Global Flare Monitoring Market

Market Size in USD Billion

CAGR :

%

USD

1.32 Billion

USD

2.99 Billion

2024

2032

USD

1.32 Billion

USD

2.99 Billion

2024

2032

| 2025 –2032 | |

| USD 1.32 Billion | |

| USD 2.99 Billion | |

|

|

|

|

Flare Monitoring Market Size

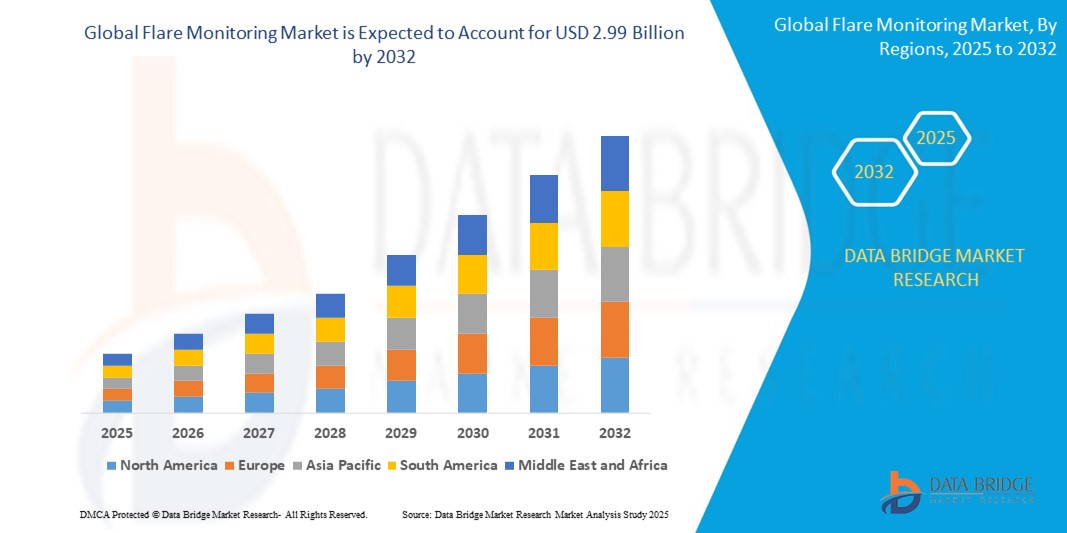

- The global flare monitoring market size was valued at USD 1.32 billion in 2024 and is expected to reach USD 2.99 billion by 2032, at a CAGR of 10.70% during the forecast period

- This growth is driven by factors such as the increasing regulatory pressure on emissions monitoring, advancements in sensor and monitoring technologies, rising environmental awareness and corporate responsibility, expansion of oil and gas exploration activities, and integration of AI and digital technologies

Flare Monitoring Market Analysis

- Global flare monitoring market refers to the sector encompassing technologies, services, and solutions aimed at monitoring and controlling flare emissions in industries such as oil & gas, petrochemicals, and chemical processing

- It involves the deployment of sensors, data analytics, and remote monitoring systems to ensure regulatory compliance, minimize environmental impact, and optimize flare performance

- North America is expected to dominate the flare monitoring market with 32.90% due to Stringent environmental regulations, to ensure compliance with emission standards

- Asia-Pacific is expected to be the fastest growing region in the flare monitoring market during the forecast period due to rapid industrialization

- In-process mounting segment is expected to dominate the market with a market share of 58.05% due to the need for real-time, on-site data collection drives the adoption of in-process mounting methods, which provide immediate insights into flare performance and operational conditions

Report Scope and Flare Monitoring Market Segmentation

|

Attributes |

Flare Monitoring Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Flare Monitoring Market Trends

“Integration of AI and IoT for Enhanced Monitoring”

- The integration of Artificial Intelligence (AI) and the Internet of Things (IoT) into flare monitoring systems is revolutionizing the industry

- These technologies enable real-time data collection, predictive maintenance, and anomaly detection, leading to more efficient and accurate monitoring of flare systems

- AI and IoT facilitate remote monitoring, allowing operators to oversee flare systems from centralized locations. This capability reduces the need for manual inspections, minimizes human error, and ensures continuous compliance with environmental regulations

- AI algorithms analyze historical data to predict potential flare system failures or inefficiencies. This proactive approach enables timely maintenance, reducing downtime and operational costs

- IoT sensors provide precise measurements of gas emissions, temperature, and pressure, ensuring high-quality data for compliance reporting and environmental assessments

Flare Monitoring Market Dynamics

Driver

“Stringent Environmental Regulations”

- Countries worldwide are implementing stringent environmental regulations to curb greenhouse gas emissions

- For instance, the U.S. Environmental Protection Agency (EPA) has introduced new flare monitoring rules targeting methane emissions, compelling industries to adopt advanced monitoring systems

- Companies are increasingly adopting flare monitoring systems as part of their CSR initiatives to demonstrate commitment to environmental sustainability and regulatory compliance

- Rising public awareness and demand for transparency regarding environmental practices are pressuring companies to invest in technologies that monitor and report emissions accurately

- Some governments are offering incentives and subsidies to industries that implement flare monitoring systems, further driving market growth

Opportunity

“Expansion in Emerging Markets”

- Emerging economies are experiencing rapid industrialization, leading to increased energy demand and a higher number of flare systems. This growth presents opportunities for the adoption of flare monitoring technologies

- Governments and private sectors in emerging markets are investing in energy infrastructure, including the installation of flare monitoring systems to meet environmental standards

- There is a growing trend of technology transfer from developed to developing countries, enabling the adoption of advanced flare monitoring solutions in emerging markets

- As emerging markets align their regulations with international environmental standards, the demand for flare monitoring systems is expected to increase

Restraint/Challenge

“High Implementation Costs”

- The initial cost of implementing advanced flare monitoring systems can be prohibitive, especially for small and medium-sized enterprises (SMEs)

- These costs include purchasing, configuring, and integrating cutting-edge technologies such as infrared sensors and optical gas imaging systems

- Flare monitoring systems require regular maintenance and calibration to ensure accurate performance. These ongoing expenses can strain the budgets of organizations, particularly in regions with limited financial resources

- Integrating new flare monitoring technologies with existing infrastructure can be complex and costly, potentially leading to operational disruptions during the transition period

- Organizations may be hesitant to invest in flare monitoring systems due to uncertainties regarding the ROI, especially in markets where regulatory enforcement is lax or environmental awareness is low

Flare Monitoring Market Scope

The market is segmented on the basis of offering, mounting method, connectivity, product type, and industry.

|

Segmentation |

Sub-Segmentation |

|

By Offering |

|

|

By Mounting Method |

|

|

By Connectivity |

|

|

By Product Type |

|

|

By Industry |

|

In 2025, the in-process mounting is projected to dominate the market with a largest share in mounting method segment

The in-process mounting segment is expected to dominate the flare monitoring market with the largest share of 56.02% in 2025 due to the need for real-time, on-site data collection drives the adoption of in-process mounting methods, which provide immediate insights into flare performance and operational conditions.

The oil & gas is expected to account for the largest share during the forecast period in industry segment

In 2025, the oil & gas segment is expected to dominate the market with the largest market share due to increasing complexity of operations in onshore oil and gas production sites and the need for stringent environmental oversight are major factors driving the segment growth. Onshore production sites, often located in remote or challenging environments, require effective monitoring solutions to ensure safety and compliance with environmental regulations.

Flare Monitoring Market Regional Analysis

“North America Holds the Largest Share in the Flare Monitoring Market”

- North America holds the largest share of the global flare monitoring market, accounting for over 32.90% of the market value

- Stringent environmental regulations in the United States and Canada, enforced by agencies such as the Environmental Protection Agency (EPA), mandate the adoption of advanced flare monitoring systems to ensure compliance with emission standards

- The region benefits from significant investments in research and development, leading to the deployment of cutting-edge flare monitoring technologies, including real-time infrared imaging and multi-spectral sensors

- The presence of a robust oil and gas industry, along with numerous refineries and petrochemical plants, drives the demand for efficient flare monitoring solutions to manage emissions and enhance operational efficiency

- North America's dominance is expected to continue, with projections indicating a steady growth trajectory due to ongoing industrial activities and regulatory pressures

“Asia-Pacific is Projected to Register the Highest CAGR in the Flare Monitoring Market”

- Rapid industrialization in countries such as China, India, and Southeast Asian nations has led to an increase in oil and gas production, thereby escalating the need for effective flare monitoring systems

- Governments in the region are implementing stricter environmental regulations to curb emissions, prompting industries to adopt advanced flare monitoring technologies

- The growing awareness of environmental issues and the availability of cost-effective monitoring solutions are accelerating the adoption of flare monitoring systems across various industries

- With substantial investments in infrastructure and a focus on sustainability, the Asia Pacific region presents significant opportunities for market players in the flare monitoring sector

Flare Monitoring Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Advanced Energy (U.S.)

- VisionTIR (Spain)

- Tecnovideo S.r.l (Italy)

- Sensia Solutions S.L (Spain)

- Honeywell International Inc. (U.S.)

- Baker Hughes Company (U.S.)

- noema.tech (Germany)

- Teledyne FLIR LLC (U.S.)

- AMETEK Land (Land Instruments International Ltd) (U.K.)

- Tempsens Instrument Pvt. Ltd. (India)

- ZEECO, INC (U.S.)

Latest Developments in Global Flare Monitoring Market

- In October 2024, AMETEK enriched its portfolio with the strategic acquisition of Virtek Vision in Q3 2024, strengthening and expanding its portfolio capabilities in advanced metrology instrumentation, thus investing in the growth of the precision technology market. Further innovation and growth within the Company's instrumentation division is fueled by this acquisition

- In September 2024, LightPath Technologies launched its new Mantis camera worldwide to monitor high-temperature processes in boilers and furnaces of power plants. The advanced camera supports applications such as flare monitoring for industrial efficiency and safety. The first commercial order was for furnace inspection by a customer in the Southeastern US. It marked the company's shift from making components to providing optical technology solutions

- In July 2024, Flotek Industries' JP3 Analyzer was approved by EPA for oil and gas flare monitoring, meeting the new NSPS OOOOb regulations. This optical analyzer assesses and measures the net heating values in flare gases with a high degree of accuracy, ensuring cleaner and more efficient operations. The approval marks a significant advance in flare regulation compliance within the oil and gas sector

- In July 2024, JP3 Measurement, a provider of innovative analytical measurement solutions and a wholly owned subsidiary of Flotek Industries, announced that the Environmental Protection Agency (EPA) has approved its system for compliance with the latest flare regulations. This cutting-edge optical instrument, was developed for accurate measurement of Net Heating Values (NHV) in flare gases. This approval supports the oil and gas industry's efforts to achieve more efficient and cleaner operations

- In March 2024, Baker Hughes, an energy technology firm, announced a significant advancement in flare emissions monitoring through a collaboration with bp, an oil and gas company. By utilizing Baker Hughes’ flare.IQ emissions abatement technology, bp is now able to quantify emissions of methane from its flares—a new application in the upstream oil and gas sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Flare Monitoring Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Flare Monitoring Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Flare Monitoring Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.