Global Release Agents In Confectionary Market

Market Size in USD Billion

CAGR :

%

USD

830.20 Billion

USD

1,323.21 Billion

2024

2032

USD

830.20 Billion

USD

1,323.21 Billion

2024

2032

| 2025 –2032 | |

| USD 830.20 Billion | |

| USD 1,323.21 Billion | |

|

|

|

|

Release Agents in Confectionary Market Size

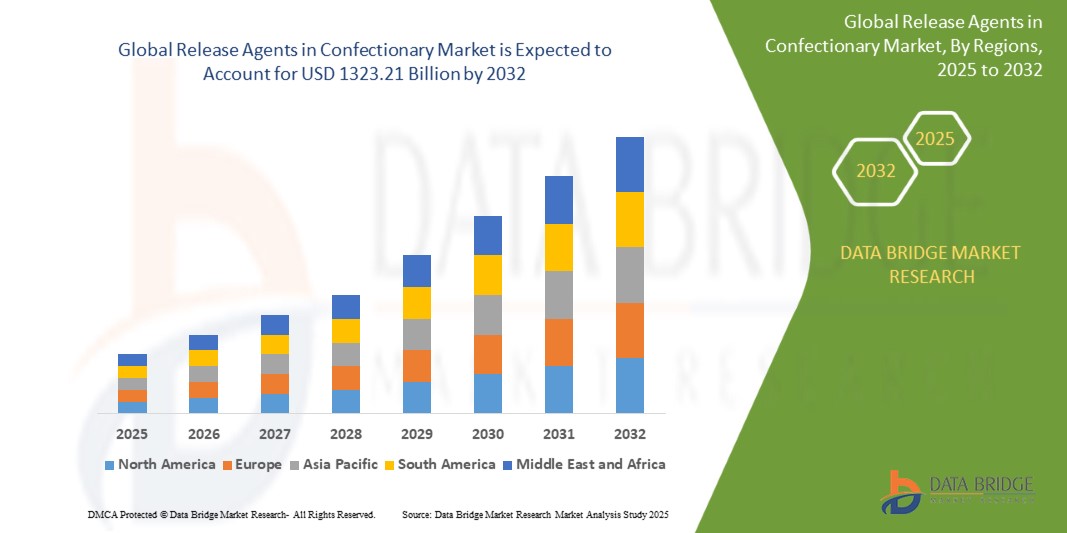

- The global release agents in confectionary market size was valued at USD 830.20 billion in 2024 and is expected to reach USD 1323.21 billion by 2032, at a CAGR of 6.00% during the forecast period

- The market growth is largely fuelled by the increasing demand for high-quality confectionery products with consistent shape, texture, and appearance, which drives the adoption of release agents to prevent sticking during manufacturing

- In addition, technological advancements in food-grade emulsifiers and oils are enabling the development of cleaner-label and allergen-free release agents, further expanding their application across premium and organic confectionery segments

Release Agents in Confectionary Market Analysis

- The market is witnessing strong growth across both developed and emerging regions, propelled by rising consumption of chocolates, gummies, and other sugar-based confections

- Key players are focusing on customized formulations to meet specific needs in different confectionery processes such as molding, demolding, and panning

- Europe dominated the release agents in confectionery market with the largest revenue share of 39.88% in 2024, driven by the strong presence of established confectionery manufacturers, strict food safety regulations, and growing consumer preference for clean-label and allergen-free products

- Asia-Pacific region is expected to witness the highest growth rate in the global release agents in confectionary market, driven by increasing urbanization, growing middle-class populations, and the rising popularity of Western-style confectionery products, particularly in China, India, and Southeast Asian countries

- The vegetable oils segment dominated the market with the largest revenue share in 2024, driven by growing demand for natural and plant-based ingredients in confectionery production. Manufacturers are increasingly turning to vegetable oil-based release agents for their clean-label appeal, regulatory compliance, and superior performance in preventing sticking during high-temperature processes. These agents are also favored for their sustainability, allergen-free nature, and minimal impact on flavor or texture

Report Scope and Release Agents in Confectionary Market Segmentation

|

Attributes |

Release Agents in Confectionary Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Release Agents in Confectionary Market Trends

“Rising Shift Toward Clean-Label and Natural Release Agents”

- Consumers are increasingly seeking transparency in ingredient lists, prompting confectionery manufacturers to move toward clean-label release agents made from recognizable and natural components. This shift aligns with growing consumer trust in minimally processed and additive-free products

- Health and wellness trends are driving food brands to eliminate synthetic compounds such as petroleum-based oils and silicones. In their place, plant-based alternatives including vegetable oils, lecithin, and natural waxes are being adopted for their safety and functionality

- Regulatory frameworks in Europe, North America, and other regions are tightening control over food-contact substances. These changes are pressuring manufacturers to use food-grade, biodegradable, and non-toxic release agents to ensure safety and environmental compliance

- Confectionery producers aiming to meet corporate sustainability targets are increasingly selecting eco-friendly release agents. These options support brand positioning, reduce environmental footprint, and meet consumer expectations for greener products

- For instance, in 2023, Cargill introduced plant-based, label-friendly release agents for confectionery use. These formulations provide effective non-stick performance while satisfying both clean-label criteria and corporate sustainability commitments

Release Agents in Confectionary Market Dynamics

Driver

“Escalating Demand for High-Speed, Non-Stick Confectionery Production”

- The growing demand for high-output production in confectionery facilities has raised the need for reliable release agents that ensure smooth detachment of products from molds, pans, and conveyor belts without breakage

- Sticky and delicate items such as gummies, caramels, and nougats often adhere to production surfaces. Proper release agents help minimize waste, preserve product shape, and maintain consistency in batch production

- In high-speed, automated manufacturing setups, downtime caused by sticking or cleaning is costly. Consistent application of efficient release agents enables uninterrupted operations and supports productivity goals

- Specialized release agents are tailored for specific confectionery applications to reduce residue buildup, enhance surface finish, and optimize line speeds without requiring frequent reapplication or equipment cleaning

- For instance, Barry Callebaut integrates customized release formulations into its molding operations to maintain product integrity, streamline output, and meet the rigorous efficiency demands of large-scale chocolate production

Restraint/Challenge

“Regulatory Restrictions on Chemical-Based and Allergen-Risk Ingredients”

- Global regulatory agencies such as the EFSA and the U.S. FDA enforce stringent safety standards on substances in direct contact with food. Many synthetic and chemical-based release agents must pass rigorous compliance reviews or face restriction

- Ingredients derived from common allergens—such as soy, milk proteins, or gluten—raise labeling concerns and pose market access challenges, particularly for products targeting allergen-free or clean-label claims

- Health concerns over prolonged exposure to certain chemical release agents are mounting. These substances may be linked to toxicity or residue risks, pushing regulators and manufacturers toward safer, natural alternatives

- A key challenge for producers is maintaining the non-stick efficacy, shelf stability, and processing ease of traditional release agents while transitioning to plant-based or compliant formulations. This often requires significant R&D investment

- For instance, in the European Union, silicone-based release agents have come under regulatory scrutiny for potential migration risks, leading confectionery manufacturers to switch to bio-based alternatives to uphold compliance and brand trust

Release Agents in Confectionary Market Scope

The market is segmented on the basis of composition, type, application, form, and formulation.

• By Composition

On the basis of composition, the release agents in confectionery market is segmented into emulsifiers, antioxidants, vegetable oils, wax and wax esters, and others. The vegetable oils segment dominated the market with the largest revenue share in 2024, driven by growing demand for natural and plant-based ingredients in confectionery production. Manufacturers are increasingly turning to vegetable oil-based release agents for their clean-label appeal, regulatory compliance, and superior performance in preventing sticking during high-temperature processes. These agents are also favored for their sustainability, allergen-free nature, and minimal impact on flavor or texture.

The emulsifiers segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising innovation in emulsifier blends that enhance both release performance and shelf stability. Their multifunctionality in improving product consistency, surface finish, and manufacturing efficiency is making emulsifiers increasingly attractive across a broad range of confectionery types.

• By Type

On the basis of type, the market is segmented into fluid release agents, solid release agents, and water-based release agents. Fluid release agents held the largest market revenue share in 2024 owing to their ease of application, consistent coating, and widespread use across automated production lines. They offer a uniform release layer, ensuring product quality while minimizing waste.

The water-based release agents segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the rising demand for eco-friendly formulations. These agents reduce environmental impact and align with evolving food safety standards, particularly in regions enforcing stringent VOC regulations.

• By Application

On the basis of application, the market is segmented into chocolate, mints, medicated confectionery, hard-boiled sweets, gums and jellies, caramels and toffees, fine bakery wares, and others. The chocolate segment dominated the market in 2024 due to the high production volumes and need for precise mold release in industrial chocolate molding. The use of premium release agents ensures smooth surfaces and uniform shapes, reducing rework and product loss.

The gums and jellies segment is expected to witness the fastest growth rate from 2025 to 2032, attributed to their expanding popularity among consumers and the technical challenges of releasing sticky, gel-based products from molds or belts.

• By Form

On the basis of form, the release agents in confectionery market is segmented into liquids and solids. Liquid release agents dominated the market in 2024 due to their broad utility, ease of spray or brush application, and ability to evenly coat intricate molds. They are ideal for high-throughput production environments and adaptable across multiple confectionery formats.

Solid release agents is expected to witness the fastest growth rate from 2025 to 2032, especially in artisanal or small-batch production settings where handling simplicity, storage convenience, and consistency in application are priorities.

• By Formulation

On the basis of formulation, the market is segmented into kosher, non-GMO, trans-fat free, allergen-free, and certified organic. The kosher segment captured the largest revenue share in 2024, supported by the expanding global demand for religiously certified and ethically processed ingredients. It is widely adopted in both domestic and export-focused production lines.

The certified organic segment is expected to witness the fastest growth rate from 2025 to 2032, driven by a surging interest in organic confectionery. Consumer awareness regarding chemical-free ingredients and traceable supply chains is compelling manufacturers to adopt organic release agents that meet stringent certification standards.

Release Agents in Confectionary Market Regional Analysis

- Europe dominated the release agents in confectionery market with the largest revenue share of 39.88% in 2024, driven by the strong presence of established confectionery manufacturers, strict food safety regulations, and growing consumer preference for clean-label and allergen-free products

- Manufacturers across the region are increasingly using advanced release agent formulations to maintain product integrity, reduce waste, and improve production efficiency in confectionery applications

- The demand for plant-based, non-GMO, and trans-fat free release agents is also growing in Europe, aligning with evolving consumer expectations and sustainable food production practices

Germany Release Agents in Confectionery Market Insight

The Germany release agents in confectionery market accounted for a major share in 2024, supported by the country’s position as a key confectionery producer in Europe. With increasing production of chocolate, baked goods, and sugar-based sweets, the need for efficient release solutions is rising. German manufacturers are embracing sustainable and allergen-free formulations to meet stringent regulations and high consumer awareness around food safety. Innovations in water-based and vegetable oil-based agents are contributing to better surface quality and equipment longevity in confectionery processing.

U.K. Release Agents in Confectionery Market Insight

The U.K. release agents in confectionery market is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising demand for clean-label and allergen-free confectionery products. With a strong domestic confectionery industry and a focus on premium offerings such as artisan chocolates, fine bakery items, and medicated sweets, manufacturers in the U.K. are adopting advanced release agents to improve product aesthetics, reduce waste, and maintain consistency. Regulatory alignment with European Union food safety standards and growing interest in vegan and certified organic formulations are also contributing to the adoption of vegetable oil- and wax-based release agents in the region.

North America Release Agents in Confectionery Market Insight

The North America release agents in confectionery market is expected to witness the fastest growth rate from 2025 to 2032, fuelled by a surge in processed food consumption, technological advancements in food manufacturing, and a strong focus on clean-label ingredients. Manufacturers in the U.S. and Canada are adopting advanced release solutions to support high-volume confectionery production, particularly in chocolate, caramel, and gummy applications. Growth is also driven by rising investments in food-grade lubricants and customized agent formulations catering to gluten-free, kosher, and organic product lines.

U.S. Release Agents in Confectionery Market Insight

The U.S. release agents in confectionery market is expected to witness the fastest growth rate from 2025 to 2032, propelled by a robust processed food industry and consumer demand for convenience-oriented sweets and snacks. The presence of leading confectionery brands, coupled with increasing production automation, is boosting the adoption of fluid and water-based release agents. Moreover, rising preference for allergen-free and organic confectionery is influencing manufacturers to invest in innovative, clean-label release agents that support both functionality and compliance with FDA standards.

Asia-Pacific Release Agents in Confectionery Market Insight

The Asia-Pacific release agents in confectionery market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, growing middle-class populations, and increased demand for Western-style confectionery products in countries such as China, India, and Japan. Local producers are upgrading manufacturing processes to meet global quality benchmarks, increasing the adoption of vegetable oil-based and emulsifier-rich release agents. Government support for food processing sectors and rising investments in industrial automation are also supporting market expansion.

China Release Agents in Confectionery Market Insight

The China release agents in confectionery market recorded the highest revenue share within Asia-Pacific in 2024, fuelled by the country's massive processed food sector and growing export-oriented confectionery production. With an increasing number of modern manufacturing units and high-volume output, demand is surging for consistent, food-safe, and equipment-friendly release agents. Chinese manufacturers are focusing on innovation in formulation, including non-GMO and water-based agents, to cater to both local consumption trends and international food quality standards.

Japan Release Agents in Confectionery Market Insight

The Japan release agents in confectionery market is expected to witness the fastest growth rate from 2025 to 2032, due to the country’s tradition of high-quality, precision-driven food production and a growing shift toward Western-style confections. Japanese confectionery producers, known for products such as mochi, jellies, and chocolate, are leveraging release agents to enhance efficiency, reduce breakage, and ensure smooth demolding. The market is also seeing increased demand for water-based and trans-fat free formulations, aligned with the country's strong consumer focus on health and safety. In addition, innovations in confectionery automation are fostering the use of high-performance release agents tailored to specific product types and textures.

Release Agents in Confectionary Market Share

The Release Agents in Confectionary industry is primarily led by well-established companies, including:

- ADM (U.S.)

- Lecico GmbH (Germany)

- Lallemand Inc. (Canada)

- Masterol Foods Pty. Ltd. (Australia)

- Orkla (Norway)

- IFC Solutions (U.S.)

- Vegalene (U.S.)

- Cargill, Incorporated (U.S.)

- Maverik Oils (U.S.)

- MC-Bauchemie (Germany)

- Puratos (Belgium)

- Caldic B.V. (Netherlands)

- Roquette Frères (France)

- Dübör Groneweg GmbH & Co. Kg (Germany)

- AAK (Sweden)

- Royal Zeelandia Group BV (Netherlands)

- Associated British Foods plc (U.K.)

- Batory Foods (U.S.)

- Bakels Worldwide (Switzerland)

- Dow (U.S.)

Latest Developments in Global Release Agents in Confectionary Market

- In September 2020, Avatar Corp introduced ProKote 5022-AO, a water-miscible release agent tailored for organic food processors. ProKote 5022-AO is devoid of allergens and comprises solely naturally derived components. It boasts a high smoke and flash point, making it resilient to extreme processing temperatures.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Release Agents In Confectionary Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Release Agents In Confectionary Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Release Agents In Confectionary Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.