Global Pest Control Market

Market Size in USD Billion

CAGR :

%

USD

26.68 Billion

USD

40.33 Billion

2024

2032

USD

26.68 Billion

USD

40.33 Billion

2024

2032

| 2025 –2032 | |

| USD 26.68 Billion | |

| USD 40.33 Billion | |

|

|

|

|

Pest Control Market Size

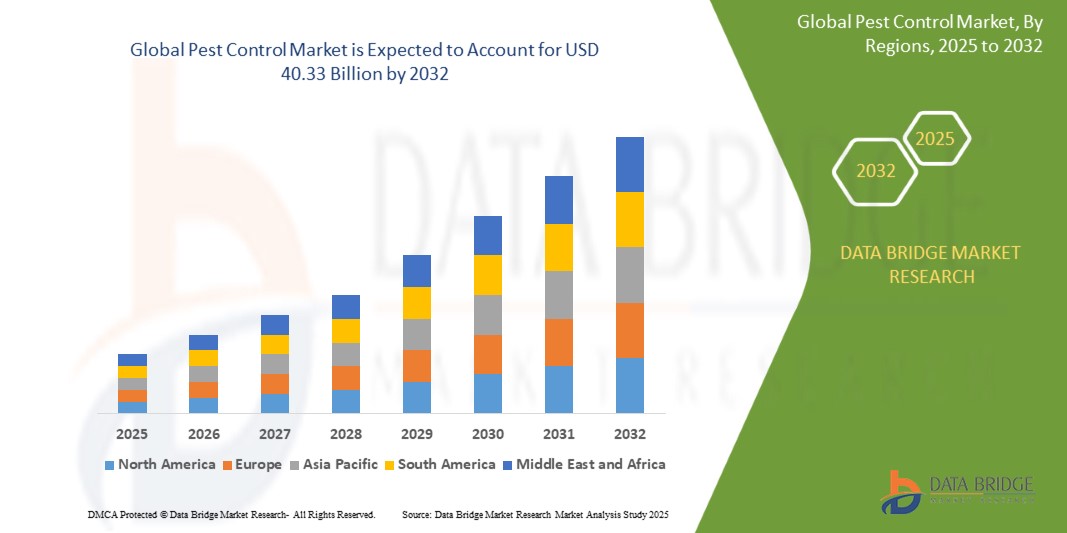

- The global pest control market size was valued at USD 26.68 billion in 2024 and is expected to reach USD 40.33 billion by 2032, at a CAGR of 5.30% during the forecast period

- The market growth is largely fuelled by the increasing urbanization and industrialization, which intensifies the need for effective pest management across residential, commercial, and agricultural settings

- Rising concerns about vector-borne diseases and food safety standards are also driving demand for innovative and eco-friendly pest control solutions

Pest Control Market Analysis

- The global pest control market is witnessing notable expansion due to increasing awareness of hygiene, stricter regulations for food and health safety, and climate change-induced pest outbreaks

- Innovations such as biological pest control agents, integrated pest management (IPM) practices, and smart pest detection technologies are reshaping the industry

- North America dominated the pest control market with the largest revenue share of 38.25% in 2024, driven by a high prevalence of urban pests, stringent regulations on hygiene standards, and rising awareness regarding vector-borne diseases

- Asia-Pacific region is expected to witness the highest growth rate in the global pest control market, driven by rapid urbanization, increasing awareness about health and hygiene, and the rising adoption of integrated pest management solutions in countries such as China, India, and Japan

- The insects segment dominated the market with the largest market revenue share of 47.5% in 2024, driven by the rising prevalence of vector-borne diseases and increased sensitivity toward hygiene, particularly in residential and commercial settings. The high frequency of cockroach, mosquito, and ant infestations across urban areas and food establishments contributes to the robust demand for insect control services. Continuous development of targeted insecticides and integrated pest management programs further supports segment growth

Report Scope and Pest Control Market Segmentation

|

Attributes |

Pest Control Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pest Control Market Trends

“Rise Of Eco‑Friendly And Smart Pest Management Solutions”

- Adoption of eco‑friendly pest control methods—such as biological agents and low‑toxicity biochemical sprays—is increasing as consumers and regulations demand sustainable solutions

- Smart pest detection systems (IoT‑enabled traps, sensors) are being deployed in commercial and residential applications for real‑time monitoring and reduced chemical usage

- For instance, a major U.S. hotel chain installed sensor‑based rodent monitoring in 2024, reducing pesticide use by 30%, while a UK farm switched to pheromone‑based insect traps in 2023, improving crop safety

- Integration of data‑driven services—like AI‑powered pest forecasting—is enhancing service providers’ ability to predict outbreaks and optimize treatment

- Green-label pest solutions, such as botanical and microbial products, are also gaining market share in Europe and North America

Pest Control Market Dynamics

Driver

“Increasing Demand for Integrated Pest Management in Urban and Agricultural Settings”

- Integrated Pest Management (IPM) involves combining chemical, biological, mechanical, and digital strategies for effective and environmentally sound pest control

- Growing pest pressures from urbanization and climate change are encouraging adoption across sectors including residential, industrial, commercial, and livestock

- Governments and organizations are promoting IPM as a sustainable and regulatory-compliant solution for food safety and public health

- In agriculture, IPM significantly reduces crop loss while minimizing chemical usage; for instance, grain storage facilities in Brazil and Australia use a combination of fumigation, traps, and drone-based insect mapping

- Urban areas such as school districts in the U.S. have adopted IPM programs, achieving up to 40% reduction in chemical pesticide use while maintaining effective pest thresholds

Restraint/Challenge

“Regulatory Barriers and Rising Costs of Eco‑Friendly Pest Solutions”

- Eco-friendly pest solutions require longer, more complex registration and testing processes compared to conventional chemical pesticides

- High upfront investment in new technology (e.g., IoT traps, AI forecasting tools) and workforce training deters adoption by small and mid-sized service providers

- Limited shelf life and specialized storage needs of biological agents, such as microbial insecticides and predatory mites, add logistical challenges

- Evolving regulations in regions such as the EU and Canada force frequent reformulation and raise operational costs for product compliance

- For instance, in 2023, several European pest control startups delayed product launches due to protracted regulatory approval for bio-based rodent control products, impacting market competitiveness

Pest Control Market Scope

The pest control market is segmented on the basis of type, control method, mode of application, and application.

• By Type

On the basis of type, the pest control market is segmented into insects, rodents, termites, wildlife, and others. The insects segment dominated the market with the largest market revenue share of 47.5% in 2024, driven by the rising prevalence of vector-borne diseases and increased sensitivity toward hygiene, particularly in residential and commercial settings. The high frequency of cockroach, mosquito, and ant infestations across urban areas and food establishments contributes to the robust demand for insect control services. Continuous development of targeted insecticides and integrated pest management programs further supports segment growth.

The rodents segment is expected to witness the fastest growth rate from 2025 to 2032 due to increasing rodent outbreaks in urban areas and rising concerns over food contamination and property damage. The use of smart traps and ultrasonic deterrents in cities such as New York and London reflects the growing adoption of tech-enabled rodent management solutions.

• By Control Method

On the basis of control method, the pest control market is segmented into chemical, mechanical, and biological. The chemical segment held the largest market revenue share in 2024 due to its immediate and broad-spectrum efficacy in eliminating pests across various environments. It remains the most relied upon method for large-scale pest eradication in industrial, agricultural, and commercial sectors.

The biological segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by increasing environmental awareness and regulatory support for sustainable pest solutions. The rising use of natural predators, microbial agents, and botanical insecticides, particularly in organic farming and green-certified buildings, is driving the shift toward bio-based pest control methods.

• By Mode of Application

On the basis of mode of application, the pest control market is segmented into powder, pellets, sprays, traps, and baits. The sprays segment accounted for the largest market share in 2024 due to its ease of use, quick action, and broad effectiveness across multiple pest types. Sprays are widely used in both urban households and large-scale commercial buildings, such as hotels and hospitals, for controlling crawling and flying insects.

The traps segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its increasing adoption in rodent and wildlife control. For instance, food manufacturing facilities in Germany have shifted toward smart traps that monitor pest activity in real-time, ensuring regulatory compliance and minimizing product contamination.

• By Application

On the basis of application, the pest control market is segmented into residential, commercial, industrial, livestock, and others. The residential segment dominated the market in 2024, accounting for the largest revenue share due to increasing consumer awareness of pest-related health risks and the rising demand for safe, user-friendly pest control solutions.

The livestock segment is expected to witness the fastest growth rate from 2025 to 2032, driven by rising concerns over animal health, biosecurity, and production losses caused by pests such as flies, mites, and lice. For instance, poultry farms in the Netherlands have adopted automated misting systems combined with biological control to reduce parasite load and enhance overall animal productivity.

Pest Control Market Regional Analysis

- North America dominated the pest control market with the largest revenue share of 38.25% in 2024, driven by a high prevalence of urban pests, stringent regulations on hygiene standards, and rising awareness regarding vector-borne diseases

- The region has a mature commercial pest control sector with increasing adoption of integrated pest management (IPM) programs across sectors such as food processing, hospitality, and healthcare. Innovations in chemical formulations and smart pest detection systems have further strengthened market presence

- Favorable regulatory support and emphasis on preventive pest management continue to accelerate the use of eco-friendly solutions across both residential and commercial applications

U.S. Pest Control Market Insight

The U.S. pest control market accounted for the largest share of 79.6% in 2024 within North America, bolstered by rising residential demand and strong commercial pest control service networks. The country faces growing infestations of termites, bed bugs, and rodents, prompting increased spending on extermination and monitoring. For instance, the National Pest Management Association (NPMA) continues to implement consumer awareness campaigns, which significantly boost residential service uptake. In addition, the rise of digital pest monitoring tools and regulatory pressure on food production facilities has increased demand for tailored pest control services across the country.

Europe Pest Control Market Insight

The Europe pest control market is expected to witness the fastest growth rate from 2025 to 2032, supported by robust regulatory frameworks, rising hygiene awareness, and an expanding hospitality and food processing industry. Countries across the region are emphasizing sustainable pest control methods due to increasing environmental and health concerns. The commercial segment, particularly in Germany, France, and the U.K., is witnessing rapid digitalization of pest management systems. Advancements in IoT-based traps and increased investment in biopesticides are also reinforcing the growth of sustainable pest control practices in the region.

U.K. Pest Control Market Insight

The U.K. pest control market is expected to witness the fastest growth rate from 2025 to 2032, driven by increased rat and insect infestations in urban centers and stricter hygiene regulations post-Brexit. The Food Standards Agency and local councils continue to enforce regular pest audits in food service establishments. In addition, the rising use of AI-integrated traps and sensors in retail and warehouse facilities reflects a growing shift toward smart pest management solutions across the country.

Germany Pest Control Market Insight

The Germany’s pest control market is expected to witness the fastest growth rate from 2025 to 2032, supported by strict environmental laws and the demand for highly regulated pest control in food and pharmaceutical industries. The German Environment Agency’s preference for non-toxic alternatives has pushed manufacturers and service providers toward green pest control innovations. Integrated pest management systems are gaining traction, particularly in industrial and institutional sectors, reinforcing Germany’s leadership in sustainable pest control practices.

Asia-Pacific Pest Control Market Insight

The Asia-Pacific is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, increasing pest-related health concerns, and growing agricultural productivity challenges. Countries such as China, India, and Australia are seeing increasing adoption of pest control solutions in both residential and commercial settings. The market is also being propelled by government-supported hygiene and vector control programs. Moreover, the agricultural sector is adopting IPM techniques to minimize crop damage and reduce pesticide residues.

China Pest Control Market Insight

The China held the largest market revenue share in Asia-Pacific in 2024, driven by large-scale pest infestations in urban and rural regions and the expansion of food safety regulations. Rising middle-class incomes, coupled with stringent hygiene standards in food processing zones and public spaces, are fostering the demand for pest control services.

Japan Pest Control Market Insight

The Japan pest control market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising concerns over hygiene in aging residential infrastructure and expanding urban centers. The country places high importance on environmental safety, leading to growing demand for low-toxicity and odorless pest control solutions. Urban areas such as Tokyo and Osaka are experiencing increased rodent and termite activity, prompting higher investments in residential and commercial pest management. For instance, pest control companies in Japan are increasingly offering IPM-based services integrated with sensor-based detection systems to minimize chemical use while maintaining efficacy. In addition, the food processing and hospitality industries are significant contributors to market demand, as strict regulatory inspections continue to drive regular pest maintenance contracts across the country.

Pest Control Market Share

The Pest Control industry is primarily led by well-established companies, including:

- Ecolab Inc. (U.S.)

- Rollins Inc. (U.S.)

- Rentokil Initial Plc. (U.K.)

- ServiceMaster Company, LLC (U.S.)

- Massey Services Inc. (U.S.)

- Arrow Exterminators Inc. (U.S.)

- Sanix Incorporated (Japan)

- Asante Inc. (Japan)

- Dodson Pest Control, Inc. (U.S.)

- Target Specialty Products (U.S.)

- Pelsis Ltd. (U.K.)

- Killgerm Ltd. (U.K.)

- WinField Solutions, LLC (U.S.)

- Univer Inc (U.S.)

Latest Developments in Global Pest Control Market

- In January 2022, Biologists at the University of California, San Diego, leveraged CRISPR/Cas9 technology to develop a method for reversing pesticide resistance. Published in Nature Communications, this research involves substituting an insecticide-resistant gene in fruit flies with a regular, susceptible variant. This innovative approach aims to significantly decrease pesticide use and has the potential to enhance the prevalence of a genetic mutation in mosquitoes that curtails malaria transmission

- In January 2022, a pilot trial in a Havana neighborhood, supported by the IAEA and FAO, effectively reduced Aedes aegypti mosquito populations by up to 90%. Early reports revealed that mosquito-borne diseases were eradicated in the final two months of the trial. The Sterile Insect Technique (SIT) involves sterilizing mass-reared insects using gamma rays, ensuring they remain competitive while preventing reproduction, offering a sustainable pest control solution

- In May 2021, Anticimex Group, a prominent global pest control company, announced its acquisition of Palmera Junior, a successful family-owned business in Colombia, marking its first strategic move into Latin America. This acquisition signifies a vital step in Anticimex's expansion strategy, capitalizing on the rapidly growing pest control market in the region. The acquisition enhances their operational capabilities and market presence in Latin America

- In March 2021, Bayer AG unveiled Vynyty Citrus, an innovative biological and pheromone-based crop protection solution, marking a significant advancement in sustainable pest control for citrus farming. Formulated with natural pyrethrum and pheromones, Vynyty Citrus effectively combats pests that threaten citrus crops. This product represents Bayer's commitment to providing environmentally friendly solutions while ensuring crop health and yield, showcasing their dedication to innovative agricultural practices

- In January 2021, Rentokil Initial plc, the leading global commercial pest control provider, announced its acquisition of Environmental Pest Services (EPS), a full-service pest control firm in Tampa, Florida. This acquisition aligns with Rentokil’s strategy to enhance its customer base and expand its reach in crucial local markets. By integrating EPS's services, Rentokil aims to bolster its operational strength and improve service offerings for residential and commercial clients

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.