Global Wired Interface Market

Market Size in USD Billion

CAGR :

%

USD

23.49 Billion

USD

47.85 Billion

2023

2032

USD

23.49 Billion

USD

47.85 Billion

2023

2032

| 2024 –2032 | |

| USD 23.49 Billion | |

| USD 47.85 Billion | |

|

|

|

|

Wired Interface Market Size

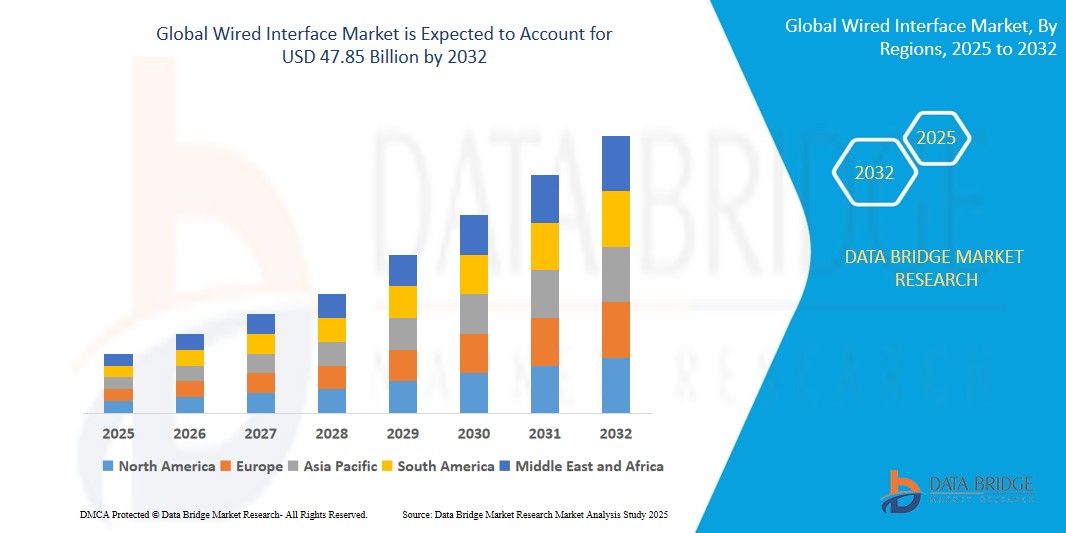

- The global Wired Interface Market size was valued at USD 23.49 billion in 2024 and is expected to reach USD 47.85 billion by 2032, at a CAGR of 9.30% during the forecast period

- This growth is driven by factors such as the Increased Demand for High-Speed Data Transfer, Rising Use in Industrial and Automotive Applications, and Wider Adoption of USB-C and Thunderbolt

Wired Interface Market Analysis

- Wired interface generally requires a physical wire connection for communication. These wires are connected from mouse, PC to display and other components. Most of the wired connection use ethernet cable for transmission.

- The wired interface provides faster speed when compared to wireless interface. It is usually used in traditional office and institutional setup.

- Asia-Pacific leads the wired interface market because of the strong presence of large number of electronic devices manufacturing companies in the region

- North America is expected to expand at a significant growth rate of 2025 to 2032 owing to the rising disposable income along with increasing automotive and consumer electronics sector in the region.

- USB Wired Interface segment is expected to dominate the market with a market share of 54.78% due to its wide compatibility, ease of use, and reliable data transfer. Its low cost and plug-and-play functionality make it a preferred choice across consumer and industrial electronics.

Report Scope and Wired Interface Market Segmentation

|

Attributes |

Wired Interface Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Wired Interface Market Trends

“Rise of USB Type-C Across Consumer and Industrial Devices”

- USB Type-C has quickly become the go-to wired interface across smartphones, laptops, tablets, and even industrial tools. Its reversible design, faster charging capabilities, and high-speed data transfer make it a favorite among manufacturers and users alike. The trend is further driven by global efforts to standardize charging ports to reduce electronic waste—especially in the EU, where legislation is pushing USB Type-C as a universal charging port.

- This interface also supports multiple protocols like HDMI and DisplayPort, which simplifies port design in thinner devices. As more brands unify their products around USB Type-C, the market is seeing growing investment in cables, connectors, and compatible components. Even heavy-duty applications like docking stations and external GPUs are embracing USB Type-C for its versatility. This shift represents a strong and ongoing trend in both consumer and enterprise tech.

- For instance, In March 2025, Apple officially transitioned all new iPads and iPhones to USB Type-C ports, complying with EU regulations. This change marked the end of Apple’s proprietary Lightning port after more than a decade. It simplifies charging and connectivity for users across Apple and non-Apple devices. The decision prompted a spike in demand for USB Type-C cables, adapters, and accessories. It also accelerated the market’s shift toward universal wired interface solutions.

Wired Interface Market Dynamics

Driver

“Surge in Demand for High-Speed Data Transmission”

- One of the biggest drivers of the wired interface market is the growing need for fast and reliable data transfer. As consumers and businesses deal with more data-intensive tasks—like 4K video streaming, gaming, cloud computing, and AI processing—devices need stronger and faster physical connections.

- Wired interfaces such as USB4, Thunderbolt 4, and HDMI 2.1 offer extremely high data rates, which wireless technologies still struggle to match in reliability. These wired connections are essential in professional settings like video production, data centers, and financial trading systems where data speed and integrity are critical.

- They are also used in external GPUs, SSDs, and docks to eliminate lag and speed up workflows. This consistent need for rapid and secure data exchange is fueling investment and innovation in wired interface technologies across sectors.

For instance,

- In February 2025, Dell introduced a line of high-performance laptops equipped with Thunderbolt 4 and USB4 ports. These laptops are designed for creators and engineers who need fast connections for editing and rendering. The ports allow users to connect multiple monitors and transfer large files in seconds. Dell emphasized that wired interfaces offer better speed and reliability than most wireless alternatives. This showcases how performance demands are steering growth in high-speed wired ports.

Opportunity

“Growing Integration in Electric Vehicles (EVs)”

- As electric vehicles (EVs) continue to gain traction worldwide, the need for stable and fast communication systems within the vehicle is rising. Wired interfaces play a crucial role in ensuring reliable data transmission between EV components such as battery management systems, infotainment, and ADAS (Advanced Driver Assistance Systems).

- Since EVs require high-speed, interference-free communication to function safely and efficiently, this trend presents a strong opportunity for wired interface manufacturers. Moreover, EVs require robust charging solutions—many of which use wired connections—further driving demand. Automakers are also demanding connectors and ports that can withstand harsh automotive environments, making durability a key selling point.

- As governments push for electrification, the scale of EV production is only expected to rise. This creates a long-term growth window for wired interface components tailored to EV needs. Suppliers that can offer high-speed, durable, and compact wired solutions are in a good position to benefit.

For instance,

- In April 2025, Tesla announced an upgrade to its internal EV communication architecture, shifting to more robust wired communication systems to improve data accuracy in battery and powertrain controls. This move improves safety and efficiency, especially under heavy performance load. The new wired setup supports faster diagnostics and firmware updates through onboard interfaces. Tesla’s focus on wired reliability highlights a growing trend in high-performance EV design. This also opens doors for component suppliers that specialize in automotive-grade wired technologies.

Restraint/Challenge

“Growing Popularity of Wireless Alternatives”

- One major challenge for the wired interface market is the rising popularity of wireless technologies like Wi-Fi 6, Bluetooth 5.3, and wireless USB. These wireless options provide users with more freedom and convenience, especially in portable and wearable devices.

- As more consumers and manufacturers prioritize sleek, cable-free designs, demand for wired connections may decline in certain segments. Wireless charging, wireless audio, and wireless data transfer have become standard in many modern devices, reducing the need for multiple wired ports.

- Although wired interfaces still offer better stability and speed, the convenience of wireless is increasingly hard to ignore for general users. This trend could limit growth in traditional wired markets, particularly in consumer electronics.

For instance,

- In January 2025, Apple announced new MacBook models with fewer wired ports, emphasizing wireless accessories and cloud storage. The company highlighted support for Wi-Fi 6E and Bluetooth 5.3 for faster, cable-free workflows. Many users now prefer wireless earbuds and chargers, reducing reliance on wired USB or audio ports. Apple’s design shift reflects the broader move toward minimal and wireless setups. This shift may reduce future demand for wired interface components in mainstream laptops.

Wired Interface Market Scope

The market is segmented on the basis component type and device type.

|

Segmentation |

Sub-Segmentation |

|

Component type |

|

|

Device type |

|

In 2025, the USB Wired Interface is projected to dominate the market with a largest share in segment

USB Wired Interface segment is expected to dominate the market with a market share of 54.78% due to its wide compatibility, ease of use, and reliable data transfer. Its low cost and plug-and-play functionality make it a preferred choice across consumer and industrial electronics.

The HDMI Wired Interface is expected to account for the largest share during the forecast period in market

The HDMI wired interface is anticipated to hold the largest market share 51.16% during the forecast period due to its widespread use in consumer electronics and entertainment systems. Its ability to transmit high-definition audio and video through a single cable makes it a preferred choice for both home and professional setups. HDMI's compatibility with TVs, gaming consoles, monitors, and projectors further boosts its adoption. Ongoing advancements, such as HDMI 2.1, also support its continued dominance in the market.

Wired Interface Market Regional Analysis

“Asia-Pacific Holds the Largest Share in the Wired Interface Market”

- Asia-Pacific holds the largest share in the wired interface market due to its strong electronics manufacturing base and growing consumer demand for advanced devices. Countries like China, Japan, and South Korea are major hubs for producing smartphones, laptops, TVs, and gaming consoles, all of which rely on wired interfaces like USB and HDMI.

- The region benefits from robust infrastructure, a skilled workforce, and favorable government policies supporting technology and electronics industries. Rapid urbanization and increasing disposable income also drive higher consumption of electronic goods.

- Additionally, the rise of industrial automation and IoT adoption in Asia is boosting the need for reliable data transmission, favoring wired connections. Continuous investments in R&D by regional tech giants contribute to innovation in interface technologies.

“North America is Projected to Register the Highest CAGR in the Wired Interface Market”

- North America is projected to witness the highest CAGR in the wired interface market due to its strong focus on technological innovation and digital infrastructure. The region is home to leading tech companies and startups that constantly drive demand for advanced connectivity solutions. Increasing adoption of smart home devices, gaming systems, and high-resolution entertainment systems fuels the need for high-speed wired interfaces like HDMI and USB.

- The expansion of data centers and cloud computing services also contributes to market growth, requiring reliable and secure data transmission. Additionally, sectors like automotive, healthcare, and aerospace are adopting wired interfaces for performance-critical applications. Government initiatives supporting digital transformation further boost growth.

- High consumer spending and demand for next-gen electronics create sustained opportunities. This combination of innovation, demand, and infrastructure makes North America a fast-growing region in this market.

Wired Interface Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Koch Industries, Inc.,

- Amphenol Corporation,

- Japan Aviation Electronics Industry, Ltd.,

- Mouser Electronics, Inc.,

- STMicroelectronics,

- NXP Semiconductors,

- Texas Instruments Incorporated,

- Cypress Semiconductor Corporation,

- TE Connectivity,

- ROHM CO. LTD.,

- HIROSE ELECTRIC CO. LTD.,

- Semiconductor Components Industries, LLC,

- Analog Devices Inc.,

- Diodes Incorporated,

- Murata Manufacturing Co. Ltd.,

- Vishay Intertechnology, Inc.,

- Silicon Laboratories,

- Maxim Integrated,

- Orbital Energy Group

- Yamaichi Electronics Co. Ltd.,

Latest Developments in Global Wired Interface Market

- In December 2022, Texas Instruments announced a collaboration with Chicony Power, integrating TI's Gallium Nitride (GaN) technology into Chicony's 65W laptop power adapter, Le Petit. This collaboration aims to cut the adapter's size by 50% and boost its efficiency by up to 94%. TI's GaN technology, using the LMG2610 half-bridge GaN FET with an integrated gate driver, plays a crucial role in this advancement. This move reflects TI’s ongoing effort to innovate power management solutions, aligning with the industry's trend for more compact, efficient designs. As this technology becomes more prevalent, it is expected to influence future product designs and set new standards in the wired interface market.

- In October 2024, Mouser Electronics was awarded the prestigious Global High Service Distributor of the Year Award by TE Connectivity for the tenth consecutive time. This recognition highlights Mouser’s strong performance in sales, market expansion, and exceptional customer service. With a vast inventory and deep technical expertise, Mouser has become a key player in meeting the growing demand for advanced wired interface components. This acknowledgment reflects the industry’s appreciation of Mouser’s role in facilitating the adoption of cutting-edge technologies and keeping up with the fast-paced evolution of connectivity solutions.

- In August 2023, ROHM Semiconductor unveiled its EcoGaN™ Power Stage ICs, designed to improve efficiency by reducing energy loss and helping miniaturize electronic components. These integrated circuits are ideal for applications that require high energy efficiency, reflecting the industry's shift towards more compact and sustainable power solutions. This development is expected to enhance the design and performance of wired interfaces across various consumer and industrial applications. ROHM’s focus on improving energy efficiency aligns with broader semiconductor industry trends and is poised to make wired interface products more reliable and sustainable.

- In 2023, Murata Manufacturing introduced a new series of capacitors, including the GJM02 chip MLCCs and KCA SMD safety capacitors. These components are designed to support the growing demand for smaller, more efficient parts in various applications. The GJM02 series offers smaller sizes without compromising performance, while the KCA SMD capacitors enhance safety in electronic circuits. These innovations are expected to drive the development of wired interfaces, particularly in consumer electronics and automotive sectors, as they contribute to the ongoing trend of miniaturization and enhanced functionality in electronic parts.

- In early 2025, Analog Devices launched its latest high-speed data converters, designed to meet the rising demand for 5G communications and high-performance computing applications. These converters offer greater bandwidth and lower latency, which are critical for high-speed, modern wired interfaces. By integrating these components, the performance of wired connectivity solutions is expected to improve significantly. Analog Devices’ focus on data conversion technology highlights the push for faster and more reliable wired interfaces, and these innovations are expected to shape the next generation of wired interface standards.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Wired Interface Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Wired Interface Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Wired Interface Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.