Global Dairy Alternative Market

Market Size in USD Billion

CAGR :

%

USD

27.11 Billion

USD

63.15 Billion

2024

2032

USD

27.11 Billion

USD

63.15 Billion

2024

2032

| 2025 –2032 | |

| USD 27.11 Billion | |

| USD 63.15 Billion | |

|

|

|

|

Dairy alternative Market Size

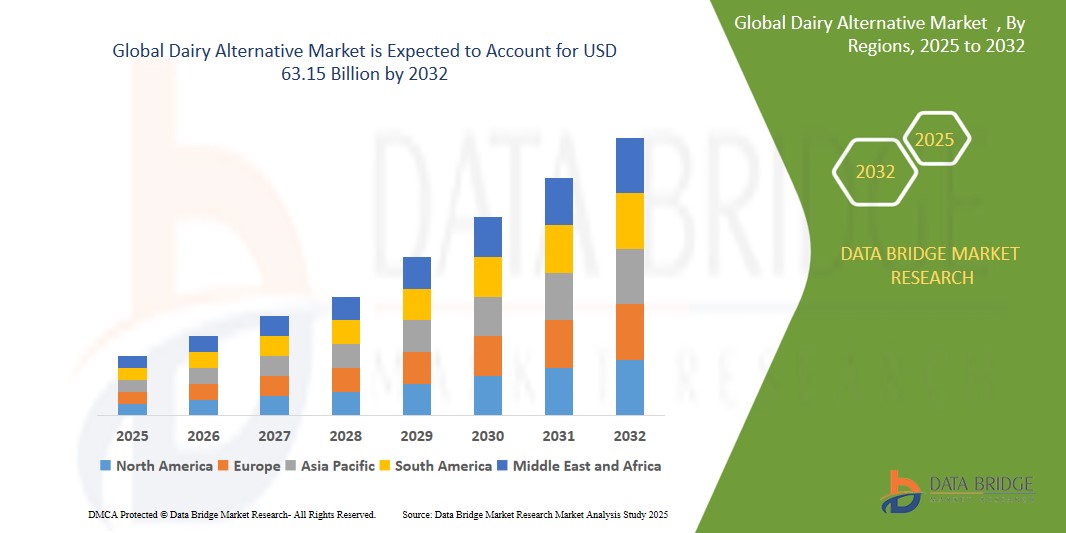

- The global Dairy alternative market was valued at USD 27.11 billion in 2024 and is expected to reach USD 63.15 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 11.20%, primarily driven by the adoption of plant-based ingredient innovations for enhanced nutritional value and taste.

- This growth is driven by factors such as the rising lactose intolerance and demand for plant-based nutrition and increasing health consciousness across the globe

Dairy Alternative Market Analysis

- The dairy alternatives market is driven by the increasing health consciousness among consumers, with a growing demand for plant-based, lactose-free, and dairy-free products to address health issues like cholesterol, lactose intolerance, and obesity.

- The rising awareness of environmental sustainability and ethical considerations in food production is also driving the shift towards plant-based alternatives. Manufacturers are innovating in product offerings, focusing on improved taste, texture, and nutritional profiles using diverse ingredients like oats, almonds, and soy.

- North America, Europe, and Asia-Pacific are the key regions for the dairy alternatives market, with North America and Europe leading the demand for plant-based products, while Asia-Pacific shows significant growth due to rising health awareness and increasing disposable incomes.

Report Scope and Dairy Alternative Market Segmentation

|

Attributes |

Dairy Alternative Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Info sets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Dairy Alternative Market Trends

“Adoption of Plant-Based Ingredient Innovations for Enhanced Nutritional Value and Taste”

- A key trend in the dairy alternative market is the rapid innovation in plant-based ingredients aimed at improving both the nutritional profile and sensory experience of dairy-free products

- New base ingredients such as chickpeas, flaxseed, hemp, and watermelon seeds are being explored beyond traditional soy, almond, and oat to deliver better protein content, creaminess, and micronutrient richness

- Fermentation techniques and enzymatic processing are increasingly employed to enhance digestibility, texture, and flavor in dairy alternatives, mimicking the taste and mouthfeel of conventional dairy

- For instance, An April 2025 article by Guardian News & Media Limited says that Oat milk has become the UK's most popular plant-based milk, accounting for about 40% of the market by volume. Brands like Alpro, owned by Danone, are emphasizing local sourcing by using British-grown oats processed at the high-tech Navara Oat Milling factory. This move supports the growing demand, with supermarket oat milk sales rising 7.2% in the year to February 2025.

Dairy Alternative Market Dynamics

Driver

“Rising Lactose Intolerance and Demand for Plant-Based Nutrition”

- The increasing prevalence of lactose intolerance and milk allergies is significantly boosting the demand for dairy alternative products. Consumers are seeking plant-based options that align with their dietary restrictions and health goals.

- Health-conscious individuals are turning to dairy alternatives like almond milk, soy milk, and oat milk, which are perceived as healthier choices due to their lower saturated fat content and absence of cholesterol.

- The Asia Pacific region, in particular, is witnessing a surge in demand for dairy alternatives, driven by a marked increase in reported cases of cow milk allergies and lactose intolerance. Consumers in this region are shifting towards vegan diets and adopting cow milk alternatives.

For instance,

- In India, studies have revealed that 60%–90% of the population suffers from lactose intolerance or dairy allergies. This high prevalence is significantly boosting the demand for plant-based dairy alternatives in the country.

- As awareness of lactose intolerance and dietary restrictions continues to rise, the market for dairy alternatives is expected to expand further, offering consumers a variety of options that cater to their health and nutritional needs.

Opportunity

“Advancing Plant-Based Dairy with Functional Ingredients & Novel Formulations”

- The integration of functional ingredients such as probiotics, prebiotics, and plant-based proteins is enhancing the nutritional profile of dairy alternatives, catering to health-conscious consumers seeking added health benefits.

- Innovations in fermentation technologies are enabling the development of plant-based dairy products with improved taste, texture, and nutritional value, closely mimicking traditional dairy.

- Advancements in precision fermentation are allowing companies to produce dairy proteins without animals, leading to the creation of lactose-free and environmentally friendly dairy alternatives.

- The growing consumer demand for clean-label and sustainable products is driving manufacturers to explore novel formulations that meet these preferences while delivering on taste and functionality.

For instance,

- In October 2024, Israeli company DairyX developed yeast strains capable of producing casein proteins through precision fermentation, enabling the production of stretchy, creamy cheese without using cows. This innovation addresses texture issues commonly associated with plant-based cheeses and could significantly reduce the environmental impact of the dairy industry.

- As the plant-based dairy market continues to evolve, these innovations present significant opportunities for product diversification and market expansion, aligning with the broader health and wellness trends influencing consumer choices.

Restraint/Challenge

“Regulatory Frameworks for Novel Vegan Products ”

- The introduction of novel dairy alternative products often involves innovative plant-based ingredients that must meet strict regulatory approvals, especially in markets like the EU, U.S., and Asia.

- These regulatory processes can be time-consuming and require extensive documentation, clinical trials, or safety testing, which delays product launches and hampers market responsiveness.

- Companies must invest heavily in compliance, labeling, and reformulation to meet evolving food safety and labeling standards, increasing operational and legal costs.

- Smaller manufacturers face disproportionate challenges in navigating complex regulatory environments, limiting their ability to scale and innovate effectively.

For instance,

According to a blog published by Eurofins, regulations for vegan products emphasize compliance with labeling, ingredient transparency, and allergen warnings. It highlights the importance of adhering to specific standards for plant-based ingredients to ensure product safety and consumer trust, and provides guidance for navigating regulatory requirements in the vegan market.

Dairy Alternative Market Scope

The market is segmented on the basis of product type, type, formulation, application, nutritive and distribution channel.

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Type |

|

|

By Formulation |

|

|

By Application |

|

|

By Nutritive |

|

|

By Distribution Channel |

|

Dairy Alternative Market Regional Analysis

“North America is the Dominant Region in the Dairy alternative Market”

-

North America dominates the global dairy alternatives market, supported by growing consumer demand for plant-based diets, lactose intolerance awareness, and ethical concerns related to animal welfare and sustainability

- The U.S. leads the regional market due to widespread adoption of oat, almond, and soy-based products, a strong presence of major plant-based dairy brands, and continuous innovation in flavors, textures, and nutritional content

- Well-established retail infrastructure, rising demand for clean-label and non-GMO products, and support from venture capital firms for plant-based startups contribute to sustained market leadership

“Asia-Pacific is Projected to Register the Highest Growth Rate”

-

The Asia-Pacific region is expected to register the fastest growth in the dairy alternatives market, driven by increasing lactose intolerance rates, urbanization, and shifting dietary preferences

- Countries like China, India, and Japan are key markets due to expanding middle-class populations, rising health awareness, and growing preference for low-cholesterol, plant-based diets

- Japan’s innovation in soy-based dairy alternatives and China’s rapid adoption of oat and almond milk through both retail and foodservice channels are accelerating market expansion

- In India, the growing vegan population, prevalence of dairy allergies, and religious inclinations toward plant-based consumption are propelling demand; local startups and international brands are increasingly launching region-specific dairy-free products to cater to these needs

Dairy Alternative Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Chobani, LLC (U.S.)

- Danone S.A. (France)

- Hain Celestial (U.S.)

- Daiya Foods (Canada)

- Eden Foods (U.S.)

- NUTRIOPS, SL (Spain)

- Earth’s Own (Canada)

- SunOpta (Canada)

- Melt Organic (U.S.)

- Oatly AB (Sweden)

- Blue Diamond Growers (U.S.)

- Ripple Foods (U.S.)

- Vitasoy International Holdings Ltd (Hong Kong)

- Organic Valley (U.S.)

Latest Developments in Global Dairy Alternative Market

- In June 2023, Oatly Group AB (Sweden) launches introduced a vegan cream cheese that is now available nationwide in the US. This oat-based cream cheese innovation comes in two flavors: Plain and Chive & Onion.

- In April 2021, SunOpta acquired the Dream and WestSoy plant-based beverage brands from The Hain Celestial Group, Inc., enhancing its product portfolio and driving further growth in the plant-based beverages segment.

- In November 2021, Blue Diamond launched Almond Breeze Extra Creamy Almond Milk, crafted using almond oil derived from premium California-grown Blue Diamond almonds to deliver a richer, creamier texture. This product introduction aimed to enhance consumer appeal and expand the company’s customer base.

- In February 2025, MALK Organics introduced two new clean-label products: Unsweetened Organic Coconut and Unsweetened Organic Soy milk. These additions align with the brand's commitment to offering plant-based milks made with minimal ingredients, catering to consumers seeking transparent and healthier options.

- Effective March 5, 2025, Dunkin' removed the additional charges for plant-based milk options like almond and oat milk across all its U.S. locations. This decision, influenced by customer feedback and advocacy efforts, aligns Dunkin' with other major coffee chains in making dairy alternatives more accessible to consumers.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Dairy Alternative Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Dairy Alternative Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Dairy Alternative Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.