Global Orthopedic Implants Market Segmentation, By Product Type (Reconstructive Joint Replacements, Spinal Implants, Dental Implants, Orthobiologics, Trauma, and Craniomaxillofacial Implants, and Others), Biomaterial (Ceramics Biomaterials, Metallic Biomaterials, Polymeric Biomaterials, and Natural Biomaterials Constipation), Procedure (Open Surgery, Minimally Invasive Surgery (MIS), and Others), Device Type (Internal Fixation Devices, and External Fixation Devices), Application (Neck Fracture, Spine Fracture, Hip Replacement, Shoulder Replacement, and Others), End User (Hospitals, Orthopedic Clinics, Home Cares, and Others) – Industry Trends and Forecast to 2031

Orthopedic Implants Market Analysis

The orthopedic implants market is experiencing robust growth, driven by an increasing aging population, rising prevalence of orthopedic diseases, and advancements in implant technologies. These implants, which include joint replacements, spinal implants, and trauma fixation devices, are essential for restoring mobility and improving the quality of life for patients. Recent developments in materials science, such as the use of bioactive and biodegradable materials, are enhancing implant performance and patient outcomes. Moreover, the growing trend toward minimally invasive surgical techniques is further propelling market growth by reducing recovery times and minimizing complications. The market is characterized by significant investments in research and development by major players, fostering innovation and competitive dynamics. As healthcare systems increasingly focus on personalized medicine, the orthopedic implants market is poised for continued expansion, catering to diverse patient needs and preferences.

Orthopedic Implants Market Size

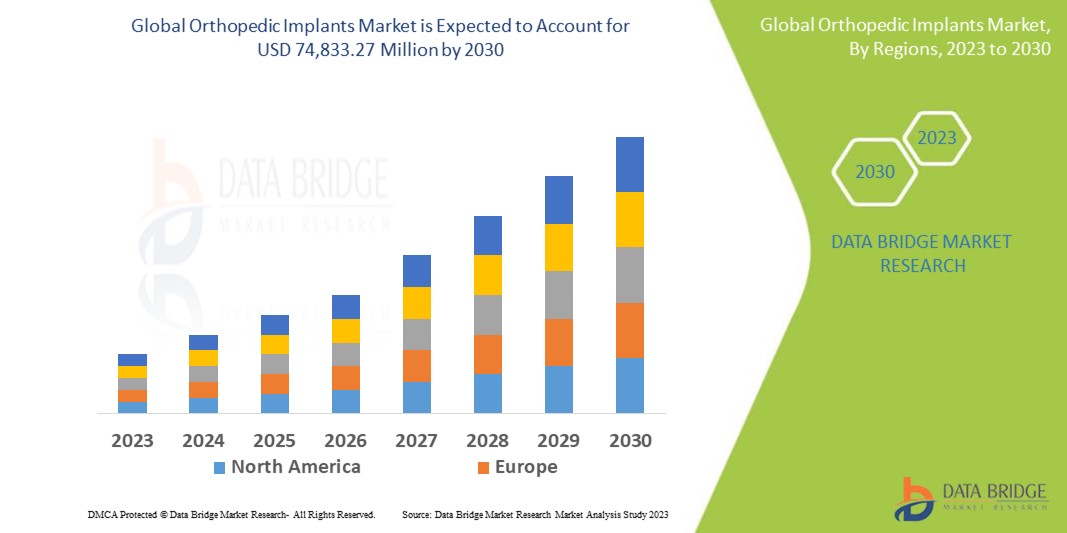

The global orthopedic implants market size was valued at USD 50.43 billion in 2023 and is projected to reach USD 79.17 billion by 2031, with a CAGR of 5.80% during the forecast period of 2024 to 2031. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Orthopedic Implants Market Trends

“Adoption of Minimally Invasive Surgical Techniques”

The orthopedic implants market is witnessing notable trends driven by technological advancements and changing patient demographics. Innovations in materials and manufacturing processes, such as 3D printing and the use of biocompatible materials, are enhancing the design and performance of implants. One significant trend is the increasing adoption of minimally invasive surgical techniques, which reduce recovery times and improve patient satisfaction. In addition, the rise in outpatient procedures is reshaping the market landscape, making orthopedic surgeries more accessible. As healthcare providers focus on personalized treatment options, the market is expected to grow, with an emphasis on developing customized implants that cater to individual patient needs. Overall, these trends highlight the dynamic evolution of the orthopedic implants sector.

Report Scope and Orthopedic Implants Market Segmentation

|

Attributes

|

Orthopedic Implants Key Market Insights

|

|

Segments Covered

|

|

|

Countries Covered

|

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

|

|

Key Market Players

|

CONMED Corporation (U.S.), Wright Medical Group N.V. (U.S.), Stryker (U.S.), Medtronic (Ireland), Smith+Nephew (U.K.), Integra LifeSciences Corporation (U.S.), B. Braun SE (Germany), Arthrex, Inc. (U.S.), Baxter (U.S.), Medical Device Business Services, Inc. (U.S.), Globus Medical (U.S.), NuVasive, Inc. (U.S.), Flexicare (Group) Limited (U.K.), Agilent Technologies, Inc. (U.S.), Narang Medical Limited (India), Auxein (India)

|

|

Market Opportunities

|

|

|

Value Added Data Infosets

|

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

|

Orthopedic Implants Market Definition

Orthopedic implants are medical devices designed to replace, support, or enhance the function of damaged or diseased musculoskeletal structures, such as bones and joints. These implants are commonly used in various orthopedic procedures, including joint replacements, spinal surgeries, and trauma repairs. Made from biocompatible materials such as metals, ceramics, or polymers, orthopedic implants are engineered to integrate with the body’s natural tissues while providing stability and strength.

Orthopedic Implants Market Dynamics

Drivers

- Increasing Prevalence of Orthopedic Injuries

The increasing prevalence of orthopedic injuries and diseases is a significant market driver for orthopedic implants, largely attributed to sedentary lifestyles and a rise in sports-related injuries. As more individuals engage in physical activities without proper training or precautions, the incidence of injuries such as fractures, ligament tears, and joint disorders has escalated. In addition, the modern sedentary lifestyle contributes to conditions like osteoarthritis and back pain, leading to a greater need for surgical interventions. This growing demand for orthopedic implants is further supported by increased public awareness about the importance of addressing these issues and the availability of advanced treatment options. As healthcare providers respond to this rising need, the market for orthopedic implants continues to expand, ultimately improving patient outcomes and quality of life.

- Integration of Advanced Biocompatible Materials

Innovations in implant design and materials are crucial drivers of growth in the orthopedic implants market. The integration of advanced biocompatible materials, which are compatible with human tissue, enhances the safety and effectiveness of implants. These materials reduce the risk of rejection and infection, leading to better patient outcomes. In addition, the development of biodegradable materials represents a significant advancement, as these implants gradually dissolve in the body, eliminating the need for subsequent surgeries to remove them. Enhanced designs, such as those using 3D printing technology, allow for customized implants tailored to individual patient anatomy, improving functionality and comfort. These innovations increase the performance and longevity of orthopedic implants and contribute to the overall growth of the market by meeting the evolving needs of patients and healthcare providers.

Opportunities

- Integration of Personalized Treatment Options

The trend toward personalized treatment options in the orthopedic implants market presents significant growth opportunities. By focusing on customized implants that cater to the unique anatomical and functional requirements of individual patients, manufacturers can enhance the overall effectiveness of orthopedic procedures. Personalized implants are designed using advanced imaging technologies and 3D printing, allowing for precise fits that improve functionality and comfort. This tailored approach boosts patient satisfaction and reduces the risk of complications associated with ill-fitting implants. As healthcare providers increasingly recognize the importance of personalized medicine, the demand for customized orthopedic solutions is expected to rise. This shift presents a compelling opportunity for companies to innovate and differentiate their product offerings, creating new growth opportunites and improving patient outcomes.

- Rising Awareness in Orthopedic Health

Rising awareness about orthopedic health, along with significant advancements in treatment options, serves as a crucial market opportunity for the orthopedic implants sector. As patients become more educated on the impact of conditions such as arthritis, fractures, and sports injuries on their daily lives, they are increasingly inclined to seek surgical interventions to relieve pain and enhance mobility. This growing awareness is fueled by educational programs, online resources, and community health initiatives that highlight the benefits of timely orthopedic care. Furthermore, innovations in surgical techniques and implant technologies improve the safety and effectiveness of procedures, reassuring patients about the potential outcomes. As a result, more individuals are likely to pursue these treatments, significantly expanding the market for orthopedic implants and creating opportunites for overall growth in the industry.

Restraints/Challenges

- High Market Competition

The orthopedic implants market is characterized by intense competition, with a plethora of established companies and new entrants vying for market share. This competitive landscape drives innovation and advances in technology, which are essential for improving patient outcomes. However, the pressure to differentiate products often leads to price wars, as companies attempt to attract customers through lower prices. This pricing pressure can significantly impact profit margins, making it challenging for manufacturers to sustain their financial health. In addition, the constant influx of new players can saturate the market, further intensifying competition. As companies strive to maintain their competitive edge, they must balance innovation and quality with cost-effective strategies, presenting a considerable challenge in navigating the evolving orthopedic implants market.

- High Production Cost

The development and manufacturing of orthopedic implants are associated with substantial research and production costs, which can result in high prices for end users. These elevated costs often limit accessibility to essential medical devices, particularly in emerging markets where healthcare budgets may be constrained. Patients in these regions may face challenges in obtaining necessary orthopedic treatments, leading to delayed surgeries and poorer health outcomes. Furthermore, healthcare providers in low-income areas may struggle to stock and offer a variety of high-quality implants due to budget restrictions. As a result, the high cost of orthopedic implants serves as a significant restraint on market growth, hindering efforts to expand access to effective orthopedic care for patients who need it most.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Orthopedic Implants Market Scope

The market is segmented on the basis of product type, biomaterial, procedure, device type, application, and end users. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product Type

- Reconstructive Joint Replacements

- Spinal Implants

- Dental Implants

- Orthobiologics

- Trauma

- Craniomaxillofacial Implants

- Others

Biomaterial

- Ceramics Biomaterials

- Metallic Biomaterials

- Polymeric Biomaterials

- Natural Biomaterials

Procedure

- Open Surgery

- Minimally Invasive Surgery (MIS)

- Others

Device Type

- Internal Fixation Devices

- External Fixation Devices

Application

- Neck Fracture

- Spine Fracture

- Hip Replacement

- Shoulder Replacement

- Others

End User

- Hospitals

- Orthopedic Clinics

- Home Care

- Others

Orthopedic Implants Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, product type, biomaterial, procedure, device type, application, and end users as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America leads the orthopedic implants market, primarily due to its robust regulatory framework and supportive initiatives from government and healthcare agencies. In addition, the rising adoption of minimally invasive surgical techniques is expected to further accelerate market growth in this region. These factors combined create a favorable environment for the expansion of orthopedic implant solutions across North America.

Asia-Pacific region is anticipated to experience substantial growth driven by rising disposable incomes and a well-established healthcare infrastructure. In addition, growing awareness of advanced orthopedic procedures and the rise of medical tourism will further enhance the market's growth potential in this area. These factors collectively position Asia-Pacific as a promising market for orthopedic implants in the coming years.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Orthopedic Implants Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Orthopedic Implants Market Leaders Operating in the Market Are:

- CONMED Corporation (U.S.)

- Wright Medical Group N.V. (U.S.)

- Stryker (U.S.)

- Medtronic (Ireland)

- Smith+Nephew (U.K.)

- Integra LifeSciences Corporation (U.S.)

- B. Braun SE (Germany)

- Arthrex, Inc. (U.S.)

- Baxter (U.S.)

- Medical Device Business Services, Inc. (U.S.)

- Globus Medical (U.S.)

- NuVasive, Inc. (U.S.)

- Flexicare (Group) Limited (U.K.)

- Agilent Technologies, Inc. (U.S.)

- Narang Medical Limited (India)

- Auxein (India)

Latest Developments in Orthopedic Implants Market

- In September 2023, Enovis finalized the acquisition of LimaCorporate S.p.A., a prominent private company in the orthopedic sector. This strategic move aims to enhance Enovis's capabilities in restoring motion through a diverse range of innovative implant solutions. The acquisition positions Enovis as a more formidable player in the global orthopedic market

- In July 2023, Smith+Nephew introduced the REGENTEN bioinductive implant in response to the increasing demand for rotator cuff repair solutions among patients in India. This innovative implant is designed to enhance the healing process and improve outcomes for individuals undergoing rotator cuff surgeries. The launch underscores Smith+Nephew's commitment to addressing the evolving needs of the orthopedic market in the region

- In May 2023, Zimmer Biomet introduced the Persona Osseo Ti KEEL Tibia, a new cement-less knee implant. This innovative product gives surgeons the flexibility to determine whether cement is necessary during the procedure, depending on the patient's bone quality. The launch reflects Zimmer Biomet's dedication to enhancing surgical options and improving patient outcomes in knee replacement surgeries

- In February 2023, CurvaFix unveiled a smaller-diameter CurvaFix IM implant designed to streamline surgical procedures for small-boned patients. This innovative implant offers strong and stable curved fixation, addressing the unique needs of this patient population. The launch highlights CurvaFix's commitment to improving surgical outcomes and enhancing the overall experience for both surgeons and patients

- In April 2022, The Orthopedic Implant Company (OIC) obtained FDA approval for its High-Value Wrist Fracture Plating System. This milestone is expected to enhance OIC's global product portfolio and expand its offerings in the orthopedic market. The approval underscores the company's commitment to delivering innovative solutions for wrist fracture treatment

SKU-