Global Substation Monitoring System Market

Market Size in USD Billion

CAGR :

%

USD

5.81 Billion

USD

10.21 Billion

2024

2032

USD

5.81 Billion

USD

10.21 Billion

2024

2032

| 2025 –2032 | |

| USD 5.81 Billion | |

| USD 10.21 Billion | |

|

|

|

|

Substation Monitoring System Market Size

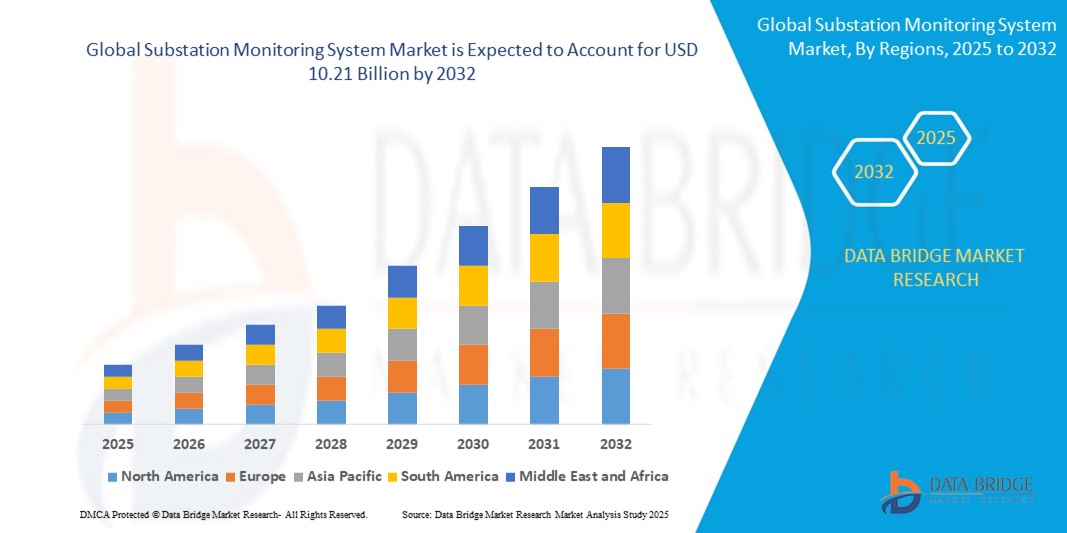

- The global substation monitoring system market size was valued at USD 5.81 billion in 2024 and is expected to reach USD 10.21 billion by 2032, at a CAGR of 7.3% during the forecast period

- The market growth is largely fueled by increasing investments in smart grid infrastructure and rising demand for real-time monitoring of substation assets to enhance grid reliability and operational efficiency

- Furthermore, utilities are rapidly adopting intelligent monitoring systems to support the integration of renewable energy, reduce outage durations, and enable predictive maintenance. These converging factors are accelerating the deployment of substation monitoring solutions, thereby significantly boosting the industry's growth

Substation Monitoring System Market Analysis

- Substation monitoring systems are intelligent solutions that enable real-time data acquisition, condition assessment, and performance tracking of substation equipment using sensors, communication protocols, and analytics platforms. These systems help utilities ensure power system stability, detect faults early, and optimize asset management across transmission and distribution networks

- The growing demand for these solutions is primarily driven by the increasing complexity of power grids, the shift toward renewable energy integration, and the need for grid automation to meet rising energy demands and regulatory compliance

- Asia-Pacific dominated the substation monitoring system market with a share of 41.51% in 2024, due to rapid industrialization, significant investments in smart grid infrastructure, and increasing electricity demand across developing economies

- North America is expected to be the fastest growing region in the substation monitoring system market during the forecast period due to increasing deployment of smart grid technologies, higher infrastructure budgets, and stronger regulatory support for grid modernization

- Hardware segment dominated the market with a market share of 61.9% in 2024, due to the rising deployment of sensors, intelligent electronic devices (IEDs), and communication modules across substations to facilitate real-time equipment monitoring. The growing need to modernize aging power infrastructure and ensure uninterrupted power supply is driving utilities to adopt advanced hardware systems that enhance visibility, fault detection, and predictive maintenance capabilities. The robustness and scalability of these hardware components make them essential for both greenfield and brownfield substation upgrades

Report Scope and Substation Monitoring System Market Segmentation

|

Attributes |

Substation Monitoring System Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Substation Monitoring System Market Trends

Rising Grid Modernization Initiatives

- The substation monitoring system market is experiencing rapid growth as utilities and governments worldwide prioritize grid modernization to handle evolving energy demands and aging infrastructure

- For instance, companies such as Schneider Electric and ABB are delivering advanced substation monitoring solutions for large grid upgrade projects, helping utilities integrate renewables, automate operations, and reduce downtime through predictive analytics and real-time diagnostics

- Integration of IoT technologies and AI-based analytics enables remote asset condition monitoring, fault detection, and optimized maintenance, providing actionable insights to increase operational efficiency

- Governments are investing in smart grid projects that require substation monitoring to manage increasing loads, accommodate distributed energy resources, and ensure resilient power delivery

- Growing urbanization and industrialization, especially in Asia-Pacific, create additional demand as modern cities require stable and efficient power networks maintained by continuous substation surveillance

- Cybersecurity and interoperability standards (such as IEC 61850) are being implemented in new deployments to safeguard data and enable seamless communication between intelligent electronic devices

Substation Monitoring System Market Dynamics

Driver

Advancements in Sensor Technologies

- Advancements in sensor technologies are a key driver, enabling the collection of high-resolution data in real time to support faster and more informed decision-making in grid operations

- For instance, Siemens and General Electric have introduced next-generation sensors equipped with embedded AI, allowing predictive maintenance and early anomaly detection to minimize unplanned outages and reduce repair costs

- New sensor designs feature enhanced accuracy, energy efficiency, and environmental resilience, allowing reliable monitoring in diverse and harsh substation conditions

- Wireless sensor networks expand coverage and lower installation complexity, making it easier to retrofit legacy substations with modern monitoring systems

- Multi-parameter sensors able to track temperature, electrical load, humidity, vibration, and other critical factors help operators manage the health of vital substation assets, maximizing service continuity

Restraint/Challenge

High Initial Investment

- The high initial investment required for installing substation monitoring systems represents a significant barrier, especially for utilities and operators in developing regions

- For instance, companies such as Emerson Electric and Eaton must address complex integration and high capital costs when deploying large-scale monitoring solutions that include new hardware, advanced sensors, SCADA systems, and cybersecurity infrastructure

- Operational budgets are often constrained by regulatory or funding limits, causing utilities to delay or stage modernization projects due to large upfront costs

- Integration with aging legacy infrastructure can increase project complexity and price, particularly when existing systems are incompatible with modern IoT and software platforms

- The need for continuous staff training, cybersecurity measures, and ongoing support further raises the total cost of ownership, slowing adoption in budget-sensitive markets

Substation Monitoring System Market Scope

The market is segmented on the basis of component, voltage, communication technology, sector, and industry.

- By Component

On the basis of component, the substation monitoring system market is segmented into hardware and software. The hardware segment dominated the largest market revenue share of 61.9% in 2024, owing to the rising deployment of sensors, intelligent electronic devices (IEDs), and communication modules across substations to facilitate real-time equipment monitoring. The growing need to modernize aging power infrastructure and ensure uninterrupted power supply is driving utilities to adopt advanced hardware systems that enhance visibility, fault detection, and predictive maintenance capabilities. The robustness and scalability of these hardware components make them essential for both greenfield and brownfield substation upgrades.

The software segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by the accelerating shift toward digital grid operations and data-driven asset management. Advanced software platforms are being increasingly utilized to analyze operational data, optimize maintenance schedules, and support decision-making through machine learning algorithms and cloud integration. With utilities aiming to boost grid efficiency and reliability, the demand for intelligent substation monitoring software is expected to grow rapidly across both developed and emerging markets.

- By Voltage

On the basis of voltage, the market is segmented into low and medium voltage. The medium voltage segment held the largest market revenue share in 2024, primarily driven by the widespread deployment of medium-voltage substations in industrial and utility applications. These substations play a critical role in the distribution of electricity from high-voltage transmission systems to end-users. The increasing investments in renewable integration and urban infrastructure projects are further augmenting demand for medium-voltage substation monitoring solutions.

The low voltage segment is projected to register the fastest CAGR from 2025 to 2032, attributed to the rising focus on smart cities and distributed energy resources. Low-voltage substations are gaining traction for residential and commercial installations, where real-time monitoring is crucial for energy efficiency and grid resilience. The surge in EV charging stations and rooftop solar installations also supports the segment’s accelerated growth by necessitating active monitoring of power quality and load management.

- By Communication Technology

On the basis of communication technology, the substation monitoring system market is segmented into wired and wireless. The wired segment accounted for the largest revenue share in 2024, owing to its long-standing use in substation environments where stability, reliability, and resistance to electromagnetic interference are critical. Utilities prefer wired communication systems such as fiber optics and Ethernet for their ability to support high data transfer rates and secure connections across mission-critical infrastructure.

The wireless segment is expected to grow at the fastest rate from 2025 to 2032, driven by the increasing need for flexible, scalable, and cost-effective communication networks, especially in remote or hard-to-reach substations. Wireless technologies, including cellular, LPWAN, and private radio networks, enable rapid deployment and reduce installation complexity, making them well-suited for retrofitting and dynamic grid environments. The integration of IoT and edge computing further enhances the capabilities of wireless monitoring systems.

- By Sector

On the basis of sector, the market is segmented into transmission and distribution. The transmission segment led the market with the largest revenue share in 2024, supported by growing global investments in high-voltage transmission infrastructure and the need for real-time grid monitoring to ensure energy security. Substation monitoring systems in the transmission sector help utilities detect faults, improve asset utilization, and ensure compliance with regulatory standards. The increasing adoption of HVDC and cross-border interconnections also contributes to segment growth.

The distribution segment is poised to exhibit the fastest CAGR from 2025 to 2032, driven by the decentralization of power systems and the rise of prosumer-based energy networks. Distribution substations face unique challenges, including load variability and increased DER penetration, prompting the need for intelligent monitoring to maintain voltage stability and grid balance. Modernization initiatives and government mandates for grid digitalization are further propelling investment in advanced monitoring for distribution substations.

- By Industry

On the basis of industry, the substation monitoring system market is segmented into utility, oil and gas, mining, steel, and transportation. The utility segment dominated the market in 2024, attributed to the sector’s continued focus on enhancing grid reliability, reducing downtime, and managing assets across widespread geographical areas. Utilities are prioritizing digital transformation to meet growing energy demand, integrate renewable sources, and adhere to evolving regulatory norms, making them the primary adopters of substation monitoring technologies.

The transportation segment is expected to register the highest growth rate between 2025 and 2032, spurred by the expansion of electrified rail networks, metro systems, and electric vehicle infrastructure. Transportation networks require real-time energy distribution and system health monitoring to ensure operational continuity and safety. The integration of substation monitoring systems in transportation enhances predictive maintenance, reduces operational risks, and supports long-term infrastructure sustainability.

Substation Monitoring System Market Regional Analysis

- Asia-Pacific dominated the substation monitoring system market with the largest revenue share of 41.51% in 2024, driven by rapid industrialization, significant investments in smart grid infrastructure, and increasing electricity demand across developing economies

- The region’s expanding energy sector, focus on reducing power losses, and widespread deployment of renewable energy sources are accelerating the adoption of advanced monitoring solutions

- Moreover, government-backed grid modernization programs, cost-efficient sensor and IoT integration, and the presence of leading local manufacturers are further strengthening market growth in Asia-Pacific

China Substation Monitoring System Market Insight

China held the largest share in the Asia-Pacific substation monitoring system market in 2024, supported by aggressive implementation of smart grid policies, large-scale renewable integration, and rapid expansion of ultra-high-voltage (UHV) transmission networks. Backed by strong state-owned enterprises and central government funding, the country is investing in digital substation infrastructure to handle growing electricity demand and improve reliability. Advancements in domestic production of monitoring hardware and software are reinforcing China’s leadership in this segment.

India Substation Monitoring System Market Insight

India’s substation monitoring system market is experiencing rapid growth, driven by national initiatives such as the Revamped Distribution Sector Scheme (RDSS) and ongoing rural electrification under DDUGJY. The need for real-time monitoring to manage grid congestion, reduce transmission losses, and improve asset performance is growing. As the country shifts toward decentralized energy sources, utilities are increasingly deploying smart monitoring systems to ensure stable power distribution and preventive maintenance.

Europe Substation Monitoring System Market Insight

The Europe substation monitoring system market is projected to grow at a steady CAGR over the forecast period, propelled by the region’s commitment to energy transition, electrification of transport, and modernization of legacy power infrastructure. European nations are heavily investing in advanced grid solutions to accommodate increasing renewable energy generation and decentralized power flows. The adoption of substation monitoring systems is being encouraged by EU regulations focused on energy efficiency, emissions reduction, and digitalization of utility operations. Integration of AI-based analytics and cybersecurity features into monitoring platforms is gaining traction, especially in Western and Northern Europe where infrastructure is highly developed.

U.K. Substation Monitoring System Market Insight

The U.K. market is expanding steadily as utilities focus on upgrading substations to support a more flexible, low-carbon grid. The country’s targets for net-zero emissions are pushing infrastructure managers to adopt smarter, more automated monitoring systems. Investments in electric vehicle charging, energy storage, and distributed generation are further driving the demand for intelligent substation monitoring across both transmission and distribution networks.

Germany Substation Monitoring System Market Insight

Germany’s substation monitoring system market continues to grow due to its rigorous renewable integration goals and emphasis on grid reliability. With a large portion of the country’s energy mix coming from wind and solar, the grid requires constant real-time visibility and control. Germany is actively replacing older systems with digital substations, featuring SCADA, condition monitoring, and predictive analytics to enhance operational performance and minimize outages.

North America Substation Monitoring System Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, fueled by increasing deployment of smart grid technologies, higher infrastructure budgets, and stronger regulatory support for grid modernization. Utilities across the U.S. and Canada are investing in substation automation systems to prevent outages, manage growing distributed energy resources, and extend the life of aging equipment. Emphasis on real-time diagnostics, integration with cloud platforms, and AI-driven analytics is driving adoption. Cybersecurity and data privacy compliance are also key factors influencing product development and deployment strategies across the region.

U.S. Substation Monitoring System Market Insight

The U.S. captured the largest revenue share in the North American substation monitoring system market in 2024, driven by ongoing federal and state-level funding for energy infrastructure upgrades. Rising concerns over grid resilience, increasing electrification of industries, and widespread adoption of renewable energy are motivating utilities to adopt advanced monitoring technologies. The integration of real-time data analytics, condition-based maintenance, and edge computing in substations is enabling faster decision-making, reducing downtime, and supporting the long-term sustainability goals of the country’s power grid.

Substation Monitoring System Market Share

The substation monitoring system industry is primarily led by well-established companies, including:

- CG Power & Industrial Solutions Ltd. (India)

- ABB (Switzerland)

- Honeywell International Inc. (U.S.)

- Hubbell (U.S.)

- Siemens (Germany)

- Cadillac Automation & Controls (India)

- Schneider Electric (France)

- NovaTech, LLC. (U.S.)

- Cisco Systems, Inc. (U.S.)

- Emerson (U.S.)

- IGRID, S.L. (Spain),

- General Electric (U.S.)

- Eaton (Ireland)

- Schweitzer Engineering Laboratories, Inc. (U.S.)

- ACUITY BRANDS, INC. (U.S.)

Latest Developments in Global Substation Monitoring System Market

- In October 2024, Schneider Electric unveiled its latest smart grid innovations at Enlit Europe 2024, including virtual substations and enhanced digital grid solutions. These advancements are poised to significantly influence the substation monitoring system market by improving grid resiliency and operational flexibility. By enabling utilities to better handle extreme weather conditions and integrate distributed energy resources, Schneider is addressing key challenges faced by modern power networks, thereby reinforcing its leadership in grid digitalization

- In August 2024, GE Vernova entered a strategic collaboration with Systems With Intelligence through a Memorandum of Understanding (MoU) to co-develop advanced substation monitoring solutions. This partnership integrates cutting-edge technologies such as gas sensing and infrared thermography, aiming to deliver higher diagnostic intelligence and asset performance visibility. The initiative is expected to accelerate the adoption of intelligent monitoring systems across global utilities, boosting GE Vernova's position in predictive maintenance and smart grid analytics

- In May 2024, ABB Ltd. partnered with a Swedish utility to implement innovative earth-fault protection solutions designed to future-proof substations. By enhancing power system safety and reliability, especially during fault conditions, this project underscores ABB’s role in promoting resilient grid infrastructure. The deployment of such advanced protection systems is likely to drive further investment in substation modernization, particularly in regions focused on maintaining grid stability amid increasing power demand

- In March 2023, Toshiba Energy Systems received an order from Tohoku Electric Power to construct a STATCOM (Static Synchronous Compensator), aimed at stabilizing the grid and improving power transmission reliability. This development highlights the growing demand for dynamic reactive power solutions within the substation monitoring market, as utilities seek to mitigate the impact of transmission faults and ensure uninterrupted power flow in high-demand areas

- In August 2021, Hitachi ABB Power Grids Ltd. (India) unveiled the TXpert remote services portfolio, aimed at remote monitoring of transformer fleets. This innovative offering provides comprehensive support, including consulting, troubleshooting, and guidance utilizing augmented reality technology. Hitachi ABB Power Grids leverages its expertise to analyze vast datasets, facilitating the creation of detailed reports essential for optimal maintenance strategies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Substation Monitoring System Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Substation Monitoring System Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Substation Monitoring System Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.