Global Railcar Unloader Market

Market Size in USD Billion

CAGR :

%

USD

1.71 Billion

USD

2.43 Billion

2024

2032

USD

1.71 Billion

USD

2.43 Billion

2024

2032

| 2025 –2032 | |

| USD 1.71 Billion | |

| USD 2.43 Billion | |

|

|

|

|

Railcar Unloader Market Size

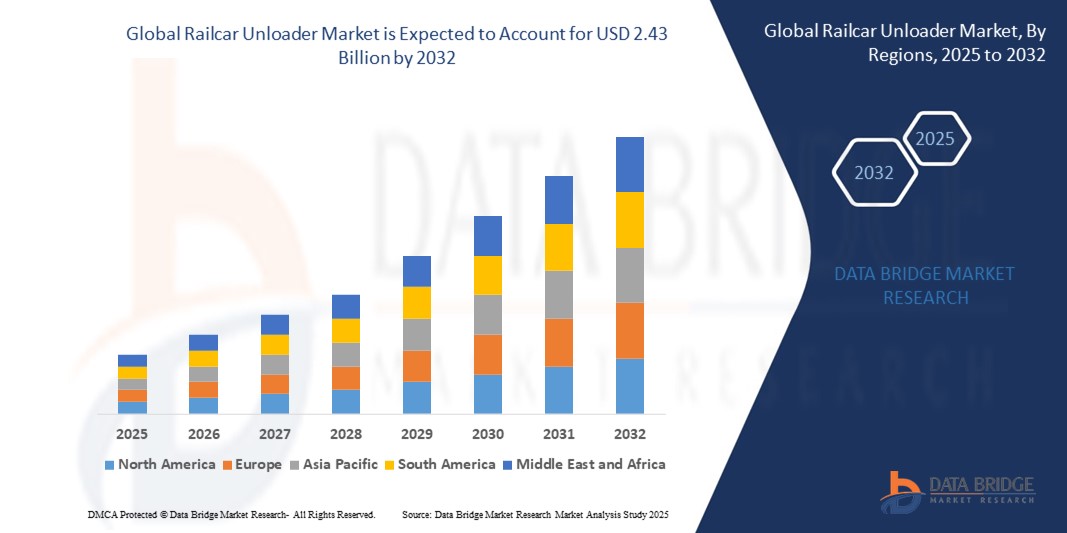

- The global railcar unloader market size was valued at USD 1.71 billion in 2024 and is expected to reach USD 2.43 billion by 2032, at a CAGR of 4.50% during the forecast period

- The market growth is largely fuelled by the increasing demand for efficient bulk material handling in industries such as agriculture, mining, construction, and chemicals, along with rising investments in rail infrastructure upgrades and automation technologies

- The growing emphasis on supply chain optimization and faster turnaround times in freight handling is further accelerating the demand for advanced and automated railcar unloading systems across global markets

Railcar Unloader Market Analysis

- Rising adoption of pneumatic and mechanical unloading systems is enhancing operational efficiency and reducing manual labor dependency across industrial sectors

- Government-led investments in rail freight infrastructure, especially in emerging economies, are positively impacting the adoption of railcar unloaders for efficient material transfer

- North America dominated the railcar unloader market with the largest revenue share in 2024, driven by the widespread use of rail for transporting bulk materials across industries such as oil and gas, mining, and agriculture

- Asia-Pacific region is expected to witness the highest growth rate in the global railcar unloader market, driven by rapid industrialization, increased trade activities, and large-scale infrastructure investments in countries such as China, India, and Southeast Asia

- The rotary railcar dumpers unloaders segment accounted for the largest market revenue share in 2024, attributed to their ability to handle high-capacity bulk unloading operations with precision and efficiency. These systems are preferred in large-scale terminals due to their robust design, automation capabilities, and minimal manpower requirements. The demand is further supported by their compatibility with varied railcar configurations, allowing streamlined unloading in industrial applications

Report Scope and Railcar Unloader Market Segmentation

|

Attributes |

Railcar Unloader Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

• Integration of Automation and Remote-Controlled Systems |

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Railcar Unloader Market Trends

Adoption of Automation and Smart Monitoring Systems

- The rising adoption of automation and remote-controlled systems is transforming railcar unloading operations by reducing human error and improving operational safety. Automated unloaders equipped with sensors and control panels allow for precision unloading of bulk materials such as grains, chemicals, and aggregates, significantly reducing spillage and material loss

- Demand is growing for systems that integrate real-time monitoring, diagnostics, and predictive maintenance features. These smart capabilities help reduce unplanned downtime and maintenance costs, while enhancing throughput and equipment lifespan

- For instance, in 2023, a major logistics provider in Canada upgraded its unloading terminals with sensor-enabled gates and remote operation technology, achieving a 15% improvement in material flow efficiency and reducing manual labor requirements

- As global supply chains demand higher throughput and efficiency, the trend toward digitalized, intelligent unloading systems is expected to accelerate. Key sectors such as agriculture, construction, and chemicals are actively investing in smart railcar unloading infrastructure

- However, the full potential of automation will depend on standardization across rail fleets, user training, and integration with existing transport management systems

Railcar Unloader Market Dynamics

Driver

Expansion of Rail Freight Transportation and Bulk Material Handling

• The growth of rail freight across global markets is driving demand for efficient and high-capacity railcar unloading systems. Rail transport is increasingly preferred for bulk materials such as minerals, grains, and chemicals due to its cost efficiency, lower carbon footprint, and ability to move large volumes over long distances

• Industries such as construction, mining, and agriculture are heavily reliant on rail for bulk logistics, leading to sustained investment in terminal infrastructure. Railcar unloading systems are vital in reducing material handling time, minimizing spillage, and supporting continuous loading-unloading operations at high-throughput facilities

• Governments in emerging economies are also boosting rail infrastructure as part of broader transport modernization plans. For instance, in 2024, India announced increased funding for multimodal logistics parks that include smart railcar unloading systems, enhancing supply chain efficiency and regional connectivity

• In addition, companies are actively exploring eco-friendly and energy-efficient unloading technologies to meet stricter environmental regulations. These innovations include electrically powered systems, dust suppression units, and noise reduction features aimed at minimizing environmental impact during operations

• As industries scale up their logistics capabilities to meet global demand, the need for reliable, fast, and low-maintenance railcar unloaders is becoming more critical. This trend is encouraging both manufacturers and operators to adopt solutions that improve productivity, reduce downtime, and optimize labor efficiency across rail terminals

Restraint/Challenge

High Installation Costs and Site-Specific Limitations

• The high initial cost associated with installing railcar unloaders, especially automated and high-capacity systems, remains a major barrier for small and mid-sized facilities. These systems often require significant capital investment in supporting infrastructure, including tracks, pits, and control equipment

• Many rail terminals operate in constrained spaces or with outdated infrastructure that may not be compatible with modern unloader systems. Retrofitting or upgrading these sites adds to project costs and may cause operational disruptions during installation

• In regions with limited rail development, the lack of standardized wagons and loading configurations further complicates equipment compatibility and reduces efficiency. This is particularly evident in underdeveloped markets where manual or semi-automated unloading remains common

• For instance, logistics firms in parts of Latin America have cited infrastructure fragmentation and high cost as major factors limiting the adoption of modern railcar unloading solutions. Limited access to capital and underdeveloped terminal facilities further hinder the deployment of automated systems in the region, slowing modernization efforts

• Addressing these challenges will require customized solutions, flexible equipment design, and financial support models that enable broader adoption across varying operational and regional contexts. Manufacturers must collaborate with local stakeholders to develop cost-effective systems tailored to specific industrial and geographic needs, ensuring scalability and long-term viability

Railcar Unloader Market Scope

The market is segmented on the basis of type, unloading material, capacity, material type, and application.

- By Type

On the basis of type, the railcar unloader market is segmented into rotary railcar dumpers unloaders, turnover railcar dumpers unloaders, and C-shaped railcar dumpers unloaders. The rotary railcar dumpers unloaders segment accounted for the largest market revenue share in 2024, attributed to their ability to handle high-capacity bulk unloading operations with precision and efficiency. These systems are preferred in large-scale terminals due to their robust design, automation capabilities, and minimal manpower requirements. The demand is further supported by their compatibility with varied railcar configurations, allowing streamlined unloading in industrial applications.

The turnover railcar dumpers unloaders segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing deployment in compact unloading stations where space constraints limit the use of larger systems. These unloaders offer flexibility, lower operational noise, and require less infrastructure modification, making them ideal for mid-sized operations. Their lower maintenance needs and ease of integration with existing logistics chains are also contributing to rising adoption across emerging economies.

- By Unloading Material

On the basis of unloading material, the global railcar unloader market is segmented into solid material and liquid material. The solid material segment dominated the market with the largest market revenue share in 2024, driven by the high-volume unloading requirements of bulk commodities such as coal, grain, and minerals. Railcar unloaders designed for solid materials are widely deployed in mining, agriculture, and construction sectors due to their high efficiency, rugged build, and ability to handle abrasive materials with minimal spillage and downtime.

The liquid material segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing demand in the chemical, petrochemical, and food processing industries. Unloaders equipped for liquid handling offer enhanced safety, leak-proof design, and compliance with environmental regulations, making them suitable for unloading hazardous and sensitive liquids in a controlled manner.

- By Capacity

On the basis of capacity, the railcar unloader market is segmented into less than 500 tons per hour, 500–1,000 tons per hour, and over 1,000 tons per hour. The 500–1,000 tons per hour segment accounted for the largest revenue share in 2024 due to its wide applicability in mid-sized industrial and agricultural operations. These systems strike a balance between throughput and equipment investment, making them a cost-effective solution for operations seeking higher productivity without over-scaling infrastructure.

The over 1,000 tons per hour segment is expected to witness the fastest growth rate from 2025 to 2032, particularly driven by large-scale mining and port operations that require rapid unloading to maintain logistical efficiency. High-capacity unloaders are being increasingly adopted by facilities that deal with high-frequency rail traffic and need to minimize turnaround time.

- By Material Type

Based on material type, the market is segmented into coal, grain, iron ore, and others. The coal segment led the market in 2024 due to the extensive use of rail-based coal transport in power generation and metallurgy sectors. Railcar unloaders for coal are engineered for high-dust and high-wear conditions, offering reliable unloading rates with minimal operational interruptions.

The grain segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by expanding agricultural exports and the modernization of grain handling infrastructure. Grain unloaders are valued for their gentle handling to prevent damage and contamination, making them crucial for food supply chain efficiency. The iron ore segment also contributes notably to the market, driven by increasing global demand for steel and raw materials, while the "others" category includes materials such as fertilizers, cement, and chemicals that require specialized unloading solution.

- By Application

On the basis of application, the railcar unloader market is segmented into coal industry, metal industry, and oil industry. The coal industry segment dominated the market in 2024 due to the bulk nature of coal shipments and the reliance on rail for long-distance transport to power plants and processing units. Railcar unloaders in this segment are essential for high-throughput unloading with minimal manual intervention, boosting operational throughput and efficiency in coal terminals.

The oil industry segment is expected to witness the fastest growth rate from 2025 to 2032, driven by growing demand for efficient transport and unloading of oil sands, petroleum coke, and related products. The increasing need for safe and spill-free transfer solutions is encouraging oil companies to invest in technologically advanced unloader systems. Integration of automation and monitoring features is also enhancing safety compliance and operational control across oil-based unloading sites.

Railcar Unloader Market Regional Analysis

• North America dominated the railcar unloader market with the largest revenue share in 2024, driven by the widespread use of rail for transporting bulk materials across industries such as oil and gas, mining, and agriculture

• The region benefits from a mature rail infrastructure, strong investment in automation, and the presence of leading manufacturers focused on high-capacity and energy-efficient unloading systems

• Increasing demand for fast, safe, and labor-efficient unloading operations is further supported by advancements in material handling technology and the ongoing shift toward intermodal freight solutions

U.S. Railcar Unloader Market Insight

The U.S. railcar unloader market captured the largest revenue share within North America in 2024, fuelled by the extensive rail network and the heavy reliance of key industries on bulk freight transport. Growing investments in logistics infrastructure, coupled with environmental goals, are accelerating the transition toward automated unloading systems. Furthermore, demand for reliable, high-throughput unloaders is being driven by the need to improve terminal efficiency and reduce operational bottlenecks.

Asia-Pacific Railcar Unloader Market Insight

The Asia-Pacific railcar unloader market is expected to witness the fastest growth rate from 2025 to 2032, supported by rapid industrial expansion and infrastructure development in countries such as China, India, and Australia. The rising movement of coal, metals, and agricultural products by rail is increasing the need for cost-effective, automated unloading solutions. Government initiatives to modernize freight corridors and enhance logistic efficiency are also playing a pivotal role in market growth.

China Railcar Unloader Market Insight

The China railcar unloader market held the highest revenue share in the Asia-Pacific region in 2024, driven by the country’s dominant role in global mining, steel, and power generation sectors. Massive infrastructure projects and state-backed investments in logistics parks have contributed to widespread deployment of modern unloading equipment. China's focus on improving energy efficiency and lowering emissions in rail logistics is further accelerating innovation and demand in the market

Japan Railcar Unloader Market Insight

The Japan railcar unloader market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country's need for advanced logistics solutions in energy, manufacturing, and construction sectors. Japan’s dense urban infrastructure and emphasis on sustainability make efficient rail-based bulk handling a priority. The increasing integration of automation and compact unloader designs suited for space-constrained facilities is expected to drive adoption during the forecast period

Europe Railcar Unloader Market Insight

The Europe railcar unloader market is expected to witness the fastest growth rate from 2025 to 2032, driven by a growing emphasis on sustainable logistics and improved freight efficiency. Industrial sectors across Germany, France, and Poland are investing in modern rail terminals equipped with automated unloading systems. The region's commitment to green transport and reduction of road congestion is further encouraging the shift to rail and boosting demand for railcar unloaders

Germany Railcar Unloader Market Insight

The Germany railcar unloader market is expected to witness the fastest growth rate from 2025 to 2032, backed by the country’s strong industrial base and advanced freight infrastructure. As a key logistics hub in Europe, Germany is prioritizing automation in material handling to improve terminal productivity and meet environmental compliance. The increasing use of high-efficiency railcar unloading systems across steel, chemicals, and construction sectors supports sustained market expansion

U.K. Railcar Unloader Market Insight

The U.K. railcar unloader market is expected to witness the fastest growth rate from 2025 to 2032, supported by investments in intermodal transport networks and the government's focus on reducing road freight dependency. The adoption of rail-based bulk handling is increasing across sectors such as construction materials, coal, and waste. The growing need for space-saving, low-emission, and low-maintenance unloading solutions is driving demand in new terminal projects and upgrade initiatives across the country

Railcar Unloader Market Share

The Railcar Unloader industry is primarily led by well-established companies, including:

- Jamieson Equipment Co (U.S.)

- Process Control Corporation (U.S.)

- NPK (Japan)

- Airmatic Inc (U.S.)

- Scherzer GmbH (Germany)

- Nippon Pneumatic (Japan)

- AGI (Ag Growth International) (Canada)

- NOV (National Oilwell Varco) (U.S.)

- Martin Engineering (U.S.)

- Dover Corporation – DoverMEI (U.S.)

- Thyssenkrupp AG (Germany)

- Coperion GmbH (Germany)

Latest Developments in Global Railcar Unloader Market

- In November 2023, TDSI announced that it is leveraging electric vehicle technology for its railcar unloaders at auto terminals. The new electric railcar unloaders are quieter and more efficient than their gas-powered counterparts, and they produce zero emissions. TDSI believes that the new unloaders will help it to improve its efficiency and customer service, while also reducing its environmental impact

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.