Global Pet Food Ingredients Market

Market Size in USD Billion

CAGR :

%

USD

36.60 Billion

USD

57.89 Billion

2024

2032

USD

36.60 Billion

USD

57.89 Billion

2024

2032

| 2025 –2032 | |

| USD 36.60 Billion | |

| USD 57.89 Billion | |

|

|

|

|

Pet Food Ingredients Market Size

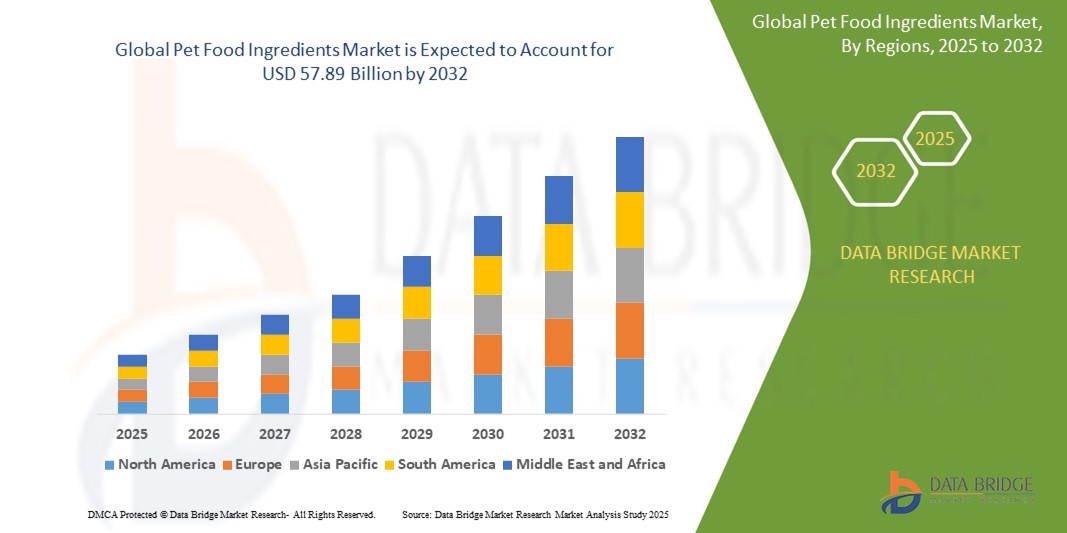

- The global pet food ingredients market size was valued at USD 36.60 billion in 2024 and is expected to reach USD 57.89 billion by 2032, at a CAGR of 5.9% during the forecast period

- This growth is driven by factors such as the increasing pet adoption rate, rising demand for natural and organic pet food, and growing awareness about pet health and nutrition

Pet Food Ingredients Market Analysis

- Pet food ingredients are essential components used in the formulation of pet foods, providing necessary nutrients and ensuring the overall health and well-being of pets. Key ingredients include proteins, fats, carbohydrates, vitamins, and minerals, sourced from both animal and plant-based materials

- The demand for pet food ingredients is primarily driven by the increasing pet ownership, growing awareness about pet nutrition, and a rising preference for premium, natural, and organic pet foods

- North America is expected to dominate the global pet food ingredients market with largest market share of 38.6%, due to a high rate of pet ownership, advanced pet food industry standards, and strong consumer preference for high-quality ingredients

- Asia-Pacific is expected to be the fastest growing region in the pet food ingredients market during the forecast period due to increasing urbanization, disposable income, and growing awareness about pet health and nutrition

- Amino acid segment is expected to dominate the market with a largest market share of 31.4% due to the essential role amino acids play in the overall health and development of pets. Amino acids are crucial for protein synthesis, muscle development, and immune function, making them vital components of pet food formulations

Report Scope and Pet Food Ingredients Market Segmentation

|

Attributes |

Pet Food Ingredients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pet Food Ingredients Market Trends

" Natural and Functional Ingredients in Pet Food"

- One prominent trend in the global pet food ingredients market is the growing demand for natural, organic, and sustainable ingredients. Consumers are increasingly concerned about the quality and origin of the ingredients used in pet foods, driving a shift toward clean-label products that avoid artificial additives, preservatives, and fillers

- For instance, plant-based proteins, organic fruits, and vegetables are gaining popularity as healthy and environmentally friendly alternatives to traditional animal-based ingredients, reflecting a broader consumer interest in both pet health and sustainability

- This trend is shaping the future of pet food formulation, with manufacturers focusing on innovative ingredient sourcing, such as insect proteins, algae, and plant-based oils, to meet consumer demand for nutritious and eco-conscious products

Pet Food Ingredients Market Dynamics

Driver

"Growing Demand Due to Rising Pet Ownership and Health Consciousness"

- The increasing rate of pet ownership globally is significantly contributing to the growing demand for high-quality pet food ingredients. As more people adopt pets, especially in emerging markets, the need for nutritious and well-formulated pet food is rising

- Furthermore, as pet owners become more health-conscious about the well-being of their pets, they are seeking premium and specialized food options that cater to specific health needs such as joint health, skin and coat quality, and digestive support

- This shift towards health-focused pet food products is driving the demand for functional ingredients, such as probiotics, omega-3 fatty acids, and amino acids, to enhance pets' overall health

For instance,

- According to a report by the American Pet Products Association (APPA), pet ownership in the United States has reached an all-time high, with approximately 70% of U.S. households owning a pet as of 2023, leading to an increase in demand for high-quality pet food ingredients

- As a result of these trends, there is a notable surge in demand for high-quality, specialized ingredients in the pet food industry, ensuring better health outcomes for pets and driving market growth

Opportunity

"Sustainability and Eco-Friendly Ingredients in Pet Food"

- The growing consumer preference for environmentally conscious products is creating a significant market opportunity for sustainable and eco-friendly pet food ingredients. Pet owners are increasingly looking for products that are ethically sourced, have minimal environmental impact, and are made with sustainable practices

- This trend includes the use of alternative protein sources such as insect protein, algae, and plant-based ingredients, which are more sustainable than traditional animal-based proteins. These ingredients not only reduce the environmental footprint of pet food but also cater to the rising demand for more ethical and eco-friendly choices in pet care

- The focus on sustainability extends beyond ingredient sourcing, with pet food companies also investing in environmentally friendly packaging and reducing carbon emissions in their production processes

For instance,

- According to a 2023 survey by the American Pet Products Association (APPA), 42% of pet owners expressed a preference for purchasing pet food made from sustainably sourced ingredients, signaling a growing market demand for eco-conscious products

- As a result, ingredient suppliers have a unique opportunity to innovate and supply sustainable, plant-based, and alternative protein ingredients that cater to this shift in consumer preferences, driving growth in the global pet food ingredients market

Restraint/Challenge

"Rising Ingredient Costs and Supply Chain Challenges"

- The increasing cost of raw materials and pet food ingredients presents a significant challenge for the global pet food ingredients market. As demand for high-quality ingredients like premium proteins, organic grains, and functional additives grows, so do their prices, putting pressure on manufacturers to maintain competitive pricing while ensuring product quality

- Supply chain disruptions, including shortages and delays in ingredient sourcing, particularly for specialty ingredients like plant-based proteins or sustainably sourced omega-3 oils, exacerbate the issue. These challenges increase production costs and can lead to supply shortages or price volatility in the market

- Smaller pet food manufacturers with limited resources may struggle to secure consistent supplies of high-quality ingredients at affordable prices, hindering their ability to meet consumer demand for premium and specialized pet food products

For instance,

- In 2024, a report by the Pet Food Manufacturers Association highlighted the rising costs of key ingredients such as meat, grains, and vitamins, which have seen price hikes of 15-20% in the past year due to supply chain disruptions and increased demand for sustainable sources

- Consequently, these cost pressures may lead to increased prices for pet food products, potentially reducing consumer affordability and limiting market growth, particularly in price-sensitive regions

Pet Food Ingredients Market Scope

The market is segmented on the basis of source, ingredient, animal, form, product type, and distribution channel

|

Segmentation |

Sub-Segmentation |

|

By Source |

|

|

By Ingredient |

|

|

By Animal |

|

|

By Form |

|

|

By Product Type |

|

|

By Distribution Channel

|

|

In 2025, the amino acid is projected to dominate the market with a largest share in ingredient segment

The amino acid segment is expected to dominate the pet food ingredients market with the largest share of 31.4% due to the essential role amino acids play in the overall health and development of pets. Amino acids are crucial for protein synthesis, muscle development, and immune function, making them vital components of pet food formulations

The dog is expected to account for the largest share during the forecast period in animal segment

In 2025, the dog segment is expected to dominate the market with the largest market share of 40.5% due to growing consumer concerns towards pet health have increased the spending on healthy dog foods. Dog obesity is one of the most common heath concerns amongst dog owners. According to Vet Innovations, Inc., nearly 100 million pets in the U.S. are estimated to be overweight Thus, with increasing health concerns the consumers have been adopting functional pet food with added ingredients such as nutrients, protein, vitamins, & minerals to keep their pets healthy

Pet Food Ingredients Market Regional Analysis

“North America Holds the Largest Share in the Pet Food Ingredients Market”

- North America dominates the global pet food ingredients market with largest market share of 38.6%, driven by a high rate of pet ownership, strong demand for premium and specialized pet foods, and advanced manufacturing and research capabilities

- The U.S. holds a significant share of approximately 32%, due to its large pet-owning population, increasing consumer awareness about pet health and nutrition, and the growing preference for natural, organic, and functional pet foods

- The presence of key market players and continued investment in research and development to innovate healthier, more sustainable pet food ingredients further strengthens the region's market position

- The expanding trend of pet humanization, along with the rising demand for products that support specific health benefits such as joint health, digestive wellness, and skin quality, is fueling the growth of the pet food ingredients market across North America

“Asia-Pacific is Projected to Register the Highest CAGR in the Pet Food Ingredients Market”

- The Asia-Pacific region is expected to witness the highest growth rate in the pet food ingredients market, driven by increasing pet ownership, growing disposable income, and rising awareness of pet health and nutrition

- Countries such as China, India, and Japan are emerging as key markets, with a significant rise in pet adoption, especially among urban populations, leading to a surge in demand for high-quality pet food ingredients

- China, with its large and rapidly growing pet food market, is seeing increased investments from both domestic and international players, boosting the demand for premium and functional pet food ingredients. Similarly, India’s pet food industry is expanding due to the growing middle class and rising interest in pet health

- Japan, known for its advanced pet care culture, continues to be a key player in the adoption of high-quality, specialized pet food ingredients, and the trend toward more sustainable and innovative pet food formulations is gaining momentum in the region

Pet Food Ingredients Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Cargill, Incorporated (U.S.)

- ADM (U.S.)

- BASF SE (Germany)

- Adisseo (China)

- Darling Ingredients Inc. (U.S.)

- Omega Protein Corporation (U.S.)

- DuPont (U.S.)

- Chr. Hansen Holding A/S (Denmark)

- Roquette Frères (France)

- SunOpta (Canada)

- Lallemand Inc. (Canada)

- Lesaffre (France)

- Daka Denmark A/S (Denmark)

- Nutreco (Netherlands)

- The Scoular Company (U.S.)

- Kemin Industries, Inc. (U.S.)

- Pointon Partners Lawyers (Australia)

- Ingredion (U.S.)

Latest Developments in Global Pet Food Ingredients Market

- In 2022, BASF SE announced its strategic plans to expand its vitamin A formulation plant, aiming to strengthen its position in the animal nutrition sector. This expansion is a key move to enhance the company's market presence, positioning BASF as a prominent leader in the industry. The initiative reflects the company’s commitment to addressing the growing demand for high-quality animal nutrition products. This development is increasing demand for nutritious, functional ingredients in pet foods drives the need for high-quality additives like vitamins and minerals

- In 2022, Cargill introduced an innovative range of by-product meals specifically designed for domestic animals, featuring a variety of treats such as wind pipes, bones, ribs, and jerkies. This strategic initiative aims to meet the rising demand for high-quality, specialized pet treats, offering pet owners a diverse selection of products to indulge their pets while promoting the sustainable use of by-products. This development aligns with the increasing consumer preference for eco-friendly and sustainable pet food options. Cargill's move not only addresses the growing demand for premium pet treats but also highlights the market’s shift towards utilizing by-products, providing cost-effective yet nutritious alternatives in the pet food industry

- In 2021, Nestlé Purina PetCare Co. made a significant investment of USD 182 million to expand its pet care product manufacturing facility in King William County, Virginia, U.S. The expansion, which is expected to be completed by late 2023, includes the addition of a 138,000-square-foot space aimed at increasing manufacturing capacity, particularly for the Tidy Cat litter product line. This expansion enhanced manufacturing capabilities supports the broader trend of innovation and capacity building within the pet food and care industry, ensuring the availability of high-quality ingredients and products to cater to the growing consumer demand for premium and functional pet care solutions

- In 2021, Mars Inc. introduced a new range of wet cat food under its well-established Whiskas brand, further expanding its product portfolio in the Indian market. This innovative line is widely available through pet stores, grocery outlets, and multiple e-commerce platforms, offering cat owners in India a convenient and diverse selection of premium pet food options tailored to the nutritional needs and preferences of their feline companions. This expansion reflects the growing demand for high-quality, specialized pet food products in emerging markets such as India

- In September 2023, Symrise inaugurated its dry pet food pilot plant in Elven, France, equipped with a dedicated R&D unit. The facility aims to enhance the understanding of the dry pet food production process, assess palatability performance, and conduct laboratory studies to improve product formulations. The establishment of this state-of-the-art facility supports the growing demand for high-quality, palatable pet food products, contributing to the ongoing evolution of the pet food ingredients market by enabling the development of more nutritious and appealing products for consumers worldwide

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.