Global Server Chassis Market

Market Size in USD Billion

CAGR :

%

USD

2.88 Billion

USD

4.74 Billion

2024

2032

USD

2.88 Billion

USD

4.74 Billion

2024

2032

| 2025 –2032 | |

| USD 2.88 Billion | |

| USD 4.74 Billion | |

|

|

|

|

Server Chassis Market Size

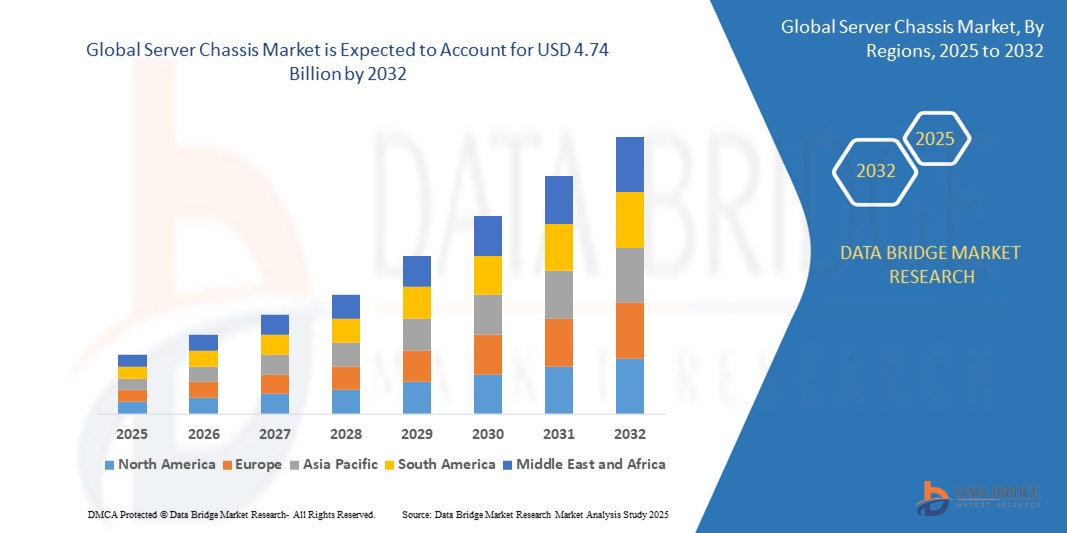

- The Global Server Chassis Market size was valued at USD 2.88 billion in 2024 and is expected to reach USD 4.74 billion by 2032, at a CAGR of 7.4% during the forecast period

- This growth is driven by factors such as the exponential growth in data generation and the increasing demand for robust, scalable computing solutions

Server Chassis Market Analysis

- Server chassis systems are essential components in data center infrastructure, housing the critical computing hardware that powers enterprise servers, storage, and networking solutions. These systems provide structural support, efficient airflow management, and heat dissipation, ensuring optimal performance and longevity of server components. The server chassis market plays a pivotal role in enabling scalable, high performance computing environments across industries.

- Market growth is driven by the rapid expansion of data centers, increasing demand for cloud computing, and the rising adoption of high density and modular servers in enterprise IT infrastructure. The growing emphasis on edge computing and hyperscale deployments further boosts demand for customizable and space efficient server enclosures.

- North America is expected to dominate the global Server Chassis Market, supported by strong investments in hyperscale data centers, high adoption of cloud-based services, and the presence of leading technology firms. The U.S., in particular, continues to be a hub for AI-driven workloads and large scale digital transformation initiatives that require robust server infrastructure.

- Asia Pacific is projected to witness the fastest growth, fueled by the digitalization of economies, government support for data localization, and increasing cloud adoption across countries like China, India, and Southeast Asian nations. The region’s growing e-commerce, fintech, and telecom sectors are further accelerating data center investments, driving the need for diverse server chassis solutions.

- The rack-mount segment holds the largest share and dominate the market with 64.98%, due to its widespread use in enterprise and colocation data centers. Its advantages such as ease of integration, scalability, and efficient cable and thermal management make it the preferred choice for medium to large IT setups. Demand for blade server chassis is also rising, particularly in high-density environments that prioritize space saving and energy efficiency.

Report Scope and Server Chassis Market Segmentation

|

Attributes |

Server Chassis Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Server Chassis Market Trends

“Surge in Demand for Modular and High-Density Chassis in Edge and Hyperscale Data Centers”

- A key trend shaping the server chassis market is the rising adoption of modular and high-density chassis systems, particularly in edge computing and hyperscale data centers. These advanced chassis designs enable efficient cooling, space optimization, and flexible scalability critical for data-heavy and latency sensitive applications.

- Hyperscale service providers and cloud companies are demanding more compact and customizable enclosures to meet dynamic IT workloads and power constraints.

For Instance,

- In April 2025, Dell Technologies unveiled its latest modular server chassis, optimized for edge deployment and AI-intensive workloads. The system offers tool-less design, improved airflow management, and supports GPU configurations highlighting the market’s shift toward efficiency and versatility in hardware infrastructure.

- This trend is also driven by increased AI/ML workloads and the need for performance-optimized computing environments in sectors such as healthcare, financial services, and telecom.

Server Chassis Market Dynamics

Driver

“Explosive Growth of Data Centers and Cloud Computing Services”

- The proliferation of data centers and growing reliance on cloud infrastructure globally are major drivers accelerating the demand for server chassis.

- Companies are increasingly investing in IT infrastructure upgrades to support big data analytics, IoT, AI, and 5G applications all of which require robust and scalable server systems.

- Server chassis serve as the physical backbone for these setups, providing structural integrity, thermal regulation, and easy maintenance.

For Instance,

- In January 2025, Amazon Web Services (AWS) announced the expansion of its North Virginia data center with next generation server chassis that support enhanced compute density and energy-efficient cooling. The move underscores the growing focus on infrastructure expansion to meet surging cloud service demand.

- The surge in SaaS (Software as a Service) and PaaS (Platform as a Service) also requires flexible, modular server chassis solutions to ensure uptime and performance in diverse environments.

Opportunity

“Integration of Liquid Cooling and AI-Optimized Hardware in Chassis Design”

- The growing push for energy efficiency and thermal management in high-performance computing environments presents a substantial opportunity for chassis manufacturers.

- Integration of liquid cooling systems and AI-optimized design features (such as adaptive airflow control and intelligent component layouts) are becoming key differentiators in next-gen server chassis products.

For Instance,

- In March 2025, Supermicro introduced a new server chassis line equipped with direct to chip liquid cooling and dynamic thermal sensors. This innovation targets customers running AI, deep learning, and HPC workloads where traditional cooling methods fall short.

- These advancements enable data centers to reduce operating costs, enhance compute density, and meet sustainability goals. Vendors who invest in smart chassis engineering and eco-friendly solutions are likely to gain competitive advantage.

Restraint/Challenge

“Semiconductor Shortage Affecting Server Chassis Integration and Delivery”

- The global server chassis market has been significantly impacted by the lingering effects of the semiconductor shortage, which disrupted the availability of essential components such as processors, power management ICs, and memory modules that are integrated into server systems. While the shortage has eased, recovery remains uneven across regions and product categories.

For instance,

- In 2024, Dell Technologies, which operates data center hardware production and server chassis assembly globally, reported extended lead times for its PowerEdge server line due to persistent delays in receiving chipsets and thermal management components. The ripple effect of upstream delays forced Dell to stagger production schedules across its plants in the U.S., Ireland, Malaysia, and China.

- This global supply constraint not only increases costs for OEMs and integrators but also delays deployments for enterprise and cloud data center customers, especially in regions lacking local component sources. As a result, maintaining agile and resilient supply chains remains a critical challenge in the server infrastructure sector.

Server Chassis Market Scope

The market is segmented on the basis of Type, Forms, Application, Distribution Channel

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Forms

|

|

|

By Application

|

|

|

By Distribution Channel

|

|

In 2025, rack-mount is projected to dominate the market with a largest share in form segment

The rack-mount segment is expected to dominate the global server chassis market with 64.98%, in 2025, due to its widespread use in enterprise and colocation data centers. Its advantages such as ease of integration, scalability, and efficient cable and thermal management make it the preferred choice for medium to large IT setups. Demand for blade server chassis is also rising, particularly in high-density environments that prioritize space saving and energy efficiency.

The 2U Server Chassis is expected to account for the largest share during the forecast period in Type segment

In 2025, the 2U Server Chassis segment is expected to dominate the market with the largest market share of 56.39%. The 2U chassis offers an optimal balance between performance, expansion capability, and space efficiency, making it the preferred choice for enterprise data centers and cloud infrastructure providers. As organizations seek to deploy high density computing without compromising on power and cooling efficiency, the demand for 2U server chassis is accelerating across various high-performance computing applications.

Server Chassis Market Regional Analysis

“North America Holds the Largest Share in the Server Chassis Market”

- North America leads the global server chassis market, primarily driven by the robust data center infrastructure and increasing demand for high performance computing in industries such as technology, finance, and telecommunications.

- The United States, in particular, is a major contributor to this dominance due to its large-scale data centers, cloud computing infrastructure, and enterprise adoption of advanced server technologies.

- Additionally, the rapid digital transformation across various sectors and increasing investments in high-capacity servers to support data heavy applications such as artificial intelligence, big data analytics, and IoT have propelled the region's growth.

“Asia-Pacific is Projected to Register the Highest CAGR in the Server Chassis Market”

- The Asia-Pacific region is expected to experience the fastest growth in the global server chassis market due to the rapid expansion of IT infrastructure, particularly in countries such as China, India, Japan, and South Korea.

- The growing demand for cloud services, data centers, and high-performance computing applications across the region is a key driver for this growth.

- Additionally, the increasing trend of digitalization in small and medium enterprises (SMEs) and the government’s push for smart city development and industry 4.0 are driving investments in server infrastructure across Asia-Pacific.

Server Chassis Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Cisco Systems, Inc. (U.S.)

- Advantech Co., Ltd. (Taiwan)

- Norco Technology, Inc. (China)

- Thermaltake Technology Co., Ltd. (Taiwan)

- Rosewill, Inc. (U.S.)

- Kontron S&T AG (Germany)

- In Win Development, Inc. (Taiwan)

- Chenbro Micom Co., Ltd. (Taiwan)

- Mootek Technologies (Taiwan)

- SilverStone Technology Co., Ltd. (Taiwan)

- Ablecom Technology Inc. (U.S.)

- One Chassis Technology Co., Ltd. (Taiwan)

- Joyance Enterprise Co., Ltd. (Taiwan)

- Super Micro Computer, Inc. (U.S.)

- iStarUSA Group (U.S.)

- Intel Corporation (U.S.)

Latest Developments in Global Server Chassis Market

- In March 2025, Supermicro introduced its latest line of high-density server chassis, designed to support cutting edge AI, big data, and cloud computing applications. The new chassis models, including the 2U and 4U configurations, are optimized for cooling efficiency and scalability, enabling data centers to manage growing workloads more effectively. This launch is expected to meet the demand for high performance computing while minimizing energy consumption and operational costs.

- In February 2025, Eaton acquired Schneider Electric’s IT business for USD 1.8 billion to expand its portfolio in the data center infrastructure sector. The acquisition aims to enhance Eaton’s data center solutions, including energy efficient server chassis and power distribution products. By integrating Schneider Electric's expertise, Eaton is strengthening its position in the growing global server chassis market and improving its offerings for modern data centers that require higher power and cooling efficiency.

- In January 2025, Dell Technologies and Intel entered into a strategic partnership to co-develop next generation server chassis and computing platforms optimized for 5G and AI workloads. The collaboration focuses on creating energy efficient, scalable, and flexible server systems that can handle the increasing demand for processing power in edge computing and data center environments. This partnership is expected to accelerate the adoption of advanced server architectures in the global market, especially in industries requiring high computational capacity.

- In November 2024, Lenovo launched a new range of modular server chassis that provide enhanced flexibility for businesses scaling their IT infrastructure. The modular design allows users to easily add or remove components such as storage, processors, and cooling systems. This innovation aims to meet the growing needs of enterprises seeking scalable, adaptable, and cost-effective server solutions. The new chassis is targeted at businesses looking to optimize space, power, and cooling while maintaining high performance.

- In October 2024, Hewlett Packard Enterprise (HPE) announced a partnership with Arista Networks to develop integrated server chassis solutions for next generation data centers. The collaboration focuses on creating high performance, scalable server systems with enhanced networking capabilities, ideal for supporting cloud-based applications and large-scale data processing. This partnership is expected to provide customers with an end to end solution for building efficient and resilient data center infrastructure, driving innovation in the server chassis market.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.