Global Circuit Breaker Market

Market Size in USD Billion

CAGR :

%

USD

6.66 Billion

USD

10.78 Billion

2024

2032

USD

6.66 Billion

USD

10.78 Billion

2024

2032

| 2025 –2032 | |

| USD 6.66 Billion | |

| USD 10.78 Billion | |

|

|

|

|

Circuit Breaker Market Size

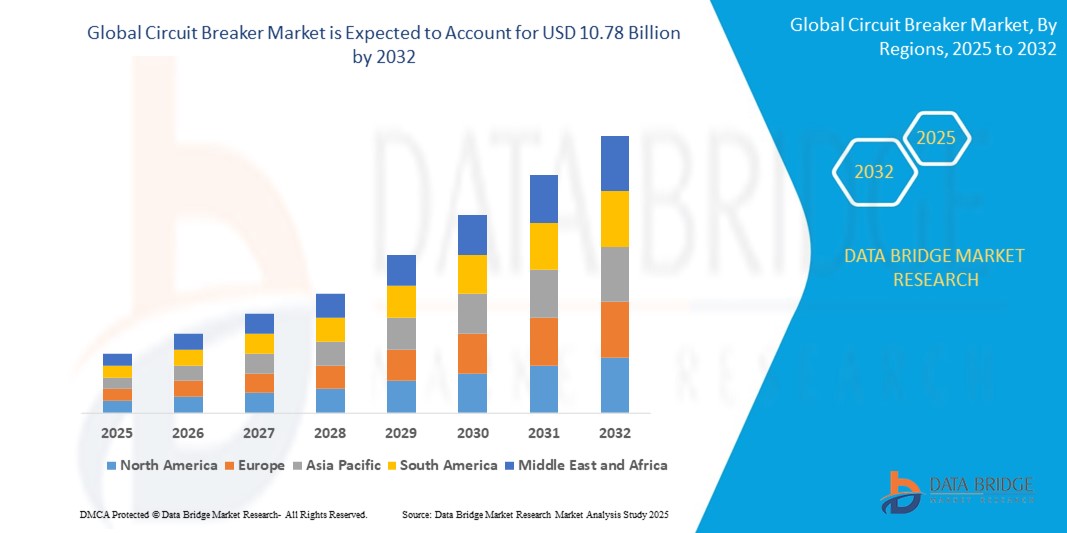

- The global circuit breaker market was valued at USD 6.66 billion in 2024 and is expected to reach USD 10.78 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.2% primarily driven by the increasing demand for electrical infrastructure and the rising need for reliable power distribution systems

- This growth is driven by factors such as the expansion of renewable energy projects, growing urbanization, the need for grid modernization, and the adoption of advanced protection and safety mechanisms in electrical systems

Circuit Breaker Market Analysis

- The circuit breaker market is expanding due to the increasing demand for reliable electrical systems in industries such as manufacturing, construction, and residential sectors

- For instance, Siemens and Schneider Electric have been heavily investing in smart grid technology, which incorporates advanced circuit breakers to enhance system reliability

- As power grids evolve into smarter networks, circuit breakers are being upgraded with automation and real-time monitoring

- For instance, ABB's launch of smart circuit breakers, which help prevent power outages by automatically detecting and isolating faults in the grid

- The shift toward renewable energy sources such as solar and wind is creating a rising demand for more advanced circuit protection

- For instance, in the U.S., solar power plants are increasingly adopting modern circuit breakers to maintain grid stability and prevent damage to electrical systems

- The trend of rapid urbanization and infrastructure development, particularly in regions such as Asia and Africa, is boosting the need for reliable electrical systems

- For instance, large-scale construction projects such as Dubai’s Expo 2020 and China's new city developments are incorporating advanced circuit breakers to ensure the safety and efficiency of their electrical systems

- Manufacturers are continuously improving the safety, durability, and functionality of circuit breakers

- For instance, the introduction of molded case circuit breakers in residential and small commercial applications, with companies such as Eaton providing more compact and reliable solutions for modern electrical systems

Report Scope and Circuit Breaker Market Segmentation

|

Attributes |

Circuit Breaker Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Circuit Breaker Market Trends

“Increasing Adoption of Smart Circuit Breakers”

- The adoption of smart circuit breakers is growing rapidly, with companies such as ABB and Schneider Electric leading the charge by integrating advanced features such as real-time monitoring and automated fault detection in their devices, helping improve grid stability across various projects, such as the integration of smart grids in Europe

- Smart circuit breakers allow for remote diagnostics, which is particularly useful in critical infrastructure such as hospitals and data centers, where uninterrupted power is crucial

- For instance, the National Health Service (NHS) in the U.K. has incorporated smart circuit breakers in its hospital systems to ensure continuous power supply during emergencies

- These devices enhance energy efficiency by optimizing power distribution in smart buildings

- For instance, the Edge building in Amsterdam, recognized as one of the world’s greenest buildings, utilizes smart circuit breakers to monitor and adjust power usage, reducing energy consumption significantly

- Predictive maintenance is a key feature of smart circuit breakers, helping detect potential issues before they cause downtime. In large industrial plants such as the Tesla Gigafactory in Nevada, these breakers provide early warnings for equipment failures, minimizing costly repairs and operational disruptions

- Smart circuit breakers are also vital for renewable energy integration.

- For instance, in solar farms such as those in California, these breakers ensure grid stability by automatically adjusting to the variable output from solar panels, preventing overloading of the electrical grid during peak production times

Circuit Breaker Market Dynamics

Driver

“Increasing Demand for Reliable Power Systems”

- The increasing demand for reliable and safe electrical power systems is a key driver, as industries such as manufacturing and healthcare rely heavily on uninterrupted power to avoid costly disruptions

- For instance, in the National Health Service (NHS) in the UK, where smart circuit breakers are used to ensure reliable power for critical hospital operations, minimizing the risk of power failure during surgeries or emergencies

- As urbanization and industrialization grow worldwide, cities and industrial zones, such as New York and Tokyo, experience more complex and interconnected electrical grids, which necessitate advanced circuit breakers to prevent large-scale outages

- For instance, Con Edison in New York has deployed smart circuit breakers in its smart grid program to enhance reliability and reduce the impact of faults on the city's electrical supply

- Advanced circuit breakers, particularly smart circuit breakers, provide better protection by detecting faults and isolating them automatically, ensuring power supply remains stable even during faults

- For instance, in San Francisco's smart grid project by Pacific Gas and Electric (PG&E), smart circuit breakers have been installed to detect and automatically isolate faults, minimizing downtime and improving grid resilience

- The growing integration of renewable energy sources, such as wind and solar, requires circuit breakers capable of managing fluctuating power loads, for instance, the Roscoe Wind Farm in Texas, one of the largest wind farms in the U.S., relies on advanced circuit breakers to handle the variable energy output and ensure grid stability during high wind generation periods

- As electrical networks evolve with digital monitoring and automation, the circuit breaker market is growing, with new technologies enhancing efficiency

- For instance, in Germany's Energiewende project, where digital circuit breakers are being used to facilitate the integration of renewable energy sources such as solar and wind into the power grid without compromising system stability

Opportunity

“Integration with Smart Grids and IoT”

- A major opportunity for the circuit breaker market lies in the integration of circuit breakers with smart grids and the Internet of Things (IoT), as these technologies optimize the distribution and use of electricity, allowing for more efficient power management

- For instance, in the U.S., the smart grid project being implemented in cities such as Chicago uses advanced circuit breakers to improve grid reliability and responsiveness through real-time data

- IoT-enabled circuit breakers are becoming essential for remote monitoring and real-time fault detection, enabling quicker responses to issues and reducing downtime

- For instance, in the city of New York, Con Edison has integrated IoT-enabled circuit breakers into its smart grid, allowing for the detection of faults and the ability to isolate affected areas, improving overall power system reliability

- These smart circuit breakers can also provide valuable data on power consumption patterns, system health, and predictive maintenance, which can prevent failures before they happen

- For instance, Pacific Gas and Electric (PG&E) in California has been using IoT-enabled circuit breakers to enhance the management of their grid and ensure uninterrupted power supply to both residential and industrial sectors

- The increasing integration of renewable energy sources such as solar and wind into the grid calls for advanced circuit breakers to manage the fluctuations in power generation

- For instance, the Roscoe Wind Farm in Texas relies on circuit breakers that can handle rapid shifts in energy output from wind power, ensuring grid stability

- The growing global demand for smart grid infrastructure, driven by government-backed initiatives in countries such as Germany and China, presents a significant opportunity for manufacturers in the circuit breaker market. By aligning products with the needs of smart grid systems, manufacturers can tap into new markets and ensure long-term growth through smarter, more efficient power distribution solutions

Restraint/Challenge

“High Initial Investment and Complexity”

- A significant restraint to the growth of the circuit breaker market is the high initial investment and complexity involved in adopting advanced circuit breakers, especially in regions with older infrastructure

- For instance, in developing regions such as Africa, where electrical grids are still being modernized, the upfront costs of upgrading to smart circuit breakers can be a major barrier, limiting investments in grid improvements

- Traditional circuit breakers are relatively simple and inexpensive to install, while smart circuit breakers require a significant investment in both hardware and software, such as in the case of projects such as Con Edison’s smart grid upgrade in New York, where the transition to advanced circuit breakers involves high initial costs and complex system integration

- For many small and medium-sized enterprises (SMEs), the cost of upgrading to advanced circuit breakers may be prohibitive, particularly when compared to the costs of maintaining existing systems. For instance, small manufacturing plants in emerging economies may struggle to justify the high initial costs of smart circuit breakers, preferring to stick with cheaper, traditional options

- The integration of advanced circuit breakers into existing electrical networks requires specialized expertise and training, adding to both the financial and operational burden

- For instance, implementing smart circuit breakers in industrial sectors such as those in India’s power sector often requires significant workforce training and the engagement of highly specialized technicians, which adds to project timelines and expenses

- While smart circuit breakers offer long-term benefits, such as reduced maintenance costs and increased energy efficiency, the return on investment may not be immediate. This delayed ROI can deter decision-makers from adopting advanced technologies, as seen in large-scale projects such as those in rural areas of Brazil, where immediate financial returns from infrastructure upgrades are not always visible

Circuit Breaker Market Scope

The market is segmented on the basis of product type, insulation type, external design, location type, voltage range, rated current, operating mechanism, and end- user

|

Segmentation |

Sub-Segmentation |

|

By Product Type |

|

|

By Insulation Type |

|

|

By External Design |

|

|

By Location Type |

|

|

By Voltage Range |

|

|

By Rated Current |

|

|

By Operating Mechanism |

|

|

By End-User |

|

Circuit Breaker Market Regional Analysis

“North America is the Dominant Region in the Circuit Breaker Market”

- North America is expected to dominate the circuit breaker market due to the growing trend of retrofitting and replacing traditional electrical equipment with advanced units, with many utilities upgrading to newer, more efficient systems

- Infrastructure modernization in the U.S. and Canada is a major driver, as cities such as New York and Toronto continue to invest in improving their electrical grids and adopting more reliable circuit breakers

- The push to upgrade aging power grids is leading to increased demand for advanced circuit breakers that provide enhanced protection, particularly in large industrial sectors that rely on consistent power supply

- The integration of renewable energy sources such as wind and solar into the grid is further boosting the demand for circuit breakers that can handle fluctuating power loads and ensure grid stability

- The rise of smart grid deployments and IoT-enabled technologies in the region is contributing to this market dominance, as these systems require circuit breakers capable of real-time monitoring and automated fault detection to improve grid efficiency and reduce downtime

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- Asia-Pacific is expected to witness significant growth in the circuit breaker market driven by rapid industrialization, urbanization, and rising electricity demand in countries such as China, India, and Japan

- The increasing electricity consumption in these countries is leading to the modernization of electrical infrastructure, with cities such as Beijing and Mumbai investing in advanced circuit breakers to ensure reliable power distribution

- The growing integration of renewable energy sources, such as wind and solar, into national grids is pushing the need for circuit breakers that can manage the variability of these power sources, particularly in countries such as China, which is the world’s largest producer of solar energy

- Government-backed initiatives in Asia-Pacific are helping modernize power distribution systems, with countries such as India investing heavily in smart grid technology and supporting the adoption of advanced circuit breakers to improve grid reliability

- This surge in demand for better grid infrastructure, driven by urban growth and the shift to renewables, positions Asia-Pacific as one of the fastest-growing regions for circuit breakers, particularly with smart grid projects being rolled out in major cities across the region

Circuit Breaker Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- ABB (Switzerland)

- Siemens (Germany)

- Schneider Electric (France)

- Mitsubishi Electric Corporation (Japan)

- Efacec (Portugal)

- Eaton (Ireland)

- Toshiba Corporation (Japan)

- Fuji Electric Co., Ltd. (Japan)

- TE Connectivity (Switzerland)

- Honeywell International, Inc. (U.S.)

- Panasonic Corporation (Japan)

- Powell Industries (U.S.)

- Carling Technologies (U.S.)

- CG Power and Industrial Solutions Ltd (India)

- LARSEN & TOUBRO LIMITED (India)

- Maxwell Technologies. (U.S.)

- Hawker Siddeley (U.K.)

- INDUSTRIAL ELECTRIC MFG (U.S.)

- E-T-A Elektrotechnische Apparate GmbH (Germany)

- Andeli Group Co., Ltd (China)

- Hitachi Industrial Equipment Systems Co., Ltd (Japan)

- Tavrida Electric (Russia)

- TERASAKI ELECTRIC CO., LTD.(Japan)

Latest Developments in Global Circuit Breaker Market

- In July 2022, Eaton Corporation acquired a 50% stake in Jiangsu Huineng Electric Co., Ltd., marking a significant development in Eaton’s global expansion. This acquisition aims to strengthen Eaton’s presence in the Chinese electrical market and enhance its ability to provide innovative and sustainable solutions in the field of power distribution and industrial automation. By partnering with Jiangsu Huineng, Eaton is poised to tap into the growing demand for advanced electrical infrastructure and solutions in China. The move is expected to benefit Eaton by expanding its product offerings and enhancing its market share in the Asia-Pacific region. This acquisition will positively impact the market by enabling Eaton to deliver more localized and efficient power management solutions, ultimately contributing to the modernization and sustainability of China’s electrical infrastructure link

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL CIRCUIT BREAKER MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL CIRCUIT BREAKER MARKET

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 MARKET GUIDE

2.2.4 COMPANY POSITIONING GRID

2.2.5 COMAPANY MARKET SHARE ANALYSIS

2.2.6 MULTIVARIATE MODELLING

2.2.7 TOP TO BOTTOM ANALYSIS

2.2.8 STANDARDS OF MEASUREMENT

2.2.9 VENDOR SHARE ANALYSIS

2.2.10 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.11 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL CIRCUIT BREAKER MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHT

5.1 PORTERS FIVE FORCES

5.2 REGULATORY STANDARDS

5.3 TECHNOLOGICAL TRENDS

5.4 PATENT ANALYSIS

5.5 CASE STUDY

5.6 VALUE CHAIN ANALYSIS

5.7 COMPANY COMPARITIVE ANALYSIS

6 GLOBAL CIRCUIT BREAKER MARKET, BY TYPE

6.1 OVERVIEW

6.2 OIL CIRCUIT BREAKER (OCB)

6.2.1 BULK OIL CIRCUIT BREAKER

6.2.2 LOW OIL CIRCUIT BREAKER

6.3 AIR CIRCUIT BREAKER (ACB)

6.3.1 MAGNETIC BLOWOUT TYPE AIR BREAK CIRCUIT BREAKER

6.3.2 AIR CHUTE AIR BREAK CIRCUIT BREAKER

6.3.3 PLAIN BREAK TYPE AIR BREAK CIRCUIT BREAKER

6.4 SULFUR HEXAFLUORIDE CIRCUIT BREAKER (SF6CB)

6.4.1 SINGLE INTERRUPTER SF6 CIRCUIT BREAKER

6.4.2 TWO INTERRUPTER SF6 CIRCUIT BREAKER

6.4.3 FOUR INTERRUPTER SF6 CIRCUIT BREAKER

6.5 VACUUM CIRCUIT BREAKER (VCB)

6.5.1 ATMOSPHERIC VACUUM BREAKERS

6.5.2 HOSE CONNECTION VACUUM BREAKERS

6.5.3 PRESSURE VACUUM BREAKERS

6.5.4 SPILL-RESISTANT VACUUM BREAKERS

7 GLOBAL CIRCUIT BREAKER MARKET, BY COMPONENT

7.1 OVERVIEW

7.2 FRAME

7.3 OPERATING MECHANISM

7.4 CONTACTS

7.5 ARC EXTINGUISHER

7.6 TRIP UNIT

7.7 OTHERS

8 GLOBAL CIRCUIT BREAKER MARKET, BY MODE

8.1 OVERVIEW

8.2 TRADITIONAL

8.3 MINIATURE

8.4 SMART

9 GLOBAL CIRCUIT BREAKER MARKET, BY EXTERNAL DESIGN TYPE

9.1 OVERVIEW

9.2 DEAD TANK TYPE

9.3 LIVE TANK TYPE

10 GLOBAL CIRCUIT BREAKER MARKET, BY INSTALLATION

10.1 OVERVIEW

10.2 OUTDOOR CIRCUIT BREAKER

10.3 INDOOR CIRCUIT BREAKER

11 GLOBAL CIRCUIT BREAKER MARKET, BY OPERATING MECHANISM

11.1 OVERVIEW

11.2 SPRING OPERATED CIRCUIT BREAKER

11.3 PNEUMATIC-OPERATED CIRCUIT BREAKER

11.4 HYDRAULIC-OPERATED CIRCUIT BREAKER

11.5 MAGNETIC-OPERATED CIRCUIT BREAKER

11.6 OTHERS

12 GLOBAL CIRCUIT BREAKER MARKET, BY VOLTAGE LEVEL

12.1 OVERVIEW

12.2 HIGH VOLTAGE

12.3 MEDIUM VOLTAGE

12.4 LOW VOLTAGE

13 GLOBAL CIRCUIT BREAKER MARKET, BY RATED CURRENT

13.1 OVERVIEW

13.2 LESS THAN 500 A

13.3 500 A – 2000 A

13.4 2000 A – 3500 A

13.5 ABOVE 3500 A

14 GLOBAL CIRCUIT BREAKER MARKET, BY DISTRIBUTION CHANNEL

14.1 OVERVIEW

14.2 WHOLESALERS

14.3 RETAILERS

14.4 ONLINE

15 GLOBAL CIRCUIT BREAKER MARKET, BY END USER

15.1 OVERVIEW

15.2 COMMERCIAL

15.2.1 HOSPITAL

15.2.1.1. BY TYPE

15.2.1.1.1. OIL CIRCUIT BREAKER (OCB)

15.2.1.1.1.1 BULK OIL CIRCUIT BREAKER

15.2.1.1.1.2 LOW OIL CIRCUIT BREAKER

15.2.1.1.2. AIR CIRCUIT BREAKER (ACB)

15.2.1.1.2.1 MAGNETIC BLOWOUT TYPE AIR BREAK CIRCUIT BREAKER

15.2.1.1.2.2 AIR CHUTE AIR BREAK CIRCUIT BREAKER

15.2.1.1.2.3 PLAIN BREAK TYPE AIR BREAK CIRCUIT BREAKER

15.2.1.1.3. SULFUR HEXAFLUORIDE CIRCUIT BREAKER (SF6CB)

15.2.1.1.3.1 SINGLE INTERRUPTER SF6 CIRCUIT BREAKER

15.2.1.1.3.2 TWO INTERRUPTER SF6 CIRCUIT BREAKER

15.2.1.1.3.3 FOUR INTERRUPTER SF6 CIRCUIT BREAKER

15.2.1.1.4. VACUUM CIRCUIT BREAKER (VCB)

15.2.1.1.4.1 ATMOSPHERIC VACUUM BREAKERS

15.2.1.1.4.2 HOSE CONNECTION VACUUM BREAKERS

15.2.1.1.4.3 PRESSURE VACUUM BREAKERS

15.2.1.1.4.4 SPILL-RESISTANT VACUUM BREAKERS

15.2.2 EDUCATION INSTITUTE

15.2.2.1. BY TYPE

15.2.2.1.1. OIL CIRCUIT BREAKER (OCB)

15.2.2.1.1.1 BULK OIL CIRCUIT BREAKER

15.2.2.1.1.2 LOW OIL CIRCUIT BREAKER

15.2.2.1.2. AIR CIRCUIT BREAKER (ACB)

15.2.2.1.2.1 MAGNETIC BLOWOUT TYPE AIR BREAK CIRCUIT BREAKER

15.2.2.1.2.2 AIR CHUTE AIR BREAK CIRCUIT BREAKER

15.2.2.1.2.3 PLAIN BREAK TYPE AIR BREAK CIRCUIT BREAKER

15.2.2.1.3. SULFUR HEXAFLUORIDE CIRCUIT BREAKER (SF6CB)

15.2.2.1.3.1 SINGLE INTERRUPTER SF6 CIRCUIT BREAKER

15.2.2.1.3.2 TWO INTERRUPTER SF6 CIRCUIT BREAKER

15.2.2.1.3.3 FOUR INTERRUPTER SF6 CIRCUIT BREAKER

15.2.2.1.4. VACUUM CIRCUIT BREAKER (VCB)

15.2.2.1.4.1 ATMOSPHERIC VACUUM BREAKERS

15.2.2.1.4.2 HOSE CONNECTION VACUUM BREAKERS

15.2.2.1.4.3 PRESSURE VACUUM BREAKERS

15.2.2.1.4.4 SPILL-RESISTANT VACUUM BREAKERS

15.2.3 PUBLIC INFRASTRUCTURE

15.2.3.1. BY TYPE

15.2.3.1.1. OIL CIRCUIT BREAKER (OCB)

15.2.3.1.1.1 BULK OIL CIRCUIT BREAKER

15.2.3.1.1.2 LOW OIL CIRCUIT BREAKER

15.2.3.1.2. AIR CIRCUIT BREAKER (ACB)

15.2.3.1.2.1 MAGNETIC BLOWOUT TYPE AIR BREAK CIRCUIT BREAKER

15.2.3.1.2.2 AIR CHUTE AIR BREAK CIRCUIT BREAKER

15.2.3.1.2.3 PLAIN BREAK TYPE AIR BREAK CIRCUIT BREAKER

15.2.3.1.3. SULFUR HEXAFLUORIDE CIRCUIT BREAKER (SF6CB)

15.2.3.1.3.1 SINGLE INTERRUPTER SF6 CIRCUIT BREAKER

15.2.3.1.3.2 TWO INTERRUPTER SF6 CIRCUIT BREAKER

15.2.3.1.3.3 FOUR INTERRUPTER SF6 CIRCUIT BREAKER

15.2.3.1.4. VACUUM CIRCUIT BREAKER (VCB)

15.2.3.1.4.1 ATMOSPHERIC VACUUM BREAKERS

15.2.3.1.4.2 HOSE CONNECTION VACUUM BREAKERS

15.2.3.1.4.3 PRESSURE VACUUM BREAKERS

15.2.3.1.4.4 SPILL-RESISTANT VACUUM BREAKERS

15.2.4 HOTEL & RESTAURANTS

15.2.4.1. BY TYPE

15.2.4.1.1. OIL CIRCUIT BREAKER (OCB)

15.2.4.1.1.1 BULK OIL CIRCUIT BREAKER

15.2.4.1.1.2 LOW OIL CIRCUIT BREAKER

15.2.4.1.2. AIR CIRCUIT BREAKER (ACB)

15.2.4.1.2.1 MAGNETIC BLOWOUT TYPE AIR BREAK CIRCUIT BREAKER

15.2.4.1.2.2 AIR CHUTE AIR BREAK CIRCUIT BREAKER

15.2.4.1.2.3 PLAIN BREAK TYPE AIR BREAK CIRCUIT BREAKER

15.2.4.1.3. SULFUR HEXAFLUORIDE CIRCUIT BREAKER (SF6CB)

15.2.4.1.3.1 SINGLE INTERRUPTER SF6 CIRCUIT BREAKER

15.2.4.1.3.2 TWO INTERRUPTER SF6 CIRCUIT BREAKER

15.2.4.1.3.3 FOUR INTERRUPTER SF6 CIRCUIT BREAKER

15.2.4.1.4. VACUUM CIRCUIT BREAKER (VCB)

15.2.4.1.4.1 ATMOSPHERIC VACUUM BREAKERS

15.2.4.1.4.2 HOSE CONNECTION VACUUM BREAKERS

15.2.4.1.4.3 PRESSURE VACUUM BREAKERS

15.2.4.1.4.4 SPILL-RESISTANT VACUUM BREAKERS

15.2.5 OTHERS

15.3 RESIDENTIAL

15.3.1 BY TYPE

15.3.1.1. OIL CIRCUIT BREAKER (OCB)

15.3.1.1.1. BULK OIL CIRCUIT BREAKER

15.3.1.1.2. LOW OIL CIRCUIT BREAKER

15.3.1.2. AIR CIRCUIT BREAKER (ACB)

15.3.1.2.1. MAGNETIC BLOWOUT TYPE AIR BREAK CIRCUIT BREAKER

15.3.1.2.2. AIR CHUTE AIR BREAK CIRCUIT BREAKER

15.3.1.2.3. PLAIN BREAK TYPE AIR BREAK CIRCUIT BREAKER

15.3.1.3. SULFUR HEXAFLUORIDE CIRCUIT BREAKER (SF6CB)

15.3.1.3.1. SINGLE INTERRUPTER SF6 CIRCUIT BREAKER

15.3.1.3.2. TWO INTERRUPTER SF6 CIRCUIT BREAKER

15.3.1.3.3. FOUR INTERRUPTER SF6 CIRCUIT BREAKER

15.3.1.4. VACUUM CIRCUIT BREAKER (VCB)

15.3.1.4.1. ATMOSPHERIC VACUUM BREAKERS

15.3.1.4.2. HOSE CONNECTION VACUUM BREAKERS

15.3.1.4.3. PRESSURE VACUUM BREAKERS

15.3.1.4.4. SPILL-RESISTANT VACUUM BREAKERS

15.4 INDUSTRIAL

15.4.1 POWER & ENERGY

15.4.1.1. BY TYPE

15.4.1.1.1. OIL CIRCUIT BREAKER (OCB)

15.4.1.1.1.1 BULK OIL CIRCUIT BREAKER

15.4.1.1.1.2 LOW OIL CIRCUIT BREAKER

15.4.1.1.2. AIR CIRCUIT BREAKER (ACB)

15.4.1.1.2.1 MAGNETIC BLOWOUT TYPE AIR BREAK CIRCUIT BREAKER

15.4.1.1.2.2 AIR CHUTE AIR BREAK CIRCUIT BREAKER

15.4.1.1.2.3 PLAIN BREAK TYPE AIR BREAK CIRCUIT BREAKER

15.4.1.1.3. SULFUR HEXAFLUORIDE CIRCUIT BREAKER (SF6CB)

15.4.1.1.3.1 SINGLE INTERRUPTER SF6 CIRCUIT BREAKER

15.4.1.1.3.2 TWO INTERRUPTER SF6 CIRCUIT BREAKER

15.4.1.1.3.3 FOUR INTERRUPTER SF6 CIRCUIT BREAKER

15.4.1.1.4. VACUUM CIRCUIT BREAKER (VCB)

15.4.1.1.4.1 ATMOSPHERIC VACUUM BREAKERS

15.4.1.1.4.2 HOSE CONNECTION VACUUM BREAKERS

15.4.1.1.4.3 PRESSURE VACUUM BREAKERS

15.4.1.1.4.4 SPILL-RESISTANT VACUUM BREAKERS

15.4.2 RENEWABLES

15.4.2.1. BY TYPE

15.4.2.1.1. OIL CIRCUIT BREAKER (OCB)

15.4.2.1.1.1 BULK OIL CIRCUIT BREAKER

15.4.2.1.1.2 LOW OIL CIRCUIT BREAKER

15.4.2.1.2. AIR CIRCUIT BREAKER (ACB)

15.4.2.1.2.1 MAGNETIC BLOWOUT TYPE AIR BREAK CIRCUIT BREAKER

15.4.2.1.2.2 AIR CHUTE AIR BREAK CIRCUIT BREAKER

15.4.2.1.2.3 PLAIN BREAK TYPE AIR BREAK CIRCUIT BREAKER

15.4.2.1.3. SULFUR HEXAFLUORIDE CIRCUIT BREAKER (SF6CB)

15.4.2.1.3.1 SINGLE INTERRUPTER SF6 CIRCUIT BREAKER

15.4.2.1.3.2 TWO INTERRUPTER SF6 CIRCUIT BREAKER

15.4.2.1.3.3 FOUR INTERRUPTER SF6 CIRCUIT BREAKER

15.4.2.1.4. VACUUM CIRCUIT BREAKER (VCB)

15.4.2.1.4.1 ATMOSPHERIC VACUUM BREAKERS

15.4.2.1.4.2 HOSE CONNECTION VACUUM BREAKERS

15.4.2.1.4.3 PRESSURE VACUUM BREAKERS

15.4.2.1.4.4 SPILL-RESISTANT VACUUM BREAKERS

15.4.3 TRANSPORTATION

15.4.3.1. BY TYPE

15.4.3.1.1. OIL CIRCUIT BREAKER (OCB)

15.4.3.1.1.1 BULK OIL CIRCUIT BREAKER

15.4.3.1.1.2 LOW OIL CIRCUIT BREAKER

15.4.3.1.2. AIR CIRCUIT BREAKER (ACB)

15.4.3.1.2.1 MAGNETIC BLOWOUT TYPE AIR BREAK CIRCUIT BREAKER

15.4.3.1.2.2 AIR CHUTE AIR BREAK CIRCUIT BREAKER

15.4.3.1.2.3 PLAIN BREAK TYPE AIR BREAK CIRCUIT BREAKER

15.4.3.1.3. SULFUR HEXAFLUORIDE CIRCUIT BREAKER (SF6CB)

15.4.3.1.3.1 SINGLE INTERRUPTER SF6 CIRCUIT BREAKER

15.4.3.1.3.2 TWO INTERRUPTER SF6 CIRCUIT BREAKER

15.4.3.1.3.3 FOUR INTERRUPTER SF6 CIRCUIT BREAKER

15.4.3.1.4. VACUUM CIRCUIT BREAKER (VCB)

15.4.3.1.4.1 ATMOSPHERIC VACUUM BREAKERS

15.4.3.1.4.2 HOSE CONNECTION VACUUM BREAKERS

15.4.3.1.4.3 PRESSURE VACUUM BREAKERS

15.4.3.1.4.4 SPILL-RESISTANT VACUUM BREAKERS

15.4.4 WASTEWATER TREATMENT

15.4.4.1. BY TYPE

15.4.4.1.1. OIL CIRCUIT BREAKER (OCB)

15.4.4.1.1.1 BULK OIL CIRCUIT BREAKER

15.4.4.1.1.2 LOW OIL CIRCUIT BREAKER

15.4.4.1.2. AIR CIRCUIT BREAKER (ACB)

15.4.4.1.2.1 MAGNETIC BLOWOUT TYPE AIR BREAK CIRCUIT BREAKER

15.4.4.1.2.2 AIR CHUTE AIR BREAK CIRCUIT BREAKER

15.4.4.1.2.3 PLAIN BREAK TYPE AIR BREAK CIRCUIT BREAKER

15.4.4.1.3. SULFUR HEXAFLUORIDE CIRCUIT BREAKER (SF6CB)

15.4.4.1.3.1 SINGLE INTERRUPTER SF6 CIRCUIT BREAKER

15.4.4.1.3.2 TWO INTERRUPTER SF6 CIRCUIT BREAKER

15.4.4.1.3.3 FOUR INTERRUPTER SF6 CIRCUIT BREAKER

15.4.4.1.4. VACUUM CIRCUIT BREAKER (VCB)

15.4.4.1.4.1 ATMOSPHERIC VACUUM BREAKERS

15.4.4.1.4.2 HOSE CONNECTION VACUUM BREAKERS

15.4.4.1.4.3 PRESSURE VACUUM BREAKERS

15.4.4.1.4.4 SPILL-RESISTANT VACUUM BREAKERS

15.4.5 MANUFACTURING

15.4.5.1. BY TYPE

15.4.5.1.1. OIL CIRCUIT BREAKER (OCB)

15.4.5.1.1.1 BULK OIL CIRCUIT BREAKER

15.4.5.1.1.2 LOW OIL CIRCUIT BREAKER

15.4.5.1.2. AIR CIRCUIT BREAKER (ACB)

15.4.5.1.2.1 MAGNETIC BLOWOUT TYPE AIR BREAK CIRCUIT BREAKER

15.4.5.1.2.2 AIR CHUTE AIR BREAK CIRCUIT BREAKER

15.4.5.1.2.3 PLAIN BREAK TYPE AIR BREAK CIRCUIT BREAKER

15.4.5.1.3. SULFUR HEXAFLUORIDE CIRCUIT BREAKER (SF6CB)

15.4.5.1.3.1 SINGLE INTERRUPTER SF6 CIRCUIT BREAKER

15.4.5.1.3.2 TWO INTERRUPTER SF6 CIRCUIT BREAKER

15.4.5.1.3.3 FOUR INTERRUPTER SF6 CIRCUIT BREAKER

15.4.5.1.4. VACUUM CIRCUIT BREAKER (VCB)

15.4.5.1.4.1 ATMOSPHERIC VACUUM BREAKERS

15.4.5.1.4.2 HOSE CONNECTION VACUUM BREAKERS

15.4.5.1.4.3 PRESSURE VACUUM BREAKERS

15.4.5.1.4.4 SPILL-RESISTANT VACUUM BREAKERS

15.4.6 OTHERS

16 GLOBAL CIRCUIT BREAKER MARKET, BY GEOGRAPHY

16.1 GLOBAL CIRCUIT BREAKER MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

16.1.1 NORTH AMERICA

16.1.1.1. U.S.

16.1.1.2. CANADA

16.1.1.3. MEXICO

16.1.2 EUROPE

16.1.2.1. GERMANY

16.1.2.2. FRANCE

16.1.2.3. U.K.

16.1.2.4. ITALY

16.1.2.5. SPAIN

16.1.2.6. RUSSIA

16.1.2.7. TURKEY

16.1.2.8. BELGIUM

16.1.2.9. NETHERLANDS

16.1.2.10. NORWAY

16.1.2.11. FINLAND

16.1.2.12. SWITZERLAND

16.1.2.13. DENMARK

16.1.2.14. SWEDEN

16.1.2.15. POLAND

16.1.2.16. REST OF EUROPE

16.1.3 ASIA PACIFIC

16.1.3.1. JAPAN

16.1.3.2. CHINA

16.1.3.3. SOUTH KOREA

16.1.3.4. INDIA

16.1.3.5. AUSTRALIA

16.1.3.6. NEW ZEALAND

16.1.3.7. SINGAPORE

16.1.3.8. THAILAND

16.1.3.9. MALAYSIA

16.1.3.10. INDONESIA

16.1.3.11. PHILIPPINES

16.1.3.12. TAIWAN

16.1.3.13. VIETNAM

16.1.3.14. REST OF ASIA PACIFIC

16.1.4 SOUTH AMERICA

16.1.4.1. BRAZIL

16.1.4.2. ARGENTINA

16.1.4.3. REST OF SOUTH AMERICA

16.1.5 MIDDLE EAST AND AFRICA

16.1.5.1. SOUTH AFRICA

16.1.5.2. EGYPT

16.1.5.3. SAUDI ARABIA

16.1.5.4. U.A.E

16.1.5.5. OMAN

16.1.5.6. BAHRAIN

16.1.5.7. ISRAEL

16.1.5.8. KUWAIT

16.1.5.9. QATAR

16.1.5.10. REST OF MIDDLE EAST AND AFRICA

16.2 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

17 GLOBAL CIRCUIT BREAKER MARKET,COMPANY LANDSCAPE

17.1 COMPANY SHARE ANALYSIS: GLOBAL

17.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

17.3 COMPANY SHARE ANALYSIS: EUROPE

17.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

17.5 MERGERS & ACQUISITIONS

17.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

17.7 EXPANSIONS

17.8 REGULATORY CHANGES

17.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

18 GLOBAL CIRCUIT BREAKER MARKET, SWOT & DBMR ANALYSIS

19 GLOBAL CIRCUIT BREAKER MARKET, COMPANY PROFILE

19.1 SCHNEIDER ELECTRIC

19.1.1 COMPANY SNAPSHOT

19.1.2 REVENUE ANALYSIS

19.1.3 GEOGRAPHIC PRESENCE

19.1.4 PRODUCT PORTFOLIO

19.1.5 RECENT DEVELOPMENT

19.2 ABB

19.2.1 COMPANY SNAPSHOT

19.2.2 REVENUE ANALYSIS

19.2.3 GEOGRAPHIC PRESENCE

19.2.4 PRODUCT PORTFOLIO

19.2.5 RECENT DEVELOPMENT

19.3 TONGOU ELECTRICAL

19.3.1 COMPANY SNAPSHOT

19.3.2 REVENUE ANALYSIS

19.3.3 GEOGRAPHIC PRESENCE

19.3.4 PRODUCT PORTFOLIO

19.3.5 RECENT DEVELOPMENT

19.4 HAVELL INDIA LTD

19.4.1 COMPANY SNAPSHOT

19.4.2 REVENUE ANALYSIS

19.4.3 GEOGRAPHIC PRESENCE

19.4.4 PRODUCT PORTFOLIO

19.4.5 RECENT DEVELOPMENT

19.5 EATON

19.5.1 COMPANY SNAPSHOT

19.5.2 REVENUE ANALYSIS

19.5.3 GEOGRAPHIC PRESENCE

19.5.4 PRODUCT PORTFOLIO

19.5.5 RECENT DEVELOPMENT

19.6 MEGGER

19.6.1 COMPANY SNAPSHOT

19.6.2 REVENUE ANALYSIS

19.6.3 GEOGRAPHIC PRESENCE

19.6.4 PRODUCT PORTFOLIO

19.6.5 RECENT DEVELOPMENT

19.7 HONEYWELL INTERNATIONAL INC.

19.7.1 COMPANY SNAPSHOT

19.7.2 REVENUE ANALYSIS

19.7.3 GEOGRAPHIC PRESENCE

19.7.4 PRODUCT PORTFOLIO

19.7.5 RECENT DEVELOPMENT

19.8 MITSUBISHI ELECTRIC CORPORATION

19.8.1 COMPANY SNAPSHOT

19.8.2 REVENUE ANALYSIS

19.8.3 GEOGRAPHIC PRESENCE

19.8.4 PRODUCT PORTFOLIO

19.8.5 RECENT DEVELOPMENT

19.9 SIEMENS

19.9.1 COMPANY SNAPSHOT

19.9.2 REVENUE ANALYSIS

19.9.3 GEOGRAPHIC PRESENCE

19.9.4 PRODUCT PORTFOLIO

19.9.5 RECENT DEVELOPMENT

19.1 TE CONNECTIVITY

19.10.1 COMPANY SNAPSHOT

19.10.2 REVENUE ANALYSIS

19.10.3 GEOGRAPHIC PRESENCE

19.10.4 PRODUCT PORTFOLIO

19.10.5 RECENT DEVELOPMENT

19.11 GENERAL ELECTRIC

19.11.1 COMPANY SNAPSHOT

19.11.2 REVENUE ANALYSIS

19.11.3 GEOGRAPHIC PRESENCE

19.11.4 PRODUCT PORTFOLIO

19.11.5 RECENT DEVELOPMENT

19.12 LARSEN & TOUBRO

19.12.1 COMPANY SNAPSHOT

19.12.2 REVENUE ANALYSIS

19.12.3 GEOGRAPHIC PRESENCE

19.12.4 PRODUCT PORTFOLIO

19.12.5 RECENT DEVELOPMENT

19.13 TOSHIBA CORPORATION

19.13.1 COMPANY SNAPSHOT

19.13.2 REVENUE ANALYSIS

19.13.3 GEOGRAPHIC PRESENCE

19.13.4 PRODUCT PORTFOLIO

19.13.5 RECENT DEVELOPMENT

19.14 FEDERAL

19.14.1 COMPANY SNAPSHOT

19.14.2 REVENUE ANALYSIS

19.14.3 GEOGRAPHIC PRESENCE

19.14.4 PRODUCT PORTFOLIO

19.14.5 RECENT DEVELOPMENT

19.15 POWELL INDUSTRIES.

19.15.1 COMPANY SNAPSHOT

19.15.2 REVENUE ANALYSIS

19.15.3 GEOGRAPHIC PRESENCE

19.15.4 PRODUCT PORTFOLIO

19.15.5 RECENT DEVELOPMENT

19.16 PHOENIX CONTACT

19.16.1 COMPANY SNAPSHOT

19.16.2 REVENUE ANALYSIS

19.16.3 GEOGRAPHIC PRESENCE

19.16.4 PRODUCT PORTFOLIO

19.16.5 RECENT DEVELOPMENT

19.17 SENSATA TECHNOLOGIES, INC

19.17.1 COMPANY SNAPSHOT

19.17.2 REVENUE ANALYSIS

19.17.3 GEOGRAPHIC PRESENCE

19.17.4 PRODUCT PORTFOLIO

19.17.5 RECENT DEVELOPMENT

19.18 E-T-A ENGINEERING TECHNOLOGY

19.18.1 COMPANY SNAPSHOT

19.18.2 REVENUE ANALYSIS

19.18.3 GEOGRAPHIC PRESENCE

19.18.4 PRODUCT PORTFOLIO

19.18.5 RECENT DEVELOPMENT

19.19 WAGO

19.19.1 COMPANY SNAPSHOT

19.19.2 REVENUE ANALYSIS

19.19.3 GEOGRAPHIC PRESENCE

19.19.4 PRODUCT PORTFOLIO

19.19.5 RECENT DEVELOPMENT

19.2 ROCKWELL AUTOMATION, INC.

19.20.1 COMPANY SNAPSHOT

19.20.2 REVENUE ANALYSIS

19.20.3 GEOGRAPHIC PRESENCE

19.20.4 PRODUCT PORTFOLIO

19.20.5 RECENT DEVELOPMENT

19.21 CAMSCO ELECTRIC CO., LTD

19.21.1 COMPANY SNAPSHOT

19.21.2 REVENUE ANALYSIS

19.21.3 GEOGRAPHIC PRESENCE

19.21.4 PRODUCT PORTFOLIO

19.21.5 RECENT DEVELOPMENT

19.22 KIRLOSKAR ELECTRIC COMPANY

19.22.1 COMPANY SNAPSHOT

19.22.2 REVENUE ANALYSIS

19.22.3 GEOGRAPHIC PRESENCE

19.22.4 PRODUCT PORTFOLIO

19.22.5 RECENT DEVELOPMENT

19.23 WEIDMULLER, USA

19.23.1 COMPANY SNAPSHOT

19.23.2 REVENUE ANALYSIS

19.23.3 GEOGRAPHIC PRESENCE

19.23.4 PRODUCT PORTFOLIO

19.23.5 RECENT DEVELOPMENT

19.24 SPRECHER+SCHUH

19.24.1 COMPANY SNAPSHOT

19.24.2 REVENUE ANALYSIS

19.24.3 GEOGRAPHIC PRESENCE

19.24.4 PRODUCT PORTFOLIO

19.24.5 RECENT DEVELOPMENT

19.25 LITTLEFUSE, INC.

19.25.1 COMPANY SNAPSHOT

19.25.2 REVENUE ANALYSIS

19.25.3 GEOGRAPHIC PRESENCE

19.25.4 PRODUCT PORTFOLIO

19.25.5 RECENT DEVELOPMENT

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

20 CONCLUSION

21 QUESTIONNAIRE

22 RELATED REPORTS

23 ABOUT DATA BRIDGE MARKET RESEARCH

Global Circuit Breaker Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Circuit Breaker Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Circuit Breaker Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.