Global White Box Server Market

Market Size in USD Billion

CAGR :

%

USD

16.90 Billion

USD

57.34 Billion

2024

2032

USD

16.90 Billion

USD

57.34 Billion

2024

2032

| 2025 –2032 | |

| USD 16.90 Billion | |

| USD 57.34 Billion | |

|

|

|

|

White Box Server Market Size

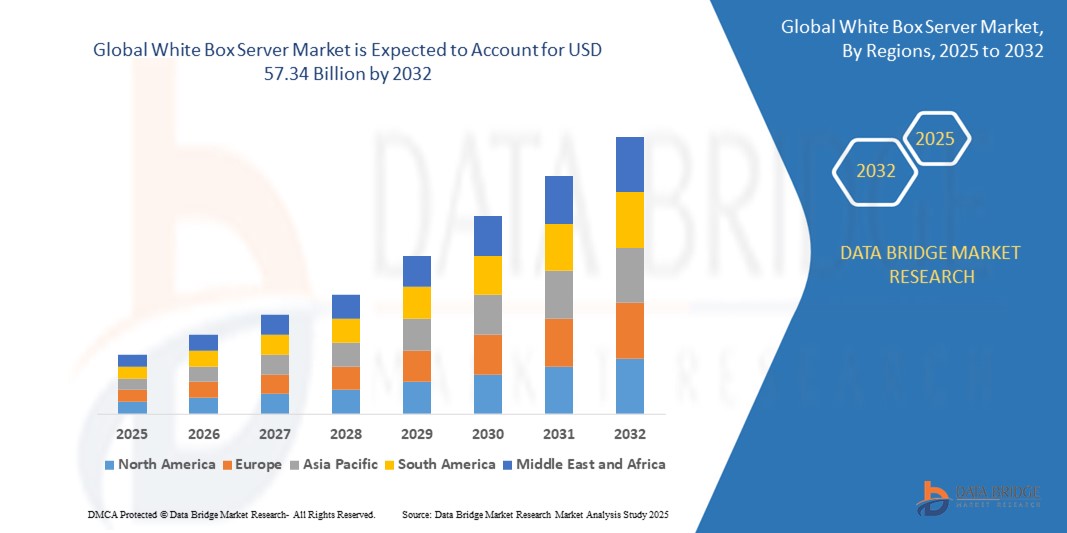

- The global White Box Server market size was valued at USD 16.9billion in 2024 and is expected to reach USD 57.34billion by 2032, at a CAGR of 16.5% during the forecast period

- The market growth is largely fueled by the Cost-Effectiveness and Customization and Adoption of Cloud Computing and Virtualization

- Furthermore, Open-Source Platforms and Software-Defined Infrastructure: Initiatives like the Open Compute Project (OCP) promote open-source hardware and software solutions, enhancing the interoperability and flexibility of white box servers. This trend supports the development of software-defined infrastructures, aligning with the industry's move towards more agile and programmable data centers.

White Box Server Market Analysis

- A computer structure in large data centers is known as the white box server. It is put together by the ODMs (original design manufacturers). It is commonly build by assembling the COTS (commercial off-the-shelf) elements in variant ways to offer customization to the consumers. It is also possible for a company to construct an in-house white box server utilizing retail computer parts which are commercially accessible.

- North America dominates the White Box Server market with the largest revenue share of 40.01% in 2025, characterized by growing utilization of ICT technologies and digitalization of enterprises are transforming traditional IT environment.

- Asia-Pacific is expected to be the fastest growing region in the White Box Server market during the forecast period due to growing acceptance of mobile devices and digital services that is driving the need for the data centers to support varying consumer and enterprise needs

- Rack Servers segment is expected to dominate the White Box Server market with a market share of 46.2% in 2025, driven by its scalability, cost-efficiency, and suitability for data centers and cloud computing infrastructure.

Report Scope and White Box Server Market Segmentation

|

Attributes |

White Box Server Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

White Box Server Market Trends

“Increasing Adoption of Open-Source Hardware”

- One of the key trends in the white box server market is the increasing adoption of open-source hardware. Open-source platforms, such as the Open Compute Project (OCP), have gained significant traction, offering an alternative to proprietary server hardware from major manufacturers. These open-source solutions enable companies to design and build their own hardware, providing more flexibility and cost savings.

- Open-source hardware promotes collaboration, allowing businesses to modify and improve their infrastructure as needed. This trend has gained momentum due to its ability to support customizable and scalable IT systems, especially in data centers and cloud environments.

- Many enterprises now see the potential of open-source hardware as a way to improve the efficiency of their operations while reducing dependency on traditional server vendors. As the market shifts toward more adaptable and cost-effective solutions, open-source hardware is expected to become a significant driver in the growth of the white box server market.

- For Instance, In July 2024, Facebook (Meta) announced its continued investment in the Open Compute Project, releasing new blueprints for energy-efficient white box servers. This initiative highlights the growing importance of open-source hardware in reducing costs and improving the sustainability of data center operations, further strengthening the trend of open-source adoption.

White Box Server Market Dynamics

Driver

“Cost-Effectiveness and Customization”

- A major driver in the white box server market is the cost-effectiveness and customization that these servers offer. Unlike branded servers, which come with high premiums for proprietary designs and technologies, white box servers allow companies to select specific components that best fit their needs, significantly reducing overall costs. This customization makes them an attractive option for companies looking to optimize their IT infrastructure while maintaining performance and functionality.

- Additionally, businesses can fine-tune their servers to meet the unique requirements of their workloads, whether it's for data centers, cloud services, or edge computing. With a greater focus on reducing capital expenditures, especially in sectors like tech and manufacturing, organizations are increasingly leaning towards white box servers. This demand for affordable yet high-performing IT infrastructure is expected to continue driving the market forward.

- For Instance, In January 2025, a major global cloud service provider, Google Cloud, announced its adoption of white box servers for its new data center expansion in North America. By using white box hardware, Google was able to save costs while maintaining the necessary flexibility for scaling its services, demonstrating how the cost-efficiency of white box servers can benefit large-scale IT operations.

Restraint/Challenge

“Lack of Brand Recognition and Trust”

- One of the major restraints in the white box server market is the lack of brand recognition and trust compared to established server manufacturers. Many businesses prefer to purchase servers from well-known, trusted brands like Dell, HP, or IBM due to the perceived reliability and customer support that come with these names.

- White box servers, being custom-built or unbranded, may not carry the same level of confidence, especially for enterprises with mission-critical operations. While white box servers can offer flexibility and cost savings, their lack of brand prestige and associated support services can make some companies hesitant to adopt them.

- Additionally, the absence of well-established warranties and technical support can discourage potential customers. This issue limits the market's ability to fully tap into industries where reliability and trusted service are of utmost importance, such as finance, healthcare, or government sectors.

- For Instance, In September 2024, a large-scale retail chain in North America opted for branded servers over white box servers for their upcoming data center expansion due to concerns over long-term reliability and the perceived risk of using unbranded hardware. Despite the cost savings offered by white box servers, the company decided to go with a more established solution to ensure reliable service and support, demonstrating the trust barriers that white box servers face.

White Box Server Market Scope

The market is segmented on the basis form factor, business type, processor, components and operating system.

- By Form Factor

Based on the form factor, the white box server market is segmented into rack servers, tower servers, blade servers, density- optimized server. Rack Servers segment is expected to dominate the White Box Server market with a market share of 46.2% in 2025, driven by its scalability, cost-efficiency, and suitability for data centers and cloud computing infrastructure.

The tower servers segment is anticipated to witness the fastest growth rate of 22.17% from 2025 to 2032, fueled by rising demand from small and medium-sized enterprises (SMEs) seeking affordable, space-saving IT infrastructure. Their ease of setup and low initial investment make them ideal for growing businesses. Increased adoption in remote and branch office environments also supports this growth. Additionally, advancements in processing power and energy efficiency are enhancing their appeal.

- By Business Type

Based on the business type, the white box server market is segmented into data centers and enterprise customers. The data centers held the largest market revenue share in 2025 of, driven by the rising global demand for cloud computing, big data analytics, and digital storage solutions. As digital transformation accelerates across industries, data centers require scalable and cost-effective server infrastructure. White box servers offer the flexibility and efficiency needed to meet these demands. Their widespread adoption in hyperscale and enterprise data centers is fueling market dominance.

The enterprise customers segment is expected to witness the fastest CAGR from 2025 to 2032, driven by its growing need for scalable, customizable, and cost-efficient IT infrastructure. Large enterprises are increasingly adopting white box servers to support cloud computing, virtualization, and data-intensive workloads. These servers offer the flexibility to tailor hardware to specific enterprise needs. Rising digital transformation efforts across sectors further accelerate this trend.

- By Processor

Based on the processor, the white box server market is segmented into X86 servers, non-X86 servers. The X86 servers held the largest market revenue share in 2025, driven by the widespread compatibility, affordability, and robust performance across diverse workloads. They support a broad range of operating systems and applications, making them ideal for enterprise and cloud deployments. Their dominance continues due to strong industry support and ecosystem maturity.

The non-X86 servers segment held a significant market share in 2025, favored for its high performance, energy efficiency, and suitability for specialized computing tasks. These servers are often used in high-performance computing (HPC), AI, and mission-critical applications. Their architecture offers advantages in processing speed and power optimization for specific workloads.

- By Components

Based on the components, the white box server market is segmented into motherboard, processor, memory, network adapter, and power supply. The motherboard segment accounted for the largest market revenue share in 2024, driven by central role in integrating and managing all server components. As demand for customizable and high-performance servers grows, so does the need for advanced, flexible motherboards. Continuous innovations in chipsets and connectivity also support its leading position.

The processor segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the increasing demand for high-performance computing, AI, and data-intensive applications. Advancements in multi-core and energy-efficient processor technologies are fueling this growth. Enterprises seek powerful CPUs to handle complex workloads and virtualization needs.

• By Operating System

Based on the operating system, the white box server market is segmented into Linux operating system, windows operating system, UNIX operating system, and other operating systems. The Linux operating system segment accounted for the largest market revenue share in 2024, driven by the open-source nature, cost efficiency, and strong community support. Its stability, security, and compatibility with white box servers make it the preferred choice for data centers and enterprises. Growing use in cloud and virtualization environments further boosts its dominance.

The windows operating system segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the user-friendly interface, widespread enterprise adoption, and strong support for business applications. Organizations favor Windows for seamless integration with existing IT ecosystems. Continued updates and security enhancements also contribute to its growing adoption in server environments.

White Box Server Market Regional Analysis

- North America dominates the White Box Server market with the largest revenue share of 40.01% in 2025, characterized by growing utilization of ICT technologies and digitalization of enterprises are transforming traditional IT environment

- the emerging economies are highly adequate in the highest number of data center facilities hosting some of the biggest data centers around the globe are the factors which will further boost the growth of the white box server market in the region.

U.S. White Box Server Market Insight

The U.S. White Box Server market captured the largest revenue share of 62% within North America in 2025, fueled by the more enterprises shift toward customizable and cost-effective IT infrastructure. Businesses across sectors, especially cloud service providers and large data centers, are embracing these servers to meet their evolving digital demands. The trend toward open-source hardware and software-defined solutions is further boosting adoption. Additionally, a strong focus on domestic tech innovation and the presence of key industry players support market momentum. The U.S. remains a critical hub for white box server deployment due to its advanced digital ecosystem.

Europe White Box Server Market Insight

The European white box server market is experiencing significant growth, driven by the increasing demand for cost-effective and customizable IT infrastructure solutions. Businesses across the region are adopting white box servers to meet specific workload requirements, particularly in data centers and enterprise environments. The rise of cloud computing, big data analytics, and edge computing has further fueled the need for scalable and flexible server solutions. Countries like Germany, the UK, and the Netherlands are at the forefront of this adoption, focusing on energy-efficient and modular deployments.

U.K. White Box Server Market Insight

The UK white box server market is experiencing significant growth, driven by the increasing demand for cost-effective and customizable IT infrastructure solutions. Businesses across the UK are adopting white box servers to meet specific workload requirements, particularly in data centers and enterprise environments. The rise of cloud computing, big data analytics, and edge computing has further fueled the need for scalable and flexible server solutions. The UK's participation in initiatives such as the Open Compute Project, which advocates for open platforms, plays a crucial role in advancing and implementing white box servers.

Germany White Box Server Market Insight

Germany's white box server market is experiencing notable growth, driven by the country's emphasis on industrial automation and data-driven applications. The increasing demand for scalable and cost-effective server solutions in data centers and enterprise environments is fueling this trend. Germany's participation in initiatives such as the Open Compute Project, which promotes open platforms, plays a crucial role in advancing and implementing white box servers. By adopting these platforms, organizations can benefit from reduced power consumption and lower infrastructure expenses, thereby propelling the market forward.

Asia-Pacific White Box Server Market Insight

The Asia-Pacific region is experiencing rapid growth in the white box server market, driven by the increasing demand for scalable and cost-effective IT infrastructure solutions. Countries like China, India, and Japan are leading this transformation, with significant investments in data centers and cloud services to support their expanding digital economies. The rise of edge computing, fueled by the proliferation of IoT devices and the rollout of 5G networks, is further accelerating the need for localized and efficient server solutions.

India White Box Server Market Insight

India's white box server market is experiencing significant growth, driven by the country's expanding digital infrastructure and increasing demand for cost-effective, customizable IT solutions. The government's initiatives, such as the Digital India program, have accelerated digital transformation, leading to a surge in data generation and the need for scalable server solutions. White box servers, known for their flexibility and affordability, are becoming the preferred choice for data centers and enterprises aiming to optimize their IT expenditures.

China White Box Server Market Insight

China's white box server market is experiencing significant growth, driven by the nation's push for technological self-reliance and the expansion of its cloud computing sector. Chinese tech giants are increasingly adopting white box servers to support their massive data centers and cloud services. The government's initiatives to bolster domestic server manufacturing capabilities and reduce reliance on foreign technology are fueling this trend. Additionally, advancements in server architecture and energy-efficient designs are being integrated into local white box servers, aligning with China's focus on green technology and sustainable development.

White Box Server Market Share

The White Box Server industry is primarily led by well-established companies, including:

- Quanta Computer lnc.,

- WISTRON CORPORATION,

- INVENTEC CORPORATION,

- Foxconn Electronics Inc.,

- MiTAC Holdings Corporation,

- Celestica International LP.,

- COMPAL Inc.,

- hyve solutions,

- Penguin Computing,

- SERVERSDIRECT.,

- Jabil Inc.,

- Super Micro Computer, Inc.,

- ZT Systems,

- USI,

- SPEED Technology Inc.,

- ZT Systems

Latest Developments in Global White Box Server Market

- In March 2025, At Supercomputing Asia, MiTAC showcased its G4520G6 AI server and TN85-B8261 HPC server. The G4520G6 features dual Intel Xeon 6 processors, delivering high-performance multi-core processing for AI-driven applications. The TN85-B8261 is a versatile 2U server supporting AMD EPYC processors, offering exceptional computing power for AI and HPC workloads. Both servers are designed to meet the growing demands of artificial intelligence, machine learning, and high-performance computing applications.

- In October 2024, Jabil introduced the J421E-S and J422-S servers, powered by AMD 5th Generation EPYC and Intel Xeon 6 processors. These servers are purpose-built for scalability in cloud data center applications, including AI, high-performance computing (HPC), fintech, networking, storage, databases, and security. Jabil's design-ready servers allow engineering teams to meet customers' specific requirements by fine-tuning custom BIOS and BMC firmware, providing a competitive advantage for higher performance, data management, and security

- In March 2025, MiTAC unveiled the G4527G6 AI server at GTC, optimized for NVIDIA MGX architecture. It supports up to eight NVIDIA GPUs, 8TB of DDR5-6400 memory, and features advanced interconnects like NVIDIA NVLink and BlueField-3 DPU. This server is designed to address the evolving demands of enterprise AI workloads, offering scalability and performance for complex AI and high-performance computing applications.

- In October 2024, Jabil launched the J421E-S and J422-S servers, powered by AMD 5th Generation EPYC and Intel Xeon 6 processors. These servers are optimized for AI, fintech, and cloud applications, offering superior performance and enhanced efficiency. The J421E-S is a single-socket 2U rackmount server, while the J422-S is a dual-socket 2U rackmount server, both designed for scalability in various cloud data center applications.

- In March 2025, Supermicro began volume shipments of max-performance servers optimized for AI, HPC, virtualization, and edge workloads. These servers are designed to deliver superior performance and efficiency, addressing the growing demands of AI and high-performance computing applications. Supermicro's servers are engineered to provide optimal performance for various workloads, including AI, HPC, virtualization, and edge computing.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.