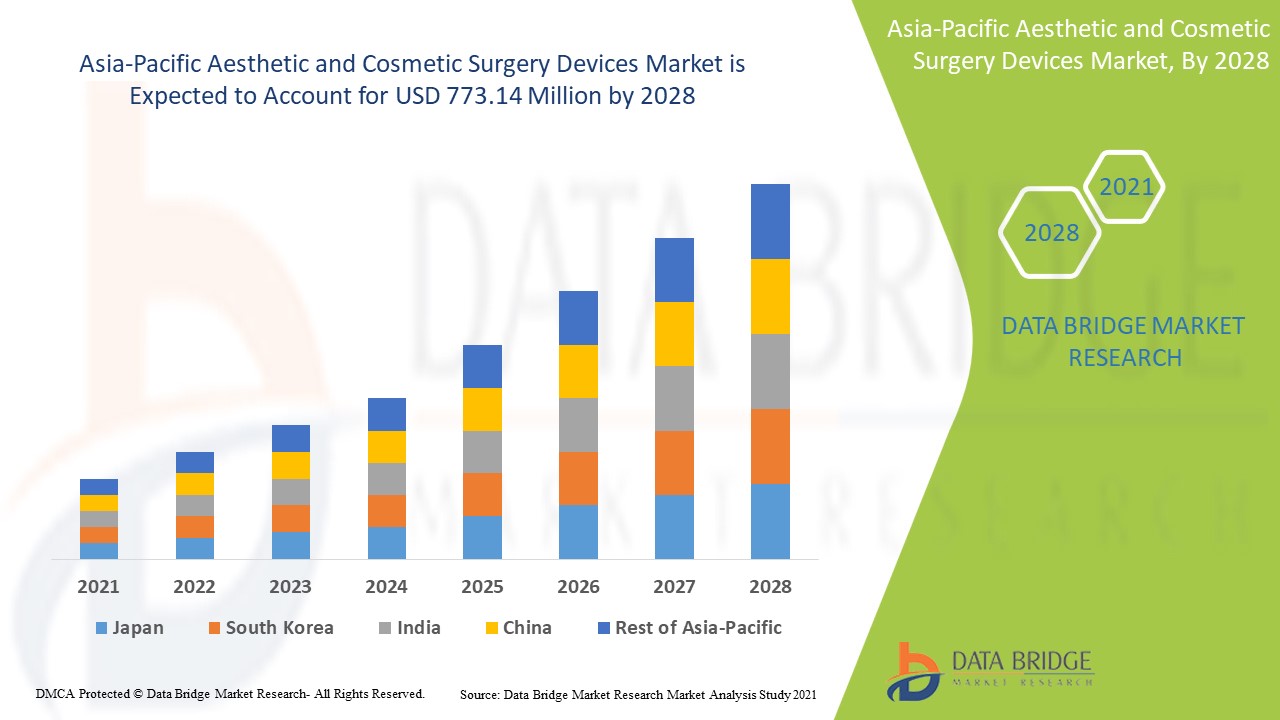

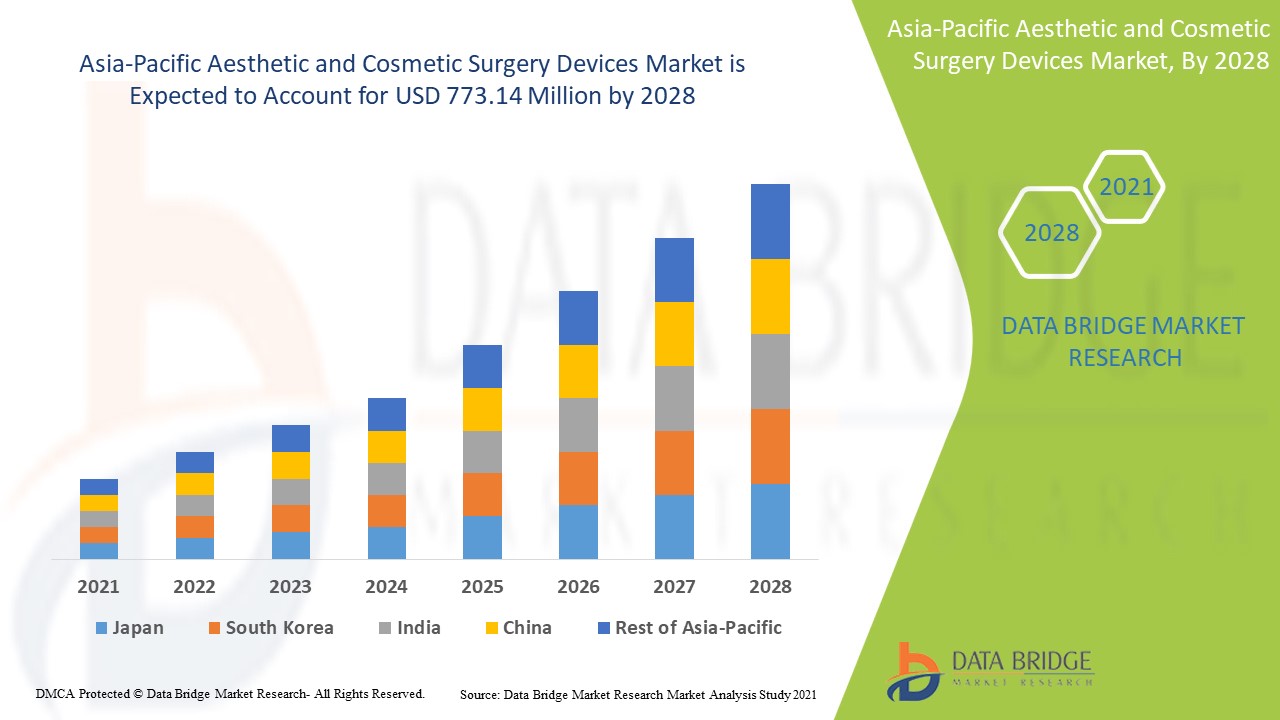

The aesthetic & cosmetic surgery devices market is expected to gain market growth in the forecast period of 2021 to 2028. Data Bridge Market Research analyses that the market is growing with a CAGR of 8.4% in the forecast period of 2021 to 2028 and is expected to reach USD 773.14 million by 2028. Growing geriatric population and rising per capita income are the major drivers which propelled the demand of the aesthetic & cosmetic surgery devices market in the forecast period.

The aesthetic & cosmetic surgery devices market is growing tremendously across the globe due to the growing geriatric population across globe. The presence of wide range of aesthetic & cosmetic surgery devices products is satisfying the need of the surgeons during aesthetic & cosmetic surgery. The increased technological advancement leads to increased product launch by key market players of the aesthetic & cosmetic surgery devices market.

Advancement in healthcare infrastructure in developed as well as developing country is anticipated to bolster the further aesthetic & cosmetic surgery devices market growth. Devices/product recall by the regulatory authorities for patient health safety concerns such as inaccuracy of device, display error are few of the major concerns that acts as a restraint in the growth of the aesthetic & cosmetic surgery devices market. Favourable labour cost and increased developments in the developing countries makes the emerging markets as an opportunity for the growth of the aesthetic & cosmetic surgery devices market. Regulation policy and increasing risks associated with the procedure are acting as challenge for hampering the demand of the aesthetic & cosmetic surgery devices market.

The aesthetic & cosmetic surgery devices market report provides details of market share, new developments, and product pipeline analysis, impact of domestic and localised market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

Asia-Pacific Aesthetic & Cosmetic Surgery Devices Market Scope and Market Size

The aesthetic & cosmetic surgery devices market is segmented on the basis of the type, raw material, end user and distribution channel. The growth among segments helps you analyse niche pockets of growth and strategies to approach the market and determine your core application areas and the difference in your target markets.

- On the basis of type, the aesthetic & cosmetic surgery devices market is segmented into breast implant/mammary implants, implants for the body and custom made implants. In 2021, breast implant/mammary implants segment is dominating the market due to the rising prevalence and incidence of breast cancer across the globe.

- On the basis of raw material, the aesthetic & cosmetic surgery devices market is segmented into polymers, metals and biomaterials. In 2021, polymers segment is dominating the market due to the rising healthcare expenditure and increasing demand of various polymer aesthetic & cosmetic surgery devices.

- On the basis of end user, the aesthetic & cosmetic surgery devices market is segmented into clinics, hospitals, dermatology clinics and others. In 2021, hospitals segment is dominating the market as it provides patients with the best and accessible healthcare services.

- On the basis of distribution channel, the aesthetic & cosmetic surgery devices market is segmented into direct tender and retail pharmacies. In 2021, direct tender segment is dominating the market because direct tender holds the largest market share along with the highest CAGR because most of the service providers buy the devices from manufacturers and it is noticed that revenue from direct sales is higher, so it is influential as well as growing in the market.

Aesthetic & Cosmetic Surgery Devices Market Country Level Analysis

The aesthetic & cosmetic surgery devices market is analysed and market size information is provided by the country, type, raw material, end user and distribution channel as referenced above.

The countries covered in the Asia-Pacific aesthetic & cosmetic surgery devices market report are China, Japan, India, South Korea, Australia, Singapore, Thailand, Malaysia, and Indonesia, Philippines, Vietnam and rest of Asia Pacific.

China is leading the growth of the Asia-Pacific aesthetic & cosmetic surgery devices market due to growing geriatric population as well as technology advancement for the breast implant/mammary implants segment in healthcare sector.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, presence and availability of Asia-Pacific brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Growing Strategic Activities by Major Market Players to enhance the awareness is boosting the Aesthetic & Cosmetic Surgery Devices Market Growth

The aesthetic & cosmetic surgery devices market also provides you with detailed market analysis for every country growth in aesthetic & cosmetic surgery devices industry. Moreover, it provides detailed information regarding aesthetic & cosmetic surgery devices sales, impact of regulatory scenarios, and trending parameters regarding aesthetic & cosmetic surgery devices market. The data is available for historic period 2011 to 2019.

Competitive Landscape and Aesthetic & Cosmetic Surgery Devices Market Share Analysis

The aesthetic & cosmetic surgery devices market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breath, application dominance, technology lifeline curve. The above data points provided are only related to the company’s focus related to aesthetic & cosmetic surgery devices market.

The major players covered in the reports are Johnson & Johnson Services, Inc., Allergan (A Subsidiary of abbvie INC.), Coloplast Corp, DPS Technology Development Ltd, GC Aesthetics, Hansbiomed Co. Ltd, Koken Co., Ltd., Laboratoires Arion, PMT Corporation, Polytech Health & Aesthetics Gmbh, Shanghai Kangning Medical Supplies Ltd., Sientra, Inc., Stryker, Wanhe, Integra Lifesciences, Lipoelastic A.S., Defygravity, and Karl Storz Se & Co. Kg among others.. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many contracts and agreements are also initiated by the companies’ worldwide which are also accelerating the aesthetic & cosmetic surgery devices market.

For instance,

- In May 2020, AbbVie Inc., the parent company of Allergan has completed its acquisition of Allergan. This acquisition has helped AbbVie Inc. to increase its market and demand for its product in future as the acquisition has combined the product portfolio of the companies thereby strengthening their business.

Collaboration, product launch, business expansion, award and recognition, joint ventures and other strategies by the market players is enhancing the company footprints in the aesthetic & cosmetic surgery devices market which also provides the benefit for organization’s profit growth.

SKU-