Global Rf Diplexer Market

Market Size in USD Billion

CAGR :

%

USD

6.33 Billion

USD

14.58 Billion

2024

2032

USD

6.33 Billion

USD

14.58 Billion

2024

2032

| 2025 –2032 | |

| USD 6.33 Billion | |

| USD 14.58 Billion | |

|

|

|

|

Frequency (RF) Diplexer Market Size

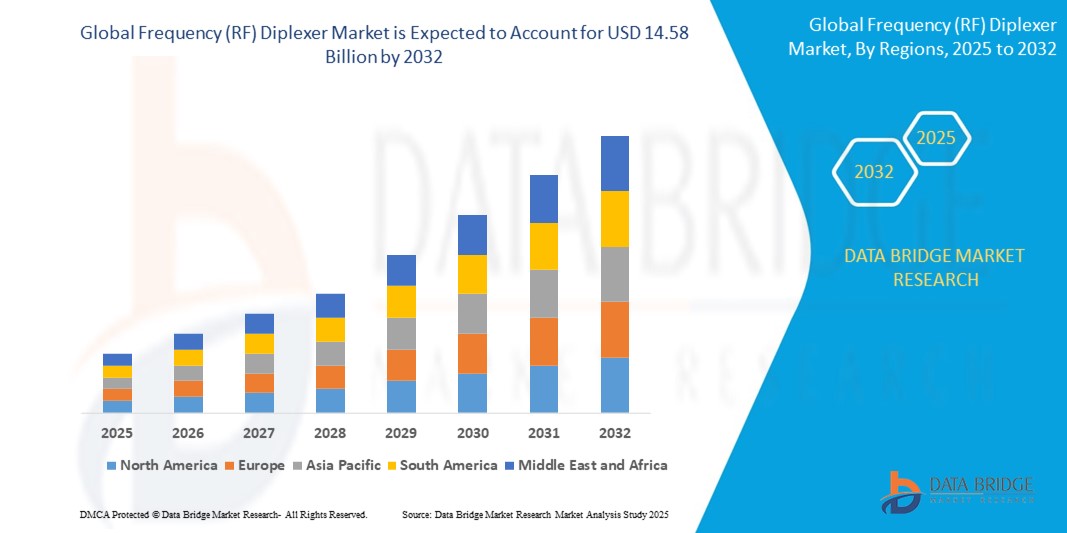

- The global frequency (RF) diplexer market size was valued at USD 6.33 billion in 2024 and is expected to reach USD 14.58 billion by 2032, at a CAGR of 11.00% during the forecast period

- The market growth is primarily driven by the increasing demand for wireless communication technologies, advancements in 5G infrastructure, and the proliferation of smart devices requiring efficient frequency management

- In addition, the growing adoption of frequency (RF) diplexers in automotive electronics, IoT applications, and consumer electronics is fueling market expansion, as these components enable seamless signal transmission and reception in compact devices

Frequency (RF) Diplexer Market Analysis

- Frequency (RF) diplexers, critical components for separating and combining different frequency bands in communication systems, are integral to modern wireless networks, automotive systems, and consumer electronics due to their ability to enhance signal efficiency and support multi-band operations

- The surge in demand for RF diplexers is driven by the rapid deployment of 5G networks, rising penetration of smartphones and IoT devices, and the need for reliable, high-speed wireless communication systems

- North America dominated the frequency (RF) diplexer market with the largest revenue share of 38.5% in 2024, attributed to early adoption of advanced communication technologies, significant investments in 5G infrastructure, and the presence of leading industry players

- Asia-Pacific is expected to be the fastest-growing region during the forecast period, fueled by rapid urbanization, increasing smartphone penetration, and government initiatives to expand 5G networks in countries such as China, India, and South Korea

- The ceramics type segment dominated the largest market revenue share of 45% in 2024, driven by its compact size, excellent thermal stability, and high-frequency selectivity, making it ideal for 5G and IoT applications in mobile devices and communication systems

Report Scope and Frequency (RF) Diplexer Market Segmentation

|

Attributes |

Frequency (RF) Diplexer Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Frequency (RF) Diplexer Market Trends

“Integration with 5G and IoT Technologies”

- The global frequency (RF) diplexer market is experiencing a significant trend toward the integration of advanced technologies such as Internet of Things (IoT) and Artificial Intelligence (AI) to enhance signal processing and filtering capabilities

- These technologies enable efficient management of multiple frequency bands, improving signal integrity and reducing interference in applications such as smartphones, automotive electronics, and wireless communication systems

- AI-driven RF diplexer solutions facilitate real-time signal optimization, enabling adaptive filtering based on environmental conditions and usage patterns, which enhances performance in dynamic communication environments

- For instance, companies are developing compact, high-performance RF diplexers, such as the HADES X2 active diplexer by Filtronic, which integrates dual high-power amplifiers for long-range E-Band communications, ensuring superior signal quality and power efficiency

- The trend toward miniaturization is driving demand for smaller, more efficient RF diplexers, particularly for integration into compact consumer devices such as smartphones, wearables, and IoT-enabled automotive systems

- These advancements are making RF diplexers more versatile and appealing across diverse applications, from cellular networks to smart manufacturing systems

Frequency (RF) Diplexer Market Dynamics

Driver

“Growing Demand for 5G Networks and IoT Ecosystems”

- The rising adoption of 5G networks and the expanding ecosystem of Internet of Things (IoT) devices are major drivers for the global frequency (RF) diplexer market

- Frequency (RF) diplexers are critical for enabling efficient communication across multiple frequency bands in 5G infrastructure, supporting high-speed data transfer and low-latency services

- The proliferation of IoT devices, such as smart home appliances, connected vehicles, and industrial sensors, is increasing the need for RF diplexers to manage simultaneous signal transmission and reception without interference

- Government initiatives and investments in telecommunications infrastructure, particularly in North America, are boosting the deployment of RF diplexers to support advanced wireless communication systems

- Manufacturers are increasingly integrating RF diplexers into devices as standard components to meet the growing demand for seamless connectivity and enhanced network performance

Restraint/Challenge

“High Development Costs and Complexity of Integration”

- The high cost of designing and manufacturing advanced frequency (RF) diplexers, particularly those using materials such as gallium arsenide or supporting 5G and IoT applications, poses a significant barrier to market adoption, especially for smaller manufacturers and in cost-sensitive regions

- Integrating RF diplexers into complex systems, such as multi-band smartphones or connected vehicles, requires sophisticated engineering, which increases production costs and time-to-market

- Data security and signal integrity concerns are also notable challenges, as frequency (RF) diplexers handle sensitive communication data, raising risks of interference or unauthorized access in poorly designed systems

- The fragmented regulatory landscape across regions, with varying standards for frequency band allocation and electromagnetic compatibility, complicates the deployment of frequency (RF) diplexers for global manufacturers

- These challenges can limit market growth in regions with high cost sensitivity or stringent regulatory requirements, despite the increasing demand for advanced communication solutions

Frequency (RF) Diplexer market Scope

The market is segmented on the basis of type, application, material, and component.

- By Type

On the basis of type, the frequency (RF) diplexer market is segmented into crystal type, ceramics type, and others. The ceramics type segment dominated the largest market revenue share of 45% in 2024, driven by its compact size, excellent thermal stability, and high-frequency selectivity, making it ideal for 5G and IoT applications in mobile devices and communication systems.

The crystal type segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its superior performance in high-frequency bands, particularly in smartphones and wireless communication systems, where precise frequency control is critical.

- By Application

On the basis of application, the frequency (RF) diplexer market is segmented into smart phone, notebook and tablet, automobile electronics, wireless communication, fiber optic communication, cellular, military, consumer, automation, and miscellaneous. The smart phone segment dominated the market with a revenue share of 38% in 2024, fueled by the global proliferation of smartphones and the need for efficient signal management in multi-band 5G devices.

The wireless communication segment is anticipated to experience the fastest growth rate from 2025 to 2032, driven by the global expansion of 5G infrastructure, increasing demand for high-speed data services, and the growing adoption of IoT devices requiring seamless connectivity.

- By Material

On the basis of material, the frequency (RF) diplexer market is segmented into silicon gallium arsenide and silicon-germanium. The silicon gallium arsenide segment held the largest market revenue share of 60% in 2024, owing to its high electron mobility, enabling faster signal processing and efficient operation at microwave and millimeter-wave frequencies, ideal for applications such as satellite communications and radar systems.

The silicon-germanium segment is expected to witness significant growth from 2025 to 2032, driven by its cost-effectiveness, established manufacturing infrastructure, and ability to support high integration for mixed-signal functions in 5G and IoT applications.

- By Component

On the basis of component, the frequency (RF) diplexer market is segmented into radio frequency filter, surface acoustic wave (SAW) filters, bulk acoustic wave (BAW), duplexers, power amplifiers, antenna switches, demodulators, and others. The surface acoustic wave (SAW) filters segment held the largest market revenue share of 30% in 2024, driven by their compact form factor, cost-effectiveness, and widespread use in smartphones and wireless communication systems for precise frequency control.

The power amplifiers segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by the increasing demand for high-power output in 5G networks, radar systems, and IoT devices, where efficient signal amplification is critical for long-range communication.

Frequency (RF) Diplexer Market Regional Analysis

- North America dominated the frequency (RF) diplexer market with the largest revenue share of 38.5% in 2024, attributed to early adoption of advanced communication technologies, significant investments in 5G infrastructure, and the presence of leading industry players

- Consumers prioritize frequency (RF) diplexers for efficient signal separation, enhanced connectivity, and support for 5G and IoT applications, particularly in regions with advanced technological infrastructure

- Growth is supported by advancements in diplexer technology, including ceramic and SAW-based designs, alongside rising adoption in both consumer electronics and industrial applications

U.S. Frequency (RF) Diplexer Market Insight

The U.S. frequency (RF) diplexer market captured the largest revenue share of 73.3% in 2024 within North America, fueled by strong demand in wireless communication and growing consumer awareness of 5G and IoT integration benefits. The trend towards smart devices and increasing regulations promoting efficient spectrum utilization further boost market expansion. Manufacturers’ growing incorporation of RF diplexers in smartphones and automotive electronics complements aftermarket sales, creating a diverse product ecosystem.

Europe Frequency (RF) Diplexer Market Insight

The Europe frequency (RF) Diplexer Market is expected to witness significant growth, supported by regulatory emphasis on efficient spectrum usage and advanced communication systems. Consumers seek diplexers that enhance signal clarity while supporting high-speed data transmission. The growth is prominent in both consumer electronics and telecommunications, with countries such as Germany and France showing significant uptake due to rising demand for 5G infrastructure and IoT applications.

U.K. Frequency (RF) Diplexer Market Insight

The U.K. market for frequency (RF) Diplexers is expected to witness rapid growth, driven by demand for improved connectivity and signal management in urban and suburban settings. Increased interest in smart technologies and rising awareness of 5G benefits encourage adoption. In addition, evolving telecommunications regulations influence consumer choices, balancing performance with compliance.

Germany Frequency (RF) Diplexer Market Insight

Germany is expected to witness rapid growth in the frequency (RF) Diplexer Market, attributed to its advanced telecommunications sector and high consumer focus on connectivity and energy efficiency. German consumers prefer technologically advanced diplexers that support 5G networks and contribute to efficient signal management. The integration of these diplexers in premium smartphones and automotive systems supports sustained market growth.

Asia-Pacific Frequency (RF) Diplexer Market Insight

The Asia-Pacific region is expected to witness the fastest growth rate, driven by expanding telecommunications infrastructure and rising adoption of smart devices in countries such as China, India, and Japan. Increasing awareness of 5G capabilities, IoT integration, and efficient spectrum usage is boosting demand. Government initiatives promoting digital connectivity and smart technologies further encourage the use of advanced RF diplexers.

Japan Frequency (RF) Diplexer Market Insight

Japan’s frequency (RF) diplexer market is expected to witness rapid growth due to strong consumer preference for high-quality, technologically advanced diplexers that enhance connectivity and communication efficiency. The presence of major electronics manufacturers and integration of RF diplexers in smartphones and automotive electronics accelerate market penetration. Rising interest in aftermarket IoT solutions also contributes to growth.

China Frequency (RF) Diplexer Market Insight

China holds the largest share of the Asia-Pacific frequency (RF) diplexer market, propelled by rapid urbanization, rising smartphone ownership, and increasing demand for 5G and IoT solutions. The country’s growing middle class and focus on smart connectivity support the adoption of advanced RF diplexers. Strong domestic manufacturing capabilities and competitive pricing enhance market accessibility.

Frequency (RF) Diplexer Market Share

The frequency (RF) diplexer industry is primarily led by well-established companies, including:

- Murata Manufacturing Co., Ltd (Japan)

- Arrow Electronics, Inc (U.S.)

- Broadcom (U.S.)

- Renesas Electronics Corporation (Japan)

- TDK Corporation (Japan)

- Qorvo, Inc (U.S.)

- MACOM Technology Solutions (U.S.)

- TAIYO YUDEN CO., LTD. (Japan)

- Integrated Microwave Corporation (U.S.)

- AVX Corporation (U.S.)

- BrightSign, LLC (U.S.)

- Intel Corporation (U.S.)

- Keywest Technology, Inc. (U.S.)

- Microsoft (U.S.)

- Hitachi, Ltd. (Japan)

What are the Recent Developments in Global Frequency (RF) Diplexer Market?

- In May 2024, Nuvotronics introduced board-mountable frequency (RF) bandpass filters and diplexers, including PSD02040B2W, PSF29B22S, and PSF34B32S, leveraging its PolyStrata technology. These components deliver high performance across broad frequency ranges (18-50 GHz) with low insertion loss and high rejection, making them ideal for radar, defense, and electronic warfare applications. The PSF34B32S filter, for instance, provides over 30 dB rejection in the stopband while maintaining less than 1.2 dB insertion loss. These innovations enhance compact, high-performance diplexer solutions for next-generation RF systems

- In August 2023, Filtronic introduced the HADES X2 active diplexer, designed to enhance E-band radio performance for 5G infrastructure and advanced networks. This diplexer operates in the 71-76 GHz and 81-86 GHz bands, featuring high-power amplifiers that deliver Tx saturated output power up to 30 dBm. It supports 512QAM modulation, ensuring high linearity and signal integrity for long-range communications. The compact, low-SWAP design makes it ideal for military, aerospace, and commercial applications

- In August 2023, MACOM Technology Solutions announced the acquisition of Wolfspeed’s Radio Frequency Business for $125 million, comprising $75 million in cash and $50 million in MACOM common stock. This deal includes a 100mm GaN wafer fabrication facility in Research Triangle Park, North Carolina, which MACOM will assume control of approximately two years after closing. The acquisition strengthens MACOM’s RF portfolio, expanding its customer base in aerospace, defense, industrial, and telecommunications sectors

- In June 2023, Broadcom Inc. introduced four RF front-end modules optimized for Wi-Fi 7 routers and access points (APs). These modules enhance wireless connectivity for enterprise environments, ensuring high-speed data transmission and low latency. The lineup features FBAR-integrated front-end modules (FiFEM), which improve 5 GHz and 6 GHz band coexistence while reducing RF power consumption by up to 40%. The modules support Broadcom’s Wi-Fi SoC Digital Predistortion (DPD) technology, delivering efficient signal processing

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Rf Diplexer Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Rf Diplexer Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Rf Diplexer Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.