Middle East & Africa Parcel Sortation Systems market, By Type (Linear Parcel Sortation Systems and Loop Parcel Sortation Systems), Offering (Hardware, Software, and Services), Tray Size (Small, Medium and Large), Parcel Handling Capacity (Less than 20000 Parcels/Hr, 20000 To 30000 Parcels/Hr And More than 30000 Parcels/Hr), End User (Logistics, E Commerce, Pharmaceutical and Medical Supply, Food & Beverages and Others), Country (U.A.E., Saudi Arabia, Israel, Egypt, South Africa and Rest of Middle East & Africa), Market Trends and Forecast to 2029

Market Analysis and Insights: Middle East and Africa Parcel Sortation Systems Market

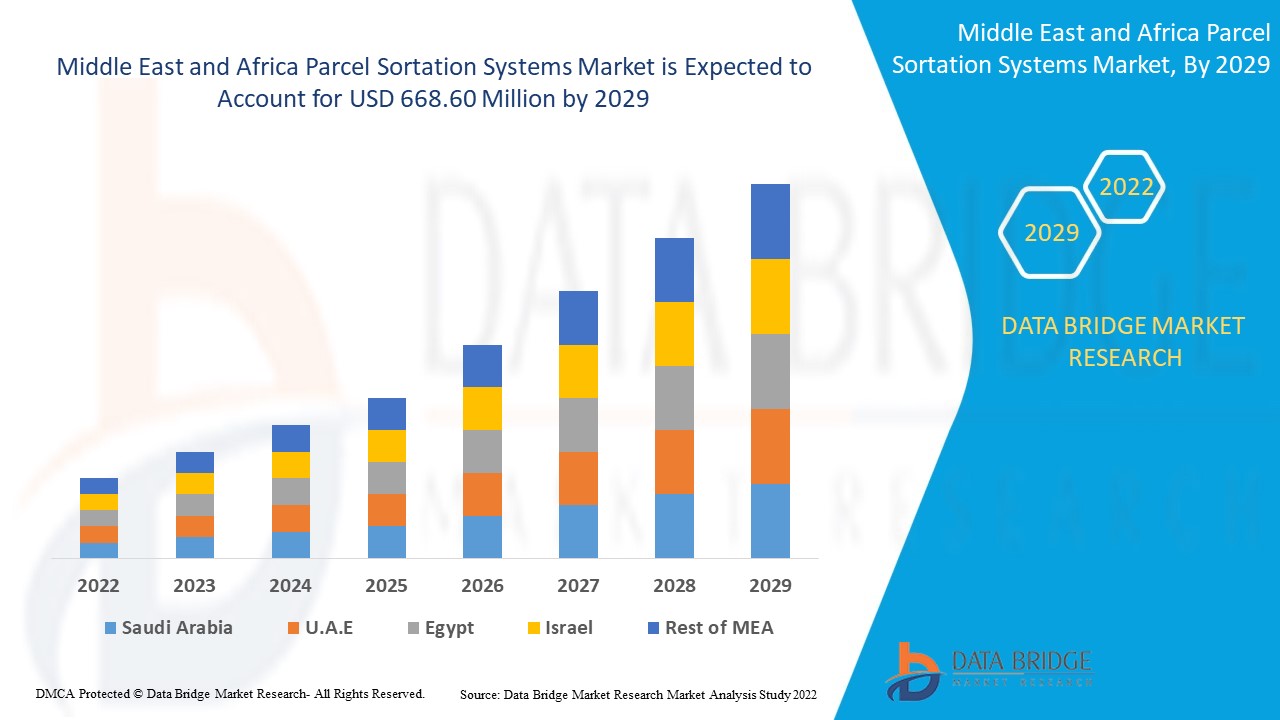

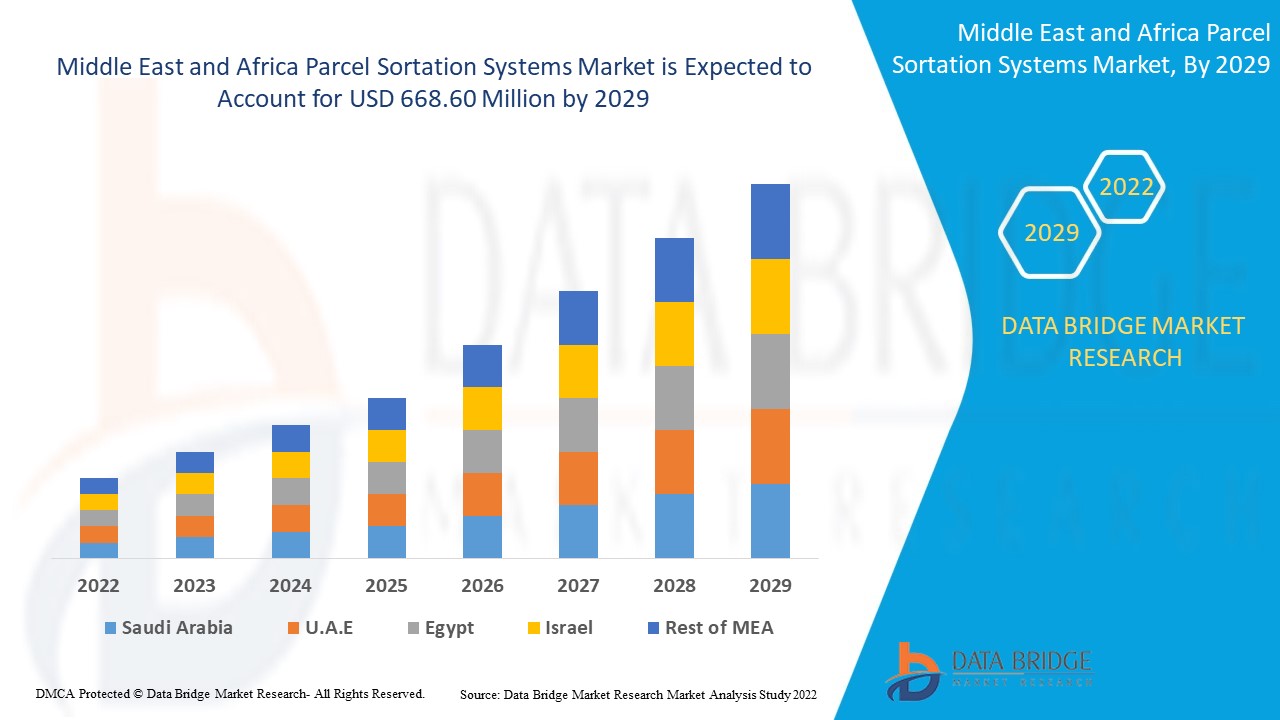

Middle East & Africa Parcel Sortation Systems market is expected to gain market growth in the forecast period of 2022 to 2029. Data Bridge Market Research analyses that the market is growing with the CAGR of 12.4% in the forecast period of 2022 to 2029 and is expected to reach 668.60 million by 2029.

Parcel sortation is the process of identifying items on a conveyor system and diverting them to specific destinations using various devices controlled by task-specific software. They can also read any applicable labels or even apply new ones. These operations are incredibly important to ensuring the packages get to their final destination, but arranging deliveries is the task that provides the most direct benefit to that end. Parcel sortation the containers into the correct delivery areas to get them on their way to their final destination. Sortation can have a great impact on the efficiency of your fulfillment automation. Parcels come in a variety of shapes and sizes and need to be arranged accordingly. Conveyor systems and other mechanical processes can help streamline your fulfillment automation and keep things moving. In a distribution center, parcel sortation can be applicable at different steps of the order fulfillment process, such as receiving, picking, packing, and shipping. The selection of sortation systems is decided considering the following characteristics such as the fragility of the material to be handled, product geometry, materials, rate consideration, sorter function, available footprint, among others.

There is an increasing investment in logistics infrastructure in urban planning, which acts as a major factor for the growth of the market. The developments in technologies such as AI and robots for sorting operations has boosted the growth of the market. However, the incorporation of automation technologies regulated by the government can act as a significant restraint for the development of the market. Middle East & Africa region has witnessed increasing adoption of automated sortation systems at airports to handle the increasing traffic, this opens up opportunities in the market. High customer expectations pertaining to delivery timelines can act as a major challenge for the growth of the market.

This parcel sortation systems market report provides details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief, our team will help you create a revenue impact solution to achieve your desired goal.

Middle East & Africa Parcel Sortation Systems Market Scope and Market Size

Middle East & Africa Parcel Sortation Systems market is segmented into five notable segments based on type, offering, tray size, parcel handling capacity, and end user.

- On the basis of type, the Asia-Pacific Parcel Sortation Systems market is segmented into linear parcel sortation systems and loop parcel sortation systems. In 2022, the linear parcel sortation systems segment is expected to dominate the market as it offers several benefits, including higher throughput, and requires less space comparatively. The small and medium fulfillment centers are increasingly adopting this system in the region to handle the increased volumes of parcels

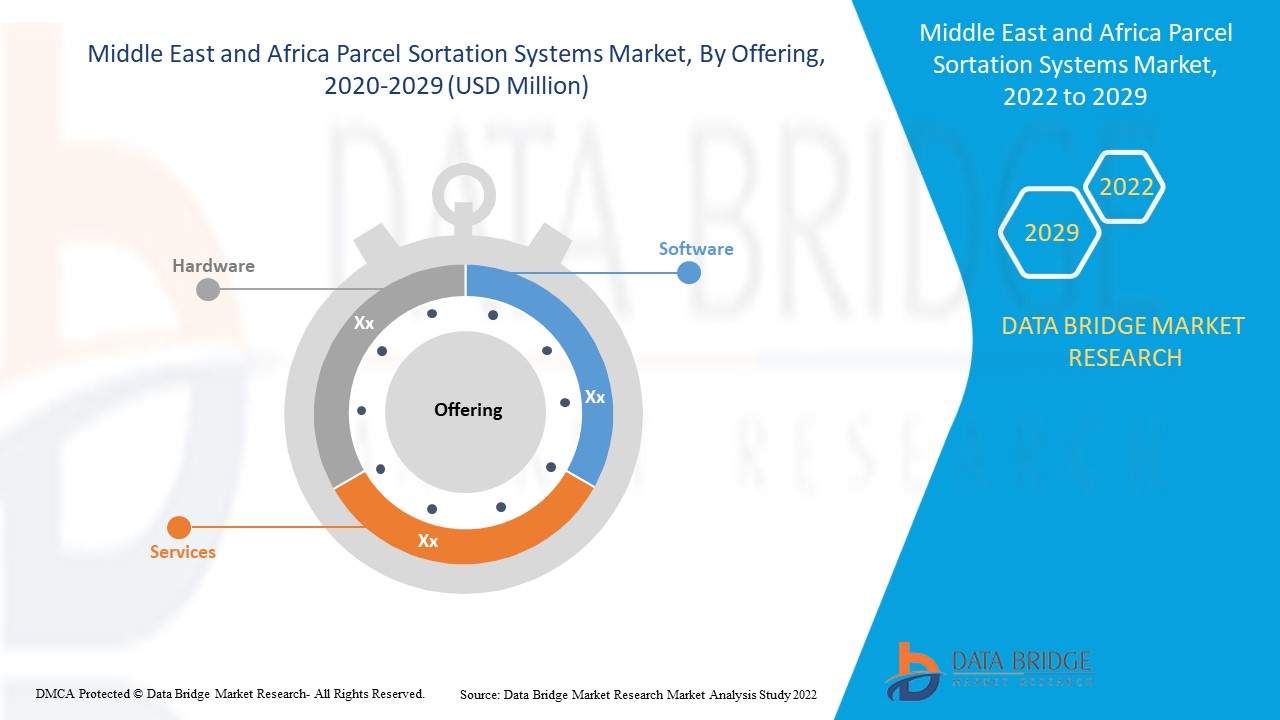

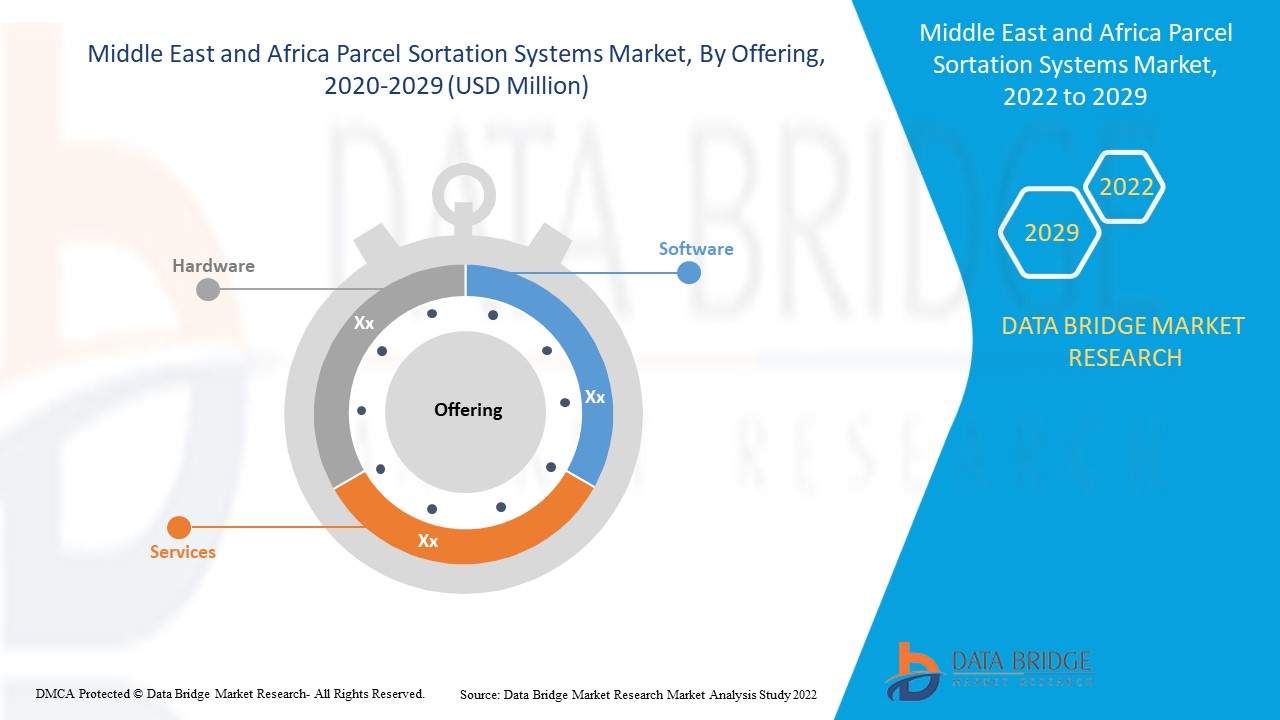

- On the basis of offering, the global Parcel Sortation Systems market is segmented into hardware, software, and services. In 2022, hardware segment is expected to dominate the market, as hardware-based sortation systems increase sorting efficiency. In addition, hardware implementation can speed up sorting applications and makes extensive use of concurrent data comparisons and swaps each clock cycle

- On the basis of tray size, the global Parcel Sortation Systems market is segmented into small, medium, and large. In 2022, the medium segment is expected to dominate the market as the number of the medium sized package is increasing in the logistic hubs owing to increased e commerce trade which requires medium sized trays and fuels the adoption of medium tray size in the parcel sortation systems market

- On the basis of parcel handling capacity, the global Parcel Sortation Systems market is segmented into less than 20000 parcels/hr, 20000 to 30000 parcels/hr, and more than 30000 parcels/hr. In 2022, less than 20000 Parcels/hr is expected to dominate the market as the adoption of sortation systems among the small and medium sized enterprises are increasing, which has a lower volume of parcels to handle and have limited spending power

- On the basis of end users, the global Parcel Sortation Systems market is segmented into logistics, e commerce, pharmaceutical, medical supply, food & beverages, and others. In 2022, e-commerce is expected to dominate the market as ecommerce industry is growing exponentially in recent years, which also increases the number of parcels to be sorted and delivered to customers worldwide

Middle East & Africa Parcel Sortation Systems Market Country Level Analysis

The Middle East & Africa Parcel Sortation Systems market is analysed, and market size information is provided by country, type, offering, tray size, parcel handling capacity, and end user.

The countries covered in Middle East & Africa Parcel Sortation Systems market report are U.A.E., Saudi Arabia, Israel, Egypt, South Africa, and Rest of the Middle East & Africa.

Israel is dominating the market in the Middle East & Africa region due to the increasing adoption of automation in the logistics sector and technological incorporations such as IoT for process monitoring and data collection to gain business insights on sortation systems for supply chain efficiency.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that affects the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to significant or scarce competition from local and domestic brands, impact of sales channels are considered while providing forecast analysis of the country data.

Rising Demand of Parcel Sortation Systems

The Middle East & Africa Parcel Sortation Systems market also provides you with detailed market analysis for every country growth in industry with sales, components sales, the impact of technological development in Parcel Sortation Systems, and changes in regulatory scenarios with their support for the Parcel Sortation Systems market. The data is available for historic period 2012 to 2020.

Competitive Landscape and Middle East & Africa Parcel Sortation Systems Market Share Analysis

Middle East & Africa Parcel Sortation Systems market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to Middle East & Africa Parcel Sortation Systems market.

The major players covered in the report are Siemens Logistics GmbH (A Subsidiary of Siemens AG), BEUMER GROUP, FIVES, Dematic, Murata Machinery, Ltd., Interroll Group, BOWE SYSTEC GMBH, and Honeywell International Inc., among other domestic players. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many product developments are also initiated by the companies worldwide, which are also accelerating the growth of Middle East & Africa Parcel Sortation Systems market.

For instance,

- In September 2019, BOWE SYSTEC GMBH announced the launch of Double Split-Tray sorter at the Parcel+Post Expo in Amsterdam. The new system was designed for sorting light items weighing up to 5 kilograms. It was able to sort products such as clothing, books, pharmaceuticals, polybags, multimedia, and flat items, or jewellery. With this, the company was able to offer sorters able to handle parcels of varying shapes and sizes, which enhanced the company's product portfolio in the market for parcels sortation systems.

- In June 2021, Interroll Group announced the launch of MX 018V Vertical Crossbelt Sorter. The new product is enabled with cost-saving, energy-efficient, easy to maintain, and made it easier for system integrators and their end customers to enter the world of ,automated crossbelt sortation solutions. It enabled courier and parcel service providers, e-commerce providers, and logistics service providers to gain the ability to handle a high variety of goods in a space-saving, gentle and energy-efficient manner via a single technical infrastructure with an increased number of end points. This enhanced the company’s product portfolio.

Partnership, joint ventures, and other strategies enhance the company's market share with increased coverage and presence. It also provides the benefit for an organisation to improve their offering for Parcel Sortation Systems through expanded range of size.

SKU-