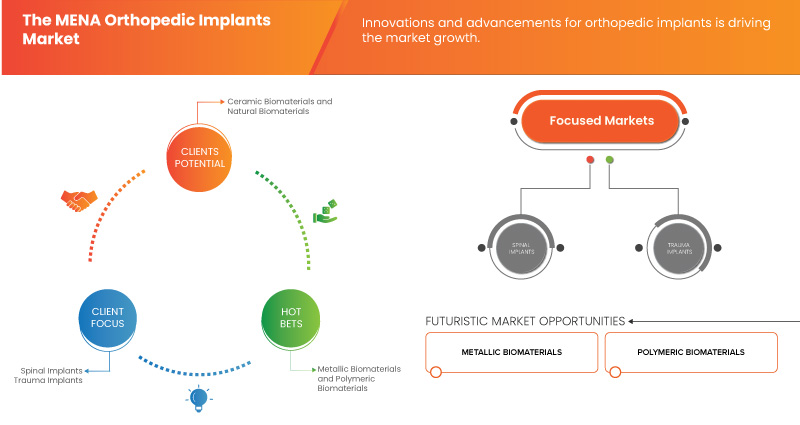

MENA Orthopedic Implants Market, By Products (Spinal Implants and Trauma Implants), Biomaterial (Metallic Biomaterials, Polymeric Biomaterials, Ceramic Biomaterials, Natural Biomaterials and Others), Mode (Open Surgery and Minimally Invasive Surgery (MIS)), Device Type (Internal Fixation Devices and External Fixation Devices), Application (Spine Fracture, Hip Replacement, Knee Replacement, Shoulder Replacement, Neck Fracture and Others), End User (Hospitals, Ambulatory Care Center, Specialty Clinics, Orthopedic Centers and Others), Distribution Channel (Direct Tender, Retail Sales and Others) - Industry Trends and Forecast to 2031.

MENA Orthopedic Implants Market Analysis and Insights

The MENA orthopedic implants market is experiencing significant growth, driven by factors such as the region's increasing aging population. This demographic trend has led to a higher prevalence of orthopedic conditions, boosting the demand for implants. However, one restraint facing the market is the high cost of orthopedic implants, which can limit access for some patients. Despite this difficulty, an opportunity exists in the form of technological advancements, which are leading to the development of more innovative and cost-effective implant solutions. Overall, while the market is poised for growth, addressing the cost barrier and continuing to innovate will be crucial for sustained success in the MENA orthopedic implants market.

Data Bridge Market Research analyzes that the MENA orthopedic implants market is expected to reach USD 683.06 million by 2031 from USD 477.03 million in 2023, growing at a CAGR of 4.6% in the forecast period of 2024 to 2031.

|

Report Metric

|

Details

|

|

Forecast Period

|

2024 to 2031

|

|

Base Year

|

2023

|

|

Historic Years

|

2022 (Customizable to 2016–2021)

|

|

Quantitative Units

|

Revenue in USD Million

|

|

Segments Covered

|

Products (Spinal Implants and Trauma Implants), Biomaterial (Metallic Biomaterials, Polymeric Biomaterials, Ceramic Biomaterials, Natural Biomaterials and Others), Mode (Open Surgery and Minimally Invasive Surgery (MIS)), Device Type (Internal Fixation Devices and External Fixation Devices), Application (Spine Fracture, Hip Replacement, Knee Replacement, Shoulder Replacement, Neck Fracture and Others), End User (Hospitals, Ambulatory Care Center, Specialty Clinics, Orthopedic Centers and Others), Distribution Channel (Direct Tender, Retail Sales and Others)

|

|

Countries Covered

|

Saudi Arabia, U.A.E., Egypt, Qatar, Kuwait, Oman, and Bahrain

|

|

Market Players Covered

|

Stryker, Anthrex Inc., Conmed Corporation, B. Braun SE, Globus Medical Inc., Auxein, Matrix Meditech, Orthomed, Medtronic and Norm Medical among others

|

Market Definition

Orthopedic implants are sophisticated medical devices crucial in the treatment of musculoskeletal conditions. These implants are meticulously designed to either replace or support damaged or diseased bones and joints, enabling patients to regain mobility and alleviate pain. They are integral in various procedures such as joint replacement surgeries (e.g., hip, knee, shoulder), fracture repair, spinal fusion, and trauma stabilization. Made from materials like metal alloys, ceramics, and plastics, orthopedic implants are engineered to mimic the natural movement and function of the musculoskeletal system. They come in different forms, including joint implants, fracture fixation implants, spinal implants, and trauma implants, each serving a specific purpose in restoring the musculoskeletal system's integrity.

MENA Orthopedic Implants Market Dynamics

This section deals with understanding the market drivers, opportunities, restraints, and challenges. All of this is discussed in detail below:

Drivers

- Focus towards Adoption of Minimally Invasive Surgery

Minimally invasive surgery involves the surgical procedure performed with minute incisions on the body. The surgeries include joint replacement, arthroscopic repairs of sports injuries, and microscopic treatment of complex musculoskeletal conditions among others. The benefits of minimally invasive surgery includes short recovery time, low risk of infection, less bleeding, small scars, and shorter hospital stays.

The techniques and instruments, such as navigation-assisted surgery equipment used in MIS, result in less damage to the body than the cases of open surgeries. The continuous advancement in minimally invasive technologies, to operate on patients with a wide variety of disabilities is anticipated to fuel the growth of the orthopedic implants market. Thus, the focus towards adoption of minimally invasive surgery is expected to act as a driver for the market growth.

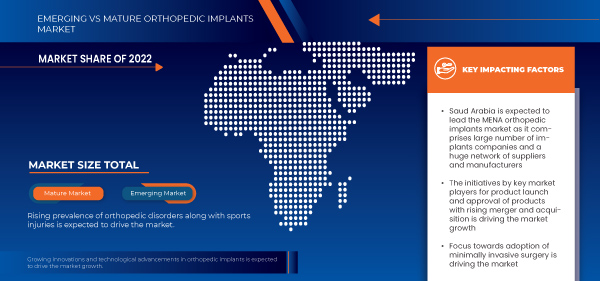

- Rising Prevalence of Orthopedic Disorders Along with Sports Injuries

There is a rising need for orthopaedic implants to treat the musculoskeletal problems such as musculoskeletal disorders (MSD), muscle pain and others. Since the ageing populations, sedentary lifestyles, and increased sports engagement all contribute to a higher incidence of orthopaedic disorders. The need for orthopaedic therapies is being driven by serious injuries like fractures and ligament breaks from sporting activities, as well as chronic disorders like osteoarthritis and osteoporosis. Sports-related injuries are becoming more prevalent. Orthopaedic implants and surgical procedures are frequently needed for these injuries in order to stabilise joints, repair ligaments, and treat fractures. As a result of this, it is anticipated that there will be a considerable increase in the need for orthopaedic implants that are compatible with sports medicine operations.t

The urgent need for orthopaedic therapies is highlighted by the rising prevalence of diseases such osteoarthritis, osteoporosis, and musculoskeletal injuries, which are further exacerbated by changes in demographics and lifestyle. Furthermore, the region's increased engagement in sports and physical activities has resulted in a rise in sports-related injuries, necessitating for the usage of orthopaedic implants and surgical procedures for fracture repair, ligament restoration, and joint stabilisation. Thus, the rising prevalence of orthopedic disorders along with sports injuries is expected to act a driver for market growth.

Opportunity

- Anticipating Surge in Demand for Orthopedic Implants

The surge in demand, particularly for spine and trauma implants, presenting a significant opportunity. Spine implants are increasingly used to address spinal disorders like degenerative disc disease and fractures, which are more prevalent due to factors such as aging populations and sedentary lifestyles. Similarly, trauma implants are in high demand for treating fractures and injuries from accidents and sports incidents, which are on the rise in the region.

In conclusion, the significant growth is driven by the increasing demand for spine and trauma implants. Companies can capitalize on this opportunity by prioritizing innovation and quality, thereby meeting the region's rising healthcare needs and establishing a strong market presence. Overall, the escalating demand for orthopedic implants in the MENA region offers substantial opportunities for market players to expand their product portfolios and enhance their market penetration. By seizing these opportunities, companies can align with the region's evolving healthcare landscape and effectively cater to the growing needs of patients with orthopedic conditions.

Restraints/Challenges

- Limited Healthcare Infrastructure and Shortage of Skilled Healthcare Professionals

The lack of adequate healthcare facilities and trained professionals can lead to delays in treatment, limited access to specialized care, and lower quality of care for patients requiring orthopedic interventions. This can result in increased healthcare costs and reduced patient outcomes.

In addition, the shortage of skilled healthcare professionals can hinder the adoption of advanced technologies and treatment techniques, limiting the availability of innovative implant solutions for patients. Furthermore, the limited healthcare infrastructure may lead to disparities in access to care, with rural or underserved areas facing greater challenges in accessing orthopedic services.

- Side Effects of Orthopedic Implants

Complications including implant rejection, infection, loosening of the implant, and unfavorable tissue reactions are among the possible side effects. Although healthcare rules and standards can differ, it is crucial to ensure the safety and effectiveness of orthopedic implants. Any documented cases of unfavorable outcomes may draw more attention from regulatory bodies, which could undermine consumer confidence and slow the uptake of orthopedic implants. The professionals use a wide range of orthopedic implants for performing orthopedic procedures on various patients of different age groups. The products are used for joint replacement, hip arthroscopy, and shoulder arthroscopy. As orthopedic implants benefit patients by maintaining their range of motion, flexibility, and movement, there are various health complications also. Thus, side effects and complications associated with the use of orthopedic implants are hampering the demand for orthopedic implants in the market.

Recent Developments

- In February 2024, Auxein Medical, a manufacturer and exporter of orthopedic implants, is showcasing its latest innovations in medical technology at Arab Health, held at the World Trade Centre from January 29th to February 1st. The company is unveiling new products in the Trauma and Arthroscopy categories, along with a comprehensive range of advanced orthopedic implants at stand CC99 in the concourse. Participating in Arab Health and showcasing new products will enhance Auxein Medical's brand visibility and attract potential customers, leading to increased sales and market expansion

- In January 2024, Arthrex, Inc. launched a new patient-focused portal named TheNanoExperience.com which highlights the science and advantages of nano arthroscopy, an innovative, minimally invasive orthopaedic technique that may enable rapid recovery to activity and reduced discomfort. Surgeons can diagnose and treat orthopaedic injuries in a variety of joint spaces, especially in smaller joints like the elbow, wrist, and ankle. They can also use Nano arthroscopy for injured or arthritic knees and shoulders. These procedures are made possible by a tiny, high-quality camera at the tip of a needle-like device, along with other miniature arthroscopic instruments

- In December 2023, Stryker announced that it has completed a legally-binding offer to Menix for the acquisition of SERF SAS. SERF SAS is well-known among medical professionals throughout the globe for its advancements in hip implants, which include the creation of the first Dual Mobility Cup. By adding this acquisition, Stryker would be able to offer improved service to a larger patient base and expand its global joint replacement portfolio

- In December 2023, B. Braun SE has introduced the CARESITE Micro Luer Access Device, aimed at minimizing exposure to hazardous chemicals and lowering the risk of infection. This innovation is intended to enhance the safety of IV access for both patients and healthcare providers. This will enhance B. Braun's market position by offering a safer IV access solution, attracting new customers, and reinforcing its reputation for innovation and safety

- In September 2023, Globus Medical, Inc., a prominent musculoskeletal solutions company, has announced its commitment to EUROSPINE by extending its silver sponsorship and confirming its participation in EUROSPINE 2023. This continued partnership and sponsorship with EUROSPINE will enhance the visibility and reputation of Globus Medical, Inc. within the spine surgery community, potentially leading to increased brand recognition and business opportunities

MENA Orthopedic Implants Market Scope

The MENA orthopedic implants market is segmented into seven notable segments based on products, biomaterial, mode, device type, application, end user, and distribution channel. The growth among segments helps you analyze niche pockets of growth and strategies to approach the market and determine your core application areas and the differences in your target markets.

Products

- Spinal Implants

- Trauma Implants

On the basis of products, the market is segmented into spinal implants and trauma implants.

Biomaterial

- Metallic Biomaterials

- Polymeric Biomaterials

- Ceramic Biomaterials

- Natural Biomaterials

- Others

On the basis of biomaterial, the market is segmented into metallic biomaterials, polymeric biomaterials, ceramic biomaterials, natural biomaterials and others.

Mode

- Open Surgery

- Minimally Invasive Surgery (MIS)

On the basis of mode, the market is segmented into open surgery and Minimally Invasive Surgery (MIS).

Device Type

- Internal Fixation Devices

- External Fixation Devices

On the basis of device type, the market is segmented into internal fixation devices and external fixation devices.

Application

- Spine Fracture

- Hip Replacement

- Knee Replacement

- Shoulder Replacement

- Neck Fracture

- Others

On the basis of application, the market is segmented into spine fracture, hip replacement, knee replacement, shoulder replacement, neck fracture, and others.

End User

- Hospitals

- Ambulatory Care Center

- Specialty Clinics

- Orthopedic Centers

- Others

On the basis of end user, the market is segmented into hospitals, ambulatory care center, specialty clinics, orthopedic centers and others.

Distribution Channel

- Direct Tender

- Retail Sales

- Others

On the basis of distribution channel, the market is segmented into direct tender, retail sales and others.

MENA Orthopedic Implants Market Regional Analysis/Insights

The MENA orthopedic implants market is segmented into seven notable segments based on products, biomaterial, mode, device type, application, end user and distribution channel.

The countries covered in this market report are Saudi Arabia, U.A.E., Egypt, Qatar, Kuwait, Oman, and Bahrain.

Saudi Arabia is expected to dominate the MENA orthopedic implants market due to its growing healthcare infrastructure.

The country section of the report also provides individual market-impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points such as new sales, replacement sales, country demographics, regulatory acts, and import-export tariffs are some of the major pointers used to forecast the market scenario for individual countries. Also, the presence and availability of regional brands and their challenges faced due to large or scarce competition from local and domestic brands and the impact of sales channels are considered while providing forecast analysis of the country data.

Competitive Landscape and MENA Orthopedic Implants Market Share Analysis

The MENA orthopedic implants market competitive landscape provides details of competitors. Details included are company overview, company financials, revenue generated, market potential, investment in R&D, new market initiatives, production sites and facilities, company strengths and weaknesses, product launch, product approvals, product width and breadth, application dominance, and product type lifeline curve. The above data points provided are only related to the company’s focus on the market.

Some of the major market players operating in the market are Stryker, Anthrex Inc., Conmed Corporation, B. Braun SE, Globus Medical Inc., Auxein, Matrix Meditech, Orthomed, Medtronic and Norm Medical among others.

SKU-