Global Suv Market

Market Size in USD Billion

CAGR :

%

USD

53.16 Billion

USD

166.05 Billion

2024

2032

USD

53.16 Billion

USD

166.05 Billion

2024

2032

| 2025 –2032 | |

| USD 53.16 Billion | |

| USD 166.05 Billion | |

|

|

|

|

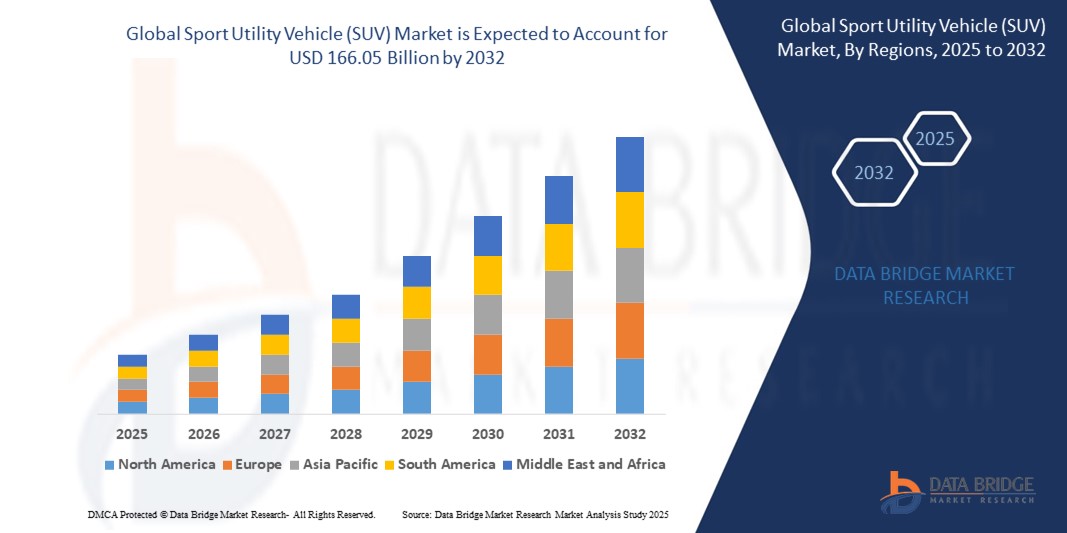

Sport Utility Vehicle (SUV) Market Size

- The global sport utility vehicle (SUV) market was valued at USD 53.16 billion in 2024 and is expected to reach USD 166.05 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 15.30%, primarily driven by the rising consumer preference for spacious and multi-functional vehicles

- This growth is driven by factors such as increased urbanization, rising disposable income, demand for advanced safety features, and the growing popularity of electric and hybrid SUVs

Sport Utility Vehicle (SUV) Market Analysis

- Sport utility vehicles (SUVs) are versatile automobiles designed to combine elements of on-road passenger vehicles with off-road capabilities. They are preferred for their spacious interiors, safety features, and performance on varied terrains

- The demand for SUVs is significantly driven by the growing consumer preference for multi-utility vehicles, increasing urbanization, and rising income levels across both developed and emerging economies

- The North America region stands out as one of the dominant regions for SUV sales, supported by high disposable income, preference for larger vehicles, and a strong automotive culture

- For instance, according to the U.S. Bureau of Economic Analysis, SUV sales accounted for over 50% of total light vehicle sales in the U.S. in 2024, highlighting the strong market presence and consumer preference for this vehicle category

- Globally, SUVs continue to gain traction across all price segments—from luxury to compact crossovers—making them one of the fastest-growing vehicle categories in the passenger car market

Report Scope and Sport Utility Vehicle (SUV) Market Segmentation

|

Attributes |

Sport Utility Vehicle (SUV) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Sport Utility Vehicle (SUV) Market Trends

“Growing Popularity of Electric and Hybrid SUVs”

- One prominent trend in the global SUV market is the rising demand for electric and hybrid SUVs as consumers and governments increasingly prioritize sustainability and emission reductions

- Automakers are rapidly expanding their electric SUV portfolios to meet tightening emission regulations and consumer interest in environmentally friendly alternatives

- For instance, In September 2023, Hyundai launched its all-electric SUV IONIQ 5 N, combining high performance with zero emissions, signaling strong manufacturer interest in expanding the electric SUV segment

- In addition, the integration of advanced technologies such as autonomous driving features, connected vehicle systems, and AI-powered infotainment is reshaping the SUV market

- This trend is transforming SUV design and appeal, attracting both traditional car buyers and tech-savvy consumers, and accelerating the global shift toward next-generation, eco-conscious vehicles

Sport Utility Vehicle (SUV) Market Dynamics

Driver

“Rising Consumer Demand for Versatile and Family-Oriented Vehicles”

- The growing preference for vehicles that offer both performance and utility is significantly contributing to the increased demand for sport utility vehicles (SUVs) worldwide

- Modern consumers are seeking vehicles that can accommodate family needs, provide ample cargo space, and offer enhanced safety features for urban and off-road driving alike

- SUVs are favored for their elevated seating position, strong road presence, and versatility across a range of driving condition

- As disposable incomes rise, particularly in emerging economies, more consumers are opting for mid-range and premium SUV models as status symbols and practical transportation solutions

For instance,

- In November 2023, Toyota reported that SUVs accounted for over 50% of its total vehicle sales in North America, underlining their strong consumer preference and contribution to overall revenue

- In February 2024, India’s Ministry of Road Transport & Highways highlighted that SUVs accounted for more than 48% of all passenger vehicle sales in 2023, reflecting a nationwide trend towards larger, multi-utility vehicless

- The increasing shift toward SUV ownership across both developed and emerging markets is expected to continue driving robust demand and expansion in the global SUV market

Opportunity

“Electrification and Integration of Advanced Driver Assistance Systems (ADAS)”

- The global SUV market is undergoing a transformation as manufacturers invest in electrification and the integration of next-generation driver assistance systems (ADAS)

- Electric SUVs (e-SUVs) are becoming increasingly popular due to environmental regulations, government incentives, and growing consumer preference for sustainable transportation options

- Automakers are also focusing on embedding ADAS features such as adaptive cruise control, lane-keeping assist, and autonomous emergency braking in SUV models to enhance road safety and convenience

For instance,

- In January 2024, Volkswagen announced the global rollout of its ID.7 electric SUV, designed with a suite of Level 2+ autonomous driving features and targeting major markets in North America, Europe, and Asia-Pacific

- In October 2023, Hyundai Motor Company introduced the updated Tucson Hybrid in India and Europe, equipped with advanced driver assistance technologies and a mild-hybrid powertrain to attract tech-savvy and eco-conscious consumers

- The move toward electric powertrains and ADAS is expected to unlock significant growth potential, especially in urban markets and regions with stringent emissions regulations

Restraint/Challenge

“High Production Costs and Supply Chain Constraints Affecting Affordability”

- The high production costs associated with SUVs, particularly electric and hybrid variants, pose a significant barrier to broader market penetration, especially in cost-sensitive markets

- SUVs often require more raw materials, larger battery packs (in EVs), and complex drivetrain technologies, which increase the overall manufacturing expense

- These high input costs, combined with global supply chain disruptions and semiconductor shortages, contribute to elevated vehicle prices that can deter price-conscious consumers

For instance,

- In February 2024, according to a report by Automotive News Europe, Ford Motor Company announced delays and production cost increases for its electric SUV models due to ongoing supply chain bottlenecks and rising costs of critical materials like lithium and cobalt

- As a result, automakers are facing pressure to either absorb higher costs or pass them on to consumers, potentially limiting SUV accessibility and slowing adoption in emerging economies and mid-income segments

Sport Utility Vehicle (SUV) Market Scope

The market is segmented on the basis of type, fuel type, size, seating capacity, price range, and application.

|

Segmentation |

Sub-Segmentation |

|

By Type |

|

|

By Fuel Type |

|

|

By Size |

|

|

By Seating Capacity |

|

|

By Price Range |

|

|

By Application

|

|

Sport Utility Vehicle (SUV) Market Regional Analysis

“North America is the Dominant Region in the Sport Utility Vehicle (SUV) Market”

- North America dominates the SUV market, driven by high consumer preference for large, versatile vehicles, favorable economic conditions, and a strong automotive manufacturing base

- The U.S. holds a significant share due to strong demand for both gasoline and electric SUV models, supported by innovations in comfort, safety features, and all-terrain performance

- In addition, the presence of major players such as General Motors, Ford, and Tesla, along with substantial investments in electrification and autonomous driving technologies, continues to bolster market growth

- The popularity of SUVs for family use, outdoor activities, and long-distance travel, combined with advanced dealership networks and easy financing options, further accelerates market expansion across the region

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the SUV market, driven by rising disposable incomes, rapid urbanization, and growing demand for personal mobility

- Countries such as China, India, and Japan are emerging as major contributors, supported by expanding middle-class populations and increasing preference for spacious and multifunctional vehicles

- Japan continues to play a pivotal role with strong domestic manufacturers like Toyota, Honda, and Nissan advancing innovations in fuel efficiency and hybrid SUV models to meet evolving consumer preferences

- Meanwhile, China and India are experiencing a surge in SUV sales due to improved road infrastructure, affordability of compact SUVs, and incentives for electric vehicles (EVs). Strategic investments by global automakers and increasing local production further contribute to regional market growth

Sport Utility Vehicle (SUV) Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Ford Motor Company (U.S.)

- General Motors (U.S.)

- AUDI AG (Germany)

- Kia Motors Corporation (South Korea)

- Groupe Renault (France)

- Groupe PSA (France)

- SAIC Motor Corporation Limited (China)

- Tesla (U.S.)

- Mercedes-Benz Group AG (Germany)

- BMW AG (Germany)

- Hyundai Motor Company (South Korea)

- BYD Company Ltd. (China)

- Continental AG (Germany)

- TOYOTA MOTOR CORPORATION (Japan)

- Nissan Motor Co., LTD. (Japan)

- Volkswagen Group (Germany)

- AB Volvo (Sweden)

- Honda Motor Co., Ltd. (Japan)

Latest Developments in Global Sport Utility Vehicle (SUV) Market

- In July 2022, Toyota unveiled the all-new Crown for global markets, marking a significant evolution in its flagship model. The company planned to introduce the Crown (Crossover type) as the first variant by fall of the same year. The 16th generation Crown, set to commence production in January, features four distinct models, including a crossover equipped with a hybrid system. This innovative lineup blends sedan and SUV elements, catering to diverse consumer preferences while emphasizing Toyota's commitment to sustainability and cutting-edge design

- In July 2022, Honda Motor Co., Ltd. revealed the all-new ZR-V SUV, set to hit the Japanese market by the year's end. This innovative model marks a milestone as Honda's first SUV to feature the sports e: HEV hybrid system. Combining a 2.0-litre direct injection engine, first introduced in the Civic e: HEV, with an advanced 2-motor hybrid system (e-CVT), the ZR-V promises enhanced performance and efficiency. This launch underscores Honda's commitment to cutting-edge technology and sustainable mobility

- In July 2022, General Motors announced its plans to introduce the third-generation GMC Canyon in 2023, showcasing a significant upgrade to its mid-size pickup truck lineup. Production of the redesigned Canyon was scheduled to commence in January 2023 at the GM Wentzville plant in Missouri. This new model promised enhanced features, including updated exterior styling, advanced technology, and improved performance, catering to the evolving needs of truck enthusiasts. The launch underscored GM's commitment to innovation and quality in the automotive industry

- In May 2022, Toyota revealed plans to elevate the RAV4 Hybrid's adventurous appeal with the introduction of the 2023 Woodland Edition. This special edition, designed for outdoor enthusiasts, features off-road enhancements such as a TRD-tuned suspension, bronze-colored wheels, and all-terrain tires. The Woodland Edition also includes practical additions like roof rails, cross bars, and a 120V inverter for camping trips. Available in striking colors like Midnight Black Metallic and Cavalry Blue, it combines rugged design with hybrid efficiency

- In May 2022, Hyundai Motor India (HMIL) announced the launch of the all-new Tucson SUV, introducing its fourth-generation model to the Indian market. This premium SUV stands out as the first Hyundai vehicle in India to feature Hyundai SmartSense technology, equipped with Level-2 Advanced Driver Assistance Systems (ADAS). The Tucson combines luxury, advanced safety features, and cutting-edge technology, catering to the growing demand for high-end SUVs. With its innovative design and enhanced driving experience, the Tucson represents Hyundai's commitment to redefining mobility in India

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.