Asia Pacific Parcel Sortation Systems Market, By Type (Linear Parcel Sortation Systems and Loop Parcel Sortation Systems), Offering (Hardware, Software, and Services), Tray Size (Small, Medium and Large), Parcel Handling Capacity (Less than 20000 Parcels/Hr, 20000 To 30000 Parcels/Hr And More than 30000 Parcels/Hr), End User (Logistics, E Commerce, Pharmaceutical and Medical Supply, Food & Beverages and Others), Country (China, Japan, South Korea, India, Australia, Singapore, Thailand, Malaysia, Indonesia, Philippines, Rest of Asia-Pacific) Industry Trends and Forecast to 2029

Market Analysis and Insights: Asia-Pacific Parcel Sortation Systems Market

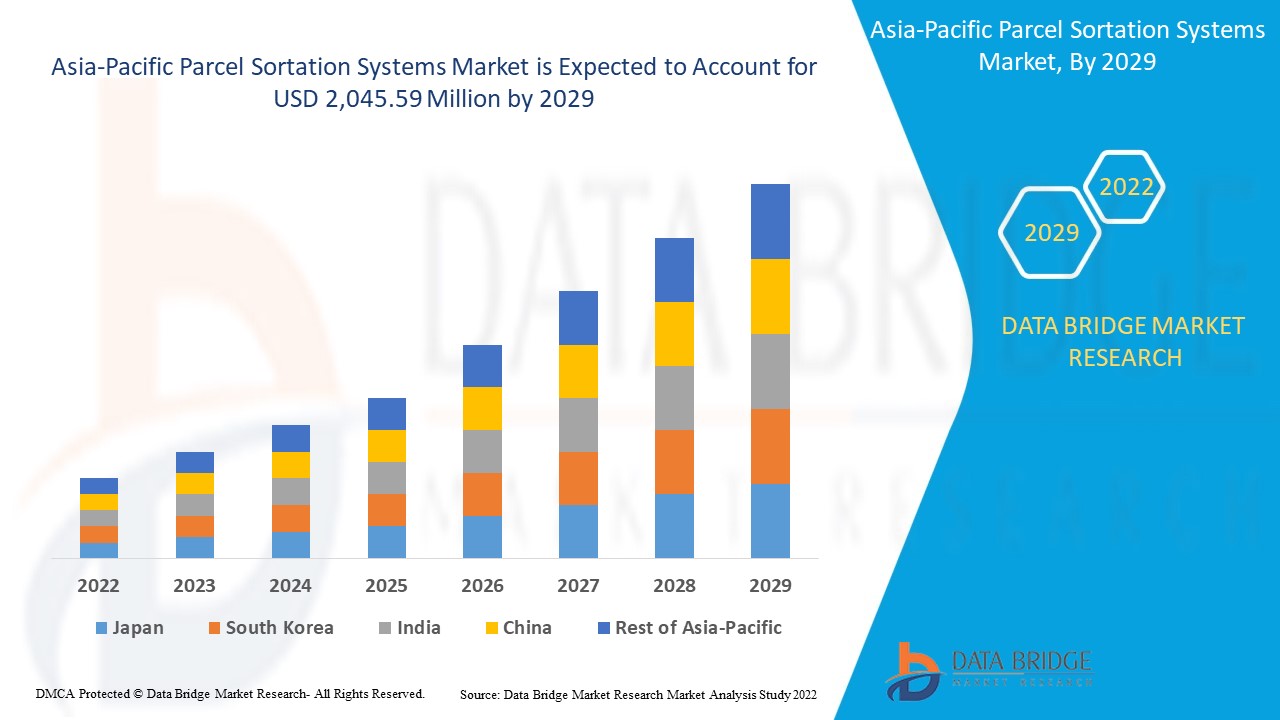

The Asia-Pacific Parcel Sortation Systems market is expected to gain market growth from 2022 to 2029. Data Bridge Market Research analyses that the market is growing with a CAGR of 14.9% in the forecast period of 2022 to 2029 and is expected to reach 2,045.59 million by 2029.

Parcel sortation is the process of identifying items on a conveyor system and diverting them to specific destinations using a variety of devices controlled by task-specific software. They can also read any applicable labels or even apply new ones. These operations are incredibly important to ensuring the packages get to their final destination, but arranging deliveries is the task that provides the most direct benefit to that end. Parcel sortation puts the packages into the correct delivery areas to get them on their way to their final destination. Sortation can have a significant impact on the efficiency of your fulfillment automation. Parcels come in a variety of shapes and sizes and need to be arranged accordingly. Conveyor systems and other mechanical processes can help streamline your fulfillment automation and keep things moving. In a distribution center, parcel sortation can be applicable at different steps of the order fulfillment process, such as receiving, picking, packing, and shipping. The selection of sortation systems is decided considering the following characteristics such as the fragility of the material to be handled, product geometry, materials, rate consideration, sorter function, available footprint, among others.

Increasing parcel volumes due to the change in the regional e commerce industry acts as a major factor in the market's growth. Developments in technologies such as AI and robots for sorting operations increased market's growth. However, high initial investment and deployment costs can act as a significantsignificant restraint for the development of the market. Asia-Pacific region has witnessed high investments in supply chain automation technologies this opens up opportunities in the market. Wide variety in parcel sizes and volume can act as a significant challenge for the growth of the market.

This parcel sortation systems market report provides details of market share, new developments, and product pipeline analysis, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, product approvals, strategic decisions, product launches, geographic expansions, and technological innovations in the market. To understand the analysis and the market scenario, contact us for an Analyst Brief. Our team will help you create a revenue impact solution to achieve your desired goal.

Asia-Pacific Parcel Sortation Systems Market Scope and Market Size

The Asia-Pacific parcel sortation systems market is segmented into five segments based on type, offering, tray size, parcel handling capacity, and end-user.

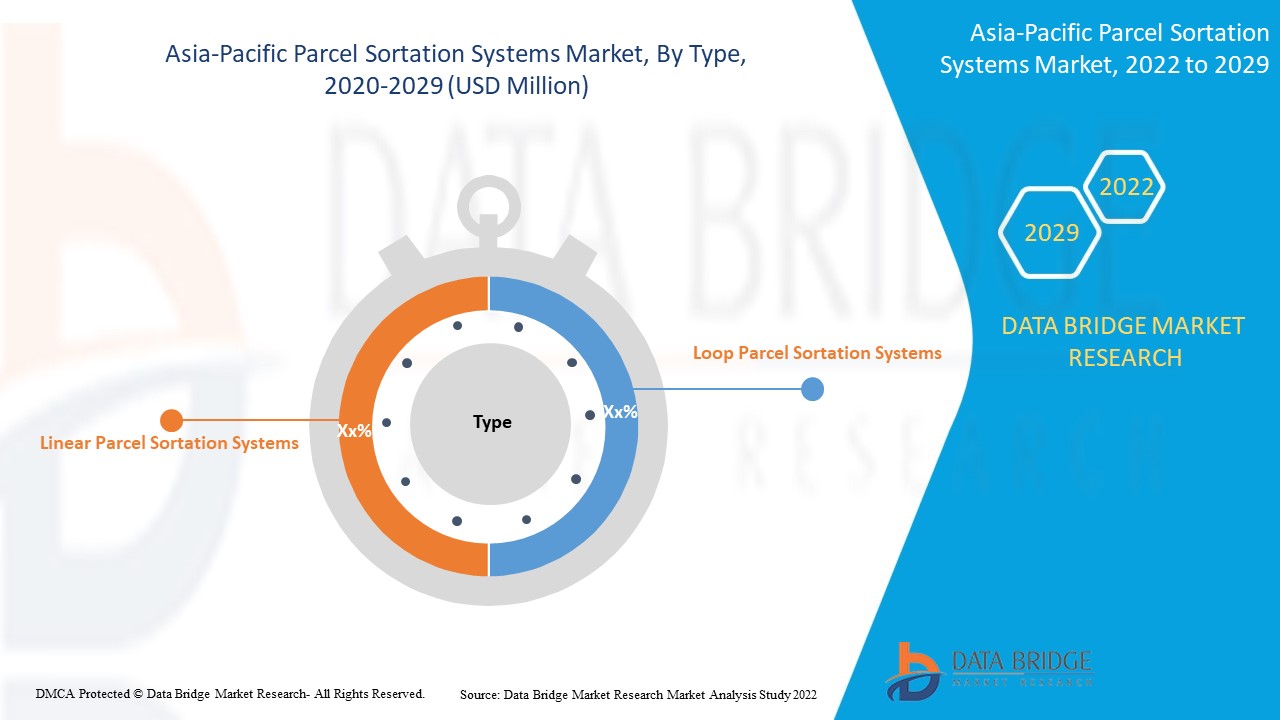

- On the basis of type, the Asia-Pacific parcel sortation systems market is segmented into linear parcel sortation systems and loop parcel sortation systems. In 2022, the linear parcel sortation systems segment is expected to dominate the market as the technological advancements in the technology has enabled them to offer high throughput, thus making them suitable for handling high parcel volumes

- On the basis of offering, the Asia-Pacific parcel sortation systems market is segmented into hardware, software, and services. In 2022, the hardware segment is expected to dominate the market as with the growing logistics infrastructure, the warehouses and fulfillment centers are increasingly adopting technological advanced sorting hardware to zmodernize the facility and increase their throughput

- On the basis of tray size, the Asia-Pacific parcel sortation systems market is segmented into small, medium, and large. In 2022, the medium segment is expected to dominate the market with increasing parcel volumes. The medium-sized trays prove to be ideal for handling the variation in parcel sizes and volumes

- On the basis of parcel handling capacity, the Asia-Pacific parcel sortation systems market is segmented into less than 20000 parcels/hr, 20000 to 30000 parcels/hr, and more than 30000 parcels/hr. In 2022, less than 20000 Parcels/hr is expected to dominate the market as the incorporation of sortation systems is increasing among the small and medium sized logistic facilities, these facilities handle and comparatively low volume and have a limited budget

- On the basis of end-user, the Asia-Pacific parcel sortation systems market is segmented into logistics, e commerce, pharmaceutical, medical supply, food & beverages, and others. In 2022, e-commerce is expected to dominate the market as the changing customer behavior in the region has led the e commerce industry to grow tremendously

Asia-Pacific Parcel Sortation Systems Market Country Level Analysis

Asia-Pacific Parcel Sortation Systems market is analysed, and market size information is provided by country, type, offering, tray size, parcel handling capacity, and end-user.

The countries covered in the Asia-Pacific Parcel Sortation Systems market report are China, Japan, India, South Korea, Australia, Indonesia, Singapore, Thailand, Malaysia, Philippines, and Asia-Pacific.

China is dominating the market in the Asia-Pacific region due to increasing investments in logistics infrastructure for increasing efficiency in the supply chain in urban planning. The proliferating growth in global ecommerce and changing consumer behavior in the country is further boosting the market growth.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to significant or scarce competition from local and domestic brands, the impact of sales channels are considered while providing forecast analysis of the country data.

Rising Demand of Parcel Sortation Systems

Asia-Pacific Parcel Sortation Systems market also provides you with detailed market analysis for every country growth in the industry with sales, components sales, the impact of technological development in Parcel Sortation Systems, and changes in regulatory scenarios with their support for the Parcel Sortation Systems market. The data is available for the historic period 2012 to 2020.

Competitive Landscape and Asia-Pacific Parcel Sortation Systems Market Share Analysis

Asia-Pacific Parcel Sortation Systems market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, company strengths and weaknesses, product launch, product trials pipelines, product approvals, patents, product width and breadth, application dominance, technology lifeline curve. The above data points provided are only related to the companies’ focus related to the Asia-Pacific Parcel Sortation Systems market.

The major players covered in the report are Siemens Logistics GmbH (A Subsidiary of Siemens AG), Vanderlande Industries B.V., BEUMER GROUP, Bastian Solutions, LLC, FIVES, Dematic, Murata Machinery, Ltd., Interroll Group, Okura Yusoki Co., Ltd., Daifuku Co., Ltd., Equinox, Pitney Bowes Inc., MHS Global, SOLYSTIC SAS, BOWE SYSTEC GMBH, Honeywell International Inc. and Intralox among other domestic players. DBMR analysts understand competitive strengths and provide competitive analysis for each competitor separately.

Many product developments are also initiated by the companies worldwide, which a, so accelerate the growth of the Asia-Pacific Parcel Sortation Systems market.

For instance,

- In July 2021, Siemens Logistics GmbH announced the launch of Parcel Data Hub, a central data platform for parcel sorting centers to integrate data sets of various sources. With this, the company provided a platform to create the basis for seamless and efficient processes in sorting centers and eventually enables operational excellence. This enhanced the company’s offerings in the market.

- In June 2021, BEUMER GROUP announced the launch of the new BG Pouch System. The development came amidst the rapid growth of interest from omnichannel and D2C operators. The BG Pouch System was developed to relieve the unprecedented pressure to deliver financial and logistical efficiency in the demanding e-commerce environment and fits perfectly into BEUMER Group’s existing end-to-end integration solutions. With this, the company was able to expand its offering for the warehouse and distribution industry with a pouch sortation solution.

Partnership, joint ventures, and other strategies enhance the company's market share with increased coverage and presence. It also provides the benefit for organisation to improve their offering for Parcel Sortation Systems through expanded range of size.

SKU-