Global Miticides Market

Market Size in USD Billion

CAGR :

%

USD

2.31 Billion

USD

3.32 Billion

2024

2032

USD

2.31 Billion

USD

3.32 Billion

2024

2032

| 2025 –2032 | |

| USD 2.31 Billion | |

| USD 3.32 Billion | |

|

|

|

|

Miticides Market Size

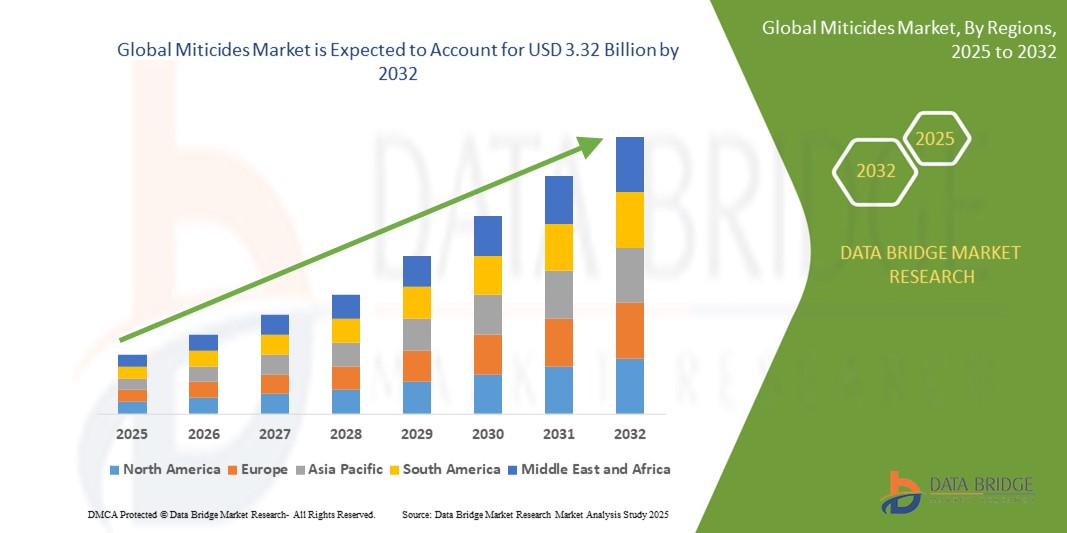

- The Global Miticides Market size was valued at USD 2.31 billion in 2024 and is expected to reach USD 3.32 billion by 2032, at a CAGR of 5.88% during the forecast period

- Growth is driven by the increasing incidence of mite infestations, the rising demand for high-quality crops, and the expansion of horticulture and floriculture industries worldwide.

- Integrated pest management (IPM) adoption, growing awareness about crop protection, and the shift toward eco-friendly and residue-free miticides are also fueling market expansion.

Miticides Market Analysis

- Miticides are chemical pesticides that are specifically manufactured to kill rodents, mice and ticks. Also known as acaricide, miticides are utilised in a wide range of applications such as soil treatment and foliar spray.

- Growing public and private expenditure for agro- genomics research capacities, rising production of cereals and food grains, and increased adoption of integrated pest management (IPM) especially in the developing economies will emerge as the major factors fostering the growth of the market.

- Asia-Pacific is expected to dominate the Global Miticides Market with a 35% share, driven by rapid urbanization, rising disposable incomes, and growing demand for processed, convenience, and clean-label food products across emerging economies.

- North America is forecasted to be the fastest-growing region with a CAGR of 5.1%, driven by consumer demand for clean-label, functional food products, and innovations in miticide blends enhancing food stability.

- Fruits and vegetables dominate the miticides market with a 46% share due to their high susceptibility to mite infestations, strict export quality standards, intensive pest management needs, and growing global demand for fresh, high-quality horticultural produce, especially in Asia-Pacific and Latin American regions.

Report Scope and Miticides Market Segmentation

|

Attributes |

Miticides Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Miticides Market Trends

“Shift Towards Bio-Based and Sustainable Miticides”

- Traditional miticides, often chemical-based, face rising scrutiny due to environmental concerns, resistance development, and potential residue in agricultural produce.

- In response, regulatory bodies and sustainable farming initiatives are pushing for eco-friendly, biodegradable, and low-toxicity miticide alternatives across global markets.

For Instance,

- The U.S. Environmental Protection Agency (EPA) promotes biopesticides and green chemistry, supporting the shift toward sustainable pest control products.

- Manufacturers are increasingly investing in bio-based miticides derived from plant extracts, essential oils, and microbial formulations to address environmental and health concerns.

- Adoption of these products is rising in organic farming, horticulture, and greenhouse cultivation where residue-free production and safety are critical priorities.

- Growing consumer and retailer pressure for sustainable agricultural practices is accelerating the demand for naturally derived, eco-friendly miticide solutions globally.

Miticides Market Dynamics

Driver

“Increasing Incidence of Mite Infestations and Crop Yield Losses”

- Rapid intensification of agriculture, monoculture practices, and climate change are contributing to the rising spread of mite infestations across global farmlands, especially in developing nations where pest management infrastructure is limited.

- Mites cause significant damage to fruits, vegetables, and ornamental plants, reducing yield quality and threatening food security in key agricultural regions with export-oriented production.

- Farmers and agribusinesses are increasingly using miticides as a preventive and curative approach to protect crop health, minimize losses, and maintain market-grade produce standards.

- With growing global demand for high-quality produce in both domestic and export markets, maintaining pest-free standards has become a critical priority for competitiveness.

- Governments and agriculture departments are supporting integrated pest management (IPM) practices, where miticides play a central role in minimizing crop damage and ensuring sustainable cultivation.

For instance,

- In Brazil, a major citrus exporter, increasing mite resistance led to wider adoption of selective miticides that minimize harm to beneficial insects and pollinators, ensuring ecological balance.

Restraint/Challenge

“Environmental Concerns and Regulatory Restrictions on Chemical Miticides”

- Regulatory bodies such as the EPA, EFSA, and India’s CIBRC impose rigorous limits on chemical pesticide residues, including miticides, to ensure ecological and consumer safety, requiring expensive compliance protocols.

- Widespread use of synthetic miticides has raised concerns about environmental toxicity, pollinator decline, and pest resistance, prompting calls for safer, sustainable pest control alternatives in agriculture.

- Compliance with evolving Maximum Residue Limits (MRLs) and safety assessments adds significant costs to registration, formulation, and international product approvals, delaying time-to-market for manufacturers.

- Farmers face limited options as many miticides are withdrawn from markets due to regulatory bans, reducing chemical diversity in pest control strategies and increasing pest resurgence risks.

- The development of bio-miticides faces hurdles such as variable field efficacy, shorter shelf life, and the need for targeted application methods and farmer training on integrated usage.

Miticides Market Scope

The market is segmented on the basis of crop type, source, formulation and mode of application.

- By crop type

On the basis of crop type, the miticides market is segmented into fruits and vegetables, cereals and grains, oilseeds and pulses and others. In 2024, Fruits and vegetables dominate the miticides market with a 46% share due to their high susceptibility to mite infestations, strict export quality standards, intensive pest management needs, and growing global demand for fresh, high-quality horticultural produce, especially in Asia-Pacific and Latin American regions.

Oilseeds and pulses are the fastest-growing segment with a CAGR of 6.8%, driven by rising global demand for plant-based proteins and edible oils, increasing mite infestations due to climate change, and growing adoption of eco-friendly and targeted miticides in sustainable agricultural practices worldwide.

- By source

On the basis of source, the miticides market is segmented into biological and chemical. Chemical miticides dominate due to their broad-spectrum effectiveness, lower cost, and widespread availability. They provide rapid control of diverse mite species, making them preferred by large-scale farmers and agribusinesses focused on maximizing crop protection and yield.

Biological miticides are fastest growing, driven by increasing regulatory restrictions on chemicals, rising consumer demand for sustainable farming, and advancements in biopesticide technology offering safer, eco-friendly alternatives with minimal environmental impact and residue concerns.

- By formulation

On the basis of formulation, the miticides market is segmented into dry and liquid. Liquid miticides dominate due to ease of application, superior coverage, and quick absorption by crops. They are adaptable for multiple crops and application methods, enhancing efficiency in pest control, especially in large-scale commercial agriculture.

Dry formulations are rapidly growing owing to their stability, longer shelf life, ease of transport, and suitability in regions lacking cold storage, increasing their adoption in developing agricultural markets.

- By mode of application

On the basis of mode of application, the miticides market is segmented into foliar spray, soil treatment and others. Foliar sprays dominate because they deliver miticides directly onto plant surfaces where mites infest, allowing precise, effective control and compatibility with modern spraying equipment, which is essential for high-value crops requiring quality maintenance.

Soil treatment is the fastest-growing mode due to rising awareness of soil-borne mite infestations, integrated pest management practices, and its role in protecting root zones, enhancing overall crop health and yield sustainability.

Miticides Market Regional Analysis

- Asia-Pacific is expected to dominate the Global Miticides Market with a 35% share, driven by rapid urbanization, rising disposable incomes, and growing demand for processed, convenience, and clean-label food products across emerging economies.

- The region’s dominance is further supported by its large agricultural base, where intensive farming practices and expanding horticulture sectors increase the risk of mite infestations. This creates a strong demand for effective miticides to protect high-value crops like fruits, vegetables, and spices that are vital for both domestic consumption and export markets.

- Additionally, increasing government initiatives aimed at improving food safety standards and promoting advanced pest management techniques bolster the adoption of miticides..

China Miticides Market Insight

China leads Asia-Pacific with a 38% revenue share in 2025, supported by expanding processed food sectors, large dairy and beverage production, and rising consumer preference for natural, plant-based miticides.

India Miticides Market Insight

India is projected to record the highest CAGR of 6.9%, fueled by urbanization, rising convenience food consumption, increasing health awareness, and government policies promoting food processing infrastructure.

Europe Miticides Market Insight

Europe market growth is shaped by strict clean-label regulations, strong demand for natural stabilizers, and significant food processing industries in Germany, France, and the Netherlands focusing on dairy, bakery, and meat sectors.

U.K. Miticides Market Insight

The U.K. market is driven by demand for plant-based, vegan-friendly miticides, innovation in low-fat food products, and advanced food manufacturing emphasizing transparency and ingredient efficacy.

Germany Miticides Market Insight

Germany leads Europe in miticide innovation, backed by robust R&D, high usage in bakery and dairy industries, and consumer preference for sustainable, high-performance stabilizers that improve texture and moisture retention.

North America Miticides Market Insight

North America is forecasted to be the fastest-growing region with a CAGR of 5.1%, driven by consumer demand for clean-label, functional food products, and innovations in miticide blends enhancing food stability.

U.S. Miticides Market Insight

In 2025, In the U.S., which holds 35% of the North American market in 2025, growth is supported by health-conscious consumers, high dairy and bakery consumption, and continued advancements in multifunctional stabilizers for convenience foods.

Miticides Market Share

The Miticides industry is primarily led by well-established companies, including:

- Illumina, Inc. (U.S.)

- Eurofins Scientific (Luxembourg)

- LGC Limited (U.K.)

- SGS S.A. (Switzerland)

- Thermo Fisher Scientific Inc. (U.S.)

- Intertek Group plc (U.K.)

- DuPont (U.S.)

- ADAMA India Private Limited (India)

- Arysta LifeScience Corporation (Japan)

- FMC Corporation (U.S.)

- BioWorks Inc. (U.S.)

- Marrone Bio Innovations (U.S.)

- Hebei Weiyuan Biochemical Co., Ltd. (China)

- Koppert Biological Systems (Netherlands)

- Molecraft (India)

- Zhejiang Rayfull Chemicals Co., Ltd. (China)

- STAR BIO SCIENCE (India)

- Varsha Bioscience and Technology India Pvt Ltd. (India)

- Novozymes (Denmark)

- Cargill, Incorporated (U.S.)

- Syngenta Crop Protection AG (Switzerland)

- Certis USA L.L.C. (U.S.)

- Andermatt Biocontrol AG (Switzerland)

- Nufarm (Australia)

- UPL (India)

- Valent BioSciences LLC (U.S.)

Latest Developments in Global Miticides Market

- In January 2023, Gowan Company introduced Magister SC, a flowable miticide formulated with Fenazaquin. This product targets mites in both Eriophyidae and Tetranychidae families and is approved for use in pome fruits, cucurbits, stone fruits, and small fruit climbing vines in Canada.

- In March 2023, BASF SE received approval from the Australian Pesticides and Veterinary Medicines Authority (APVMA) for Danisaraba, a miticide aimed at controlling spider mites in almond orchards and various fruit and fruiting vegetable crops.

- In September 2023, Syngenta AG launched Plenum, a broad-spectrum miticide with a novel mode of action designed to control resistant mites in fruits and vegetables. This product addresses the growing concern of pesticide resistance in agricultural pests.

- In March 2023, Certis USA LLC acquired the miticide division of Gowan Company. This acquisition expanded Certis' portfolio, enhancing its position in the global miticides industry and broadening its product offerings to meet diverse agricultural needs.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.