Global Radio Frequency Rf Components Market

Market Size in USD Billion

CAGR :

%

USD

34.81 Billion

USD

77.94 Billion

2024

2032

USD

34.81 Billion

USD

77.94 Billion

2024

2032

| 2025 –2032 | |

| USD 34.81 Billion | |

| USD 77.94 Billion | |

|

|

|

|

Radio Frequency (RF) Components Market Size

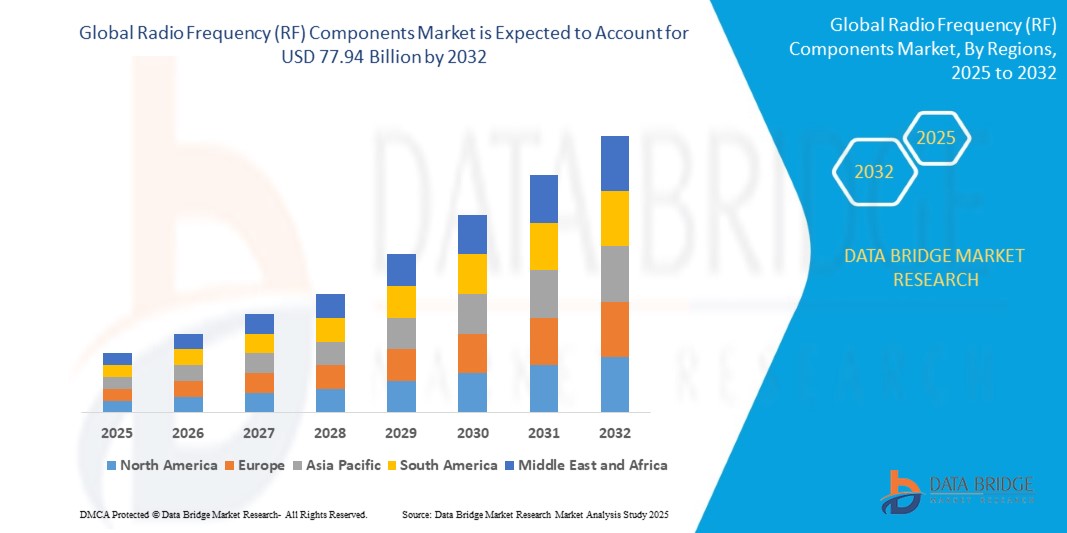

- The global Radio Frequency (RF) Components market size was valued at USD 34.81 billion in 2024 and is expected to reach USD 77.94 billion by 2032, at a CAGR of 10.6% during the forecast period

- This growth is driven by the rapid expansion of 5G networks, increasing demand for wireless communication devices, and the proliferation of IoT-enabled applications across industries like telecommunications, automotive, and healthcare. The surge in consumer electronics, such as smartphones and wearables, further accelerates market growth.

- Advancements in RF technologies, including the adoption of GaN and SiGe for high-performance applications, coupled with the integration of RF components in autonomous vehicles and smart cities, are propelling market expansion, particularly in regions with strong technological infrastructure.

Radio Frequency (RF) Components Market Analysis

- RF components are critical electronic elements that enable wireless communication by transmitting and receiving radio frequency signals. These components, including antennas, amplifiers, and filters, are integral to devices like smartphones, base stations, radar systems, and medical imaging equipment, ensuring efficient signal processing and connectivity.

- The market is fueled by the global rollout of 5G networks, with over 2.5 billion 5G subscriptions projected by 2028, driving demand for high-frequency RF components in telecommunications infrastructure. The IoT market, valued at USD 662 billion in 2023, further boosts demand for RF components in connected devices.

- The integration of advanced materials like GaN and SiGe enhances RF component performance, offering higher efficiency and power handling for applications in aerospace, defense, and automotive sectors. The rise of autonomous vehicles, requiring RF components for V2X (Vehicle-to-Everything) communication, is a significant growth driver.

- Asia-Pacific led the global RF components market with a commanding revenue share of 38.4% in 2024, driven by its robust electronics manufacturing ecosystem, high 5G adoption rates, and presence of key players in China, Japan, and South Korea. China, in particular, dominates due to its massive telecommunications infrastructure investments.

- North America is anticipated to witness the fastest growth rate, with a projected CAGR of 11.8% from 2025 to 2032, propelled by advancements in defense technologies, increasing demand for consumer electronics, and significant R&D investments in the U.S. and Canada.

- Among product types, the filters segment held the largest market share of 28.6% in 2024, valued at USD 9.95 billion, attributed to their critical role in signal processing for 5G networks, consumer electronics, and automotive applications, ensuring minimal interference and high performance.

Report Scope and Radio Frequency (RF) Components Market Segmentation

|

Attributes |

Radio Frequency (RF) Components Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Radio Frequency (RF) Components Market Trends

“Advancements in 5G, GaN Technology, and Miniaturization”

- A prominent trend in the global RF components market is the widespread adoption of 5G-compatible RF components, with over 60% of new product launches in 2023 and 2024 designed for high-frequency bands like mmWave, enabling ultra-fast data transmission in telecommunications.

- The integration of gallium nitride (GaN) technology, offering superior power efficiency and thermal performance, is gaining traction, with over 35% of new RF amplifiers and components in 2024 utilizing GaN for aerospace, defense, and 5G applications.

- Miniaturization of RF components, driven by advancements in CMOS and SiGe technologies, is expanding their use in compact devices like wearables and IoT modules, with 30% of new components designed for space-constrained applications.

- The rise of software-defined radio (SDR) technologies is enhancing RF component flexibility, allowing dynamic reconfiguration for multiple applications, with adoption rates increasing by 20% in telecommunications and defense sectors.

- Increasing focus on energy-efficient RF designs, particularly for battery-powered devices, is aligning with sustainability goals, with over 25% of new components in 2024 featuring low-power consumption for IoT and consumer electronics.

- The growth of online distribution channels is transforming market access, with online sales of RF components growing by 15% annually, driven by the convenience of e-commerce platforms for small manufacturers and developers.

Radio Frequency (RF) Components Market Dynamics

Driver

“5G Expansion, IoT Proliferation, and Autonomous Vehicle Development”

- The global rollout of 5G networks, with over 2.5 billion subscriptions projected by 2028, is a primary driver, increasing demand for RF components like filters and amplifiers in base stations and smartphones, ensuring high-speed connectivity.

- The proliferation of IoT devices, with the global IoT market valued at USD 662 billion in 2023 and projected to reach USD 2.3 trillion by 2030, is driving demand for RF components in smart homes, cities, and industrial applications.

- The rise of autonomous vehicles, with global sales expected to reach 3 million units by 2030, is boosting demand for RF components in V2X communication, radar, and LIDAR systems, enhancing vehicle safety and connectivity.

- Increasing investments in aerospace and defense, with global defense spending reaching USD 2.2 trillion in 2023, are driving demand for high-performance RF components in radar, satellite communication, and electronic warfare systems.

- Growing consumer electronics adoption, with over 1.5 billion smartphones sold globally in 2023, is fueling demand for compact and efficient RF components for seamless wireless connectivity and signal processing.

- Government initiatives, such as China’s 14th Five-Year Plan and the U.S. CHIPS Act, are promoting semiconductor and RF technology development, supporting market growth through R&D funding and manufacturing incentives.

Restraint/Challenge

“High Costs, Supply Chain Disruptions, and Technical Complexities”

- The high cost of advanced RF components, particularly those using GaN and mmWave technologies, poses a challenge to adoption in cost-sensitive markets, limiting scalability for small-scale manufacturers and developers.

- Supply chain disruptions, including semiconductor shortages and geopolitical tensions, have impacted RF component production, leading to delays and increased costs, with the COVID-19 pandemic exacerbating supply constraints.

- Technical complexities in designing and integrating high-frequency RF components for 5G and IoT applications require specialized expertise and advanced manufacturing processes, increasing development costs and time-to-market.

- Stringent regulatory requirements, such as FCC standards in the U.S. and CE certifications in Europe, increase compliance costs and complexity for RF component manufacturers, particularly in telecommunications and defense sectors.

- Competition from alternative technologies, such as optical communication in certain high-speed applications, poses a challenge to RF component adoption, particularly in data centers and long-haul networks.

- The need for continuous innovation to meet evolving 5G and 6G standards, coupled with rapid technological obsolescence, creates pressure on manufacturers to invest heavily in R&D, limiting profitability for smaller players.

Radio Frequency (RF) Components Market Scope

The global RF components market is segmented on the basis of product type, component, application, technology, end-user, and sales channel.

- By Product Type

On the basis of product type, the market is segmented into antennas, amplifiers, filters, duplexers, modulators & demodulators, mixers, and others. The filters segment dominated the market with a commanding revenue share of 28.6% in 2024, valued at USD 9.95 billion, driven by its critical role in signal processing for 5G networks and consumer electronics.

The amplifiers segment is anticipated to witness the fastest CAGR of 12.1% from 2025 to 2032, fueled by its use in high-power applications like base stations and radar systems.

- By Component

On the basis of component, the market is segmented into hardware, software, and services. The hardware segment held the largest market revenue share of 70.4% in 2024, driven by the widespread demand for physical RF components in telecommunications and consumer electronics.

The software segment is expected to witness the fastest CAGR from 2025 to 2032, propelled by the adoption of software-defined radio (SDR) solutions for flexible signal processing.

- By Application

On the basis of application, the market is segmented into consumer electronics, automotive, telecommunications, aerospace & defense, healthcare, industrial, and others. The telecommunications segment accounted for the largest market revenue share of 35.2% in 2024, driven by the global 5G rollout.

The automotive segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the rise of autonomous vehicles and V2X communication.

- By Sales Channel

On the basis of sales channel, the market is segmented into direct sales, distributors, and online retail. The direct sales segment held the largest share of 55.6% in 2024, driven by B2B contracts with telecommunications and defense firms.

The online retail segment is expected to grow at the fastest CAGR from 2025 to 2032, fueled by e-commerce growth for smaller manufacturers and developers.

- By Technology

On the basis of technology, the market is segmented into GaAs, GaN, SiGe, CMOS, and others. The GaN segment held a significant share in 2024, driven by its high efficiency and power handling in 5G and defense applications.

This segment is expected to grow at the fastest CAGR from 2025 to 2032, fueled by its adoption in high-frequency and high-power systems.

- By End-User

On the basis of end-user, the market is segmented into commercial, industrial, residential, and government & defense. The commercial segment dominated with a 45.8% revenue share in 2024, driven by high demand in consumer electronics and telecommunications.

The government & defense segment is expected to grow at the fastest CAGR from 2025 to 2032, fueled by investments in radar and satellite systems.

Radio Frequency (RF) Components Market Regional Analysis

North America

North America is poised to grow at the fastest CAGR of approximately 11.8% from 2025 to 2032, driven by advancements in defense technologies, high consumer electronics adoption, and R&D investments. The U.S. accounted for 85.4% of the regional market in 2024, supported by the CHIPS Act and strong demand for 5G and IoT solutions.

U.S. Radio Frequency (RF) Components Market Insight

The United States is expected to dominate the North American market, driven by its leadership in telecommunications, defense, and consumer electronics. The adoption of GaN-based RF components in 5G and radar systems, coupled with the presence of key players like Qualcomm and Skyworks, supports market growth.

Europe Radio Frequency (RF) Components Market Insight

Europe held a significant share in 2024, driven by its focus on 5G deployment and automotive innovations. Countries like Germany, the U.K., and France are key contributors, with growth fueled by the adoption of RF components in V2X communication and smart manufacturing.

U.K. Radio Frequency (RF) Components Market Insight

The United Kingdom is anticipated to grow steadily, driven by its strong telecommunications sector and investments in 5G and IoT technologies. Government initiatives like the U.K.’s 5G strategy are boosting demand for RF components in infrastructure and smart cities.

Germany Radio Frequency (RF) Components Market Insight

Germany’s market is expected to grow at a considerable CAGR, fueled by its leadership in automotive and industrial automation. The adoption of RF components in Industry 4.0 and autonomous vehicles, supported by players like Infineon Technologies, drives market expansion.

Asia-Pacific Radio Frequency (RF) Components Market Insight

Asia-Pacific dominated the global RF components market with a revenue share of 38.4% in 2024, driven by its robust electronics manufacturing ecosystem, high 5G adoption rates, and significant investments in telecommunications infrastructure. The telecommunications segment accounted for the largest application share of 40.1% in 2024, driven by 5G deployments. The automotive segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the rise of electric and autonomous vehicles.

Japan Radio Frequency (RF) Components Market Insight

Japan’s market is expanding at a notable CAGR, fueled by its advanced electronics industry and focus on 5G and IoT applications. The presence of key players like Murata Manufacturing and Mitsubishi Electric, coupled with investments in automotive and defense technologies, drives market growth.

China Radio Frequency (RF) Components Market Insight

China captured the largest revenue share of 42.6% within Asia-Pacific in 2024, driven by its leadership in 5G infrastructure, with over 3 million 5G base stations deployed by 2023, and a thriving consumer electronics market. Government initiatives like the 14th Five-Year Plan support RF component development through R&D funding and manufacturing incentives.

Radio Frequency (RF) Components Market Share

- The Radio Frequency (RF) Components industry is primarily led by well-established companies, including:

- Qualcomm Incorporated (U.S.)

- Broadcom Inc. (U.S.)

- Skyworks Solutions, Inc. (U.S.)

- Qorvo, Inc. (U.S.)

- Analog Devices, Inc. (U.S.)

- Murata Manufacturing Co., Ltd. (Japan)

- NXP Semiconductors N.V. (Netherlands)

- Texas Instruments Incorporated (U.S.)

- STMicroelectronics N.V. (Switzerland)

- Infineon Technologies AG (Germany)

- Renesas Electronics Corporation (Japan)

- Microchip Technology Incorporated (U.S.)

- MACOM Technology Solutions Holdings, Inc. (U.S.)

- Mitsubishi Electric Corporation (Japan)

- Wolfspeed, Inc. (U.S.)

- TDK Corporation (Japan)

Latest Developments in Global Radio Frequency (RF) Components Market

- In March 2023, Qualcomm Incorporated launched the Snapdragon RF Modem, a 5G-compatible RF solution with enhanced mmWave capabilities, improving data speeds by 20% for smartphones and IoT devices, adopted by over 50 OEMs globally.

- In January 2024, Skyworks Solutions, Inc. introduced a new line of GaN-based RF amplifiers for 5G base stations, offering 25% improved power efficiency, deployed in over 200 telecommunications projects in North America and Asia-Pacific.

- In April 2024, Murata Manufacturing Co., Ltd. unveiled a compact RF filter series for IoT and wearable applications, reducing size by 30% while maintaining high performance, gaining traction in consumer electronics markets.

- In February 2024, Qorvo, Inc. launched an integrated RF front-end module for automotive V2X communication, enhancing signal reliability for autonomous vehicles, with adoption by major automakers in Europe and the U.S.

- In June 2023, Analog Devices, Inc. introduced a software-defined RF transceiver for aerospace and defense applications, supporting multi-band operations and reducing system complexity, adopted in over 100 radar and satellite projects.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Radio Frequency Rf Components Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Radio Frequency Rf Components Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Radio Frequency Rf Components Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.