Global Programmable Application Specific Integrated Circuit Asic Market

Market Size in USD Billion

CAGR :

%

USD

20.02 Billion

USD

35.97 Billion

2024

2032

USD

20.02 Billion

USD

35.97 Billion

2024

2032

| 2025 –2032 | |

| USD 20.02 Billion | |

| USD 35.97 Billion | |

|

|

|

|

Programmable Application Specific Integrated Circuit (ASIC) Market Size

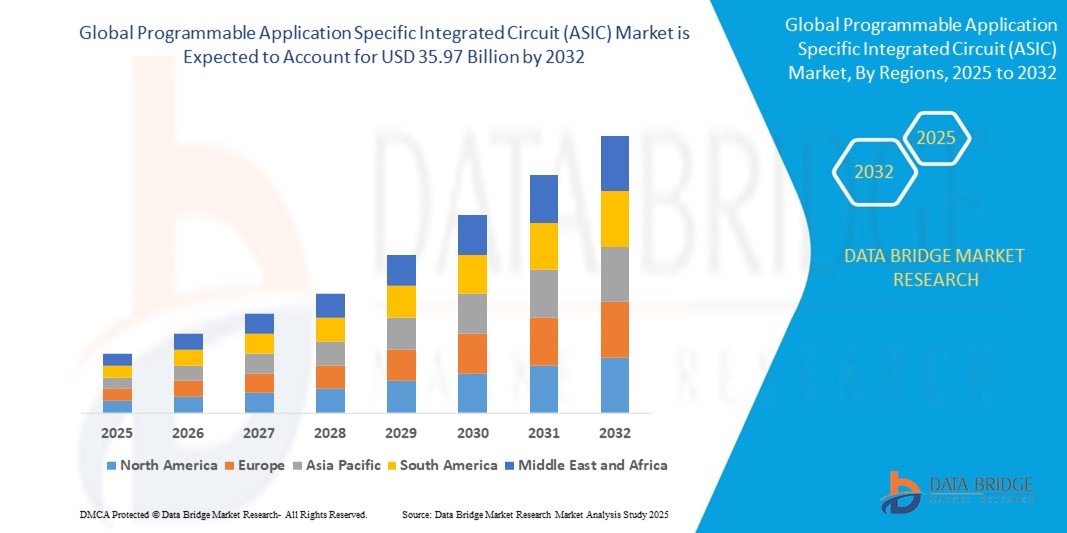

- The global programmable application specific integrated circuit (ASIC) market size was valued at USD 20.02 billion in 2024 and is expected to reach USD 35.97 billion by 2032, at a CAGR of 7.60% during the forecast period

- Market growth is primarily fueled by increasing demand for customized, high-performance chips in consumer electronics, automotive, telecommunications, and industrial automation sectors

- Key growth accelerators include the rising adoption of AI and machine learning, deployment of 5G infrastructure, and the need for energy-efficient semiconductor components in connected and smart devices globally

Programmable Application Specific Integrated Circuit (ASIC) Market Analysis

- Programmable Application Specific Integrated Circuits (ASICs) are vital to modern digital systems, enabling high-performance computing, efficient data processing, and real-time responsiveness across diverse applications including automotive, telecommunications, and consumer electronics

- Rising integration with AI, IoT, and edge computing technologies is accelerating demand for programmable ASICs that offer flexibility, customization, and optimized power consumption in next-generation smart devices and infrastructure

- Strong market momentum is driven by the need for adaptable, cost-efficient semiconductor solutions among OEMs, cloud data centers, and tech startups, as they seek greater control over hardware functionality and improved computational performance at scale

- Asia-Pacific dominates the programmable application specific integrated circuit (ASIC) market, holding the largest revenue share of 37.81%. This dominance is driven by the presence of major electronics manufacturing hubs, particularly in countries such as China, Taiwan, and South Korea

- North America is expected to be the fastest-growing region in the programmable application specific integrated circuit (ASIC) market with the CAGR of 6.8%, driven by significant investments in research and development and the presence of leading technology companies

- The semi-custom segment dominates the market with a revenue share of 51.2% in 2024, due to its optimal balance between performance, cost, and design flexibility. Semi-custom ASICs are widely used across multiple industries due to their shorter design cycles and moderate non-recurring engineering costs

Report Scope and Programmable Application Specific Integrated Circuit (ASIC) Market Segmentation

|

Attributes |

Programmable Application Specific Integrated Circuit (ASIC) Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Programmable Application Specific Integrated Circuit (ASIC) Market Trends

“Increasing Customization and Technological Advancements Driving Market Evolution”

- A significant and growing trend in the global programmable application specific integrated circuit (ASIC) market is the increasing demand for highly customized chips tailored to specific application needs. This allows companies to achieve optimal performance and power efficiency for their unique products, enhancing differentiation and competitive advantage

- For instance, in February 2025, NVIDIA announced a partnership with Synopsys to offer an AI-customized ASIC platform for edge inference systems, addressing performance and efficiency demands

- The trend towards incorporating heterogeneous integration, combining different functionalities and technologies onto a single chip, is also accelerating the market. This enables higher performance and reduced system complexity for applications ranging from high-performance computing to embedded systems

- In January 2024, TSMC introduced its 3D IC chip stacking services, helping clients integrate memory and logic units within programmable ASICs for faster and denser solutions

- Another key trend is the advancement in Electronic Design Automation (EDA) tools and methodologies. These advancements are making the design and verification of complex programmable ASICs more efficient, reducing development time and costs. High-level synthesis (HLS) and AI-driven design tools are becoming increasingly important

- The rising adoption of programmable ASICs in emerging applications such as artificial intelligence (AI), machine learning (ML), 5G communications, and the Internet of Things (IoT) is a prominent trend. These applications require specialized hardware acceleration that programmable ASICs can provide

- Furthermore, there's a growing focus on low-power programmable ASIC designs to cater to the increasing demand for energy-efficient devices and systems, especially in mobile and IoT applications. Techniques such as clock gating and power management are becoming crucial design considerations

- This trend towards greater customization, integration of advanced features, and focus on emerging applications is fundamentally reshaping the market landscape. Consequently, companies are heavily investing in research and development to offer innovative programmable ASIC solutions

- The demand for programmable ASICs offering high performance, low power consumption, and flexibility for various specialized workloads is growing rapidly across diverse sectors, as businesses increasingly rely on custom silicon to achieve their specific technological and market goals

Programmable Application Specific Integrated Circuit (ASIC) Market Dynamics

Driver

“Demand for Application-Specific Optimization and Flexibility”

- The increasing need for application-specific optimization in terms of performance, power consumption, and cost is a significant driver for the heightened demand for programmable application specific integrated circuit (ASIC) systems. Standard off-the-shelf components often cannot meet the stringent requirements of advanced and specialized applications

- In April 2024, Google expanded its in-house Tensor Processing Unit (TPU) program, focusing on AI-specific ASICs that outperform general-purpose chips in inference workloads

- The flexibility offered by programmable ASICs, allowing for design modifications and updates even after manufacturing (in some cases), is another crucial driver. This is particularly important in rapidly evolving technology areas where requirements may change frequently

- Furthermore, the ability of programmable ASICs to integrate multiple functionalities onto a single chip reduces the overall system bill of materials and improves performance, making them an attractive option for many applications. The increasing complexity of electronic systems further emphasizes the need for customized and integrated solutions

- The growing demand for edge computing and the need to process data locally, with low latency and high security, is also a significant factor driving the adoption of programmable ASICs in various industrial, automotive, and consumer applications

Restraint/Challenge

“High Development Costs and Design Complexity”

- While the market presents significant opportunities, the high initial investment and development costs associated with designing and manufacturing programmable ASICs can be a restraint, particularly for smaller companies or projects with limited budgets. The cost of EDA tools, design expertise, and fabrication can be substantial

- In October 2023, a report by Gartner highlighted that the average cost to develop a 7nm ASIC exceeds USD 120 million, primarily due to mask sets, verification, and IP licensing

- Another significant challenge is the increasing design complexity of modern programmable ASICs. As chips become more sophisticated with billions of transistors and intricate architectures, the design and verification processes become significantly more challenging and time-consuming

- Ensuring timely market entry and managing the risk of design flaws in complex programmable ASICs are ongoing challenges for companies in this market. The need for advanced simulation and testing methodologies adds to the complexity and cost of development

Programmable Application Specific Integrated Circuit (ASIC) Market Scope

The market is segmented on the basis of design type and application.

• By Design Type

On the basis of design type, the programmable application specific integrated circuit (ASIC) market is segmented into full custom, semi-custom, and programmable. The semi-custom segment dominated the market with a revenue share of 51.2% in 2024, due to its optimal balance between performance, cost, and design flexibility. Semi-custom ASICs are widely used across multiple industries due to their shorter design cycles and moderate non-recurring engineering costs.

The programmable segment is expected to register the fastest CAGR from 2025 to 2032, driven by growing demand for reconfigurable hardware platforms that allow post-manufacturing updates. Their adaptability makes them highly suitable for applications in dynamic markets such as telecommunications and consumer electronics.

• By Application

On the basis of application, the programmable application specific integrated circuit (ASIC) market is segmented into telecommunication, consumer electronics, automotive, industrial, and others. The consumer electronics segment led the market with a revenue share of 37.8% in 2024, fueled by the integration of ASICs in smartphones, wearable devices, and home automation systems for enhanced functionality and power efficiency.

The automotive segment is projected to witness the fastest CAGR from 2025 to 2032, supported by the increasing adoption of electric vehicles, advanced driver-assistance systems (ADAS), and autonomous driving technologies. ASICs play a vital role in managing complex automotive functionalities while ensuring energy efficiency and system reliability.

Programmable Application Specific Integrated Circuit (ASIC) Market Regional Analysis

- Asia-Pacific dominates the programmable application specific integrated circuit (ASIC) market, holding the largest revenue share of 37.81%. This dominance is driven by the presence of major electronics manufacturing hubs, particularly in countries such as China, Taiwan, and South Korea

- The increasing demand for consumer electronics, automotive applications, and advanced communication infrastructure within the region fuels the growth of programmable ASICs

- The focus on technological advancements and government initiatives supporting the semiconductor industry further solidifies Asia Pacific's leading position

China Programmable Application Specific Integrated Circuit (ASIC) Market Insight

The China programmable application specific integrated circuit (ASIC) market holds a significant portion of the Asia-Pacific region. The rapid expansion of its electronics industry, coupled with the growing adoption of AI, IoT, and 5G technologies, creates a substantial demand for programmable ASICs. Government support for domestic semiconductor production and a large consumer base further contribute to the market's strength and growth in China.

Japan Programmable Application Specific Integrated Circuit (ASIC) Market Insight

The Japan programmable application specific integrated circuit (ASIC) market is a key player in the Asia Pacific region, characterized by its strong focus on high-quality and technologically advanced electronics. The demand for programmable ASICs in Japan is driven by applications in automotive electronics, industrial automation, and advanced communication systems. The emphasis on research and development and the presence of leading semiconductor manufacturers contribute to the market's momentum.

North America Programmable Application Specific Integrated Circuit (ASIC) Market Insight

North America is expected to be the fastest-growing region in the programmable application specific integrated circuit (ASIC) market with the CAGR of 6.8%, driven by significant investments in research and development and the presence of leading technology companies. The increasing adoption of programmable ASICs in data centers, telecommunications, artificial intelligence, and automotive sectors is fueling this rapid growth. The strong emphasis on innovation and the integration of advanced technologies across various industries position North America as a high-growth market.

U.S. Programmable Application Specific Integrated Circuit (ASIC) Market Insight

The U.S. programmable application specific integrated circuit (ASIC) market holds a dominant position in North America and is expected to witness substantial growth. This growth is fueled by the presence of major players in the technology and semiconductor industries, coupled with the increasing demand for high-performance computing, advanced networking solutions, and AI applications. The strong focus on innovation and early adoption of new technologies significantly contribute to the market's expansion in the U.S.

Canada Programmable Application Specific Integrated Circuit (ASIC) Market Insight

The Canadian programmable application specific integrated circuit (ASIC) market is experiencing steady growth, aligning with the technological advancements and industry trends observed in the U.S. The rising adoption of programmable ASICs in sectors such as telecommunications, automotive, and industrial applications is driving market expansion. The increasing focus on research and development initiatives within the country also supports the growth of this market.

Europe Programmable Application Specific Integrated Circuit (ASIC) Market Insight

The European programmable application specific integrated circuit (ASIC) market is experiencing consistent growth, propelled by increasing investments in digitalization and the expansion of various end-use industries. The demand for programmable ASICs in Europe is driven by applications in automotive, industrial automation, telecommunications, and healthcare. Government initiatives supporting technological advancements and a strong presence of established industrial players contribute to the market's growth.

U.K. Programmable Application Specific Integrated Circuit (ASIC) Market Insight

The U.K. programmable application specific integrated circuit (ASIC) market is growing at a significant rate, driven by a strong focus on technological innovation and the development of advanced electronic systems. The increasing adoption of programmable ASICs in sectors such as telecommunications, aerospace, and defense, along with the growing smart infrastructure initiatives, is fueling market expansion in the U.K.

Germany Programmable Application Specific Integrated Circuit (ASIC) Market Insight

The German programmable application specific integrated circuit (ASIC) market is expected to expand considerably, primarily driven by its strong automotive industry and increasing focus on industrial automation. Programmable ASICs are crucial components in advanced driver-assistance systems (ADAS), electric vehicles, and Industry 4.0 initiatives, leading to high demand. The emphasis on engineering excellence and technological advancement further boosts the adoption of programmable ASICs in Germany.

Programmable Application Specific Integrated Circuit (ASIC) Market Share

The programmable application specific integrated circuit (ASIC) industry is primarily led by well-established companies, including:

- Texas Instruments Incorporated (U.S.)

- STMicroelectronics (Switzerland)

- Infineon Technologies AG (Germany)

- Qualcomm Technologies, Inc. (U.S.)

- Semiconductor Components Industries, LLC (U.S.)

- Analog Devices, Inc. (U.S.)

- Renesas Electronics (Japan)

- NXP Semiconductors (Netherlands)

- Intel Corporation (U.S.)

- Calogic, LLC (U.S.)

- Marvell (U.S.)

- Socionext Inc. (Japan)

- IBM (U.S.)

- Linear Dimensions Semiconductor (U.S.)

- PREMA Semiconductor GmbH (Germany)

- Samsung (South Korea)

- Synopsys, Inc. (U.S.)

Latest Developments in Global Programmable Application Specific Integrated Circuit (ASIC) Market

- In October 2024, OpenAI, an artificial intelligence company, collaborated with Broadcom, Inc., a leading ASIC provider, to co-develop a specialized AI chip aimed at improving the efficiency of AI model inference. This strategic partnership is expected to significantly accelerate AI workloads through optimized chip performance

- In July 2023, Faraday Technology Corporation unveiled its SerDes total solution, which includes the SerDes IP designed on UMC 28nm technology along with the IP Advanced (IPA) service. This solution is designed to simplify and speed up customer integration for high-speed data transmission

- In September 2022, Infineon Technologies AG introduced its new OptiMOS 5 IPOL buck regulators, featuring VR14-compliant SVID and I2C/PMBus digital interfaces tailored for Intel and AMD server CPUs and ASIC/FPGA platforms. This innovation supports high-efficiency power regulation for next-generation server, telecom, and datacom applications

- In April 2022, Intel Corporation launched the Intel Blockchain ASIC, which offers energy-efficient SHA-256 hashing tailored for proof-of-work consensus mechanisms in blockchain networks. This ASIC supports both computing power and sustainability needs in scalable blockchain infrastructure

- In February 2022, Faraday Technology Corporation completed several Factory Automation ASIC projects focused on industrial IoT (IIoT), incorporating technologies such as PLC processors, industrial robot controls, and communication systems using 8" and 12" wafers. These ASICs are built for high reliability and long-term supply assurance, aligning with rigorous industrial standards

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Programmable Application Specific Integrated Circuit Asic Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Programmable Application Specific Integrated Circuit Asic Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Programmable Application Specific Integrated Circuit Asic Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.